Stocks Bear Market Focus Point: Equities merely the froth on the financial cappuccino

Stock-Markets / Stocks Bear Market Jan 09, 2013 - 01:19 AM GMTBy: Garry_Abeshouse

As the banks continue to take advantage of the free money offered by the US Fed to feed their financial habit, it is important to remember that equity markets have now become merely the froth and bubbles on top of the financial cappuccino, while the currency markets are the bulk of what lies underneath and true indicators of future market movements. To extend this analogy further, you could then possibly consider financial derivatives as the opiates of the markets as a whole, allowing the Bankster traders to maintain their opulent lifestyles in the way to which they have long become accustomed. But as is inevitable, when the froth deflates from this equity market bubble, there will be deflationary consequences.

As the banks continue to take advantage of the free money offered by the US Fed to feed their financial habit, it is important to remember that equity markets have now become merely the froth and bubbles on top of the financial cappuccino, while the currency markets are the bulk of what lies underneath and true indicators of future market movements. To extend this analogy further, you could then possibly consider financial derivatives as the opiates of the markets as a whole, allowing the Bankster traders to maintain their opulent lifestyles in the way to which they have long become accustomed. But as is inevitable, when the froth deflates from this equity market bubble, there will be deflationary consequences.

But any movements in financial markets today, really need to be interpreted in the context of their times – and not necessarily in the way the text books say they should. Some of these text books concerning Technical Analysis or Charting were written up to 100 years ago, a time when the weather and the seasons were more influential than what they are now and computer software similar to what is used now was totally beyond human comprehension.

The ability of governments to heavily manipulate markets was then limited and financial derivatives did not exist, certainly in the way they do now. Usable charting software has only been around for 20 to 30 years, high quality trading software for less than 20 years and effective high frequency trading for less than 10 years. Global financial markets have moved from a medium once thought to be more aligned to financing businesses and world trade, have now become an essential part of a worldwide money laundering organisation and are now the mere playthings of large banks, global corporations, hedge funds, international mafia groups and drug cartels. See also here and here. All these entities ably supported by the low interest rate policies of the larger countries. The self-interests and ambitions of these disparate groups have now become so intertwined, that any meaningful change towards world economic and social stability will be at a snail’s pace at best and a major deflationary catastrophe at worst.

Bloomberg – “Global central bank chiefs agreed to water down and delay a planned bank liquidity rule to counter warnings that the proposal would strangle lending and stifle the economic recovery.

Under yesterday’s deal, banks’ would only have to meet 60 percent of the LCR obligations by 2015, and the full rule would be phased in annually through 2019, according to an e-mailed statement from the GHOS.”

This announcement from Basel, received as I write these words, only underlines what I have just written – read it and weep, certainly no sense of urgency here. We live in a reactive world not a proactive one, so the only way there will be meaningful change is if there is another financial disaster of some sort – and then it will be too late.

So the quadrillion dollar overhang of global speculative “investments” is still there and partly due to high frequency trading, the world financial markets are even more imbedded into the gambling culture than they were in 2008, with no hope for the foreseeable future that anything much will change.

In real terms in the real world this means that over the last few years there has been a huge paradigm shift in the way financial markets operate, to the extent that they are no longer recognisable for what they once were, shape shifted perhaps into something unrecognisable by most of us in the world today.

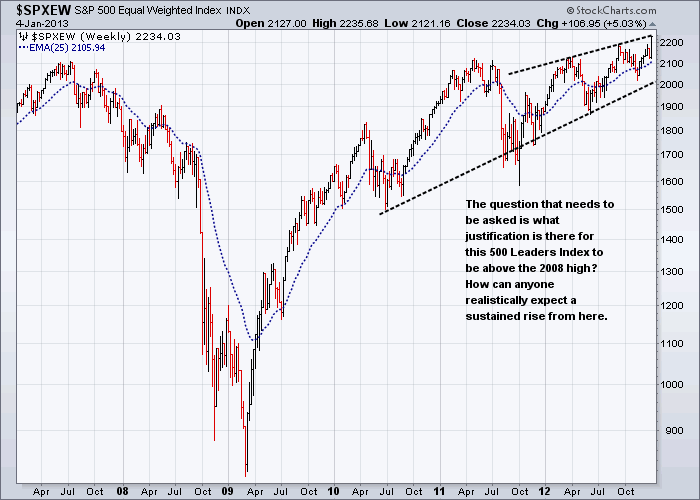

So I must congratulate the Banksters et al. It has now been 4 years since the 2008 global financial crisis, very little has changed, there is just as much or more debt than there ever was, equity markets are far higher than they should be given the deteriorating world economy, with many of the US indices testing their all-time highs, just waiting for another Lehman Bros. to leap out and surprise everyone. This is what great Bull traps are made of. It is only a matter of time before someone in the not too distant future stuffs up big time somewhere, somehow – it’s inevitable.

Side issue - Go milk futures.

But for Australian dairy farmers there is a bright side, as they experience a genuine bull market in exports. Frantic mothers from mainland China are getting their friends and relatives in Australia to buy up supplies of Karicare Aptamil Gold baby formula for them, as the food pollution and substitution problems in China are so bad, they are too frightened to use the local product for fear of poisoning their babies. It’s more than a little worrying, that in what is construed to be “the world's second largest economy by nominal GDP” it has all come down to accessing baby food that won’t kill babies.

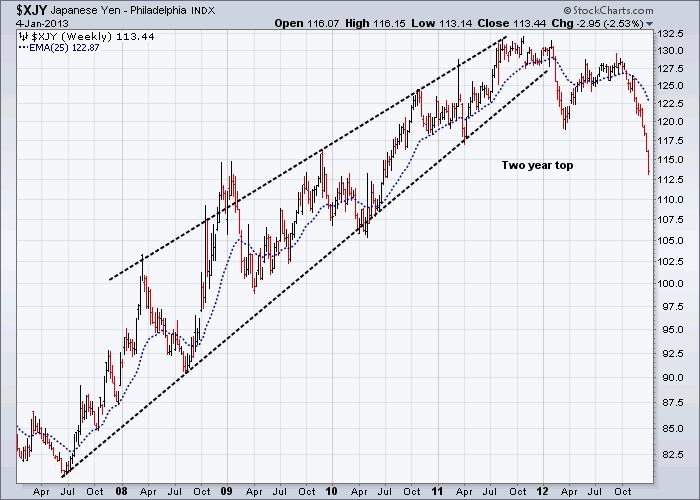

The yen – signs of things to come.

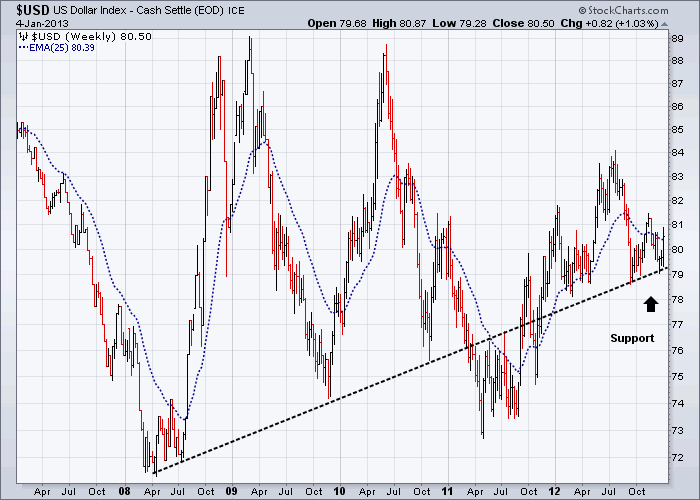

When world GDP and consumer consumption continues to decline there has to be consequences. The latest in this new order of accepting reality is the fall of the yen – a desperate attempt to retain a competitive edge against manufacturers from other countries and a certain sign that the coming trade war will be fought out in the currency markets, as exporting countries try and keep their currencies as weak as possible in order to stay competitive. As I have said many times before, money must go somewhere and in this case into the US dollar and US government bonds - for the time being at least. To paraphrase, in the global land of the weak, it is the least weak that shall be king.

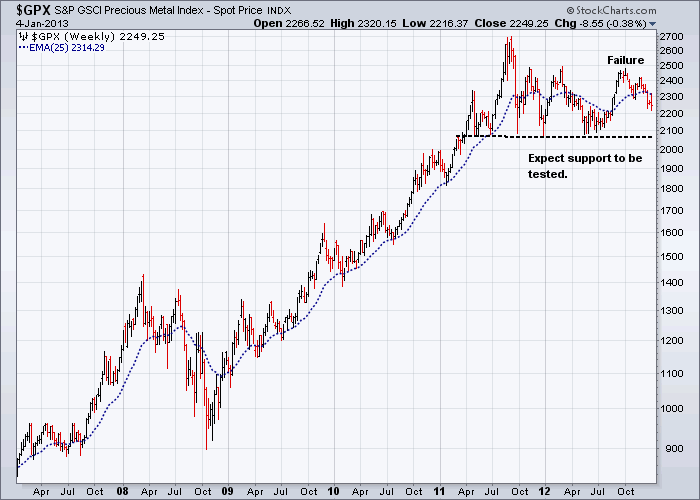

I expect the first shake out in equities when it comes, to also trigger off an overdue sell off in precious metals, as investors begin to realise that in deflationary times, gold does not buy food, shelter and your kids’ education. If you look at any long term chart of the gold price, you will see it has climbed up to these levels over the last 40 years, together with equity markets, as a hedge against inflation rather than against anticipated deflation. There is a difference. In deflationary times, cash and easily convertible safe haven money is usually the way to go, hence the initial move to the US dollar – despite all the naysayers about the trillions of dollars of debt. At the same time the US will actively resist any strong move up in their currency as it is also in their interests to keep their currency from moving skywards.

But for gold and silver there is a flip side to this as I have mention before also. The main thrust of any move down in the gold price will be in terms of the US dollar. In almost all other currencies this fall will be tempered by corresponding rises in the gold price in terms of their own currencies – taking into account of course any net fall that gold may suffer. Life was never meant to be easy.

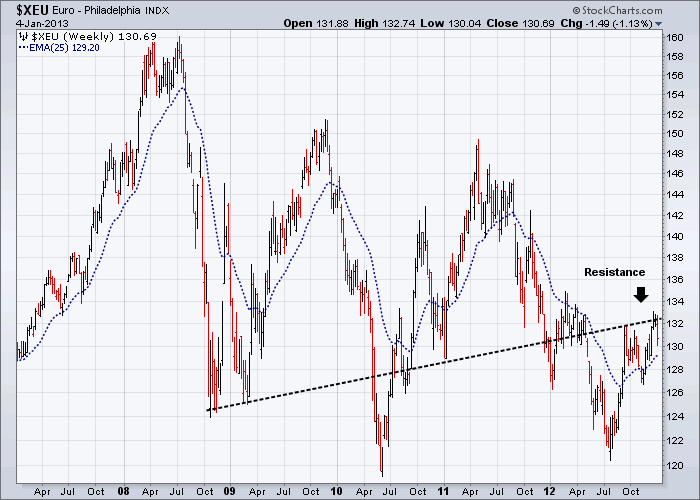

So as exporting countries face an uncertain future with increased trade and fiscal deficits, they will each in turn look to lower their exchange rates against the US dollar and their main trading partners. It has always been so and it will continue to be. It is a natural part of the world economic order and one that the European Union will have a hard time to fight. I expect the leaders from the weaker European economies will increasingly vent their anger against the Germans and the maintenance of a strong Euro, as it is quite simply against their economic self-interests to maintain parity with the USD at these levels. The pressure will be also on China, who will be caught between a rock and a hard place, as they try to placate the needs of exporters working on low or no profit margins. They too require a weak currency to remain competitive in the face of rising wages and weak demand. And then there are pressures from the international community who will want the Chinese currency to be as strong as possible against other world currencies, especially the USD.

Balancing all these issues has always been a problem, not just for China but most countries. This is why the term “trade wars” was coined to explain how when times get tough, the players play rough.

In this context, it should be realised that global economics and the domination of financial markets has always had less to do with capitalism per se, than being used as a major force for the concentration monetary power into the hands of the few and to the detriment of the many. And this being the case as in any war, the main casualty of course will be always be the availability of the truth.

Equity markets

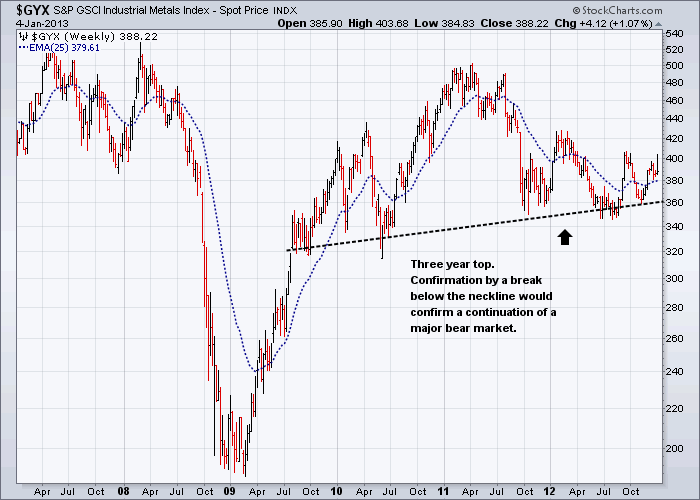

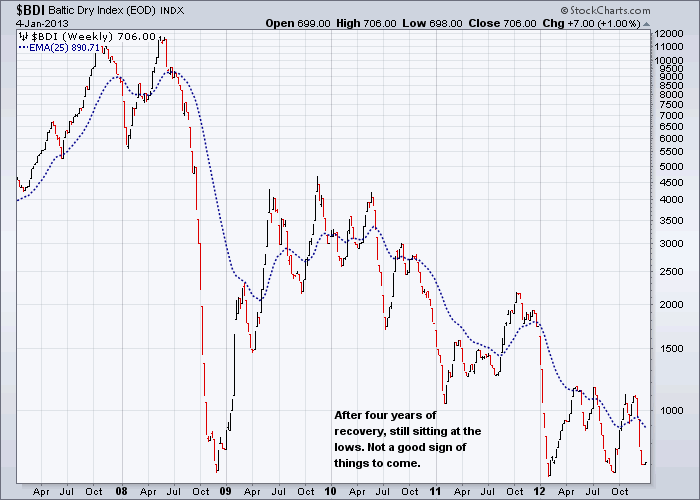

There are many signs that equity markets will have a lot of trouble maintaining an upward trajectory over the coming weeks, suggesting that these markets are now heading into yet another bull trap.

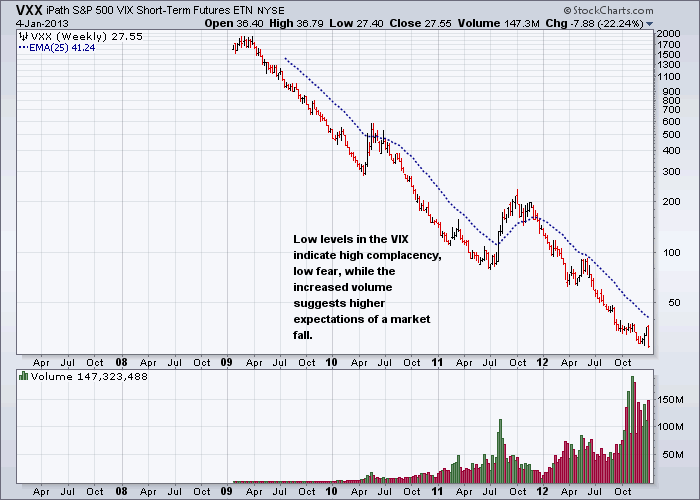

The contrast between the continuing weakness in the Baltic Dry index, which is showing no signs of recovering from the lows experienced 4 years ago during the world financial crisis, and US equity markets in particular, is stark. You can easily see the contrast between the weakness of the $BDI testing its lows and the $SPXEW as it tests the 2008 highs. Note also that the low levels experienced by the $VIX Indicator (not shown) and the VXX ETF show a high level of complacency and a low level of fear in US equity markets at the moment, with the high recent volume indicative that an increasing number with a more bearish lean are putting their money with their mouths are.

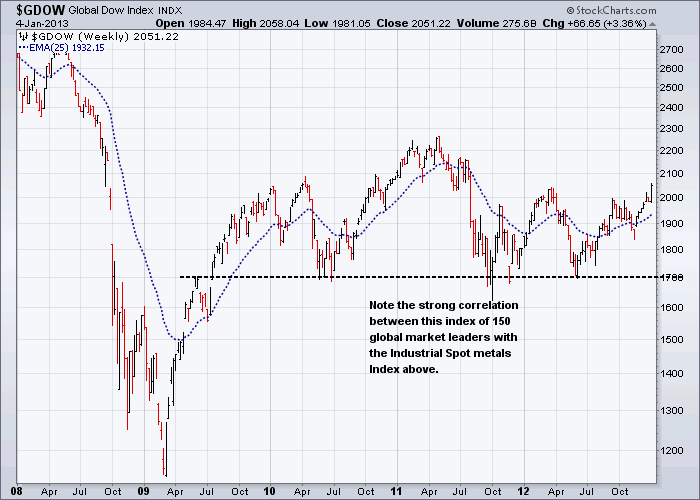

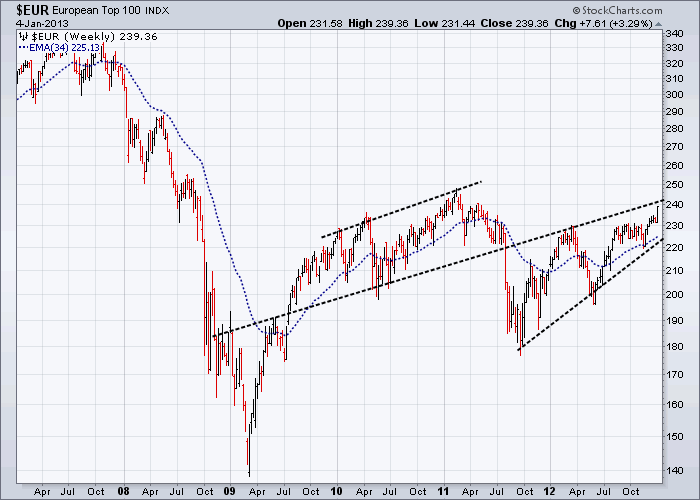

If the bull trap over the coming weeks comes into force as expected, it would suggest that equity indices such as the Global Dow Equal Weighted Index and the European 100 Index amongst others, will at a minimum extend the size of their tops, making their eventual collapse at some future date even more eventful, and not in a nice way.

The fiction of austerity economics

“Now that computer-generated images are all over the films we see, the game has changed. Filmmakers are no longer out to fool us into thinking the digital effects are real. They just want us to ignore the fact they're not. It's a contract. We undertake to go along with the make-believe if they ensure it will be worth our while. If they can enchant us with the worlds they create, we're willing to overlook the artifice. After all, that's what movie-going has always been about.”

Sandra Hall (SMH) was commenting on the recent Ang Lee visual masterpiece, Life of Pi, when she made these comments. But these words could be just as pertinent as a scathing commentary on the relevance of much of what passes for financial and political commentary in the somewhat “artificial artifice” of today’s media. Enchant the readers with the make-believe, keep them drugged and calm with the trivial and the banal and all will be well. After all, if we're willing to overlook the artifice, that’s what the mainstream media has always been about.

Austerity economics, as it is expounded by the right wing of economic thought, can never be construed as a realistic expression of what should or even could be done to correct past economic wrongs. It depersonalises the mainstream population like nothing else. It ignores the suffering of the many to placate the greed of the few and reduces consumption at the wrong time of the market cycle. Make no mistake, it was poor governance and the hyperactive greed of the young banksters, anxious to make their mark in a cut-throat profession, that put us into the current state of financial affairs we find ourselves in. Any attempt to correct these past ills through too much austerity would be to invite not only rebellion by those who suffer the most – but would encourage extreme and violent elements who thrive on the poverty, distress and ignorance of others.

In the USA, a country still dominated by the NRA, where guns have more rights than people, where educated and critical informed thinking by a major part of the population has taken a major step back – these elements need no encouragement from increased austerity measures – despite their rhetoric to the contrary. Prior to the recent Presidential election it appeared that any sense of living in an egalitarian society in parts of this country, had given way to the selfishness of rich individuals and ignorant white middle aged men, who would rather see their country destroyed, than to be seen to give in to an intelligent black president. Where is Edward R. Murrow when you need him.

"Right now you can be on the terrorist watch list, you can be prevented from boarding an aeroplane, but you can go down the street and buy a semiautomatic assault weapon."

US Democrat congressman Chris Van Hollen, January 2013

To read much of what is written by some of the financial commentators and bloggists today in the right wing press, is to read one track dialogues by those who appear to lack empathy for the least privileged among us. Proposed economic changes affecting real people in real ways are discussed superficially as statistics and policy changes, ignoring unpalatable facts and the inevitable negative consequences to people’s lives. It is far easier to talk about economic policy, as the GOP and their Tea party friends do, in abstract terms. In this way it is easier to ignore the realities of the real world and the effects of policy change on real people. The reality is that the one percent who control the real financial power do not want to see their economic and political power diminished and their image dimmed – hence the paucity of critical commentary on economic matters at the moment – ably assisted by Mr Murdoch and his editors.

But this could be changing. Prior to the recent presidential election in the USA, it appeared that much of the US media was walking on eggshells in fear of what the political extremists might say. But since Obama’s 51.1% win, in what appeared to outsiders like me, to be a remake of the American Civil War on the south, the GOP and its Tea Party mates have been duly exposed, like the proverbial emperor, as having no clothes.

The impact of this over recent weeks on the non-Murdoch media has been nothing short of game changing in its impact on the tone of political discussion. Hesitancy and timidity changed virtually overnight to increased confidence, as the left of centre media began their own fight back to legitimacy, throwing derision, scorn and black humour to those on the right with gay abandon. There is a rule in politics, when a large part of the media start making fun of you – you are finished. And to the Tea Party and their ilk – perhaps their time has passed into history.

Financial markets take heed: People Power and the rise of a global social and political revolution.

‘Hope, it is the only thing stronger than fear. A little hope is effective; a lot of hope is dangerous. A spark is fine, as long as it's contained.’

President Snow (Donald Sutherland), The Hunger Games Film – 2011 (not in the book).

Hope is a powerful emotion and keeps people alive in the face of overwhelming adversity. When times are tough, we hope things will get better, but often we are powerless to do anything about it. As individuals we have limited power to change our lives, but in large groups we can change the world.

Even the bacteria in our gut can organise themselves as a group using a technique called Quorum Sensing. “. . . in recent years, it has become evident that, far from operating in isolation, they coordinate collective behaviour in response to environmental challenges using sophisticated intercellular communication networks.” So if primitive bacteria can do it, why can’t humans? Well it so happens humans have begun emulating our humble gut bacteria also “using sophisticated intercellular communication networks”.

Instant communication, often with video, has changed everything

This ability, for what has effectively become a series of large global resistance movements, to instantly communicate with each other is unprecedented in human history, giving a growing amount of political power to the bottom 99% of people in the economic food chain in a growing number of countries. This loosely connected global resistance movement has already and will continue to have a substantial effect on the way the world is run over the coming years. This is more than just a generational change, this will continue to evolve into substantial social, political and economic upheaval over the coming generations and has the pent up fury of hundreds of years of subjugation behind it.

The disparity between corporate greed and the reality that workers experience every day of their lives was highlighted only three short months ago in the Foxconn sweatshops in China, where descriptions of working conditions more reminiscent of prison workshops than modern factories shocked or rather forced Apple and Foxconn into belated action to at least partly rectify the situation.

This visceral account from Bloomberg at the time says it all:

“Security teams wearing riot helmets and wielding plastic shields marched around a Foxconn Technology Group factory in a show of force after a fight involving 2,000 workers prompted the company to suspend production there. Employees outside the factory said the pay was good, though their living conditions were not. The food was of low quality, dorm rooms had four bunk beds for eight people, and the shared bathrooms weren’t clean. “The dormitories are too crowded,” said a 24-year-old worker identifying himself as Wang. “I don’t sleep well because it’s noisy. The environment isn’t good.” “

The ability to communicate quickly has come a long way from the use of ocean travelling sailing boats, carrier pigeons, the pony express, telegrams and faxes. The internet has changed the way we communicate forever and has now become a very powerful medium for social and political change across the world.

What is pertinent to these turbulent times is the narrow concentration of media ownership and the lack of objective in-depth reporting from the mainstream media. This has resulted in a dramatic growth of highly partisan opinion, especially in the Murdoch owned press in the USA and Australia. But the rise and rise of the blogosphere and social media, together with instant interaction assisted by high tech mobile phones and computers, is changing the balance of power more towards the poorer 99%. A dramatic shift in the use of social media power in today’s world began in December 2010, triggered by a single event in a small African country.

On December 17th 2010 a Tunisian street vendor named Tarek al-Tayeb Mohamed Bouazizi set himself on fire in protest of the confiscation of his wares and the harassment and humiliation that he reported was inflicted on him by a municipal official and her aides. His act became a catalyst for the Tunisian Revolution and the wider Arab Spring, inciting demonstrations and riots throughout Tunisia in protest of social and political issues in the country. It was this act that almost single-handedly began what has now become known as the Arab Spring. This activation of people seeking a better social, economic and political deal for themselves then began to spread throughout the world, rising to the surface and being expressed in different ways in different countries.

WikiLeaks and Julian Assange, The Occupy movement , punk rock band ***** Riot, the Pakistani girl falsely accused of burning a copy of the Qur’an, Malala Yousafzai, the Pakistani school student, education activist blogger shot by the Taliban, Jyoti Singh Pandey, a young female medical student recently gang raped in horrific circumstances in New Delhi as well as the saturation coverage of the continuing violence in various countries in the Middle East, clearly show the importance of the internet in communicating issues of varying types instantly across the world, with the capacity of directly influencing future events associated with them.

Singing the Blues: Those Texans never seem to take losing gracefully.

This revolution in the use of cyberspace has now spread to various degrees to all over the Middle East, Pakistan, India, China and even the USA, where the fall from grace of the GOP has shown them to be merely a group of angry old white men, out of touch with contemporary values and who have never got over the South’s loss of the Civil War on April 9th, 1865, when the Confederate army officially surrendered to General Grant. In those days the Republican Party had run on an anti-slavery platform, and many southerners felt that there was no longer a place for them in the Union. How times have changed.

Joe Hagan’s nymag.com dispatch en route at sea to the Cayman Islands with a boatload of Republicans, pondering the plight of their GOP, is like reading about a 1946 meeting in Argentina of Hitler’s elite for their first get together since they lost the war in ’45. Or perhaps closer to the point geographically, a meeting in early 1867 of southern landholders after they lost the civil war to those darn Yankees in the north. This is frightening stuff to say the least, but the truth quite often is, so this is a must read for everyone.

Till next time.

Garry Abeshouse Technical Analyst. Sydney Australia

I have been practicing Technical Analysis since 1969, learning the hard way during the Australian Mining Boom. I was Head Chartist with Bain & Co, (now Deutsch Bank) in the mid 1970's and am now working freelance. I am currently writing a series of articles for the international "Your Trading Edge" magazine entitled "Market Cycles and Technical Analysis".

I specialise in medium to long term market strategies.

© Copyright Garry Abeshouse 2012

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.