Stock Market Rally Should Boost Discounted Rare Earth and Uranium Miners

Commodities / Metals & Mining Feb 01, 2013 - 12:55 PM GMTBy: Jeb_Handwerger

I notice with interest that the popular media is ignoring the World Trade Organization case against China for restricting exports of critical materials (REMX). This reduction of supply of the critical metals has a significant impact on the global economy.

I notice with interest that the popular media is ignoring the World Trade Organization case against China for restricting exports of critical materials (REMX). This reduction of supply of the critical metals has a significant impact on the global economy.

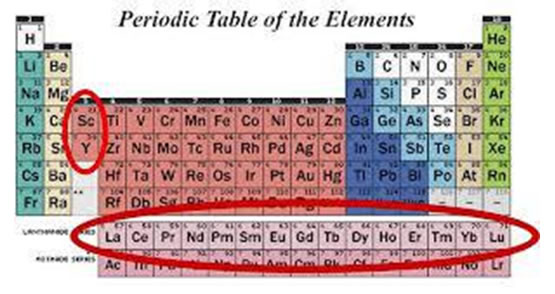

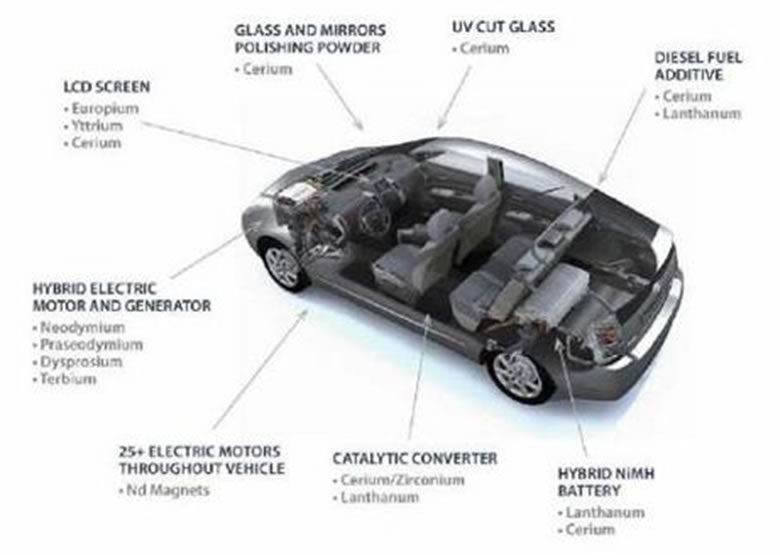

These critical metals are not only crucial for your iPads and smartphones, but for our top secret, most advanced weaponry. Looking for substitutes for rare earths has proven to be a poor return on investment. For 50 years, they have been trying to find alternatives, only to find out that the chemical characteristics of rare earths are inimitable.

I have been a major proponent of advancing domestic strategic mines in the U.S. and Canada. Recently, the U.S. Department of Defense partnered with one of our rare earth recommendations to advance studies.

This move may show investors that the our national security is dependent on domestic critical rare earth production. I would not be surprised to see Canada make a similar move to support rare earth mining and development.

Recently during the quiet holiday season, China (FXI) announced that they were tightening exports again on critical materials. Rare earth export quotas for next year will drop again. China claims that they are cutting back because of the weak global economy.

Nevertheless, stealthily China continues to announce infrastructure plans within the country, and has been stockpiling these critical materials for their own domestic demand. For months, we have been predicting a rebound in China's economy as iron ore prices began rising.

Now we read headlines that China's exports are very strong, even with a rising yuan (CYB). Risk assets such as the rare earths miners and uranium miners (URA) should rally on this news. More smart money from the investment community is realizing that China is far from a hard landing. In fact, they may be in the midst of a powerful recovery.

Exports have jumped to a seven-month highs despite the debt issues in Europe and the United States. This rebound in China may be a spark for the undervalued junior miners (GDXJ), which have been in a downtrend for close to two years as economists predicted a Chinese hard landing.

Many investors have been concerned about the recent Fed minutes, which indicated some sort of exit plan from quantitative easing. These accommodative actions to expand the Fed's balance sheet to record levels have boosted bonds (TLT), the housing (XHB) and the financial markets (XLF) with easy money.

We may be witnessing capital flowing to growing economies such as China. All these actions over the past few years by Central Banks could be starting an inflationary cycle, which could boost the undervalued commodities such as uranium and industrial/strategic metals.

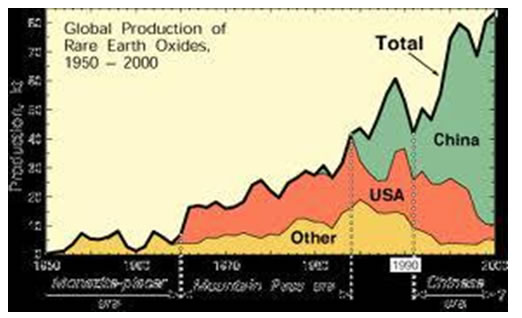

China's equity markets are up around 20% in the past six months, far outpacing equity markets in Europe and the United States. Many do not realize yet that not only is China the world's biggest supplier, but their own economy has grown to a point where they may become the largest consumer of these materials as major industries continue to move their factories to China.

China continues to control the rare earth industry despite attempts from companies like Molycorp (MCP) and Lynas (LYSCF.PK) to begin production. Both companies have been plagued by delays and obstacles. Mining and refining rare earths is not an easy ballgame, as it requires advanced metallurgy and favorable geopolitics.

For decades, the world has been relying on cheap rare earths from China. Nevertheless, this will change rapidly over the next few years. The Chinese are especially short on the critical rare earths needed for permanent magnets, wind turbines, guided missiles and lighting, as they are building their own facilities to manufacture these finished products.

Molycorp and Lynas should be able to supply a large amount of light rare earths after they work out their issues. However, Lynas is still dealing with protestors in Malaysia, and Molycorp is dealing with delays and rising costs to start production. The disappointing performance in these two equities has hurt the entire sector.

In 2011 and 2012, we experienced a decrease in the price of the entire industrial metal sector as QE2 expired and the U.S. and European debt crisis intensified. However, we may be at a turning point for the undervalued rare earth and uranium miners as China leads a rebound.

Large amounts of quantitative easing in the U.S. were announced in the second half of 2012. The new Japanese government is also devaluing the yen to boost the Nikkei, while restarting nuclear plants. China is rebounding quickly, announcing infrastructure projects and starting construction on nuclear reactors. China is leading the world with building new reactors.

China's decreasing rare earth exports, combined with declining production and rapidly depleting heavy rare earth resources, could cause an even greater supply shortfall in 2013. China is consolidating the rare earth industry and cutting down on critical metal smuggling. This will help the Chinese have greater control of their own domestic production.

I will closely follow in my free newsletter both the critical heavy rare earth space and the uranium sector as Asia rebounds, as these metals are crucial for China's domestic needs. These rare metals are vital for our latest high tech devices, and there are only a few viable companies that can get into production in a timely manner.

In the rare earth mining sector, geopolitical support and infrastructure is crucial. In the uranium space, rising geopolitical tensions in Africa and the Middle East with Al Qaeda could cause increased interest in junior uranium developers in the Western Hemisphere.

Two ways of investing in these sectors is through the Rare Earth ETF (REMX) and the Uranium Miners ETF (URA). Both of these metals are critical for China's clean energy initiatives and Middle Eastern energy independence. The ETFs were poor performers in 2012 as fears of a slowdown in China increased. Now, they may represent bottoming situations, which I will be following closely for my readers.

Now, they may represent bottoming situations, which I will be following closely for my readers.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Disclosure: I am long GLD, SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

© 2013 Copyright Jeb Handwerger - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeb Handwerger Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.