Fed Pressuring Investors to Buy Stocks

Stock-Markets / Stock Markets 2013 Feb 11, 2013 - 06:10 PM GMT The average investor is worried and yet he doesn’t know why. The media tells him that things are getting better, and thus far he doesn’t feel like he’s sharing in the improvement. Somehow he’s missed the proverbial boat. Supposedly inflation is low and yet he never makes it to the end of the month with his paycheck. Through manipulation of the markets, the Fed is trying to create an atmosphere that allows for improvement in the economy. Yet it’s this very manipulation that seems to keep investors away from the markets. I know that because I look at the volume of shares traded. Friday’s volume was a measly 3.1 billion shares, an average morning in early 2009.

The average investor is worried and yet he doesn’t know why. The media tells him that things are getting better, and thus far he doesn’t feel like he’s sharing in the improvement. Somehow he’s missed the proverbial boat. Supposedly inflation is low and yet he never makes it to the end of the month with his paycheck. Through manipulation of the markets, the Fed is trying to create an atmosphere that allows for improvement in the economy. Yet it’s this very manipulation that seems to keep investors away from the markets. I know that because I look at the volume of shares traded. Friday’s volume was a measly 3.1 billion shares, an average morning in early 2009.

The Fed has been manipulating the bond market by buying US $85 billion a month and keeping bond prices higher than they would naturally be. The Fed is also manipulating the interest rate by keeping rates very low. This type of relationship has the effect of chasing investors away from bonds even though the Fed is being forced to push more and more supply into the market. Perhaps that’s why the market has taken it upon itself to raise rates over the last six months:

The end result is much like incestuous relationship, full of defects. Finally, by keeping rates low the Fed is pressuring investors by forcing them to buy stocks in the vein hope of capturing dividends and at the same time creating profits through rising stock prices.

So far the Fed has had a lot more success pushing stock prices higher that it has keeping rates lower and bond prices higher. The Fed is straining to keep the wheels on in the bond market and that is evident in the latest numbers. In January the US debt increased by US $47.2 billion and yet the Fed increased its holding in treasuries by more than US $50 billion. That’s only logical if you stop to think about it since the Fed pays you next to nothing for your money while supply and risk increase daily. Besides who knows what the dollar will be worth five, ten or thirty years down the road. After all it’s been losing value for more than a decade and there is nothing to indicate that it will change course anytime soon.

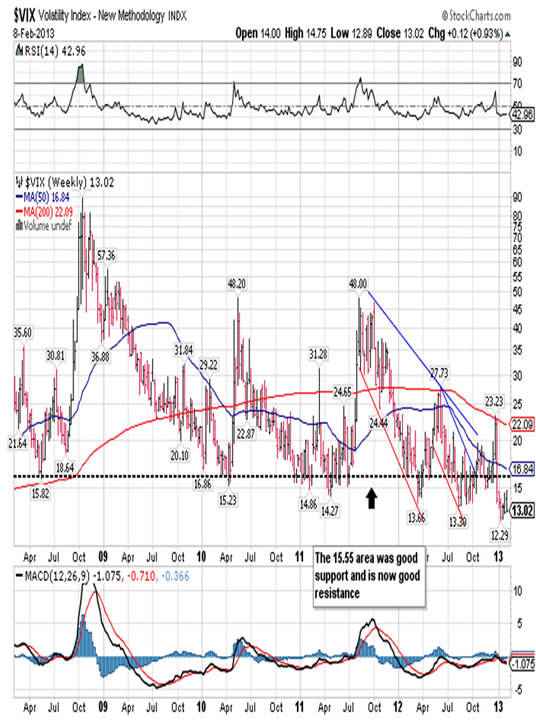

Politically even the janitor that cleans the Capital building knows the US has a serious debt problem, but among Congressmen and Senators there is absolutely no will to deal with the issue. That’s why you will eventually see an elimination of the debt ceiling and that will be celebrated as a solution. Of course nothing could be further from the truth. Meanwhile everyone will look to the stock market for gains and absolutely no one seems to be worried about it. As proof of the complacency, take a look at the VIX:

It recently made a new multi-year low and is still quite low. If the futures are any indicator the Dow should open higher so we just might see the VIX pressured even lower. This is all very confusing since the stocks are paying historically low dividends and the price-earnings ratio is high at 16.50. It seems that value went out the window just after the baby and the bath water.

The panorama gets even more confusing when you stop to consider that the darling of the US market, Apple, has been in a free fall:

Perhaps the market has come to the conclusion that an Apply without Steve Jobs is an Apple out of ideas?

In any event the only real burning question right now is whether or not the Dow can make a new all-time closing high and confirm the Transports in the process:

Back in October 2007 the Dow closed at 14,164 and right now its trading around 13,964, so just 200 points separates the Dow from a new bull market in stocks. Nothing else matters right now and it will have repercussions for inflation, the US dollar, commodities prices and bonds. About the only thing it won’t influence is economic growth and jobs. Talk about irony!

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2013 Robert M. Williams - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.