Gas Prices as an Indicator of Energy Costs

Commodities / Gas - Petrol Feb 29, 2012 - 10:22 AM GMTBy: BATR

The consumer does not need more reminders about the pain experienced with every fill up at the pump. The drain on your pocketbook is growing. During economic dislocation and diminished vitality any prospects of a turnaround dim as gas approaches $4.00 a gallon and beyond. Been here before and the idea that this time the economy will be less effected is unreasonable. The cost for all energy is rising but the impact of gas prices has a personal burden on everyday budgets. The Price of Fuel provides a useful synopsis.

The consumer does not need more reminders about the pain experienced with every fill up at the pump. The drain on your pocketbook is growing. During economic dislocation and diminished vitality any prospects of a turnaround dim as gas approaches $4.00 a gallon and beyond. Been here before and the idea that this time the economy will be less effected is unreasonable. The cost for all energy is rising but the impact of gas prices has a personal burden on everyday budgets. The Price of Fuel provides a useful synopsis.

"While crude oil is traded in a global market, gasoline is part of a regional market . . . The price of crude oil may account for over half the price of a gallon of gasoline.

Transitions in supply can also affect the short-term availability of gasoline. Going into the peak summer driving season, refineries are adjusting their gasoline formulas . . . and many states are switching to ethanol-blended gasoline.

Many states require specific formulations of gasoline - there are currently 18 separate gasoline formulas for different regions of the country-and it is often difficult to import gasoline supplies from one region to another.

Each gallon of gasoline also is subject to numerous taxes and fees, which vary by state.

After the crude oil is processed through the refinery, the finished gasoline product is transported to a terminal, where it may be sold to a wholesaler for distribution to the wholesaler's retail network or delivered to the retail location. There the retailer sets the "street price".

Now these factors are the industry’s explanation that establishes the price. But, we all know that there are few commodities that are more manipulated than crude oil. The Business Insider adds this viewpoint in Here's The REAL Reason Gasoline Prices Have Been Surging In The US

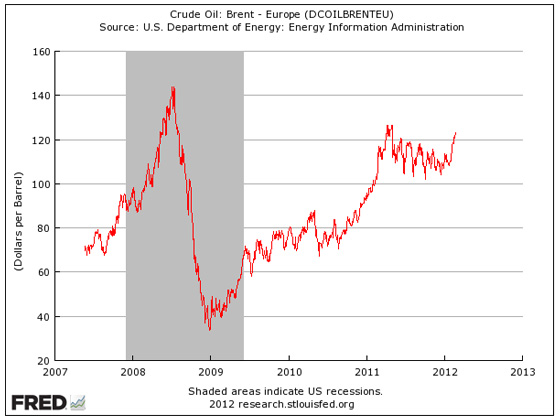

Another article in BI suggests the worse, Gas Could Easily Go To $5 And Crush The National Economy."You may have heard that the price of a barrel of oil is around $109, but actually that's the US domestic West Texas Intermediate price of oil. A better international benchmark is probably Brent Crude, and that's now well over $120/barrel, having surged all year.

The problem with judging the global pace of oil demand growth is that the epicentre of that growth has most definitely moved away from the US to Asia, and China in particular. Yet, due to the lack of prompt alternatives, the more readily available oil data from the US is still used as a global guide to the health of the oil markets."

"The USA has evolved into a two-tier gas market. The supply of crude from Canada and the Bakken fields has created a lower cost of supply for the central portion of the country. This differential is most notable in the market spread between WTI (a futures contract that settles physical delivery in Oklahoma) and LLS (Louisiana Light Sweet Crude) - the pricing of crude for the big Gulf refineries."

The conclusion from these factors suggests that the domestic retail price of gas varies for the reasons stated. The level of hurt is based upon needs to use individual transportation; however, the added cost for moving consumer goods is experienced by all in the added charged at the register. Published government inflation rates are skewed to tap down actual increases.

Anyone buying into replacing gasoline for personal vehicles as the most efficient cost form of energy denies the practical. Diesel as a fuel for over the road eighteen-wheelers may be the most promising for conversion to natural gas. Honda has a CNG version for automobiles. Gasoline will be around a lot longer than any hybrid or electric car. The reason is unmistakable, the lowest cost fuel that equates to identical vehicle performance, wins the battle in the marketplace.

In spite of this aspect of business, the government and their corporate partners are pushing to force a conversion away from gasoline. No better example of the "Yugo Syndrome" is the Government Motor’s Volt. The failure to sell consumers on a ridiculous car is clear.

Chevy Volt Fleet Sales Rise, Government GM Purchases Increase

Even the favorite Obama corporate collaborator, General Electric, uses its muscle to cover-up the botched venture. GE "Forcing" Employees Into Chevy Volts reports,"According to GM, 992 of the Volts sold were to retail customers while 537 went to fleet purchasers.

Government purchases of GM vehicles rose 32% from last year. This represents yet another conflict as the Obama Administration has a vested interest in GM's success as it spends more taxpayer dollars to help support the company as 2012 elections near."

"A memo leaked to Green Car Reports lays out GE’s plans for their new fleet of Volts, and as expected, it has some people crying foul.

The memo, sent to employees of GE Healthcare Americas team explains that all sedan, crossover, and minivan purchases in 2012 will be replaced by the Chevy Volt. Only field engineers are exempt from having to drive a company Volt.

GE will offer estimates for installation Level 2 Charging Stations, though all-gas use will be allowed when there is no electric option. Any employees who opt out of the Volt program will not be compensated for their expenses."

One cannot ignore the economic cost of failed and foolish "Green Energy" projects. The idea of forced buying expensive and government subsidized vehicles in the future borders on irrational paranoia. The environmental "true believers" in the global warming hoax would have you pay a price for gasoline that only the rich could afford.

Opposition to building the Keystone pipeline will only reduce addition oil supplies. This is lauded by the Peak Oil charlatans because they seek higher gas prices to compel the consumer to convert to their anti fossil fuel existence. Reduce energy costs by abolishing the Obama green energy tax. Lower gasoline prices foster dynamic economic growth. As long as the policy wonks are determined to bankrupt the public with high gas costs, you will experience a fallen standard of living.

James Hall

SARTRE

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.