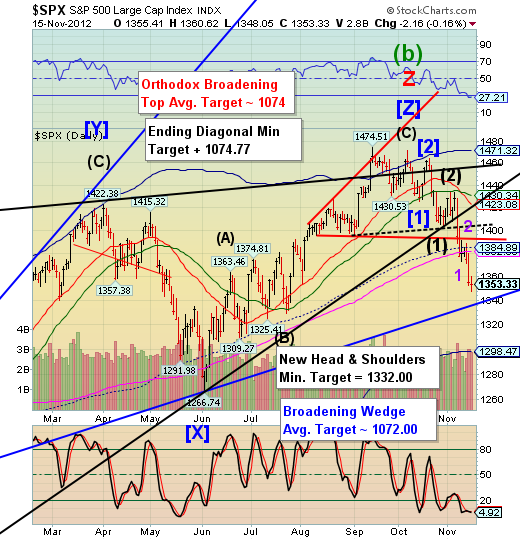

Stock Market Crash to Start This Morning!

Stock-Markets / Financial Crash Nov 16, 2012 - 03:34 AM GMTThe fractals are getting shorter, which means that the market is gaining momentum as it declines. Let’s examine the fractals making up the waves in the chart.

First, a point of clarification. I view the October 5 high as the Orthodox high, although the cycles called for the high on September 14. In my opinion, the Elliott Waves fell in line by producing a truncated 5th wave on October 5.

Starting from the September 14 high, there were 3 fractals to October 5. Their lengths were 34 hours, 43 hours and 26 hours.

From October 5 to October 18 there were two fractals, the first was 34 hours and the second was 30 hours.

From October 18 to November 1, there were two fractals of 21 hours each.

Since November 1, there have been five fractals, each at 17 hours duration. The last one peaked at 2:00 pm Eastern time today.

Today is another Pivot day, so we may see a further change in the fractals going forward. They might compress to 12.9 hours, 11 hours or possibly 8.6 hours. The next Pivot day is Tuesday, November 20. The one following is on Friday, November 23. This leaves us with the probability of taking profits most likely on Tuesday or Wednesday early morning. If the decline lasts until Thanksgiving day, November 22, there will probably be a hue and cry for the Fed to do something about it, so I don’t expect the decline to last after next week…the worst that may happen is that it could last until the Friday after Thanksgiving. Pray that the officials don’t close the market for more than 15 minutes or a half hour. That would make these calculations a bit more difficult.

I expect the crash to start tomorrow morning. A panic situation usually resolves in three days. My best guess is that, if the fractals measure 8.6 hours each, we should be done by Tuesday morning, with the brunt of the crash on Monday. 12.9 hour fractals may prolong the crash until Wednesday morning. The May 6, 2010 Flash Crash fractal was exactly 8.6 hours long. Last year’s August 1 through August 9 Flash Crash consisted of 4 fractals in the following order; 21 hours, 11 hours, 9 hours and 6 hours.

There is no telling what combination we may see, so I will simply have to monitor the fractals to gauge the time. The wave structure suggests there may be at least 3-4 more fractals left in this decline, so compression will be the name of the game next week.

In regards to distance, I fully expect to meet or exceed the October 2011 low at 1974.77. However, there are some additional issues in regards to the Yen, the Euro and High Yield markets that may put even more liquidity demands on the market. Plus margin calls…you get the picture. Again, my model suggests that, if the SPX declines beneath 1100, there may be yet another 200-point drop in store. That may mean the fractals may be shorter in time, but longer in distance as the crash persists.

I have just about worn out this topic, so I’ll call it a day.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.