Why Buy Silver?

Commodities / Gold and Silver 2013 Feb 05, 2013 - 02:28 AM GMTBy: DeviantInvestor

■Silver has no counter-party risk. It is not someone else's liability. Silver Eagles or Canadian Silver Maple Leaf coins are recognized around the world and have intrinsic value everywhere. The same is NOT true for hundreds of paper currencies that have become worthless, usually because the government or central bank printed them to excess to pay the debts of governments that did not control spending.

■Silver has no counter-party risk. It is not someone else's liability. Silver Eagles or Canadian Silver Maple Leaf coins are recognized around the world and have intrinsic value everywhere. The same is NOT true for hundreds of paper currencies that have become worthless, usually because the government or central bank printed them to excess to pay the debts of governments that did not control spending.

■Silver has no counter-party risk. It is not someone else's liability. Silver Eagles or Canadian Silver Maple Leaf coins are recognized around the world and have intrinsic value everywhere. The same is NOT true for hundreds of paper currencies that have become worthless, usually because the government or central bank printed them to excess to pay the debts of governments that did not control spending.

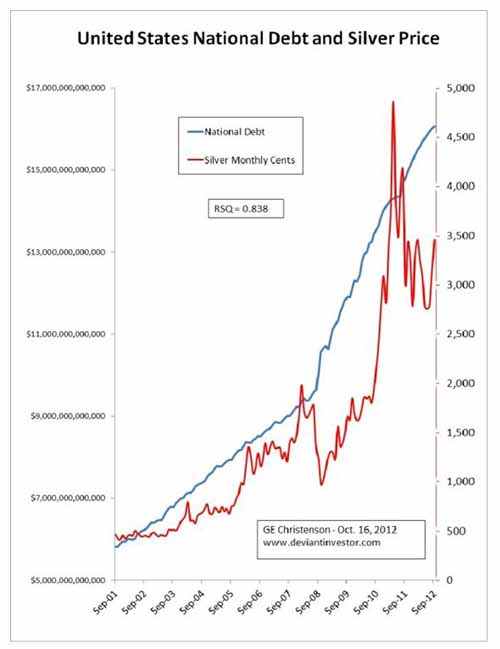

■The price of silver in US dollars since the year 2001 has been strongly correlated with the ever-increasing official national debt of the United States. Read $100 Silver! Yes, But When? I doubt that anyone believes the national debt will decrease or even remain constant over the next four years. We have every reason to believe that it will increase by well over $1,000,000,000,000 per year for many years. If the national debt is rapidly increasing and it correlates, on average, with the price of silver, then we can be reasonably certain that the HIGHLY VOLATILE price of silver will increase substantially over the next few years.

■Silver has been used as money (medium of exchange and a store of value) for over 3,000 years. In most cultures, silver has been used for daily transactions far more often than gold. I have read that the word for "money" is the same as the word for "silver" in many languages.

■In the United States silver was used as money - coins - until the 1960s when inflation in the paper money supply caused the price of silver to rise sufficiently that silver coins were removed from circulation. Do you remember silver dollars? They contained approximately 0.77 ounces of silver. Currently the US Mint produces silver eagles which contain 1.0 ounce of silver - and cost approximately $35.

■Argentina has devalued their currency several times and has dropped eight zeros off their unbacked paper money in the past 30 years. The United States has not dropped any zeros from dollars, but it took approximately one-half of one dollar to buy an ounce of silver 100 years ago, while it takes over 30 in today's reduced value dollars. It took about 20 dollars to buy an ounce of gold 100 years ago and it takes over 1,600 dollars to buy that same ounce of gold today. There are many more dollars (paper and electronic) in circulation today compared to 100 years ago. Hence the prices, measured in declining value dollars, for silver, gold, wheat, crude oil, bread, coffee, and ammunition is MUCH larger.

■Throughout history the prices of gold and silver have increased and decreased together, usually with gold costing 10 to 20 times as much as silver. A historical ratio of 15 or 16 is often quoted and that places the current ratio, which is in excess of 50, as relatively high. Since Nixon "closed the gold window" on August 15, 1971 and allowed the dollar to become an unbacked paper currency that could be created in nearly unlimited quantities, the gold to silver ratio has ranged from a high of approximately 100 to a low of approximately 17. There is room for silver prices to explode higher, narrowing the ratio to perhaps 20 to 1. When gold reaches $3,500 (Jim Sinclair) and subsequently much higher in the next few years, and assuming the ratio drops to approximately 20 to 1, the price of silver could approach $200 per ounce, on its way to a much higher number, depending on the extent of the QE-Infinity "money printing," panic, hyperinflation, and investor demand.

■If you think a silver price of $200 per ounce is outrageous, I suspect you would find near universal agreement among most Americans. But is a national debt in excess of $16,000,000,000,000 less outrageous? If unfunded liabilities are included the "fiscal gap" is, depending on who is calculating it, approximately $100,000,000,000,000 to $220,000,000,000,000. For perspective, that places the unfunded liabilities of the US government at approximately $700,000 per person in the United States. Is $700,000 unfunded liability (debt) per man, woman, and child more believable than a price for silver of $200?

It seems likely that the populace will eventually realize that:

■Government spending is out of control and will not be voluntarily reduced.

■"Printing money" or debt monetization (QE) is necessary and inevitable in order to continue funding the excess spending of the US government. More money in circulation means a declining purchasing power for the dollar. The decline is likely to accelerate at some time in the future.

■The real value of our savings and retirement diminishes as the dollar declines in value.

■People will panic and shift into real assets to preserve their purchasing power. (There is no fever like gold fever!)

■That panic will cause gold, silver, and many other real assets to drastically increase in price, as measured in devalued dollars.

■It is better to be early than late if a panic-moment is about to arrive.

■Silver is less expensive per ounce than gold and more available for purchase than gold, particularly for middle-class westerners. An investment into silver is likely to appreciate more than a similar investment in gold.

What Do You Believe?

■Do you believe that excessive spending and debt will be reduced?

■Do you believe that the decline in purchasing power of the dollar over the last 100 years will suddenly reverse?

■Do you believe that congressional promises for Social Security, Medicare, Medicaid, and government pensions will be broken?

■Do you believe the Federal Reserve will continue to print the money to pay for those promises?

■Do you believe your savings and retirement are totally safe in paper investments denominated in dollars?

■Do you believe, as history indicates, that paper money eventually devalues to zero while gold and silver retain their value?

■Do you believe that the world will suddenly stop using silver, instead of finding new uses for it every year?

Would you rather trust silver coins in a safe place or paper money and political promises? Read Ten Steps to Safety.

Most people will do nothing to protect their financial future. Will you?

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.