Germany Prepares: The Bundesbank Repatriates Gold Reserves

Commodities / Gold and Silver 2013 Jan 23, 2013 - 08:47 AM GMTBy: GoldSilver

It is official: Germany is set to repatriate a large share of its gold reserves. This is one of the most definitive measures the country has taken in light of the ongoing global crisis.

It is official: Germany is set to repatriate a large share of its gold reserves. This is one of the most definitive measures the country has taken in light of the ongoing global crisis.

Earlier this month, the Bundesbank (Germany's central bank) announced its intention to take delivery of over half of its gold reserves by 2020, gradually transferring it to gold vaults in Germany.

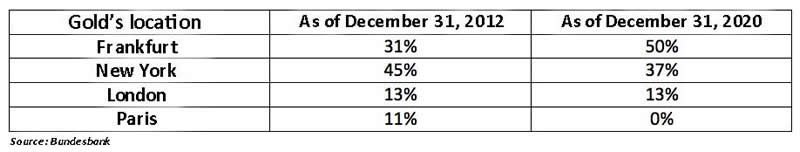

The remaining half of Germany's gold holdings will remain vaulted in New York and London. The following table illustrates current and future locational allocations of Germany's gold holdings.

This means the Bundesbank will eventually remove 300 tons of gold (9,645,000 troy oz) currently located with the Federal Reserve in New York, and all of its 374 tons of gold (12,024,100 troy oz) with the Bank of France in Paris.

Germany's gold holdings of 3391.3 tons are second only to the 8133.5 tons which the United States allegedly holds.

According to official sources, the Bundesbank has taken these measures with the intent of reinforcing confidence domestically and to have "the ability to exchange gold for foreign currency within a short space of time".

What is striking is the sudden change of posture by the central bank. In a matter of weeks, the Bundesbank went from an absolute confidence in its counterparts, to an almost panic-like demand for the delivery of its reserves.

While similar measures taken by other central banks are often conducted unconsciously, today's action will not go unnoticed by the public.

Recently in October 2012, the Bundesbank responded to public allegations regarding the legitimacy of its overseas gold holdings saying, "for years, our gold has been stored by the highly esteemed central banks of the United States, Great Britain and France without provoking any complaints whatsoever – not by just any fly-by-night operators. Part of the debate in Germany has veered somewhat towards the absurd."

Further, Andreas Dombret, Executive Committee member of the Bundesbank, was quoted in a statement to the New York Federal Reserve as saying : "Please let me also comment on the bizarre public discussion we are currently facing in Germany on the safety of our gold deposits outside Germany – a discussion which is driven by irrational fears.[...] you can be assured that we are confident that our gold is in safe hands with you."

Why then this sudden change of posture from Germany? That part of course will never be official.

Heed What They Do, Ignore What They Say

Confidence amongst the largest players (central banks, governments, etc) has been ruptured, signaling the beginnings of systemic disintegration, strikingly similar to the end of the Bretton Woods Era. These types of actions and sudden policy shifts were distinguishing precursors to the last precious metals bull market (1971-1980).

While analysts attempt to decipher the true intent behind the move, a decision of this magnitude was likely taken due to very significant external and internal pressures.

Among the reasons for the repatriation could be the Office of Federal Audits declaration last year that the Federal Reserve failed to properly audit and test for the quantity and purity of the metal being held.

Beyond speculation, the reality is that Germany will not take until 2020 to repatriate its total gold holdings. It has already given the Federal Reserve a wake up call and is likely to request complete repatriation in the near future.

There is no true justification for a prolonged repatriation of its gold, as doing so would only expose Germany to the risk of confiscation in the face of a crisis which shows few signs of ending.

It looks like Mike Maloney's message "If you can't hold it, you don't own it."… is resonating with the German people.

Considering that the Federal Reserve and the Bank of France might not have all of Germany's gold in their possession, (after possibly 'lending' some of it) could be reason enough for deciding to repatriate it in the course of a seven year time period. Legal accounting "tricks" (gold swaps) currently allow central banks to "lease" and provide the physical metal to the market (causing gold price suppression) while still reporting it in their balance sheets.

It is unlikely the Bundesbank will publicly declare whether or not these respective central banks can account for each serialized gold bar belonging to Germany. Doing so might shine further light on how many overlapping paper claims multiple financial institutions, sovereign / exchange traded funds (ETFs), and unknowing investors have over the same bars of gold.

This explains why the Bundesbank is not expediting the repatriation process, as this would force creditors to buy gold today from the market, potentially triggering a breakout in price (something that the Bundesbank would not like ). This would create a breakout in the gold market. Instead, the Bundesbank has given these central banks time in order to avoid the removal of thousands of paper ounces which have simply been leased out of their own books.

Long-term, these events should be seen as "very bullish" for gold. We are not talking about simply transferring metal from one vault to another, but truly accounting for each physical ounce in existence. When the physical shortages are exposed to the holders of infinite paper claims, the physical gold bullion will have to be delivered at any cost, regardless of price.

If not, creditors will suffer substantial losses, which they will be unlikely to withstand.

Considering gold's relatively low physical supply, the potential collapse of re-hypothecation chains of paper gold could decisively move the gold market in the years ahead.

As for now, Germany, in full use of its sovereignty, has opted for prioritizing national interests instead of those of foreigners.

This is a warning to those who do not have a good backup plan. Physical possession is more critical than ever.

Eliminating counter-party risk whether it be from central banks, governments, or private entities will make all the difference. Today's economic situation is more serious than ever.

When a cruise ship is sinking, there are only a limited amount of lifeboats. Germany has now officially requested their financial lifeboat, the repatriation of German gold bullion reserves.

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2013 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.