Why The Stock Market Rallies Despite Worries

Stock-Markets / Stock Markets 2013 Feb 01, 2013 - 02:10 PM GMTBy: Clif_Droke

The fiscal cliff, tax increases, the debt ceiling, missed earnings - investors certainly have had much to worry about lately. So why in spite of these fears has the market continued to rally?

The fiscal cliff, tax increases, the debt ceiling, missed earnings - investors certainly have had much to worry about lately. So why in spite of these fears has the market continued to rally?

There's a Wall Street bromide that succinctly answers this question: "Bull markets climb a wall of worry." Fear tends to fuel higher prices when internal momentum is rising due to short covering and other technical factors. It's normally not until everyone has entered the market that the market finally tops out.

Many are wondering why the market has been so strong in the face of all these potential pitfalls. The best answer I've heard for this question to date is that the U.S. stock market is the "best horse at the glue factory" so to speak.

As one newsletter writer pointed out, "Pension plans get contributions every month and have to invest them. Individuals are saving money and they have to invest it. And high yielding bonds and CD's from yesteryear are maturing. What are your investment options?" Certainly not low-yielding CD's and Treasuries. Moreover, the dividend yield on the Dow was recently as high as 2.6%, well about the yield on a 10-year T-Bill. In other words, the U.S. stock market is winning the race for investors' dollars by default.

On the investor psychology front, the latest AAII investor sentiment readings have been at their most enthusiastic in several months. The percentage of bullish investors recently hit 52%, the highest bullish reading since last February 8. Bullish readings above 50% often signal market tops, or at least serve as preliminary warnings that a top is ahead. I would point out, though, that last year's (Feb. 8) 52% bullish reading in the AAII poll was followed by nearly two more months of higher prices in the S&P before a sizable correction occurred.

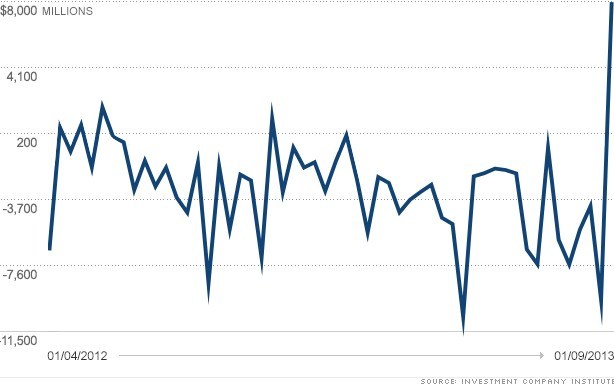

Along with increasing investor enthusiasm has come an increase in equity market inflows. CNNMoney pointed out recently that investors poured a record $8 billion into U.S. stocks at the start of 2013 after removing more than $150 billion from U.S. stock mutual funds last year. According to the Investment Company Institute, the $8 billion investors put back into stocks as of January 9 was the highest amount within a short space since ICI first began keeping records in 2007.

As Hibah Yousuf of CNNMoney wrote, "The massive inflow represents a significant departure from the recent trend of investors fleeing the stock market." Along these lines, Art Huprich, chief technical analyst at Raymond James asks, "Is there a slow yet marginal shift out of fixed income and into equities taking place?" It's still early, but it's beginning to look that way. Assuming this trend continues it would certainly jibe with our Kress cycle "echo" forecast for 2013, which concluded that this year would likely resemble 2007 in many ways. In other words, 2013 could prove to be a major topside transition year with some major ups and downs along the way as investor bullish sentiment reaches a crescendo.

In the meantime, it will do well to keep in mind the famous saying of the venerable Charles Dow: "Neither the length nor the duration of a trend can be forecast. The best we can do is identify trend changes and act accordingly."

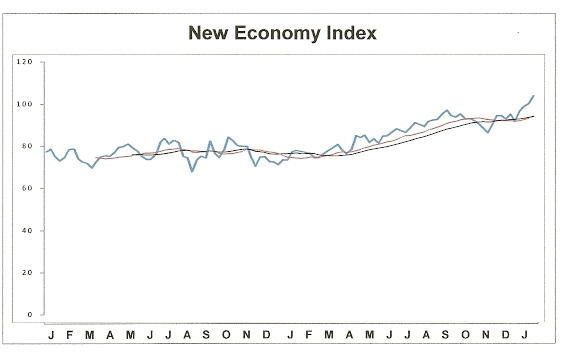

U.S. Economy

The Bureau of Economic Analysis said fourth quarter GDP contracted by 0.1%, which represents the first such contraction in over three years. Most of that contraction was due to a 22% decline in government defense spending, however. Personal consumption expenditures, accounting for 70% of GDP, rose 2.2%. This is more in line with the New Economy Index (NEI) which rose to a new high last week. According to Briefing.com, this was also the largest quarterly uptick since a 2.4% increase in consumption was reported during the first quarter of 2012.

The NEI chart shown above is the true reflection of the U.S. retail economy. It's telling us that consumers are still spending and show no signs as yet of letting up. We haven't seen an economic "sell" signal in this indicator since the early part of 2010. It's possible, however, we could see one at some point later this year as the economic headwinds begin to increase.

Gold

Speaking of economic headwinds, these include the Congressional battle over the U.S. debt ceiling, a potential downgrade of the U.S. credit rating by Moody's, the continued weak labor market in the U.S., trouble in the Middle East and North Africa, and the coming implementation of Obamacare. Each of these factors, if not offset by an equally positive event, could prove sufficient to galvanize a gold rally at some point.

On the subject of the U.S. credit rating, the editors of The Kiplinger Letter concluded that if Moody's or Fitch Ratings were to downgrade the country's debt, banks, insurers and others "may need to shuffle some assets around. If Treasury holdings no longer qualify as ultra-safe, other, high-risk investments may need upgrading to toe the line on statutory capital standard requirements." Kiplinger also suggested that this could cause some erosion of the dollar's status as a reserve currency. Such a development would likely prove favorable to gold.

One person who believes gold will have a good year in spite of the negative investor sentiment is Rob McEwen, chairman and CEO of McEwen Mining (MUX). According to McEwen, gold tends to have a positive performance in the year following a U.S. presidential election. He points out that in the seven electoral contents from 1984 to 2008, gold climbed by as much as 85% in the year after the election. The yellow metal suffered only one decline in that span, a 36% drop in 1997, the year following Bill Clinton's second election victory.

McEwen also noted that gold stock prices as measured by the Gold Silver Index (XAU) fell in all presidential election years dating back to 1984, including last year, when the index declined 8.3%.

We're currently in a cash position as we await the next confirmed buy signal from our indicators for gold.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.