Ready, Steady, GOLD

Commodities / Gold and Silver 2012 Aug 24, 2012 - 03:34 AM GMTBy: Bob_Kirtley

In anticipation of the ECB and the Federal Reserve deciding to stimulate the economy through an infusion of newly created paper money gold prices have started to recover and head north. We know that the Greek PM Antonis Samaras has met with Jean Claude Junker, President of the Eurogroup in order to try and secure more time for Greece to get its act together and that further meetings are planned in an attempt to resolve this problem. However, so many of these meetings have been held with very little emanating from them making it difficult for us to become enthusiastic about this latest round of what has been a merry-go-round of talks over the last two years. As we see it they will print rather than have Greece leave the eurozone as the fear of contagion worries them more than the fear of inflation.

In anticipation of the ECB and the Federal Reserve deciding to stimulate the economy through an infusion of newly created paper money gold prices have started to recover and head north. We know that the Greek PM Antonis Samaras has met with Jean Claude Junker, President of the Eurogroup in order to try and secure more time for Greece to get its act together and that further meetings are planned in an attempt to resolve this problem. However, so many of these meetings have been held with very little emanating from them making it difficult for us to become enthusiastic about this latest round of what has been a merry-go-round of talks over the last two years. As we see it they will print rather than have Greece leave the eurozone as the fear of contagion worries them more than the fear of inflation.

Meanwhile across the pond we have the Jackson Hole meeting where Ben Bernanke may just hint of further action to be taken by the Federal Reserve. A positive hint at this meeting would drive the markets higher, however, he will still have to deliver solid numbers at the next meeting of the Federal Reserve, which is scheduled for September 12–13. Failure to do so will see the markets go into free fall.

We disagree totally with quantitative easing as we believe that liquidity is not a cure for insolvency, it is merely the application a band aid in the forlorn hope that something or someone will come to the rescue. Alas, this story does not have a happy ending.

Back to the recent rise in the price of both gold and silver. We could attribute this move to the US dollar topping out and losing some of its strength recently as it has dropped from 84.00 to 81.49 on the US Dollar Index (EOD) and that might be the case. There is also the unrest in the Middle-East which is driving both precious metal prices higher as the fear premium prevails.

Fundamentally, both gold and silver prices have been through a lengthy period of consolidation and it can be argued that this embryonic rally is long overdue.

What fascinates us is that investors are prepared to invest in anticipation of more financial stimulus by both Europe and the United States. Why not wait until we know for definite, before risking our hard earned cash? The current rational would appear to be 'get in now while prices are cheap.' If these investors are correct in their assumptions then they will indeed make bigger profits than those who wait and ascertain for sure which way our political masters are going to jump. Those who wait will have to pay higher prices for the metals and the stocks for that matter, but this is not a sprint, or a one off cup game, its a marathon or a season that has many years to run. And if there is no QE3, then it will look a tad like a suckers rally.

We all have to do the work and make our own decisions as we are responsible for our own well-being. In articles such as this one we can only outline our strategy and be warned it is personal to us as it suits our goals, aspirations, cash position, aversion to risk, etc. You are uniquely different and so must read as widely as possible in order to gather all the data required to formulate your own investment strategy.

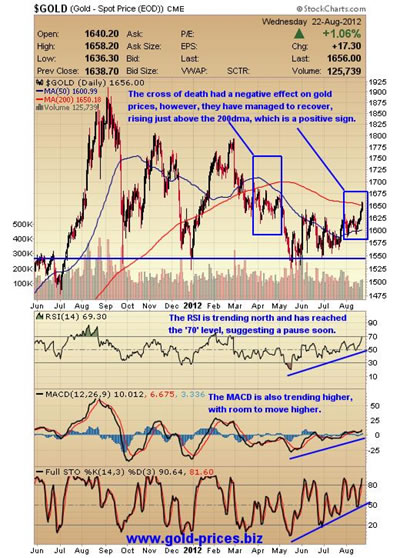

Before we conclude we will take a quick look at the chart where we can see that the RSI is trending north and has reached the '70' level, although it can go higher the penetration of this level suggests a pause may be on the way. The cross of death had a negative effect on gold prices, driving them lower, however, they have managed to recover, rising to just above the 200dma, which is a positive sign. Also note that the MACD is also trending higher, with room to make further progress. What we would like to see next is the 50dma cross over the 200dma in an upward swing, that would signal that a serious rally was underway, in our very humble opinion.

In conclusion we can only reiterate our defensive strategy against such ill winds is to own physical gold and silver along with a selection of gold and silver mining stocks. That’s our core position, however, in order to gain a little leverage we do venture into the options market where our portfolio gets a bit of a boost. If you can anticipate the movement of the underlying asset and acquire the appropriate options contracts that are tied directly to it, then the returns can be many times that of the gain made by the asset itself. It is this sort of leverage that attracts investors to the mining sector, however, this sector is not performing at the moment and so we will not be increasing our exposure to it, despite the clamour to do so. Until we have some indication that the mining stocks are performing relative to the risk of owning them will continue to look for opportunities in the options arena, where leverage can be found, making a small move in the underlying asset a rewarding trade. This is not for the faint hearted, but then again neither is the mining sector in general.

Your investment plan should be solid by now, so be brave and execute it in your own time ignoring the white noise emanating from the mainstream herd, those holding the folding stuff will lose this battle.

Have a good one!

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.