Should the Government Remove Fuel Subsidies?

Politics / US Politics Apr 04, 2012 - 06:13 AM GMTBy: Sam_Chee_Kong

Subsidy can be defined as a financial assistance to certain product or category of industry so that the price will be low, and hopefully continue to provide jobs and spin off other economic activity. Subsidies have been around for ages and it comes in many forms such as cash, labor, farm, export, consumption, education, housing and etc.

Subsidy can be defined as a financial assistance to certain product or category of industry so that the price will be low, and hopefully continue to provide jobs and spin off other economic activity. Subsidies have been around for ages and it comes in many forms such as cash, labor, farm, export, consumption, education, housing and etc.

Fuel subsidy refers to the effort by the government to pay for the difference between the price of fuel in the pump and the actual cost of the product. So by paying the difference the government enables fuel to be sold at a lower price so that it will help ease the burden its people especially the lower income group.

Before a government began implementing a new policy on either reducing or increasing the fuel subsidy, it had to gauge the public response towards the policy. Whether it is a gradual reduction or a sudden removal of the subsidy will have an economic impact on its people and the economy. A case in point will be the sudden removal of subsidy of fuel in Nigeria this year.

The Government of Goodluck Jonathan had been keeping the price of fuel low at $0.45 a litre. However, on 1st January 2012, President Jonathan abandoned the subsidy for fuel and resulted in a price increase to $0.94 a litre. The end result is the inflation of more than 100% in food and transportation. Tens of thousands of people are taken to the street to stage demonstrations, which eventually pressured the government to reduce the price of fuel to about $0.69 a litre.

Another example will be the recent Indonesian Government’s attempt to reduce fuel subsidies by another 30% on 1st April 2012, had been met with a roadblock. Due to intense public demonstration, the government had to give in its demand and delayed for another six months.

So from the above scenarios we can assume that the problem does not lie on the Government policy to reduce fuel subsidy but the amount of subsidy that is being removed. In the case of Nigeria, the reduction of fuel price from $0.94 to $0.69 managed to restore law and order in the country.

Such fragile situations are now placing governments in between a hard place and a rock. On one side, no government in its right mind will forever subsidized its citizens for their comfort without being risk of being send to the cleaners (bankruptcy). So there now exist an Opportunity Cost of leaving things unchanged or reduce the subsidy to unleash funds for the development of the country such as infrastructure, health, clean water and etc.

Understanding Price Elasticity of Demand

Before we go on to address this issue I think we should educate ourselves on some simple economics regarding price elasticity of demand to fuel subsidy.

A product is said to be price elastic when a change in the price will have a big effect on its demand. Products that fell into this category include big-ticket items such as cars, air travel, luxury items, high-end real estates,jewelry and etc. Such products are very sensitive to price changes. An increase in fuel price will dampen people’s demand for larger cars and also travel due to the price increase in tickets.

Likewise a product is said to be price inelastic when a change in the price will have minimal effect on its demand. Products that make up this category include alcohol, cigarettes, lottery tickets and etc. These products are not sensitive to any price changes because even with a 20% hike in the price of cigarettes will not prevent a smoker from smoking less.

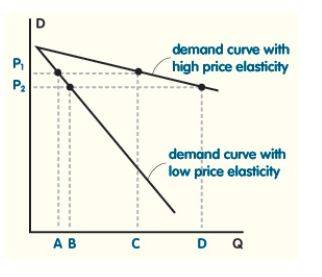

The following graph help explains the concept of price elasticity’s to demand.

As you can see from the above the steeper the demand curve the lower will be the price elasticity. When price increase from P2 to P1, the reduction of quantity demand is only equivalent to B-A.

When a product is of a higher price elasticity an increase in the price from P2 to P1 will result in a larger reduction in the quantity demand which can be measured as D-C.

Formulating Public Policies

So how can the understanding in the price elasticity of fuel subsidy can aid Governments in implementing their energy policies?

First, by knowing the elasticity of demand, the government can gauge public response towards a policy change that involved a reduction in the fuel subsidy. How can we calculate the elasticity of demand in response to a subsidy reduction.

The elasticity of demand can be calculated with the following formula.

E = (% change in Demand) / (% change in Price)

We present below 3 different scenarios to illustrate how a change in price affects demand

a. If a 10 % change in price of a product results in a 30% increase in the demand, then we can conclude that the demand is elastic. This is because the percentage change in demand is bigger than the percentage change in price . Hence by using the formula we will obtain,

E = 30% / 10% = 3

b. If a 10 % change in price of a product results in a 5% increase in the demand, then we can conclude that the demand is inelastic. This is because the percentage change in demand is lesser than the percentage change in price. Hence by using the formula we will obtain,

E = 5% / 10% = 0.5

c. If a 10 % change in price of a product results in a 10% increase in the demand, then we can conclude that the demand is in unit elastic. This is because the percentage change in demand leads to a same percentage change in price. Hence by using the formula we will obtain,

E = 10% / 10% = 1

Consequently, there are three outcomes from the above equation. The E can be equal, less than or greater than 1. Economist refers a reading of less than 1 to inelastic, greater than 1 as elastic and equal to 1 as unit elastic where a 10% change in price results in a 10% change in the demand.

According to a study by Robert Archibald and Robert Gillingham in the Review of Economics and Statistics, their analysis on Consumer Demand for Gasoline using Household survey produce the following chart, where it shows how a 10% increase in its price will affect the quantity demanded.

Goods |

Short Run (%) |

Long Run (%) |

|

|

|

Air Travel |

1 |

24 |

Theatre Opera |

2 |

3 |

Gasoline |

2 |

5 |

Medical Care |

3 |

9 |

Jewelry |

4 |

7 |

Physician Services |

6 |

6 |

Alcohol |

9 |

36 |

Movies |

9 |

37 |

Automobiles |

1 |

15 |

China and Glassware |

15 |

26 |

Or in Graphical form.

How do you interpret the data?

It can be interpreted, as in the case of Gasoline, a 10% increase in gasoline price will produce a 2% and 5% reduction in quantity demand for both short and long run respectively. In short we can conclude that Gasoline is inelastic since a 10% increase in price only resulted in less than a 10% reduction in the quantity demand in both short and long run.

The above data shows that on all products surveyed, the long term price elasticity is greater than short term. This is because like the case of gasoline price increase, people will find other alternatives like using public transport, car pooling, use less automobile and more scooters to counter the price increase of Gasoline.

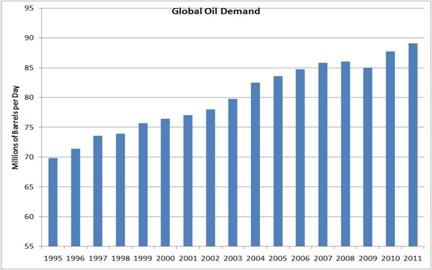

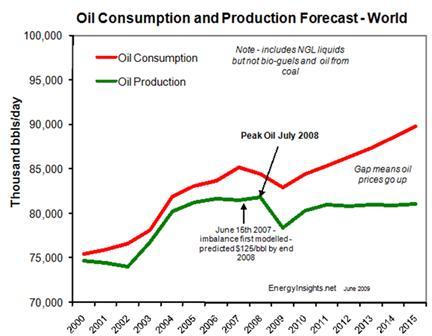

Further evidence of how inelastic oil demand to a price increase can be seen from the following chart.

Even during the peak of about $146 in 2008, demand for oil is still steady at about 87 MBPD. However due to the price hike in 2008, demand slows. This drop in demand (people are consuming less gasoline due to other alternatives available) pressured the price of crude oil to drop to below $40 in 2009. By then demand pick up again in the later part of 2009.

Effect on Public Policies

Understanding Price Elasticity prove useful to policy makers because when they know that gasoline is inelastic then people will be more adaptive and will tend to find alternatives in the long run. Instead of removing subsidies in big numbers like 30%, 50% or 100% as in Nigeria’s case, they can remove it in stages.

Like in Indonesia’s case, instead of a sudden removal of 30% in subsidy, the government can lessen the pain by prolonging it to18 months with three equal reduction of 10%. By doing this it will give more time for the people to adjust their lifestyle and less protest can be expected. As in Nigeria’s case it demonstrates that people are more tolerable to a 50% reduction ($0.45/$0.69 x 100) than a 100% removal in subsidy.

Law of Unintended Consequences

When policy makers draft a policy, their intention is to solve a given problem but unaware that there are other secondary consequences or side effects. This situation can be interpreted as One Policy but many consequences and this is known as the Law of Unintended Consequences. An example will be the implementation of rent control.

When the government calls for a rent control in certain areas, the effect will be of help to the low-income earners. However, it is not good news for property owners and since the rent is subjected to control the end result will be neglected or run down properties, low vacancy rates, discrimination against the tenants, under maintain properties and so on. Eventually the whole neighborhood will be affected areas.

Likewise when policy makers plan for a reduction in fuel subsidy, all they have in mind is the dollar amount in savings that can be channel to other sectors of the economy. Unintended Consequences like inflationary effect on goods and services, inability of the public transport system to cope with the ‘extra’ passengers, increase in smuggling activities, lost of confidence in the government, flip flop policies, demonstrations and so on are not taken into consideration.

Problems with Fuel Subsidy

After addressing the issues on policy making and its problems we can now direct our attention on the problems arising from fuel subsidy. Any government cannot be forever subsidizing its economy on any schemes be it farm, fuel, electricity, minimum wages and so on. Because sooner or later the Law of Diminishing Returns will prevail because it will reach a point where any further subsidies will only create wastage and inefficient allocation of resources.

The following are the problems that may arise from the effect of fuel subsidy.

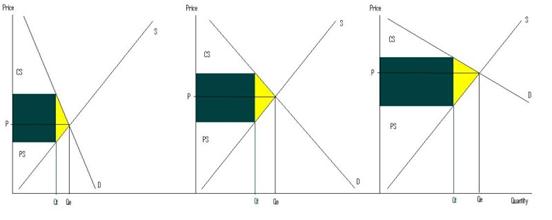

- High Opportunity Cost. A higher subsidy on fuel means less budgetary spending on other development projects such as infrastructure, health, education, poverty eradication, supply of clean water and other high impact projects. In other words it is denying the funds that should otherwise be used in implementing projects to help improve the well being of its people. Or in economics we call it Deadweight or Welfare Loss. Welfare loss is always inversely related to subsidy. The higher the subsidy the higher the welfare loss. The following graphs show how the reduction of subsidy (which increases the price of the product, Fuel in this case) will affect the welfare loss in different demand elasticity.

Assumptions.

- Supply curve (S) is constant

- Price hike due to reduction of subsidy is constant (P)

- Welfare loss represented by yellow box

- Different Elasticity Demand curves represented by (D)

We have 3 scenarios here with different elasticity of Demand. Charts from left represents an inelastic demand curve, more elastic and very elastic demand curves. As you can see in Chart 1, a price hike of P resulted in a small change in the quantity and also the yellow box. In Chart 3 where the demand curve is most elastic and a change in price P resulted in a larger change in quantity and also the yellow box, which represents the Welfare Loss.

So we can conclude that a reduction in the subsidy will only cost a small Welfare Loss when the product (Fuel) is demand inelastic. So policy makers now know that even with an eventual complete removal of Subsidy for Fuel, it will only cause a minimal Welfare Loss.

2. Enriching the rich cronies

Fuel subsidies have always been a policy to help a country’s under privileged to ease their burden. However the problem with fuel subsidies is that it had benefited the rich more than the poor. When demand is inelastic to price changes, middleman seems to have an upper hand in the distribution of the supplies.

There are many cases where subsidized fuel are sold at 3-5 times the original price and instead of helping the lower income, it further burdened them. In India, much effort have been carried out to deliver subsidize kerosene and electricity to targeted lower income consumers. However middleman seems to have their way around by bribing local officials. The result is more than 40% of the subsidize fuel and electricity went to the black market and industrial uses. Hence, it defeats the purpose of providing cheap fuel to needy families while at the same time enriching some of the political cronies.

In the case of Indonesia, home to the world’s largest archipelago with more than 17000 remote islands, enforcement will be out of the question. Fuel that are sold in remote outpost like Maluku Islands, West Papua, NTT, Sulawesi and so on, go as high as 5 times the subsidized price.

Similarly in Malaysia where it borders Thailand and Singapore in the West and Indonesia in the East, fuel smuggling seems to be a booming business. This is due to the higher price differential between Malaysia and its neighbor.

Cars and lorries from Singapore and Thailand are pouring in to fill up their tanks and as a result the government is losing a lot of money subsidizing the wrong group of people. Moreover, certain groups of people like the transport companies, fisherman, company lorries and etc, are allocated a fixed sum of subsidized fuel each month. Instead of using the fuel to help lower their cost of doing business, they resell the fuel to industrial customers.

3. Increasing world oil price means more State funds will be diverted to fuel subsidies since all countries that provide fuel subsidies are net oil importers. During periods of escalating prices, governments will find it more difficult to finance its subsidies. Years of subsidizing had created a ‘comfort zone’ in many people.

The above chart shows the Oil Consumption versus Production. From 2012 onwards the gap between the consumption and production continue to widen which signifies further price hike in oil in the future. So it certainly look foolish for any government to continue subsidizing fuel into the future because the higher the price the bigger will be the subsidy.

To them it is almost like a natural birth right for the government to provide them with cheap fuel. Cut in subsidies will always met with resistance and demonstrations from certain special interest groups especially the large industrial users and middlemen.

4. A country’s economic development is directly linked to its energy supply. Without energy its economic activity will grind to a halt. It is always a preferable government policy to encourage the development of alternative and renewable energy like solar, wind and wave. Further than that it will also hope to increase its efficiency in energy usage by promoting energy conservation, efficient clean technologies and new techniques of oil extraction and exploration.

However all this needs money but due to the fact that the low price of subsidized fuel discourage investments in the above projects due to low profit and hence will prohibit any further development. With the current trend towards less pollution and CO2 emition, governments will find it difficult to achieve this objective as long as the subsidy on fuel is not removed.

5. Artificially created competitiveness. Fuel subsidy help increase competitiveness artificially. By subsidizing, the government hoped to create economic activity by reducing the cost of living and also the cost of production. Subsidies are like cocaine to drug addicts. Once they are implemented they are very difficult to remove. Industries tend to depend on artificially low price electricity, fuel and etc, in order to stay competitive. Once lifted or reduced, they are unable to compete internationally due to the sudden increase in cost.

Moreover due to subsidies most national oil corporation like Pertamina in Indonesia and Petrobras in Brazil incurred hugh losses. Bailout will be in the form of tax payers money. Bailing out with tax payers fund means less funds available for other development projects.

Worse still, like the case of Indonesia, it had turned from being an oil exporting country to an oil importing country in 2004. Being an oil importing country mean more funds will be flowing out of the country and hence will increase its balance of payments deficits.

6. Subsidies become entrenched. Once subsidies are given to any sector of the economy, it is very difficult to revoke. Studies have shown that the main beneficiaries of subsidies are the politically connected cronies. In other words it encourage crony capitalism and corruption. These are people that are responsible for the diversion of the subsidized products to the black market and industrial uses.

Profits made form these illegal businesses will be directed back to the politicians through future election campaign contributions. It is more of a culture of ‘you scratch my back and I will scratch yours’.

What are the Solutions?

Some of the following solutions have been implemented and some are still in the evaluation stage.

- Use of special dye to color the subsidized fuel. This will make life easier for enforcement officers to detect illegal subsidized fuel sold to industrial customers. However those middlemen have somehow perfected the art of neutralizing the color of the dye by adding natural clay to it

- Fitting GPS equipments and RFID chips implant into the fuel transport trucks to track their movements and deter any mishandling of the product during transition.

- Provide cash to low income families as a form of compensation. In Indonesian it is called Bantuan Langsung Tunai.

- Quota or coupon based on previous month sales. For example in Malaysia the quota for diesel for fisherman is determined by the amount of fish they caught.

- Implementing a 50km demarcation zone. In Malaysia foreign owned vehicles from Thailand and Singapore are not allowed to fill up their tanks in any petrol stations that fall between the 50 km zone from the customs check points.

- Provide smart cards. Only certain groups of the economy are allowed to use subsidized fuel. Fuels like diesel can only be purchase by showing the smart card.

In Conclusion, we view that a country’s fuel subsidy should be removed on a gradual scale before its economy can move up on the competitive ladder. It is not a question of should but when. Policy makers will have to choose between ‘short term pain and long term gain’ or ‘short term gain and long term pain’. Lesson we can learn here is that a reduction in the subsidy in any product that displays demand inelastic to price changes will only cost a small Welfare Loss. So policy makers now know that even with an eventual complete removal of Subsidy for Fuel, it will only cause a minimal Welfare Loss.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2012 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.