Today’s Global Economic Crisis Worse than the Great Depression?

Economics / Great Depression 2010's Sep 21, 2012 - 05:35 AM GMTBy: Washingtons_Blog

What Do Economic Indicators Say?

What Do Economic Indicators Say?

We’ve repeatedly pointed out that there are many indicators which show that the last 5 years have been worse than the Great Depression of the 1930s, including:

■The housing slump

■The bank charge off rate

■The collapse in world trade

■The withdrawal of short-term credit

■The level of inequality between rich and poor (too much inequality destroys economies)

■The interconnectedness of financial systems and economies worldwide (interconnectedness leads to financial instability)

■Runaway spending and greed

Mark McHugh reports:

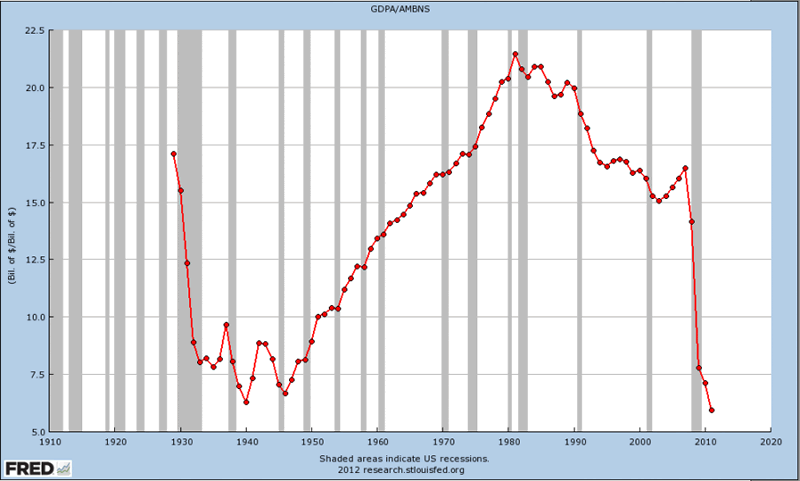

Velocity of money is the frequency with which a unit of money is spent on new goods and services. It is a far better indicator of economic activity than GDP, consumer prices, the stock market, or sales of men’s underwear (which Greenspan was fond of ogling). In a healthy economy, the same dollar is collected as payment and subsequently spent many times over. In a depression, the velocity of money goes catatonic. Velocity of money is calculated by simply dividing GDP by a given money supply. This VoM chart using monetary base should end any discussion of what ”this” is and whether or not anybody should be using the word “recovery” with a straight face:

In just four short years, our “enlightened” policy-makers have slowed money velocity to depths never seen in the Great Depression.

(As we’ve previously explained, the Fed has intentionally squashed money multipliers and money velocity as a way to battle inflation. And see this)

Indeed, the number of Americans relying on government assistance to obtain basic food may be higher now that during the Great Depression. The only reason we don’t see the “soup lines” like we did in the 30s only because of the massive food stamp program.

And while apologists for government and bank policy point to unemployment as being better than during the 1930s, even that claim is debatable.

What Do Economists Say?

Indeed, many economists agree that this could be worse than the Great Depression, including:

■Fed Chairman Ben Bernanke

■Former Fed Chairman Alan Greenspan (and see this and this)

■Former Fed Chairman Paul Volcker

■Economics scholar and former Federal Reserve Governor Frederic Mishkin

■The head of the Bank of England Mervyn King (and see this)

■Nobel prize winning economist Joseph Stiglitz

■Nobel prize winning economist Paul Krugman

■Former Goldman Sachs chairman John Whitehead

■Economics professors Barry Eichengreen and and Kevin H. O’Rourke (updated here)

■Investment advisor, risk expert and “Black Swan” author Nassim Nicholas Taleb

■Well-known PhD economist Marc Faber

■Morgan Stanley’s UK equity strategist Graham Secker

■Former chief credit officer at Fannie Mae Edward J. Pinto

■Billionaire investor George Soros

■Senior British minister Ed Balls

Bad Policy Has Us Stuck

We are stuck in a depression because the government has done all of the wrong things, and has failed to address the core problems.

For example:

■An economics professor says we’ll have “a never-ending depression unless we repudiate the debt, which never should have been extended in the first place”

■Fraud was one of the main causes of the Depression, but nothing has been done to rein in fraud today. Indeed, the only action the government is taking is to help cover up fraud

■All leading independent economists have said that the economy cannot recover until the big, insolvent banks are broken up, but the government has just helped them to get bigger

■Excessive leverage helped cause the Great Depression and the current crisis, but the government has encouraged more leverage

■The Federal Reserve caused the Great Depression and the current crisis, and has done nothing but help the fatcats at the expense of the little guy. And yet the government has given the Fed more power than ever.

■Government policies send manufacturing jobs and dollars abroad

■The government is doing everything else wrong. See this and this

Quantitative easing won’t help … it will only make things worse.

This isn’t an issue of left versus right … it’s corruption and bad policies which help the super-elite but are causing a depression for the vast majority of the American people.

The government and the banks are doing all of the wrong things.

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2011

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.