Stock Market Insiders Head For the Exits, Do They Know Something "We" Don't Know?

Stock-Markets / Stock Markets 2013 Feb 08, 2013 - 02:44 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Whenever the markets begin to look toppy like they do now, I turn to short-term indicators to help me figure out "what's next" for the markets. It complements the fundamental analysis I rely on for the big picture.

Keith Fitz-Gerald writes: Whenever the markets begin to look toppy like they do now, I turn to short-term indicators to help me figure out "what's next" for the markets. It complements the fundamental analysis I rely on for the big picture.

Some people - lots of people, in fact - will tell you that this is a wasted exercise. Predicting the markets, they say, can't be done. I disagree if for no other reason that if that were true, guys like Jim Rogers, Warren Buffett, Steve Jobs, Richard Branson and Carlos Slim wouldn't be the legends they are today.

As I see it, learning to "read" the markets and anticipate its twists and turns is absolutely possible.

But let me qualify my statement. My goal is not necessarily to be "right."

Any savvy trader will tell you the objective is to get enough of a read - right or wrong -so that you can use the appropriate tactics needed to be profitable.

For example, the markets have one heckuva run and flirted with new highs in recent trading. To the casual investor, it appears that things are good because the economy is gradually recovering.

Yet, there have been nine insider sales for every single buyer among NYSE stocks in the past week, according to the Vickers Weekly Insider Report as reported by CNBC.

Clearly something doesn't match up, especially when you consider that the last time insiders sold this aggressively was in early 2012, right before the S&P 500 took a 10% header.

As my colleague, Bill Patalon, noted recently in his Private Briefing column, there are all kinds of legitimate reasons insiders sell their shares. They range from simply taking profits to portfolio reallocations, estate planning, raising cash to pay the ginormous taxes that come with success, even financing dream homes. So there could be something else at work here. But I don't think so.

What concerns me is that insiders, particularly when you're talking about senior management types, typically know a lot more than the average investor. Further, they tend to have a consistent view of very specific longer term market conditions and, more importantly, its earnings potential.

They are, as Enis Taner of RiskReversal.com noted to CNBC, "usually right over a long period of time."

What Insiders Sales Say About the Market

My take is that the insiders are spot on. I also believe that the fact that they've chosen to sell aggressively right now suggests a looming correction is in the works. Here's why:

■The markets have run higher against a backdrop of seriously flawed fundamental data, incessant Federal meddling, political disarray and a complete lack of supervision on Wall Street.

■Insiders are taking profits at a time when the rate of earnings growth is declining and forward-looking forecasts have been dropped to almost laughable levels. They - the insiders - are well aware of not only market uncertainty, but corporate insecurity in the months ahead.

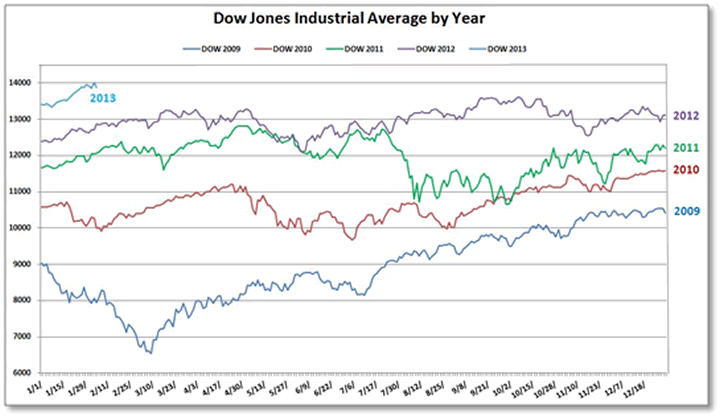

■Markets tend to take a while to digest their gains after each run higher. Since 2009, for instance, the markets have taken nearly 12 months to consolidate after every 1,000 point run before moving higher. This means that there will plenty of dips, twists and turns that will test investor resolve. Because the markets have an upside bias over time, most corrections, reversals and complete breakdowns generally turn out to be tremendous buying opportunities - a fact that will be lost on most investors who panic if a rollover gets started in earnest.

Figure 1: Fitz-Gerald Research Publications, Yahoofinance.com

■We have not seen the kind of "blow-off" action yet that has accompanied major market reversal points in the past, most notably those in 2000, 2003, 2007, and 2009. So I want to be on guard against the possibility if trading becomes frothy.

With that in mind, here are my key takeaways:

■Market history shows that insiders tend to sell holdings shortly before market tops or short-term corrections. Generally speaking, the more aggressive the sales, the more serious the following correction.

■A 9-to-1 selling ratio is significant because it resembles extremes associated with other major market turning points in recent history.

■While not a fait accompli, investors should tread lightly under the circumstances. They should also take appropriate action to ensure their portfolios are not ravaged if a substantial correction does, in fact, materialize. Examples include tightening up trailing stops, purchasing put options, going "long" volatility or buying specialized inverse funds - all of which can take the sting out of a sudden reversal while also preserving upside and income.

My fear is that we've already reached the point where there is so much money sloshing around that the next "big thing" from Team Fed may actually be the straw that breaks the camel's back. But that's another story for another time.

Thank goodness protection is cheap at the moment. Assuming, of course, insiders know something "we" don't.

Source :http://moneymorning.com/2013/02/08/as-insiders-head-for-the-exits-do-they-know-something-we-dont-know/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.