Blythe Master's Next Move - Silver Leads Again

Commodities / Gold and Silver 2012 Jun 23, 2012 - 09:02 AM GMTBy: Marshall_Swing

We have seen hundreds of articles in the last couple of weeks that the bottom is in for the PMs and they are about to go upward and onward...

Not so, I have been telling everyone for months that prices are headed down, down, down. But down is a very good thing for us who are in the physical scene because we can add far more ounces to our stash for the same fiat money number we have sitting on the sidelines.

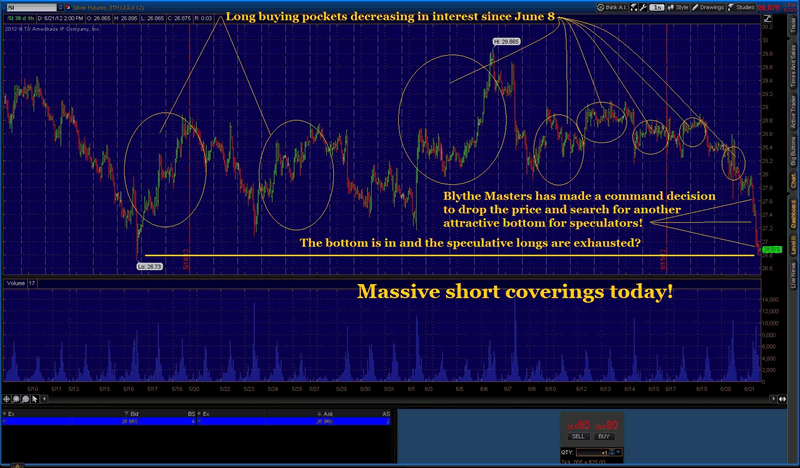

What we see today is a complete change in method by JP Morgan to drop the silver price below $27 to find a new bottom to generate paper long interest in the white metal.

As you can clearly see on the chart, at bottom, long interest has once again waned and since Blythe Master's in on a tight time schedule to get JPM's short position sold off, before Southern is toast, they have to try a new strategy to draw in the long buyers who have been sitting out of the market for quite some time now. They were content from about mid May to the 5th of June to allow some longs to buy in and make a little profit only to be smashed at regular intervals so those long's stops were tripped and JPM could cover huge amounts of shorts.

That strategy did not work up on the 6th however so fearing a long speculator deluge JPM had to smash those longs because things heated up too quickly and that is the result of the chart we see on June 7th. Since then, things have been well managed but there has been little speculative long interest so Blythe has decided only taking silver to lower levels can/will attract the speculators back into the game.

We shall see how the managed money responds over the next few days and if they think a bottom is in and they feel lucky.

Either way, they get killed one way or the other as this is nothing but a bear trap being set in the darkness of the COMEX wilderness for unsuspecting money managers who have a quick hand on the till and tight stops.

Gotta love going short in the 29s on options!

Be careful out there,

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.