Gold And Silver – All Fundamentals/Opinions Are Useless

Commodities / Gold and Silver 2013 Jan 27, 2013 - 12:45 PM GMTBy: Michael_Noonan

All general statements are untrue, [including the one above and this one].

All general statements are untrue, [including the one above and this one].

There are exceptions to every general rule, so they cannot always be true.

There is truth to the consideration that all fundamentals and opinions are

useless in the markets, as they pertain to timing, and timing plays a huge

role when investing/trading. What fundamentals/opinions do is put one’s

belief system into a context with regard to the market[s]. If one wants to

profit from any belief, he/she is then pitted against the forces of the

marketplace in their exercise.

If you know about the fundamentals, to whatever degree you believe, and/or

if you have an opinion, from whatever source and however reliable or not, the

question then becomes, “What are you going to do about it?” Our premise

topic, fundamentals and opinions are useless, goes back to what we have stated

before:

It does not matter what others say about the market; what matters

is what the market says about others.

People are drawn to articles/information that reinforces their beliefs. Markets

force people to put aside their bias and deal with what is, or else deal with the

consequences if the bias/belief is in conflict. The market is, and always will be,

the final arbiter of all “facts” and “opinions.”

The market is composed of all the known [and not so well-known] facts that affect

supply and demand. “The gold held in New York and London is/may be gone.”

Fact or fiction? The Fed and London ain’t telling, or what they are telling is that

“belief” is untrue. Fiat currencies are being created at unprecedented levels. We

all know that is a fact, and many believe gold and silver will/should recognize that

fact and be priced accordingly, [but are not]. The fundamentals for silver supply and

demand are incredibly bullish. Few can deny that, the few being the Fed and JPM,

et al.

The market knows all of this! Yet, the price of both gold and silver are languishing

in protracted trading ranges. So how valuable are the fundamentals or opinions

about gold going to $5,000, or silver to $400, [pick your own number, as most

undoubtedly have one]?

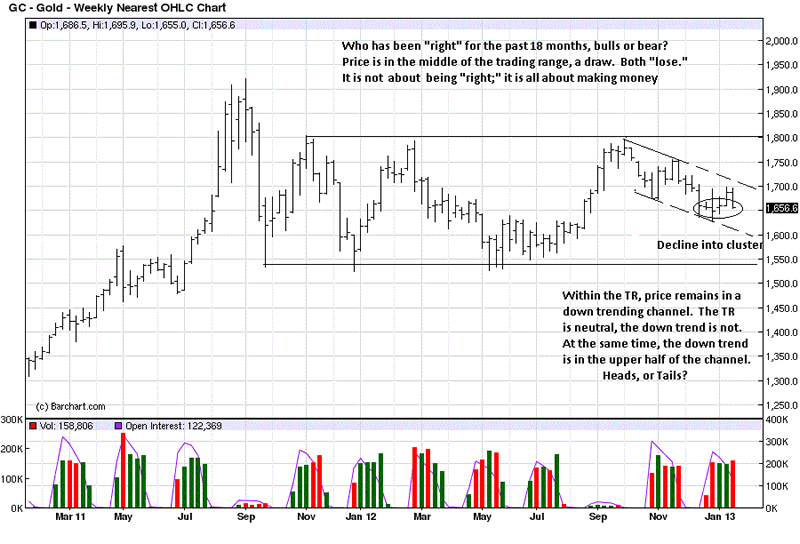

For right now, and for the pat 18 months or so, the best information in the world,

the strongest opinions held have been “useless.” The charts, [the market translated

into a visual format], reflect the trading ranges, and current prices are just about

dead center within them. The middle of a trading range is where the level of knowledge

is at its lowest. It is a coin toss. Price can rally to the top of the range and still fail, or

it can decline to the bottom of the range and fail to go lower. Flip a coin!

Whatever your opinion of where the price of gold and/or silver should be, this is what

the market is saying about your “belief/opinion:”

[Monthly charts are not included as the month ends next week, and those charts will be

included next week. The discussion for gold is more general, and a little more detail is

given in the silver charts, as both are similar.]

The market is showing price to be in the middle of a lengthy trading range, [TR], and

until the TR is broken, up or down, one is spinning wheels in between. Last week, we

showed how the clustering of closes could signify support and a rally, or a pause before

continuing lower. The gold “rally” fizzled and has retraced back to the clustering. Will

it continue to act as support, or fail?

Not only is gold in the middle of the TR, it is also in the middle of a down channel. It

is anyone’s guess for now.

Let us add that the fundamentals are incredibly bullish, and within that context, we

continue to advocate buying the physical at any price, and buy consistently. Our

analysis pertains to trading/buying the futures. Regardless of the bullish context of

the fundamentals, the market is saying, “Not right now.” Until price rallies above

$1,800, it is not going reach whatever future expectation one may have, which is

all we are saying. For timing, any/all fundamental considerations are useless. For

positioning one’s self in the physical, now is the time. When gold/silver take off,

[even we have a bias], it will be fast and furious [opinion], with no looking back, but

that can be months, Quarters, possibly year[s] away.

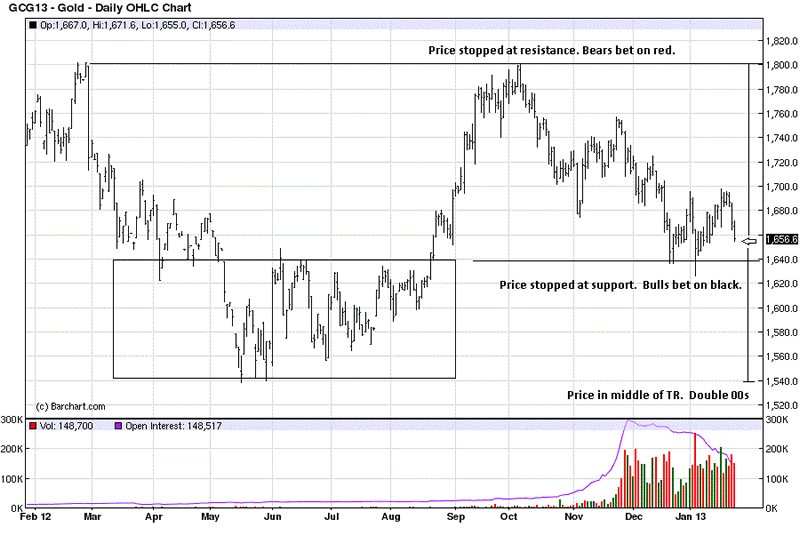

The daily chart comments pretty much speak for themselves.

Last week, we noted a long position on the strength of the wide range, strong close bar,

6th bar from the end. The recommendation did not lead to much profit, but profits were

taken prior to the decline, based on developing market activity at the time.

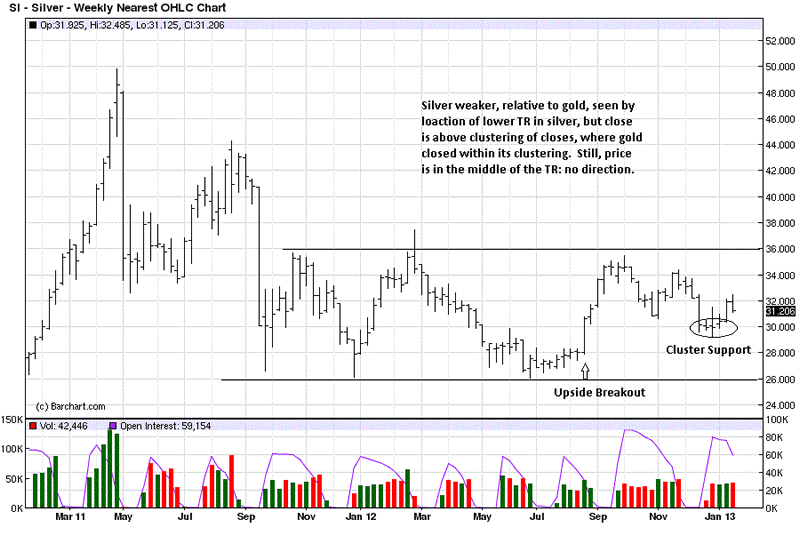

While silver is weaker, relatively to gold, it is behaving relatively stronger of late. Note

how the weekly close is higher/above the clustering of closes, where gold is right at

the clustering location, [both still in the middle!].

As with gold, now is the time to continue accumulating [stacking, as it were] silver at

any price. Sales of the American Eagle are going through the roof and were recently

halted until 28 January. Why the government continues to sell them at all is beyond

us in comprehension, given it is part of the forces [of evil] endeavoring to suppress the

market’s alternative to the insidious issue of fiat.

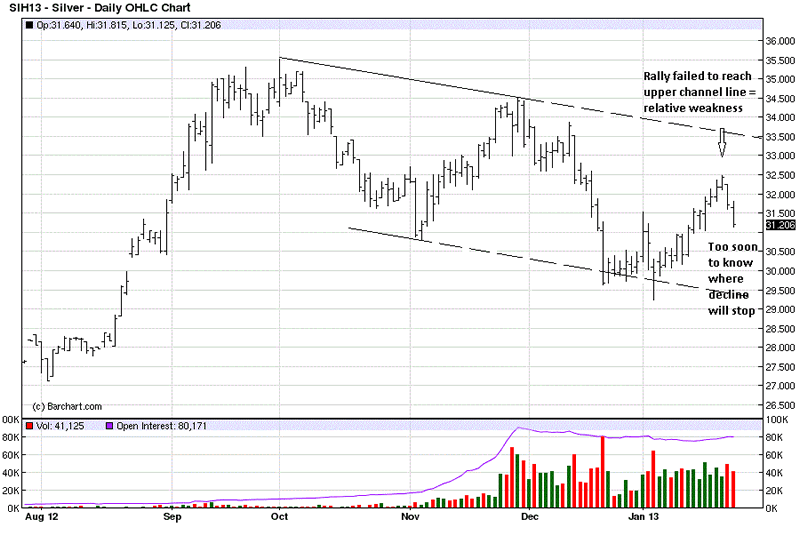

For as much as an argument can be made that price is holding reasonably well within

the ongoing TR, the “fact” that silver failed to reach the upper channel line is a sign of

weakness. Yet, unlike gold, the decline in silver held above the wide range, strong close

bar where a long position was recommended. You can see the small range high at 32.50,

3rd bar from the end. It was the market’s message telling us that demand was weak. The

long position was liquidated profitably, before the decline set in. Love those messages!

Where will the decline stop? We have no clue, nor do we [or you] need to guess. Instead,

simply wait for developing market activity to indicate demand is overcoming supply. Why

guess when the best source of information will make some kind of factual declaration?!

Maybe price will hold potential support at the clustering of closes, maybe not. What is

more important is that the existing TR is telling everyone to wait, for those inclined to

heed the market’s message. Even on a shorter time frame, within the TR, the market is

STILL saying, price is not strong. Buy the physical, but not the futures.

Fundamental context matters for what side one chooses. The message from the market

matters the most for timing and implementing one’s belief. That is a fact that has never

changed and one that never will. Count on it!

[Just don't take it to the bank. Banks cannot be trusted.]

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.