Green Energy Stocks 90% Price Collapse

Companies / Renewable Energy Dec 12, 2012 - 12:06 PM GMTBy: Andrew_McKillop

TIME WAS

TIME WAS

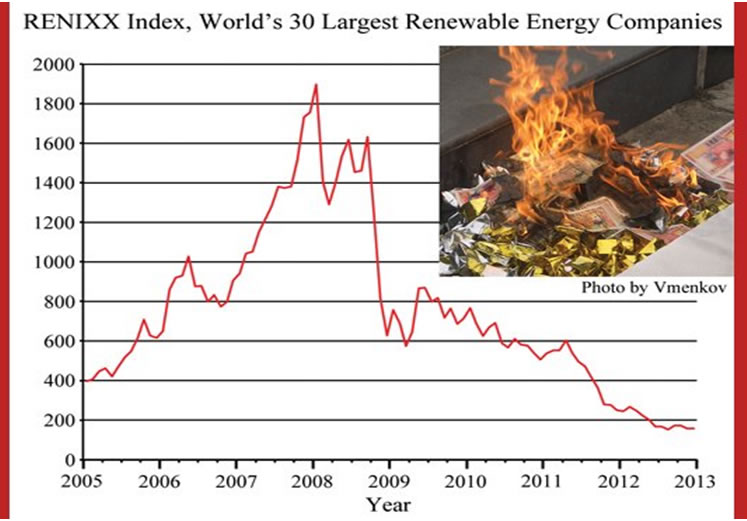

In late 2007 the RENIXX index of 30 leading clean energy stocks reached its peak: since then it has almost constantly fallen, and to early December 2012 has lost more than 90% against the peak.

Explaining the fall through 2010-2012 could seem difficult. Other stock indices outside the renewable enery sector covered by RENIXX, which includes a few diversified companies operating in fuel cells, power transmission, biotech and smart metering as well as wind and solar, have shown sometimes massive recovery and growth since the 2008-2009 stock panic. The bounce was of course a fake and lent heavily on extreme or massive government handouts and bailouts, but why did it not also tweak green energy stocks?

For 2010 and 2011 according to Germany's IWR renewable energy institute, which created and maintains the index, the RENIXX index lost 29.3% followed by 54.4% against year previous.

This could be called a normal thing for "early mature" market sectors, or due to growing investor disappointment with bad financial performnce, or continuing headwinds from the 2008 crisis, or similar arguments, but other explanations are in fact needed. The IWR's attitude is stoic. It says all fundamentals able to power the growth of renewable energy company stock and able to outperform other market sectors, are still in place. Its one-liner is "The finite nature of fossil energy resources".

SHIFTING SANDS

IWR still claims its 30 leading companies are "Global companies with more than 50% of revenues coming from the wind energy, solar power, bioenergy, geothermal energy, hydropower or fuel cell sector", but starting with the 22 listed solar photovoltaic and windpower companies, almost all of these these are so government friendly they are government dependent. This is mostly because these companies had no choice. They had the choice of going out of business - for whatever reason - and staying in business but depending on big government. To be sure IWR can argue that a certain, but declining number of the companies in its index are genuine free market entities pursuing normal goals without undue or special interference by government. Putting things bluntly, global renewable energy business may have started with stars in its eyes, but certainly since 2008 has become crony capitalist.

This itself can explain investor disenchantment. Governments have a way of walking away from their self-assigned "burdens" in the economy and society. They can quickly abandon the honeymoon quest of helping or saving solar, wind, biofuel, wave energy, electric car, battery tech or other government-friendlies from a growing list of New Energy pink elephants and Pink Sheets. The official reason is always that costs grew like wildfire, job costs were too high to protect, there were no national security issues, the Chinese or Indians can do the tech better and cheaper, and so on. Previous to this, of course, the exact opposite was argued.

12 of the companies listed by the RENIXX are Chinese and 10 of them are solar-based or oriented - but these companies are now sure and certain "wards of state", with zero freedom of company board decision. Chinese government treatment of them may be as simple and brutal as shrinking these 10 companies to 5-only by 2015, or before. This pending government action is well known, and the causes of it are also well known. China's production capacity in solar PV is approximately two times world total market absorbtion capacity, offering the choices of "waiting for the world to catch up" or more likely not waiting. Just as revealing but in a different way, the world's No 2 producer of solar PV, Germany, has only one entrant company from the solar PV sector, in the RENIXX index. The rout of major solar power equipment producer companies in Germany helps explain the IWR's choice.

The only difference is the German solar rout already happened; the Chinese one is yet to come.

There is little need to look at Gamesa of Spain, India's Suzlon or Denmark's Vestas in the windpower sector of this index: all three are as heavily in need of government support to stay in business, as the straight majority of German and Chinese solar PV equipment producers. Overall, 22 out of the 30 companies listed by the RENIXX are solar and windpower producers, identifying the real causes of the index crash since 2008.

TECHNOLOGICAL TRIUMPH-FINANCIAL DISASTER

Even before 2008 the writing was on the wall for "classic type" company growth paths and strategies, in the green-and-clean alternate energy sector. By "classic" we can look at the Silicon Valley growth model, and try applying it in the same way as several Barons of the Valley tried. These included Bill Gates, Vinod Khosla, Peter Thiel, Bill Joy, Elon Musk and several other big names - their ventures either folded in a sea of red ink or still today stumble on from one government handout to another.

The number of technological but especially industrial differences between IT and coummunication technology on one hand, and alternate energy on the other are all we need to explain why the Barons of the Valley hit a brick wall, despite solar PV using semiconductor technology! Quick and drastic changes in activity, production, operating systems, infrastructures, user habits and expectations - for example - are all possible in IT and communications, but not in energy. Industrial plant for alternate energy is very often, for example solar power, at least as high cost and capital intensive as fossil energy equipment plant and manufacturing. Extreme rapid growth of alternate energy manufacturing capacity, driven by government handouts, feed-in tariffs, tax breaks, and other support including a surge of investor enthusiasm around 2005-2008, has strapped producers to the mast of their corporate ships, condemned to sail forward or abandon ship.

Renewable energy is often compared with the ultimate government protected White Elephant of nuclear power. Some comparisons are possible, but the real difference is clean energy will and does work, unlike nuclear power. Major changes in the energy infrastructure needed to integrate green energy, and the long-term nature of this adaptation and transition also make it certain that green energy will stay dependent on and close to government, like nuclear power. For stock market players looking to choose the right numbers on the spinning roulette wheel this long term need for government aid and support is a sure reason to stay away from alternate energy stocks.

Drawing down surplus production capacity in green energy, at the same time as government subsidies and feed-in tariffs are slashed, makes for a long dark tunnel ahead. Adding in the transformation of world energy since 2008, both supply side and demand side, the nearterm future outlook for the sector remains troubled and will surely include major mergers, restructuring and downsizing. These will create sure prospects for stock gains, in the sector that as the IWR proudly announces, continue to have double digit annual growths of production and output - not profits.By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2012 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.