If Bank of England Approved LIBOR Rate Manipulation, Will Mervyn King Resign?

Interest-Rates / Market Manipulation Jul 01, 2012 - 04:21 PM GMTBy: Nadeem_Walayat

Bankster's, such as Bob Diamond have just started to play their Ace card that they have held close to their chests for near 4 years now. That Ace card alledges that the Bank of England gave a nod and a wink to manipulate the LIBOR interest rates lower on several occasions during credit crisis extremes when the interbank lending market had effectively frozen.

Bankster's, such as Bob Diamond have just started to play their Ace card that they have held close to their chests for near 4 years now. That Ace card alledges that the Bank of England gave a nod and a wink to manipulate the LIBOR interest rates lower on several occasions during credit crisis extremes when the interbank lending market had effectively frozen.

BBC's Robert Preston is one of the first to be a recipient of the Bankster's Ace card and has duly reported:

In making false submissions about their borrowing costs, managers at Barclays believed they were operating under an instruction from Paul Tucker, deputy governor of the Bank of England, I have learned.

This belief was fostered after a telephone conversation in the autumn of 2008 between Mr Tucker and Bob Diamond, who at the time ran Barclays' investment bank, Barclays Capital, and is today chief executive of Barclays.

In finding Barclays guilty of attempting to manipulate the important Libor borrowing rate, the benchmark rate for bank-to-bank lending, the Financial Services Authority (FSA) made an elliptical reference to this conversation.

The relevant passage from the FSA's judgement against Barclays talks of a "telephone conversation between a senior individual at Barclays and the Bank of England during which the external perceptions of Barclays' Libor submissions were discussed".

I have established that the conversation was between Mr Diamond and Mr Tucker, who is a leading candidate to succeed Sir Mervyn King as governor of the Bank of England.

I last wrote on the Bank of England effectively giving the go ahead to the banks to manipulate LIBOR just a few days ago on the 28th of June - Barclays LIBOR Market Manipulation Fraud To Boost Profits and Mask Insolvency, RBS, HSBC and Lloyds to Follow

The LIBOR rate manipulation story is followed to its logical conclusion then it will eventually be found out that the banks received a nod and a wink from the Bank of England to under report their LIBOR rates as an panic measure (one amongst many) to avert financial armageddon and promote financial stability

and continuing with the fact that the Bank of England itself manipulates LIBOR lower, therefore the banks manipulating LIBOR lower is just facet of the Bank of England's overall policy of QE to force interest rates lower -

and it should not be forgotten that Quantitative Easing (QE) of £325 billion to date has been for the purpose of manipulating market interest rates lower across the yield curve, all the way from short LIBOR right through to the long dated Government Bonds. This is a FACT, the Bank of England has manipulated the market interest rates lower between banks and for government bonds but not for retail customers.

Yesterday I wrote how the Politicians and Bank of England were putting up highly public smoke and mirror screens to try and mask the truth of their own involvement in the manipulation of LIBOR - Bank of England, FSA and Politicians Try to Insulate themselves from Bankster Fraud Fallout

The Bank of England, FSA and politicians of all parties have been busy all week putting up multiple screens of smoke and mirrors to try and separate themselves from their bankster brethren despite the facts of close relationships between all parties that amounts to negligence to regulate and hold bankster's to account where the fundamental fact remains that despite all of the continuing crimes amounting to an ongoing risk of actual bankruptcy of Britain i.e. continuing to inflict far more financial damage than the likes of Al-Qeeda could ever have hoped to have imagined to achieve, NO bankster criminal has gone to prison! The only consequence so far has been to lose a bonus for a year or two, let alone face the sack.

LIBOR Manipulation is NOT news as my article of 28th June illustrated that the mainstream press is only now coming to terms with the fact that the LIBOR rate is manipulated, something that most market participants have know for years and so will have the Bank of England and FSA, though they appear to be pretending otherwise, and something that I was aware of BEFORE Lehman's went bust in September 2008.

April 2008 - LIBOR Interbank Market Stays Frozen Despite Bank of England £50 Billion Bailout

Neither do the Bank of England and the Treasury recognise that the official BBA LIBOR rate is broken , i.e. that the reported rate is not reflective of the true level of crisis as the reporting Banks are reluctant to announce the degree to which the banks are unable to function due to the continuing deleveraging of the huge $500 trillion derivatives market.

Financial Armageddon - The Reason Why LIBOR Was Manipulated

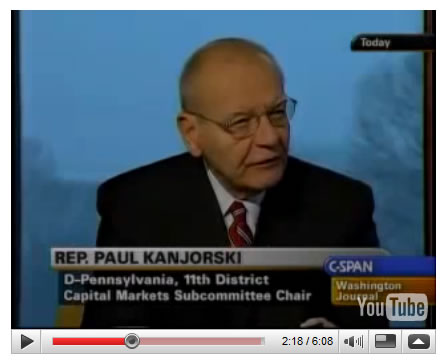

The following video from Jan 2009 should remind readers of the real reason why LIBOR is manipulated and why there will be many more instances of market manipulations and financial rules and regulations being broken that will be revealed over the coming years because when one is on the edge of financial armageddon, literally anything goes, the Bank of England, politicians and FSA will all have given many nudge and a winks to the banks.

At 2 minutes, 20 seconds into this C-Span video clip, Rep. Paul Kanjorski of Pennsylvania in Jan 2009 explains how the Federal Reserve told Congress members about a "tremendous draw-down of money market accounts in the United States, to the tune of $550 billion dollars." According to Kanjorski, this electronic transfer occurred over the period of an hour and threatened a further $5 trillion to be drawn out triggering a total collapse of the Financial System, which prompted Hank Paulson's emergency $700 billion TARP bailout action.

Therefore the Bankster's at the likes of Barclays and all major UK banks took the nod and a wink from the Bank of England to lower LIBOR rate submissions so as to give an illusion of solvency during times of credit crisis extremes, that they increasingly used and abused to boost profits to the cost of interest rate derivatives counter parties (usually other banks), as they always had a get out of jail card.

If Bank of England senior staff sanctioned manipulation of LIBOR rates, then so ultimately one of the heads to roll could be Mervyn King's as the Governor of the Bank of England. Off course others to have known or even directly sanctioned LIBOR manipulation "prevent financial armageddon by any means necessary" would have been the previous Prime Minister Gordon Brown ( who the public sacked him from office 2 years ago), so the Bank of England will have their own Ace card to play that will point back to Alistair Darling and Gordon Brown whether they realised the consequences of what they were requesting at the time or not! However, today's government may attempt to veer investigations away from the Bank of England because of the important role the BoE plays in the monetization of government debt and the potential consquences if the markets lose confidence in the Bank of England (I smell the potential for the mother of all coverups).

The Real Problem is that the bankster's continue to run rings around politicians and regulators because they have imbedded themselves so deep into the system that the know the politicians cannot survive without them, because the politicians rely on the bankster's to bankroll the deficit with the tax payers OWN money !

That is how our political / economic system functions - Politicians rely on the Bank of England to print debt / money to finance the huge annual budget deficits (£130 billion per year) so as the party in power can buy votes, to achieve this the Bank of England encourages the banks with cheap money (QE) and capital requirements to buy government debt with the FSA playing its role by employing ex-bankers that employ light touch regulation so as the government can achieve it's objective of continuing its confidence game Greece style of an ever increasing debt mountain at ultra-low sub inflation interest rates. However there is a price to be paid for this money / debt printing confidence game and that is INFLATION.

Ultimately this achieves the bankster's goal of turning everyone and everything into a debt slaves and for the party in power to maximise its chances of getting re-elected as they buy votes with borrowed money just as Gordon Brown did at the last election and just as David Cameron will attempt to do at the next election, which means the system will only ever be tinkered with around the edges until there is a REAL revolution!

So get ready for another round of inflation inducing money printing of £50-75 billion for the banks to buy government bonds possibly as early as Thursday of next week! So much for holding bankster's to account, instead they will be stuffed with even more cash! Instead, if the Bank of England did not primarily work to serve its bankster brethren, the £75 billion could actually boost the economy if the 28 million tax payers each received a tax refund of £2,678!

By Nadeem Walayat

Copyright © 2005-2012 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.