Gold Supply Issues Offer Additional Price Underpinnings

Commodities / Gold and Silver 2012 Oct 30, 2012 - 12:27 PM GMTBy: Pete_Grant

Gold turned defensive in recent weeks, weighed by global growth concerns, persistent economic uncertainty in the eurozone and the United Sates, along with a rising lack of clarity about the likely outcome of next week's U.S. Presidential election. However, downside potential is thought to be limited by continued robust demand for the precious metal as a hedge against the global debasement of fiat currencies, as well as ongoing central bank demand for the purposes of reserve diversification.

Most of our readers are probably pretty well aware of these macro-drivers on the demand side, but it's also worth noting some significant supply side considerations:

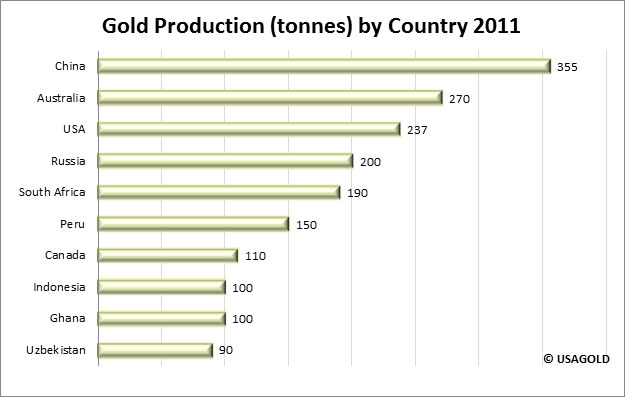

First of all, and this is a topic we've discussed on numerous occasions, none of the mining supply from China is making it to the open market. Essentially, every ounce of gold mined in the world's largest producer is going right to their insatiable reserve building effort.

Secondly, James Rickards, a partner at JAC Capital Advisors, suggested via Twitter last week that the primary takeaway from the Sydney Gold Symposium was that the "Chinese are buying gold mines in Western Australia faster than lawyers can write the contracts." It would seem that the Chinese have their eyes on some of the output from the world's second largest producer of gold as well.

Thirdly, the fourth largest producer in the world is also in full-on accumulation mode. The World Gold Council says Russia has more than doubled its gold reserves in the last five years and now holds the fifth largest stockpile. It is likely that much — if not all — of their mining output is going right to reserves as well.

And finally, labor unrest in South Africa has negatively impacted production in the fifth largest producing nation. Earlier in the month, Reuters reported that strikes were costing AngloGold 32,000 ounces of gold each week, while Gold Fields was losing 2,300 ounces a day at the two mines affected. According to Reuters: "Wildcat strikes that started in the platinum mines have left more than 50 people dead and spilled to other industries, undermining investor confidence in Africa's biggest economy and tarnishing President Jacob Zuma's government."

While the unrest eased last week, the situation remains volatile, and police fired rubber bullets at striking workers outside a mine owned by Anglo American Platinum just today. The strikes have already reportedly cost South Africa ZAR10 billion ($1.5 billion), forcing the finance ministry to lower its 2012 growth forecast to +2.5%, from +2.7% previously.

We know that China has been actively seeking to acquire African gold interests as well. Most recently, state-owned China National Gold entered into talks with Barrick Gold to gain their majority stake in African Barrick. Those discussions are ongoing.

If you would like to broaden your view of gold market, we invite you to sign-up for our regular newsletter and receive quality commentary like what you are now reading. It's free of charge and comes by e-mail. You can opt out at any time.

Just to round out the list of top-five gold producers: The United States is number-three. But the takeaway here is that nearly a third — and likely more — of global gold production is being impacted either by sovereign reserve building or labor strife. That's huge.

So while supply issues often get short-shrift in the financial press, it's important to realize that they too provide significant underpinnings to this market. Simple supply and demand economics, strong demand relative to available supply, suggest that the long-term secular bull market remains dominant and that short-term corrective activity should continue to be limited.

By Pete Grant , Senior Metals Analyst, Account Executive

USAGOLD - Centennial Precious Metals, Denver

For more information on the role gold can play in your portfolio, please see The ABCs of Gold Investing : How to Protect and Build Your Wealth with Gold by Michael J. Kosares.

Pete Grant is the Senior Metals Analyst and an Account Executive with USAGOLD - Centennial Precious Metals. He has spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. In 1988 Mr. Grant joined MMS International as a foreign exchange market analyst. MMS was acquired by Standard & Poor's a short time later. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. As a manager of the award-winning Currency Market Insight product, he was responsible for the daily real-time forecasting of the world's major and emerging currency pairs, along with gold and precious metals, to a global institutional audience. Pete was consistently recognized for providing invaluable services to his clients in the areas of custom trading strategies and risk assessment. The financial press frequently reported his expert market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.