The Fed's Inflation Target; QE3, QE4, QE5, etc. are in the Queue

Interest-Rates / Quantitative Easing Jan 29, 2012 - 11:26 AM GMT The U.S. Federal Reserve policy announcement on Tuesday, January 25, 2012 marks an important moment in monetary history. The forecast by a majority of the members of the FOMC for interest rates to hug zero until late 2014 was of interest and points to the FOMC conviction extended global economic stagnation at best, reflecting the long wave forces at work in the global economy. However, more importantly, it was the first time that the U.S. Federal Reserve has clarified its interpretation of its mandate for price stability, i.e. the target for inflation.

The U.S. Federal Reserve policy announcement on Tuesday, January 25, 2012 marks an important moment in monetary history. The forecast by a majority of the members of the FOMC for interest rates to hug zero until late 2014 was of interest and points to the FOMC conviction extended global economic stagnation at best, reflecting the long wave forces at work in the global economy. However, more importantly, it was the first time that the U.S. Federal Reserve has clarified its interpretation of its mandate for price stability, i.e. the target for inflation.

This announcement is preparing global markets for the primetime monetary super bowl of inflation vs. deflation, aka U.S. Federal Reserve quantitative easing (QE) driven inflation efforts vs. a Kondratieff long wave debt deflation depression. Since bad debt is the problem in a long wave debt deflation, the Fed plans to buy all the bad debt required to hit their inflation target and put it in on their balance sheet until it matures and repaid or is written off. The Fed only has two mandates; maximum employment and stable prices. These objectives are a bit sketchy and have not been specific targets historically, so an actual inflation target sends a clear message.

The Fed officially informed market participants that its target for inflation is two percent. The Fed is signaling to global markets the message that below this level of inflation, they are within their mandate to keep the monetary spigots open by buying any debt, and therefore we can anticipate additional rounds of QE released from the queue on a regular basis over the next few years if inflation falls below this target.

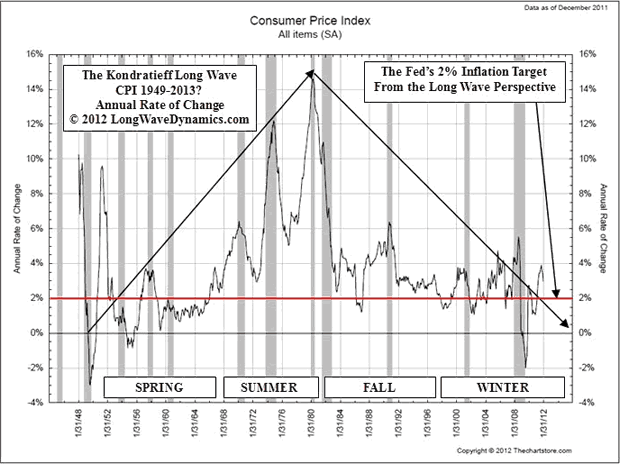

The CPI, like interest rates, is following its natural long wave trend. It is on schedule to reverse higher in a new long wave spring in 2013 and beyond. Unfortunately and ironically, the Fed's attempt to produce inflation could prolong the deflation by socializing bad debts and weighing down the U.S. and global economy. The CPI annual rate of change below demonstrates the long wave forces at work.

The natural global long wave disinflation and deflation is in the process of clearing non-viable bad ideas out of the global economy with what Schumpeter called creative destruction. QE wants to keep those bad ideas in business, taking profit and reward away from the more prudent and better ideas in the market. The problem is that central banks are pouring trillions of additional debt into the economy when a long wave spring is right around the corner. This creates a real risk of hyperinflation once the long wave winter season is over and a new long wave spring gets underway, a real life bonfire of the vanities.

This is an election year. The Federal Reserves likes to be removed from the economic equation in election years. Unfortunately, in light of a long wave winter season of debt deflation and overproduction in an anti-business political environment, they represent a very large piece of the U.S. and therefore global economic equation. The inflation target announcement is an attempt to put their cards on the table early in an election year cycle, an election year that promises to be driven largely by global economic, financial and monetary policy news.

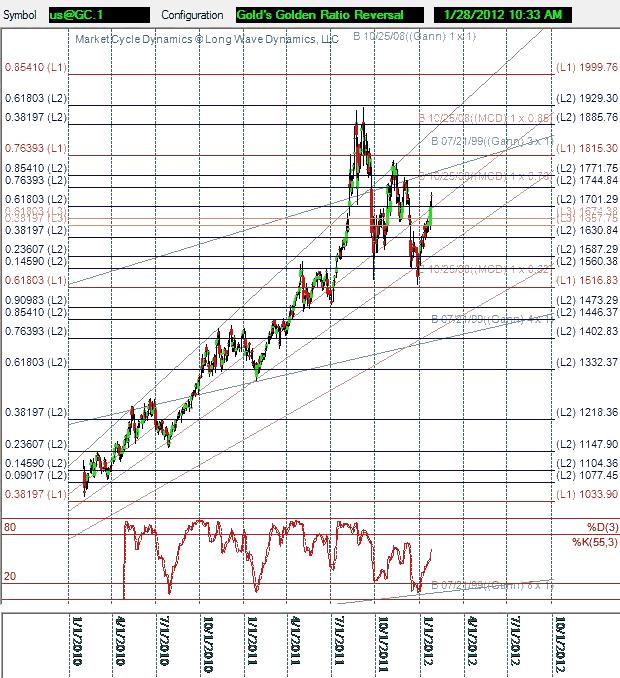

The more the U.S. Federal Reserve attempts to stop deflation with quantitative easing, the more other central banks around the world are buying gold. Gold is becoming the natural alternative world reserve currency with every new round of QE released from the queue. The chart below demonstrates a Fibonacci projection grid that reflects the desire of central banks and others to boost their gold reserves. Gold is trading like a currency, because it is one. Gold was snapped up as it corrected down to the golden ratio in the projection grid in late December. There is something extra compelling about the forces generated by a golden ratio on a gold chart. The price action of gold is directly related to actual and anticipated QE programs.

The Fed has basically announced that below that two percent inflation number, their balance sheet will keep on growing with new QE programs, including reinvesting the earnings of their growing portfolio and QE3, QE4, QE5, etc. The further inflation drops below two percent, the larger the new QE interventions and debt purchases are likely to be. Markets and investors now have an important piece of the Fed's game plan.

The two percent inflation number represents the level of inflation below which the Federal Reserve will feel additional debt purchases are within its mandate. There is nothing to stop them from going beyond government bonds and mortgages. The Fed has the authority to buy Zimbabwean sewer bonds if necessary. The Fed has enjoyed this power since the Monetary Act of 1980. Let us hope that sort of QE is not deemed necessary as the debt disaster continues to engulf the global economy. The $7 trillion plus, depending on who's numbers you use, that the Fed loaned out in recent years reflects just how far they are willing to go to stop the long wave debt deflation.

The call for another trillion dollars in QE in the mortgage market has already begun. However, there are tens of trillions in debt in the system, much of it potentially bad debt. This debt is in various stages of a great long wave winter season deleveraging. It is presumptuous to think that only a trillion more or so in QE can stop the potential deflation and get inflation back up to two percent.

Unfortunately, as the global debt crisis accelerates, it may take far more than a few trillion in QE to stop the deflation. Will it work? No one knows for sure. It may take $10 trillion or more. Even then, the debt levels are so high that global debt deflation could still get the upper hand, and accelerated deleveraging could and likely will trigger deflation and not inflation. Is there the political will in the U.S. to stomach $10 trillion in QE if that is what it takes to get to the magic two percent inflation rate.

The cumulative effects of the QE in the system has produced a late sugar high in U.S. economic activity that will wear off shortly. When it does, the business cycle is going to turn down hard. Taxpayers know they must be taxed to pay for the debts created by QE purchases of government bonds. This puts a damper on economic activity in the form of a QE hangover, and no one knows where the level of QE triggers systemic shock.

The amount of QE required to stop the deflation will paralyze those that know they will be the ones required to repay the debts produced by QE bond buying. Economic activity will slow, triggering more debt defaults, and more deflation. A vicious cycle and not a virtuous circle will produce only more ineffective debt and more deflation, just like in Japan for the past 20 years.

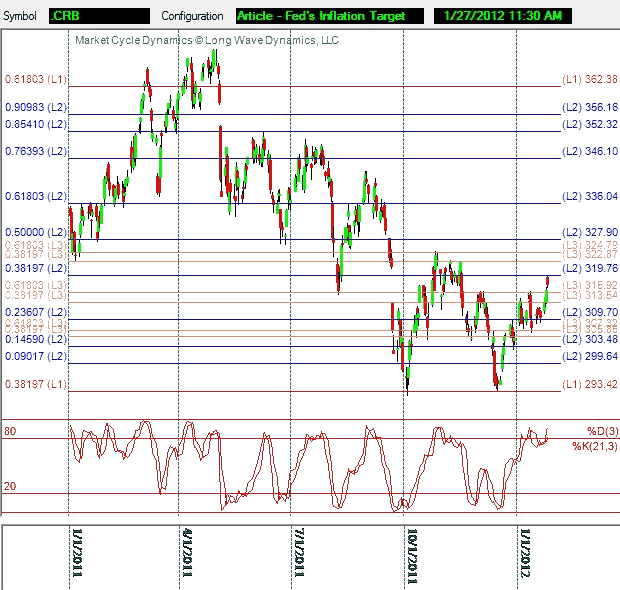

To track the impact of past and future QE keep an eye on commodities. Commodity prices are a good reflection of how the battle is going between the Fed's QE driven mandate targeted inflation and the forces of Kondratieff long wave deflation that threaten to pull the CPI under two percent and then negative.

Take a look at the chart below of the CRB commodity index. In spite of the trillions in intervention and QE in recent years, the CRB appears to be signaling that deflation and not inflation has the upper hand. Keep an eye on the Fibonacci drill-down grid in the CRB. The Level 1 support at the 38.2% target of 293.42 appears to be critical. If that support goes, debt deflation is laughing in the face of trillions in QE, when tens of trillions in debt is rolling over. Presently the CRB is knocking on the door of the Level 2 38.2% target of 319.76, so QE inflation has the wheel at least for the moment.

In the end, using QE to manipulate inflation rates toward the announced two percent target will not work. The only way to counter the forces of debt deflation will be aggressive pro-growth policies and spending cuts, which will restore confidence to business and investors and get the real global economy moving. Fortunately, the global economy is on the cusp of a new long wave spring season in 2013 and beyond. Aggressive and pro-growth economic policies can mute the natural forces of debt deflation at work in the long wave cycle. Unfortunately, slow growth tax and economic policies are in place now that will slow the coming spring season.

QE programs are a government-sanctioned and central bank administered process of shifting financial risks and losses from the parties that created the risks and losses onto innocent parties, the taxpaying public. Essentially, profits are being privatized and losses are being socialized on a massive scale. By shifting bad debt from private hands onto taxpayers and extending the maturities on the debt, the central banks are essentially shifting the financial risks onto the unsuspecting public in a future cycle. QE lengthens the cycles, but it does not stop them. The long wave, business cycle and trading cycles are simply expanding.

The expectation had been for political constraints to keep unlimited QE in check in the United States and globally. Clearly, the politicians are giving central bankers a green light and free reign to continue the QE and shift the risks onto the public. Based on statements, it would appear that no limit on QE is on the table. Essentially, trillions more in QE is not out of the question.

Political forces could still emerge to constrain the central bankers, but this is growing less likely. If political forces do not emerge to put a limit on the QE, although deflation remains the most likely outcome, the risks of a deep debt deflation V shaped crisis is declining. It is clear that the central banks are willing to use QE on an unlimited basis. Trillions in bad debt will be transferred onto the public in the final phase of this long wave winter season. The coming long wave spring will be a shadow of its true potential for global growth due to the maturity on the debts being extended and shifted into the next long wave cycle.

If the central banks show restraint, it is possible that pro-growth policies, combined with a global long wave spring season, the economy will start to turn the corner by mid-2013. However, without fiscal constrain and responsibility, and if excessive QE is on the balance sheets of central banks, it will turn into an inflationary force that will do great damage.

By mid-2013, after multiple additional QE programs in pursuit of the two percent inflation target, the amount of QE in the system may be so high that it threatens the foundations of the global economy. The Fed and ECB will both likely engage in QE in pursuit of the illusive two percent inflation target. The QE attempts to stop global debt deflation will likely turn into hyperinflation.

If PQ Wall's interpretation of Oswald Spengler's cycles in The Decline of the West were correct, this is the ninth and final Kondratieff long wave in the fall season of western civilization. He believed that the winter of western civilization lies directly ahead. Like the White Witch in the Chronicles of Narnia who cast a spell and created an unending winter in the land beyond the wardrobe, the central bankers are in danger of creating a perpetual long wave winter season. Unfortunately, instead of a new long wave spring, with too much QE, a perpetual winter and a new dark age is possible.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2012 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.