Wild Stock Market Start to 2013

Stock-Markets / Stock Markets 2013 Jan 02, 2013 - 07:42 AM GMTBy: PhilStockWorld

Happy New Year!

Happy New Year!

And what a way to start it off with our Futures flying up another 1.5% – on top of Monday's 2% gains you might have missed as we celebrate the non-event of the Fiscal Cliff that we kept telling you not to worry about last year (see any post). On Monday morning's Alert, and in our Chat Room, I reminded our Members, as the market tanked, not to be too bearish, saying:

Keep in mind that we need to spend 2 days below our levels to be officially bearish so let's hope we do get some good news today and take back those 50 dmas so we can treat them as a blip and throw the spike out in our forward calculations.

As you can see from Dave Fry's SPY chart, that was pretty good advice as we quickly reversed that bad open and flew higher. We looked over our virtual portfolios at 11:52 and decided, fortunately, to maintain our very bullish stances based on the news available to us and, of course, our general attitude that the whole cliff thing was overdone.

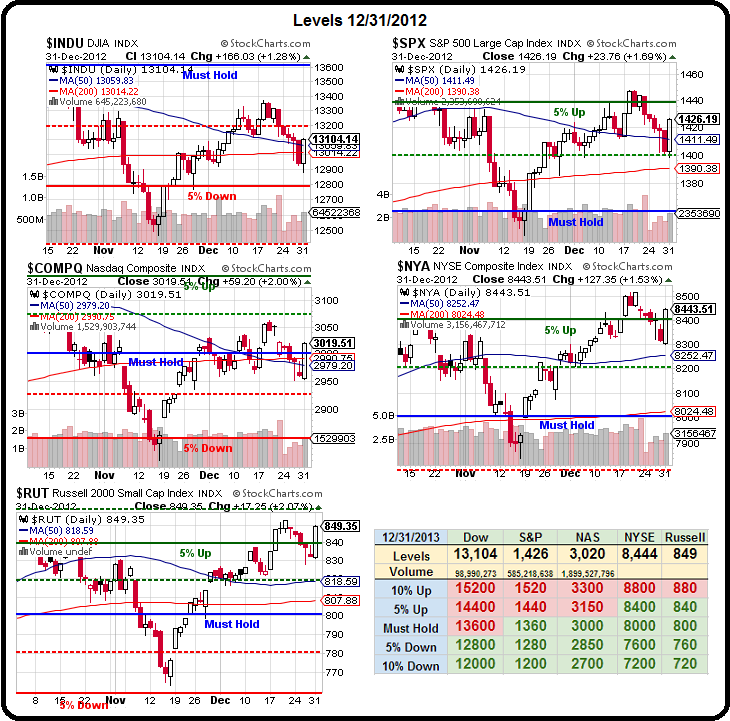

We added long plays on GDX and CIM but maintained general hedges (medium-term) on TZA and USO – just in case talks broke down or the cliff deal turned out to be a "sell on the news" event – which still remains to be seen after this morning's excitement. As you can see from our Big Chart (welcome back StJ!), we still have a long way to go before re-establishing a bullish position – as opposed to confirming a double top in the high end of our channel.

This morning, in Member Chat, we already had 4 pages of extensive commentary on the cliff deal and Europe, 2012 in review and 2013 looking forward, so I'm not going to get into that again here and I've made commentary over the last two weeks on why we are bullish about 2013 – especially in the housing sector.

Pimco's Mahamed El-Erian made the point well this weekend on why investors HAVE to have confidence in equities for 2013 – the Fed. El-Erian said: "If you have an institution that has a printing press in the basement, you respect it." That's a nice, simple, investing premise…

As the chart on the right, from Business Insider, clearly illustrates, the Fiscal Crisis is very clearly the Republican's Fault (their title, not mine) as Federal Spending (red) had simply gone out of control at the same time as Tax Revenues, (blue) had been cut to long-term lows. It took Bill Clinton more than one term to reverse the madness of 12 years of Reagan and Bush the First and it is taking President Obama more than one term to reverse the madness of George the 2nd – this is not a complex issue folks.

Don't forget, Obama only did the 2010, 2011 and 2012 budgets and we're currently in the middle of Fiscal 2012 and look how drastically he's already cut the out-of-control spending – now the revenues need to catch up a bit and then we'll be making some progress – maybe on the way back to those Clinton surpluses that were squandered away at the turn of the century.

How did Bill Clinton reverse the horrible Republican "don't tax and spend anyway" policies during the 80's? Clearly from the chart – he cut Government spending significantly and raised taxes significantly, in fairly equal measures – until those red and blue lines crossed back over each other. This is not complicated folks – you can see what needs to be done – we just have to have the will to do it and today is a good first step but it sure as Hell better not be the last!

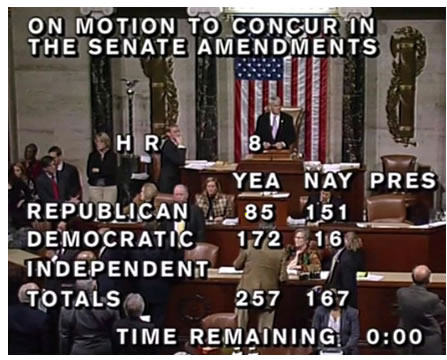

Unfortunately, we have what the Rude Pundit aptly calls "A Congregation of Motherf*ckers in the Senate" as well as the House, of course, of GOP hard-liners who are willing to throw this country into chaos rather than allow their precious contributors to suffer tax increases. In fact, just to get this deal past those same MF'ers, $205Bn in Corporate Tax Breaks were handed out to the people who need it the least.

Unfortunately, we have what the Rude Pundit aptly calls "A Congregation of Motherf*ckers in the Senate" as well as the House, of course, of GOP hard-liners who are willing to throw this country into chaos rather than allow their precious contributors to suffer tax increases. In fact, just to get this deal past those same MF'ers, $205Bn in Corporate Tax Breaks were handed out to the people who need it the least.

Like $1.6Bn in tax-free financing for Goldman Sachs to build a new headquarters along with $9Bn in tax loopholes to banks and other lenders like GE, who can engage in certain lending practices and not pay taxes on income earned from it. According to this Washington Post piece, supporters of the bill include GE, Caterpillar, and JP Morgan. Steve Elmendorf, super-lobbyist, has been paid $80,000 in 2012 alone to lobby on the “Active Financing Working Group.” With his $205Bn win for just $80,000, or even if you include $700,000 over the past few years, Elmendorf may be the most cost-effective employee in America (next to Grover Norquist, of course)…

$205Bn is more money in tax breaks than US Corporations pay in taxes – total! It's also twice as much as the payroll tax cuts, which were lost by the people who work for these corporations (although 85% work for small businesses who don't get any benefits from these top 1% cuts). There are not small business tax breaks here. In fact, it's tax advantages like these that give large corporations unfair advantages that they then use to crush the life out of small businesses – further eroding the middle class – all the while crying crocodile tears about how eliminating tax cuts will hurt small business people. MADNESS!

We know we're going to get a knee-jerk rally as the shorts run for cover today but we'll see how long it lasts against incoming data, as well as pending earnings reports that will give us a much better picture of what to expect from this brand new year.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.