U.S. Economy is Adding Jobs, Fed Will Take a Pass at the March 13 FOMC Meeting

Economics / Employment Mar 10, 2012 - 12:24 PM GMTBy: Asha_Bangalore

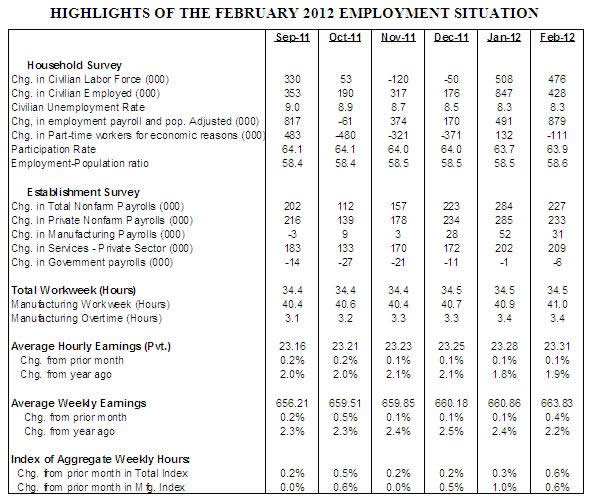

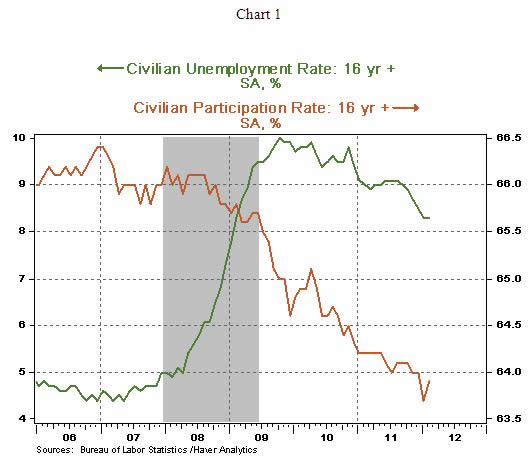

Civilian Unemployment Rate: 8.3% in February, unchanged from January. Cycle high jobless rate for the recent recession is 10.0%, registered in October 2009.

Civilian Unemployment Rate: 8.3% in February, unchanged from January. Cycle high jobless rate for the recent recession is 10.0%, registered in October 2009.

Payroll Employment: +227,000 jobs in February vs. +284,000 in January. Private sector jobs increased 233,000 after a gain of 285,000 in January. A net gain of 61,000 jobs due to revisions of payroll estimates of December and January.

Private Sector Hourly Earnings: $23.31 in February vs. $23.28 in January; 1.9% y-o-y increase in February vs. 1.8% gain in January.

Household Survey – The unemployment rate held steady at 8.3% in February. The labor force and employment advanced in February, hiring was strong but not enough to more than offset the increase in the labor force. The increase in the participation rate to 63.9% from 63.7% in January is important because it implies that people who left the labor force are returning back. Also, the number of part-time workers who would like full-time jobs dropped 111,000, another encouraging sign. It is quite likely that the jobless rate may move up a few ticks as the labor force expands and job creation lags a bit.

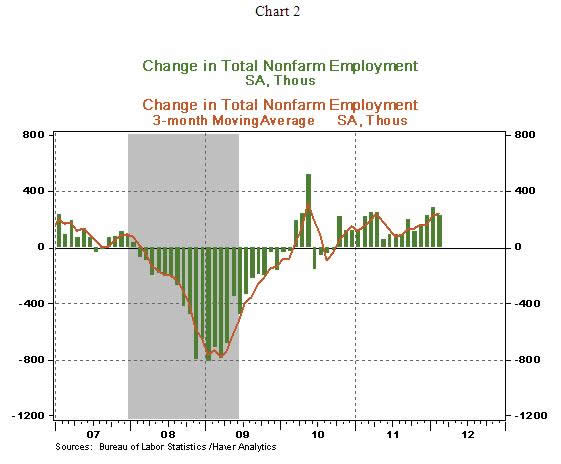

Establishment Survey – Payrolls increased 227,000 in February, following upward revisions of job estimates for December and January resulting in 61,000 new net jobs. The private sector created 233,000 jobs in February vs. 285,000 in the prior month. The 3-month moving average of payroll employment at 245,000 in February is the second best performance for the entire recovery (see Chart 2).

The employment diffusion index dropped to 57.9 from 70.3 in January, suggesting that hiring was less widespread in February vs. January, which is one of the negatives of the February employment report. The loss of construction and retail jobs and slower pace of hiring in the factory sector are other pockets of softness. Government employment fell 6,000 in February, reflecting a loss of federal (-7,000) and state (-1,000) government jobs but a gain of 2,000 local government jobs.

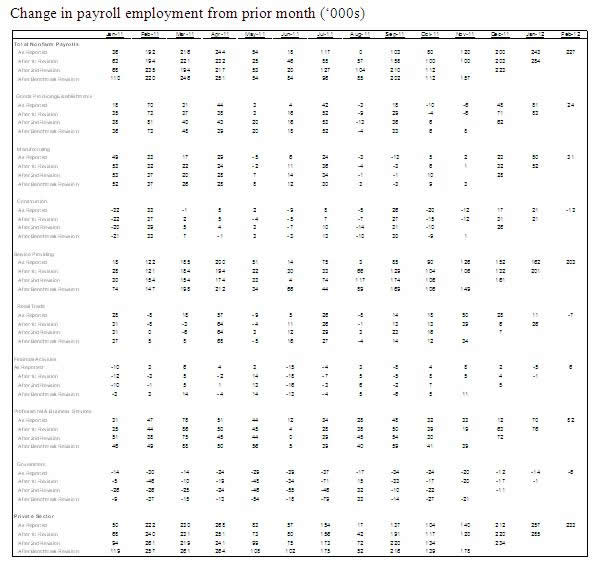

Highlights of changes in payrolls during February 2012:

Construction: -13,000 vs. +21,000 in January

Manufacturing: +31,000 vs. +52,000 in January

Private sector service employment: +285,000 vs. +233,000 in January

Retail employment: -7,000 vs. +26,000 in January

Professional and business services: +82,000 vs. +76,000 in January

Temporary help: +45,200 vs. +32,100 in January

Financial activities: +6,000 vs. -1,000 in January

Health care: +49,000 vs. +43,300 in January

Government: -6,000 vs. -1,000 in January

The 0.6%increase in the factory man-hours index bodes positively for industrial production in February. The 0.4% gain in weekly earnings points to a more-than-moderate improvement of the wage and salary component of personal income in February. Hourly earnings rose 1.9% in February vs. a 1.8% gain in the prior month.

Conclusion – The many positives of the employment rate are noteworthy but the high unemployment rate remains problematic. The Fed is nearly certain to stand pat at the March 13 FOMC meeting. The February factory ISM survey shows a small deceleration in the pace of factory activity, the January trade deficit widened largely due to faster growth of imports compared with exports, auto sales advanced in January and February, although sales of existing homes rose in January and inventories of unsold new and existing homes are dwindling, home prices continue to trend down. Consumer spending has held steady for each of the three months ended January. The mixed nature of these economic reports encourages a wait-and-see attitude, for now.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.