Death Knell of the Economic Recovery, the Future of Inflation

Stock-Markets / Stock Markets 2013 Jan 07, 2013 - 12:56 PM GMTBy: Clif_Droke

Call it the "shot heard round the world." Its aim was ostensibly to reduce the U.S. budget deficit, its effect was tantamount to a bullet in the chest of the consumer recovery.

Call it the "shot heard round the world." Its aim was ostensibly to reduce the U.S. budget deficit, its effect was tantamount to a bullet in the chest of the consumer recovery.

Last week the U.S. working class was hit with a significant payroll tax increase, a blow which couldn't have occurred at a worse time. Just as the economic recovery was starting to gain some traction, our elected officials took the proverbial wind out of its sails by raising taxes. A tax increase is the last thing needed when the economic undercurrents are deflationary, as they are now. This measure will eventually beget even more deflation as consumers reign in spending once they see their paychecks diminished courtesy of the U.S. Congress.

Reading through scads of news articles and blog postings pertaining to the tax hike, I'm amazed at the lack of outrage among its victims. Few seem to realize the enormity of the situation: a $100/month paycheck cut is coming for many wage earners in the U.S. this year, yet few seem to grasp the implications.

To put into perspective just how much $100 a month is for the typical American, let's look at the expected cost of living increases for the coming year. Along with smaller paychecks because of Social Security and healthcare deductions, Americans also face higher grocery bills. Retail food costs for 2013 are projected to rise 4 percent, according to AOL Daily Finance. That adds up to about $40 a month for the average family.

Health care premiums will rise by $20 a month, once the new rates are implemented in February. Internet service will increase by $2 a month as service providers raise rates once again. Cable TV will also go up $5 a month due to rising rates. "This means your total expenses could be $70 a month higher this year, assuming gas prices remain the same, and do not exceed $4 a gallon," observes John Matarese of EW Scripps Co.

For even more perspective, consider the findings of a recent study by the Center for Responsible Lending: the typical American has only $100 after monthly expenses. The study found, "After controlling for inflation, the typical household had less annual income at the end of 2010 than it did at the beginning of the decade. Moreover, as worker productivity increased, the workplace has seldom rewarded them with higher pay."

The study went on to say that the combined effect of stagnant wages, unemployment and under-employment is forcing many families to curb spending and use any available assets to remain financially solvent. It concludes with this warning: ""In order for the U.S. economy to grow again, individual households must find themselves in a position to increase their spending. This will be difficult as long as households continue to face stagnant incomes, increasing expenses, increasing levels of debt, and declining net worth."

It's not a stretch then to surmise that the the tax hike represents at least one nail in the coffin of the U.S. consumer's recovery. Much of what Wasington has done in the last four years to revive consumer spending has been sacrificed by this thoughtless act. The "self-inflicted wound" the president spoke of before the vote has become reality.

The bi-partisan tax hike also undermines the claim by Congress that lowering the unemployment rate is its top priority. As Sal Gentile observed in an MSNBC article, "The political class has apparently convinced itself that unemployment is no longer a problem, despite the fact that only 58% of Americans have jobs, essentially the lowest number since 1983 and virtually unchanged since the end of the recession." The expiration of the payroll tax cut will likely make it worse. Writes Gentile, "According to the Congressional Budget Office, the payroll tax cut did much more to stimulate the economy than income tax cuts, because most households pay more in payroll tax than income tax."

Adding insult to injury, whatever money was earned for deficit reduction as a result of the tax hike was immediately squandered. As Gentile wrote, "The payroll tax increase, it turns out, will save about $95 billion in 2013 alone. But Congress turned around and gave most of that savings away in tax breaks for businesses like NASCAR, Hollywood studios and Wall Street. The Joint Committee on Taxation estimates those so-called 'tax extenders,' tucked into the bill with little notice, will cost $68 billion in 2013."

Despite what members of Congress may think, it's the middle class that is the backbone of the U.S. economy. Responding to the problem of diminished tax revenues by raising taxes on the those already financially distressed won't do anything to solve the government's fiscal problem. Lowering taxes on middle wage earners would have been the more sound approach.

Socialism's last stand?

Credit David Knox Barker (www.LongWaveDynamics.com) with this interesting observation: "Even the New York Times recognizes the lousy job government does in spending the taxes it collects. The flight from France after tax increases is increasing the conversation on whether government has gone too far. The article concludes, 'No matter how high the taxes, there is never enough.' In France and the U.S., the tax grab and will evoke its own reversal."

The future of inflation

Despite the clear deflationary implication of Congress' latest act, many on Wall Street are actually worried about inflation.

"It's Not Too Early to Worry about the End of Fed Easing" proclaimed one recent news headline. The article was written in response to the release of the minutes from the U.S. Federal Reserve's latest meeting which were released last Thursday. The minutes revealed that Jeffrey Lacker, Richmond Fed Bank President, is concerned that the Fed's bond-buying stimulus plan will eventually stoke inflation.

"It is unlikely that the Federal Reserve can push real growth rates materially higher than they otherwise would be, on a sustained basis," said Lacker. "I see an increased risk...that inflation pressures emerge and are not thwarted in a timely way." The minutes showed several members of the Federal Open Market Committee foresaw a chance that asset purchases would need to be slowed or halted altogether before the end of 2013.

Just like that, Wall Street has a new worry going forward, viz. the end of quantitative easing (QE). This is in marked contrast to Wall Street's worry of just a few weeks ago that the Fed was going overboard with QE. Investors are now apparently torn between the fear of inflation and the worry that the Fed's efforts at re-infllating the financial market will end too soon.

A straight forward reading of the long-term Kress cycles tell us that inflation won't be a major concern until after 2014. The dominant long-term components of the 120-year cycle, the 40-year and 60-year cycles, will both bottom around October 2014. The increasing descent of these cycles into late 2014 is expected to create significant deflationary pressures on the economies of developed nations, particularly the U.S.

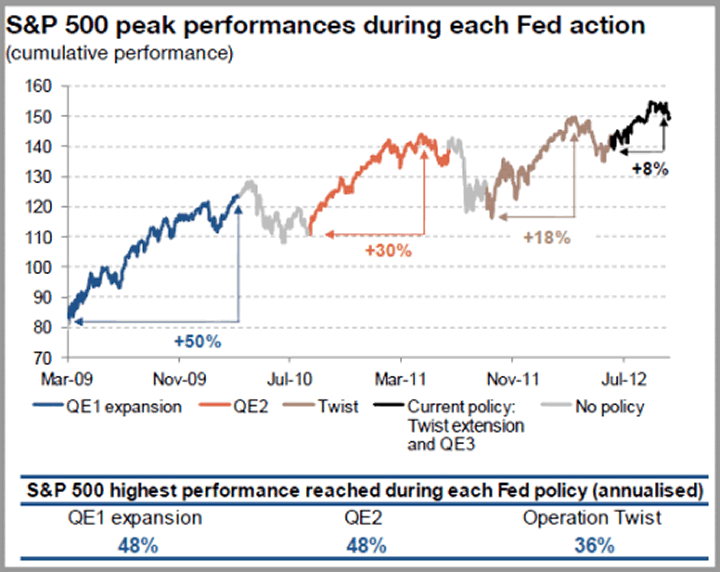

This is one of the main reasons why the Fed's intensive efforts at re-stimulating the economy through QE have been relatively ineffective. As the following graph vividly shows, each successive QE has resulted in a less vigorous increase in equity prices, to say nothing of economic output.

Inflation is also being kept at bay through the deflationary policies of the U.S. Congress (payroll taxes, Obamacare taxes, etc.) as well as the austerity policies of other major governments around the globe. The year 2013 will ultimately tell the tale of whether the Kress deflationary scenario comes to pass. My best guess is that we'll start seeing an erosion in retail sales by the second quarter with increasing deterioration in each subsequent quarter. By the end of the year corporate profits will be in decline, then the real trouble begins entering the fateful final year of the 120-year cycle - 2014.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.