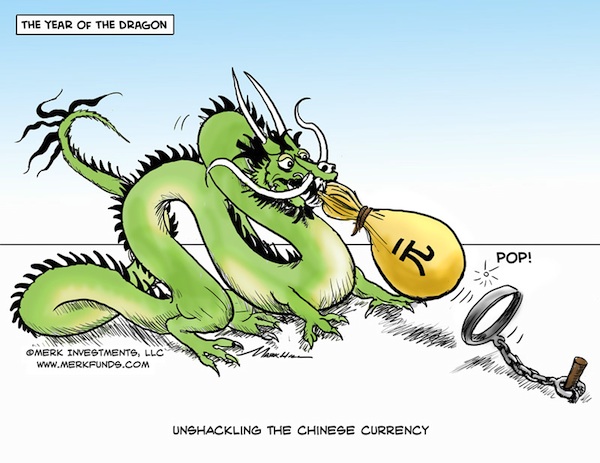

Chinese Dragon To Unshackle Renminbi?

Currencies / China Currency Yuan Jan 18, 2012 - 11:19 AM GMTBy: Axel_Merk

With the Year of the Dragon around the corner, will the renminbi be unshackled? Will there be a surge in domestic consumption, or will a housing bust weigh on the economy, dragging down global economic growth? To understand how dynamics may play out in China, try to put yourself into the shoes of the proverbial Chinese consumer. Better yet, put yourself into hundreds of millions of such shoes…

With the Year of the Dragon around the corner, will the renminbi be unshackled? Will there be a surge in domestic consumption, or will a housing bust weigh on the economy, dragging down global economic growth? To understand how dynamics may play out in China, try to put yourself into the shoes of the proverbial Chinese consumer. Better yet, put yourself into hundreds of millions of such shoes…

First, let’s put the Chinese housing market into perspective. High-net-worth individuals own, on average, an astounding 3.3 housing units per person (2011 Allianz survey). Many of these “investment properties” have recently been developed and are not occupied. Rents are so low compared to the value of homes that it isn’t even worth looking for tenants. In 2010, about 5.1% of total national employment was in the construction industry, up from 3.8% in 2006. In Spain, known for its colossal housing bust, employment in the construction industry peaked around 2007, at 13.5% of the total workforce (about half those jobs have since been lost). In the U.S., residential construction supported 4.2% of the total workforce in the mid 1990’s and grew to over 5% in 2005, before dropping to around 3% in 2008. While China does not appear to have Spanish excesses, these metrics suggest China may still be vulnerable, given the recent U.S. experience.

However, there are some key differences between China and the U.S. Maybe most notably, most Chinese still hold the traditional view that home ownership is a prerequisite for marriage and the one child policy has fostered a culture where parents want their children to own a home – apparently at just about any price. Which brings us to an important point: with mom and dad paying for the house, many homes are paid for in cash. Indeed, according to a 2010 Citi survey, only 18% of households borrow money from banks to buy property; a further 15% borrow money from relatives. This is vastly different from the U.S. experience, where consumers drowning in debt financed the property boom.

Unfortunately, many U.S. homeowners have recently experienced first hand that when property prices fall, the debt remains. It is the debt overhang that causes consumers to stop spending, banks to stop lending and real estate developers to collapse.

Chinese consumers come from a different vantage point: afraid of inflation and limited in ability to invest abroad, the Chinese put much of their money into stocks, real estate, and precious metals. Of these choices, real estate has been most broadly embraced so far. We don’t doubt for a minute that Chinese real estate prices could plunge. However, we take exception to the conclusion that China is thus destined to suffer the same consequence as Spain or the U.S. When leverage is not employed, consumers may react to a drop in real estate prices similarly as they would to a drop in stock prices.

In a housing downturn, real estate developers may go bust; banks will face non-performing loans; and workers will lose their job. With regard to banks, China has the resources to act swiftly to bolster any banks should the government choose to do so. A drop in construction related jobs would have an impact on GDP, but while migrant workers working in the construction industry may earn much more than the average farmer, their income is a fraction of that of urban residents. As such, the drag caused by a housing bust in China on consumer spending may be limited.

To understand where consumption may be heading, one must look beyond housing. Notably, with government statistics not at the standards of most developed countries, a recent study concluded that household consumption may be underreported by as much as 20%, leading to a potential underestimation of GDP by 10%. China is already the world’s largest market for automobiles and internet use, as well as the second largest market for luxury goods.

Despite the State trying to micro-manage economic growth, China is said to be more capitalist than most Western countries these days. Differently said, despite government attempts to manage prices and bank lending, amongst others, Chinese businesses find plenty of ways around restrictions. We see these dynamics showing up in data such as inflation metrics that are stubbornly high, and a substantial amount of spending, notably on luxury goods, that appears to be under-reported. In many ways, the ineffectuality of China’s government is a good thing. Imagine that the government was more effective in controlling prices and credit: you’d end up with a Soviet Union-style economy, where tight government control that actually works leads to empty shelves and shortages of all sorts of goods and services. Not in China.

But Chinese policy makers are keenly aware of the dangers of runaway growth, notably inflation. From the price of food to the price of luxury goods, living costs have become expensive in China. It’s the inevitable result of rapidly “moving up the value chain” in the types of goods and services produced. As Chinese policy makers have come to the realization that administrative tools are not very effective in containing inflation, they have embraced currency appreciation as a tool to tame domestic inflationary pressures. A stronger Chinese renminbi will also serve as another catalyst for the rapid transformation of the Chinese economy towards a greater focus on domestic consumption. For an in-depth look at how the upcoming leadership transition in China may affect policies, please read our White Paper: China’s Leadership Transition: Social Stability May Require a Stronger Renminbi

Don’t count China out as an exporter as the renminbi strengthens. Indeed, we believe that China increasingly has pricing power and may be able to pass on its increasingly higher cost of doing business. American businesses are outsourcing ever more complex processes: China is best positioned to attract these projects; the more complex a process, the more pricing power the provider of such services may have.

Many Chinese businesses will undoubtedly fail in such an environment. But also consider how competitive the surviving businesses must be, having had to compete in an environment where some businesses were kept afloat through an artificially weak currency. Those that compete profitably within China may be well placed to compete with the rest of the world.

In summary, Chinese consumer spending is likely to have been under-reported for some time; we don’t think a housing bust in China will stifle consumer spending as much as some fear. Importantly, Chinese consumer spending may rise like an avalanche in years to come. China is right to prepare its economy for this rise, amongst others, by unshackling the renminbi. A currency serves as a natural valve for domestic policies, helping to tame inflationary pressures. Currencies of the more developed Asian neighbors may also benefit in the process.

Please register for our Webinar on Thursday, January 19, or sign up for our newsletter to be informed as we discuss global dynamics and their impact on currencies. We manage the Merk Funds, transparent no-load currency mutual funds through which investors may add currency exposure to their portfolios while potentially mitigating stock market, credit and interest risks with the ease of investing in no-load mutual funds. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.