One great way to make money ... Trade Between China and Brazil

Stock-Markets / Analysis & Strategy Feb 13, 2007 - 02:15 AM GMTOne great way to make money is to scour the globe ... find a unique point where two powerfully positive forces come together ... and then choose the investments that are most likely to convert those forces into profits.

That's what I've done. And I'm going to give you some of the results this morning.

The two forces:

#1. China's virtually insatiable demand for natural resources — driven by the world's largest population and fastest growing economy.

#2. Brazil's vast, rapidly evolving capacity to export precisely what China needs — including the world's largest, untapped, arable farmlands and largest, richest iron ore reserves.

To see the intersection of these forces with your own eyes, just visit the Panama Canal.

You'll see an endless flotilla of cargo ships ... laden with Brazilian iron ore, zinc, and other raw materials ... squeezing through the buoyed entrance channel in the Gulf of Panama ... traveling eight miles to the Miraflores locks ... passing under the Bridge of the Americas ... and slipping into the Pacific for the long trek to China's ports of the Yangtse River Delta, now the busiest on Earth.

But the feverish activity at the isthmus of Panama is just one symptom of the mindboggling facts:

* Overall, Latin America's exports to Asia have surged to $47.5 billion, growing by a breakneck pace of 20% per year since 2000.

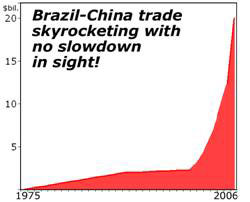

* Brazil's trade with China, which was under $20 million in the mid-1970s, has now grown by over one thousand times, to nearly $20 billion. And it's still skyrocketing. With no slowdown in sight.

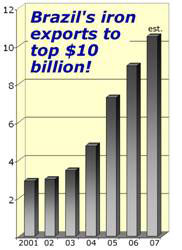

* The value of Brazil's iron ore exports have tripled just in the last six years — from $2.9 billion in 2001 to at least $10 billion this year. And most of that new growth is driven by China.

Ironically, this trade boom between China and Brazil is still in its infancy.

But already, the volume is so large — and a massive bottleneck at the Panama Canal so likely — China is now considering the construction of a second Inter-Oceanic canal in Nicaragua.

In the meantime, Chinese interests are seeking to gain control over existing facilities.

Hutchinson Whampoa, for example, owned by Hong Kong mogul Li Ka-shing, controls the Panama Ports Company, the operator of the Cristobal and Balboa ports at each end of the Canal. And more penetration by Chinese-owned companies is likely in the near future.

Most people might miss the importance of this new development. But most historians wouldn't.

They know that Teddy Roosevelt's successful completion of the Panama Canal in 1914 was a key factor that helped transform America into a world economic power in the 20th century.

And they know that a newer, wider, more modern canal could play a similar role for China in the 21st century.

Why China's Inroads into Latin America

Have Caught Most of the World by Surprise

Most economists in the Americas, Europe and even Asia had no inkling this was coming. Even those with some level of awareness thought China could take a century to achieve goals that are now being reached in a decade.

Why? Because they missed three non -economic factors that most economists don't usually deal with:

First, China is operating virtually unchallenged by competing powers.

During the Cold War, for example, China competed head-to-head with the Soviet Union for economic and political influence among Third World and non-aligned nations.

But after the Cold War, China has had that space virtually to itself ... moving in with remarkable deliberation and speed ... forging new friendships in Southeast Asia where it was formerly feared ... making major inroads into Latin America and Africa, where it was formerly ignored.

Even the U.S. is falling behind China in Latin America. Sure, it's firmly entrenched with old business. But it's falling behind China in generating new deals.

Second, unlike other world powers, China is strictly business.

When China is operating abroad, it routinely ignores corruption and human rights abuses. It uncouples commercial goals from military support. And it rarely attaches conditions to loans. This policy may return to haunt China in the future. But right now, it's viewed mostly as a broad strategic advantage.

With few exceptions, all that China does is offer money, cut deals , and buy assets — to build infra-structure, extract resources, and get them shipped to China.

Third, unlike Japan, China is not tip-toeing around the giant to the north, the United States.

Back in the early 1970s, when Japan was the biggest Asian player in Latin America, the Japanese hesitated to go all the way.

I know because I personally visited Japanese-run enterprises in the southern industrial state of São Paulo and in the Amazonian state of Pará. I also saw similar situations in Peru.

Everywhere, Japanese companies were seeking to secure new sources of raw materials — from soybeans to iron ore. And much like the Chinese today, they were helping to build the needed infrastructure.

But unlike the Chinese, they did not put the pedal to the metal. They didn't want to step on the U.S. dominance in the region. They took it slow.

To promote goodwill, they even sponsored a dozen new colonies of postwar Japanese immigrant families throughout Latin America.

Despite these hesitations, Japan's economy challenged America's economic leadership in the world, and its trade with Latin America — especially Brazil — grew by leaps and bounds.

Now, China is poised to repeat that feat, but with much greater speed and in far larger volume.

Unlike Japan, China is going for the gold. No hesitation. Virtually nothing to slow it down.

Just two years ago, for example, China's Hu Jintao signed 16 agreements with the Cuban government, including a 10-year extension to pay back Cold War era loans.

He cut major deals with Peru, Venezuela and Argentina.

He looked to Uruguay as a potential hub to penetrate Mercosur, South America's common market, helping to launch new joint ventures with Chinese auto manufacturers.

And most important, he locked in massive trade and joint venture deals with Brazil, China's largest trading partner in Latin America.

After Jintao toured Brazil, Lula reciprocated by taking an entourage of nearly 500 business entrepreneurs to China. Since then, trade between the two countries has skyrocketed.

The Biggest Single Beneficiary

Of the Brazil-China Boom

Some Brazilian companies are being hurt by Brazil's trade boom with China. They can't compete with cheap Chinese imports flooding into their economy.

And they've been trying to resist China's penetration ... but to little avail: The trade boom is continuing to accelerate, and the Brazilian companies that feed it are making out like bandits.

Case in point: Companhia Vale do Rio Doce, easily the biggest single beneficiary of the rapidly-emerging China-Brazil boom.

From 2001 to 2006, the total return to its shareholders (including dividends, currency appreciation and stock appreciation) was an average of 42.7% per year.

And since October of last year, the stock has been on a moon shot, up from less than $19.76 per share last September to $33.27 this past Friday. (That's even after a minor correction that began on Wednesday.)

We first looked at “Vale” (pronounced much like “Valley” in English) in the 1970s, when it was a state-owned company mostly unknown outside of Brazil. Today, Vale is ...

- The largest mining company in the Americas

- The second largest mining company in the world

- The world's largest producer and exporter of iron ore and pellets

- The world's largest producer of nickel, manganese and ferroalloys

- One of the lowest-cost integrated producers of aluminum copper, potash and kaolin.

It's operating on five continents. And it's the most immediate and direct beneficiary of the Brazil-China trade boom.

My brother's son, who got his bachelor's degree in mineral engineering in the U.S., visited the company's Carajás mine nearly two decades ago.

At the time, it was just about beginning production. Today it's a huge mining complex, producing everything from iron ore to gold, set to undergo still further expansion this year.

Just last month, Brazil's president announced a $250 billion investment and reform package for the next four years, and a substantial portion of that is going to wind up at Vale or its subsidiaries.

Meanwhile,

- Vale has established a strategic alliance with Nippon Steel, one of the world's largest metal groups, to produce iron pellets, make iron alloys, and embark on new coal and iron ore projects.

- Vale has just taken over Canada's largest copper mining company, INCO.

- Vale has signed a deal with Shanghai's Baosteel Group to buy its iron ore with a hefty 9.5% price hike, a sales agreement which is likely to set the basis for similar contracts for the rest of the year.

The outlook is not all roses. Vale bought INCO's copper mines near peak prices for the metal. We're wary of some legal actions in Brazil's courts seeking to annul the privatization process, claiming it was a give-away. And more downside in the stock would come as no surprise.

But if you want to jump on the China-Brazil trade boom, I think this an investment you can't ignore.

Just remember: Like all stocks, it can also go down in value. So invest with moderation, while keeping a good portion of your money safely tucked away in cash-type investments like Treasury bills or a Treasury-only money fund.

Good luck and God bless!

By Martin Weiss

P.S. Our free, live teleconference, “The Easy and Hassle-Free Way for Reaping Windfall Profits in Foreign Markets,” is coming this Thursday, February 15. But it's nearly booked up! So if you want to attend, you'd better register immediately .

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.