Ron Paul: “6,000 Years of History, Gold Is Always Money, Paper Money Fails”

Commodities / Gold and Silver 2013 Feb 11, 2013 - 05:25 PM GMTBy: GoldCore

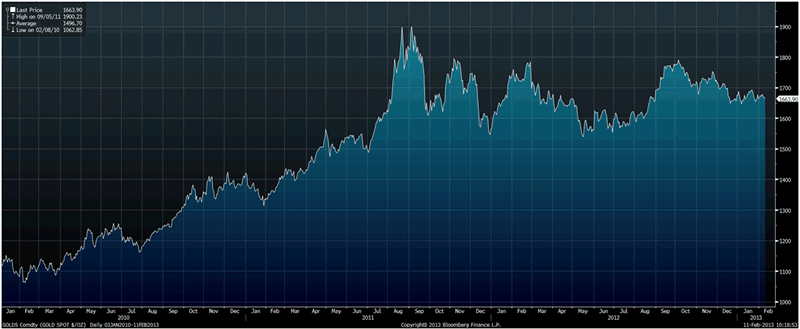

Today’s AM fix was USD 1,663.50, EUR 1,242.16 and GBP 1,057.94 per ounce.

Today’s AM fix was USD 1,663.50, EUR 1,242.16 and GBP 1,057.94 per ounce.

Friday’s AM fix was USD 1,669.75, EUR 1,245.15 and GBP 1,059.55 per ounce.

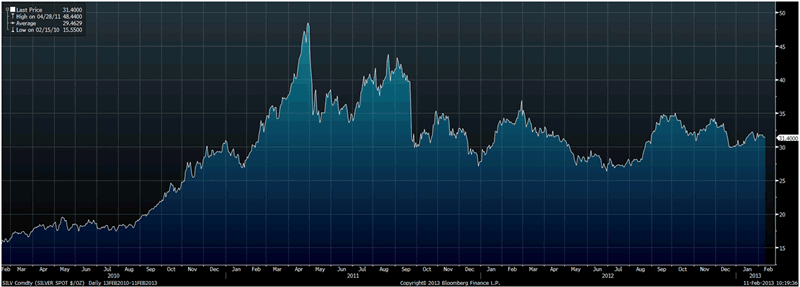

Silver is trading at $31.24/oz, €23.40/oz and £19.99/oz. Platinum is trading at $1,720.75/oz, palladium at $748.00/oz and rhodium at $1,220/oz.

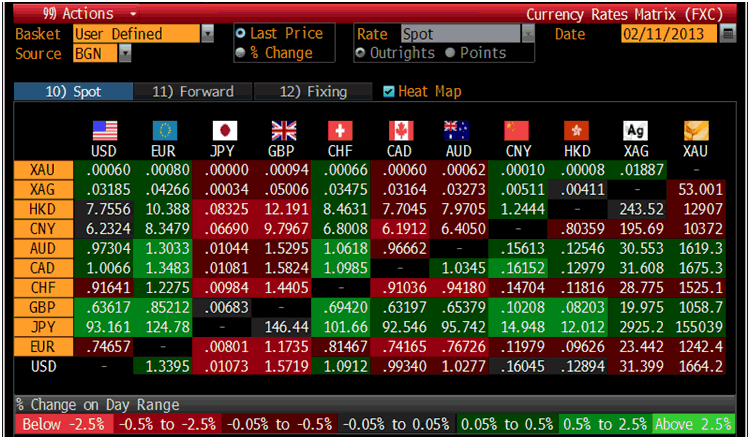

Cross Currency and Precious Metal Table – (Bloomberg)

Gold fell $3.20 or 0.19% on Friday closing at $1,668.60/oz. Silver edged down to $31.31 in early New York trade, but it then climbed higher and finished unchanged on the day.

Spot gold was up 0.05% for the week while silver was off 1.13%.

Gold Spot $/oz, Daily, 03JAN2010-11FEB2013 – (Bloomberg)

Gold is slightly weaker in dollar and euro terms today but higher in pounds and yen.

Volumes are light in thin trade as most of Asia is closed for the week long Lunar New Year holiday.

Palladium and platinum remain just shy of their strongest levels in almost a year and a half.

Europe’s finance ministers are meeting to discuss aid to Greece and Cyprus. They aim to tidy the sea of debt before the Italian elections on February 24-25 and a political scandal in Spain – both of which could quickly destroy the market calm.

Pro-independence parties in Scotland and Catalonia are preparing for referendums next year that they hope could see their regions as independent free countries. A few analysts feel the freedom of seceding may incite others in Europe to follow suit.

Venezuelan President, Hugo Chávez announced a surprise devaluation of the bolivar by 36% over the carnival weekend.

Some analysts say that although the exchange rate adjustment was necessary to correct growing distortions in the economy, it did not go far enough as they feel the currency is still overvalued.

The moved shows the importance of gold as a diversification to protect against currency devaluations.

U.S. economic highlights this week follow: The Treasury Budget on Tuesday, Retail Sales, Export and Import Prices, and Business Inventories on Wednesday, Initial Jobless Claims on Thursday, and Empire Manufacturing, Net Long-Term TIC Flows, Industrial Production, Capacity Utilization and Michigan Sentiment on Friday.

Silver Spot $/oz, 13FEB2010-11FEB2013 – (Bloomberg)

Ron Paul spoke with Bloomberg television (see video in Commentary) and said that we are in a currency war and we have been for decades. He noted that governments have always competed against each other’s currencies even under Bretton Woods. It has always been a form or protectionism and will make people want to export more.

Dr. Paul said don’t blame countries like China and Japan just look at the debt the U.S. is buying. There will always be currency wars. The Bank of Japan claims it has to defend itself against deflation and decades of slow growth.

Ron Paul noted that the Bank of Japan’s yen devaluations will eventually lead to further price inflations that are to come. Investors and citizens will eventually reject the yen and switch to other currencies like dollars or Swiss francs. Then eventually people will move to hard assets altogether as they are losing confidence in paper assets.

Dr. Paul was asked, “Do you think protectionism will lead to a crash in the international monetary system? He replied, “Nothing good can come of it. Even short run trade benefits leads to a weaker economy and higher prices. It doesn't solve the problem they won't face the truth. That is that all governments spend too much money, there is too much debt and they get away with it by taxing people”.

“It seems that all we have is more debt, more printing money, and more government interventions. Governments won’t even talk cutting things. They only want to make slight decreases of proposed increases in their budgets!”

On the next U.S. Treasury Secretary, Jack Lew, Paul says, “We don't need an intervener. He should have a strong dollar policy by defining it, and not by propping up the market. Don't devalue a currency. It is then that you hurt savers and cost of living goes up. This only damages the middle class and the poor no matter what welfare programmes you have because they lose purchasing power.”

Dr. Paul says that he feels the Obama administration is trying to devalue the dollar, they are very different then sound people and different then the Austrian economists. They feel debt is ok.

The interviewer noted that the gold standard has not immunized us from financial crisis.

Dr. Paul retorts, “If you look at it over several years it does maintain money. There were flaws with the gold standard, during wars, there were problems in the past and we understand so much more today and we could do better.”

“If you think we need a wiser Federal Reserve, central economic planning for the manipulation of credit, or a better Treasury Secretary, I reject that. “

After all, Ron Paul says for over 6000 years of history gold is always money and paper money fails.

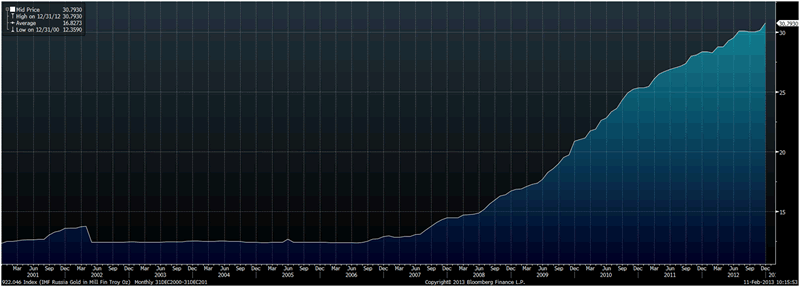

IMF Russia Gold in Million Fine Troy Oz, Monthly – (Bloomberg)

Russia buys gold to protect against “cataclysm with the dollar, euro, pound or any other reserve currency"

Not only has Putin made Russia the world’s largest oil producer, he’s also made it the biggest gold buyer. His central bank has added 570 metric tons of the metal in the past decade, a quarter more than runner-up China, according to IMF data compiled by Bloomberg. The added gold is also almost triple the weight of the Statue of Liberty.

“The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency,” Evgeny Fedorov, a lawmaker for Putin’s United Russia party in the lower house of parliament, said in a telephone interview in Moscow.

Gold, coveted by Russian rulers including Tsar Nicholas II and the Bolshevik leader whose forces assassinated him, Vladimir Lenin, has soared almost 400% in the period of Putin’s purchases. Central banks around the world have printed money to escape the global financial crisis, sapping investor appetite for dollars and euros and setting off a scramble for safety.

In 1998, the year Russia defaulted on $40 billion of domestic debt, it took as many as 28 barrels of crude to buy an ounce of gold, data compiled by Bloomberg show. That ratio tumbled to 11.5 by the time Putin first came to power a year later and in 2005, after it touched 6.5 -- less than half what it is now -- the president told the central bank to buy.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.