Bulgaria Hyperinflation Fifteen Years Later

Economics / HyperInflation Nov 19, 2012 - 02:39 AM GMTBy: Steve_H_Hanke

The first of July marked the anniversary of a momentous day in Bulgarian history. On that day, fifteen years ago, Bulgaria installed its currency board system (CBS), finally ending its hyperinflation, which had peaked with a monthly inflation rate of 242%, in February 1997.

The first of July marked the anniversary of a momentous day in Bulgarian history. On that day, fifteen years ago, Bulgaria installed its currency board system (CBS), finally ending its hyperinflation, which had peaked with a monthly inflation rate of 242%, in February 1997.

But, I am getting ahead of myself. As the Soviet Union and allied communist countries began to collapse, I anticipated that a big issue facing the newly-liberated, former communist countries would be inflation, and the instability associated with it. In consequence, I shifted the emphasis of my research program from privatization to currency reform.

For me, this was a big shift, since I had been President Ronald Reagan's chief White House adviser on privatization, in the early 1980s, and had a great deal invested in developing that policy agenda. By 1990, I was operating as the personal economic adviser to Zivko Pregel, the vice president of the Socialist Federal Republic of Yugoslavia.

Yugoslavia had been plagued by very high inflation rates for many years. As I reflected on Yugoslavia's problems and the inflation storms which were gathering in the former communist lands, I concluded that currency board systems were the best monetary arrangements for stopping inflation and establishing economic stability. I also embraced the idea that, while stability might not be everything, everything is nothing without stability.

Early on, it became clear that Bulgaria would face the curse of hyperinflation. So, thinking Bulgaria was fertile ground to plant the CBS idea, Mrs. Hanke and I traveled to Sofia in 1990. Our objective was to present the CBS idea to Bulgarian officials, intellectuals, and the general public. After our initial trip, we concluded that Bulgarian economists had never heard the words "currency board" and had no idea how such a monetary regime would work. To remedy this, I developed a blueprint for a Bulgarian CBS, which I incorporated into a book that I co-authored with Dr. Kurt Schuler: Teeth for the Bulgarian Lev: A Currency Board Solution (1991).

Armed with that book, Mrs. Hanke and I made several subsequent visits to Bulgaria. Even though the CBS idea generated genuine interest in certain circles, the official response was negative. The often-repeated refrain of the respected former Governor of the Bulgarian National Bank, Prof. Dr. Todor Valchev, was typical of government officials: thank you for your proposal and interest in Bulgaria, but we know the realities of the local situation and have everything under control.

Once hyperinflation broke out, in 1996, resistance to the CBS idea vanished. In December 1996, the Bulgarian Ambassador to the U.S. requested that I present my CBS ideas in Washington, D.C. That same month, a pirated version of the book Dr. Schuler and I co-authored (in English) was translated into Bulgarian and reached the top of the best-seller list in Sofia. Two months later, Mrs. Hanke and I traveled to Sofia, and President Petar Stoyanov invited me to become his adviser. He requested that I draft a currency board law for Bulgaria, and explain to the Bulgarian people, and their politicians, how such a system would halt hyperinflation.

After the currency board was installed on 1 July 1997, inflation and interest rates plunged immediately. I can recall the genuine pleasure (and, perhaps, relief) that President Stoyanov displayed when he congratulated me on the outstanding results produced during the first few months of the CBS. He then admitted to me that, while he had hoped the CBS would kill inflation, he was initially somewhat skeptical. Indeed, he was amazed when the CBS worked even more rapidly than I had predicted. Much later, President Stoyanov confided that, without the stability created by the CBS, Bulgaria would have had much more difficulty entering NATO (2004) and the European Union (2007).

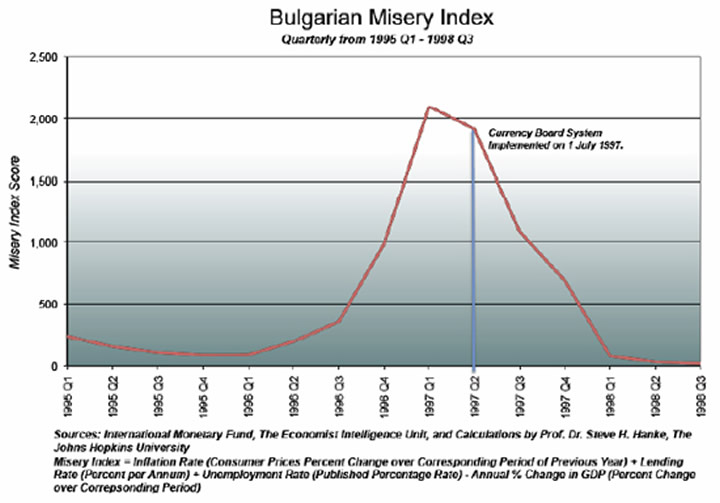

To illustrate just how dramatically the CBS improved life for Bulgarians, I constructed a Misery Index for the 1995-98 period. The index is the sum of the inflation, interest, and unemployment rates, minus the annual percent change in the gross domestic product (GDP).

With the establishment of the CBS, Bulgaria's hyperinflation crisis came to an abrupt halt. Since then, Bulgarians have strongly embraced their currency board. This embrace has forced all political parties in the past 15 years to practice monetary and fiscal discipline. The result has been stability, even in the face of the Russian ruble crisis of 1998 and the current economic implosion in neighboring Greece.

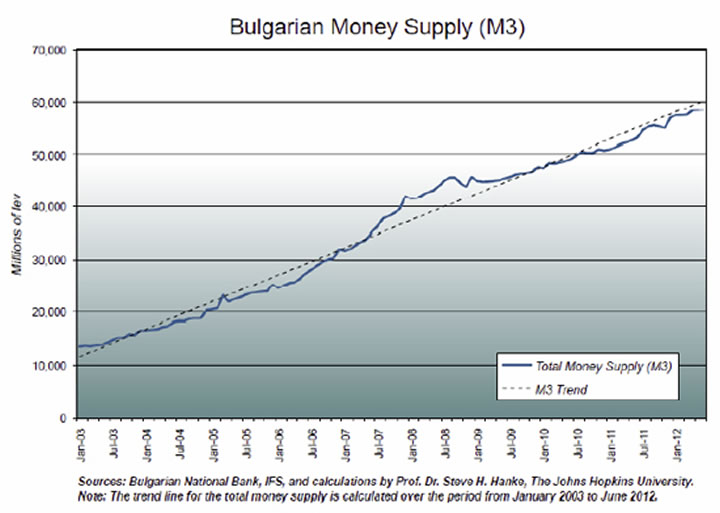

On the fiscal side, Bulgaria's annual fiscal accounts have been closer to balance than those of almost any other EU country. And, Bulgaria's debt is one of the lowest in Europe. As for the money supply, Bulgaria's has registered stable growth, and the total money supply is very close to the trend rate. By contrast, most other EU countries are witnessing huge money supply deficiencies and deflationary pressures.

The CBS delivered Bulgarians from the crisis of 1996-97. But, crime and corruption remained a persistent plague. Because I was an adviser to the President – and an independent one – many foreign companies alerted me to the problems they were facing. To underscore just how big the corruption problem was, I reached into my briefcase, during one meeting Mrs. Hanke and I had with President Stoyanov, and pulled out proof that a Bulgarian minister was demanding bribes from an American company.

I soon advised President Stoyanov that his next step should to mount a campaign to end Bulgaria's rampant corruption, as it stood in the way of more healthy economic growth.

Sadly, little has changed since then.

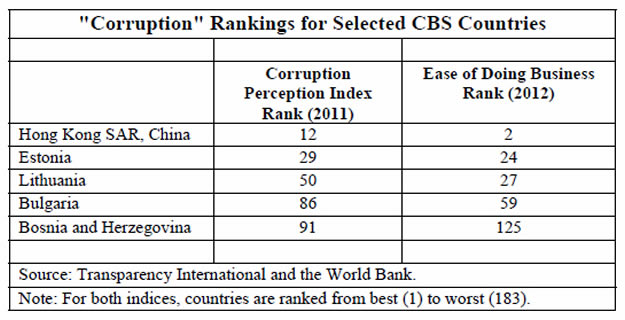

For evidence of this, just look at where Bulgaria ranks on two "corruption indices" – Transparency International's Corruption Perception Index and the World Bank's Ease of Doing Business Ranking (which was pioneered by none other than Bulgaria's Minister of Finance, Simeon Djankov). The accompanying table illustrates how Bulgaria compares to other countries which currently (or until recently) employ(ed) CBSs.

Bulgaria's finance minister is uniquely qualified to clean up the corruption mess. Prime Minister Borisov should issue a mandate directing Minister Djankov to dramatically improve Bulgaria's position in these corruption rankings, and should grant him extraordinary powers to accomplish this task. In addition, the Minister should be given a new employment contract, based on the "first-class pay for first-class performance" principle. Indeed, Dr. Djankov should be awarded a much higher salary – one commensurate with his new responsibilities.

For those who might be skeptical, just consider Singapore, where the Finance Minister earns €1.2 million per year. This first-class salary has indeed generated first-class results – for the past two years, Singapore has held down the top position in the Ease of Doing Business Rankings, and corruption is almost non-existent.

Armed with a currency board system, Bulgarians overcame the hyperinflation crisis of 1996-97, and finally began to realize stability and economic growth. Now, it's time to get serious about Bulgaria's biggest problem: corruption.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2012 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.