Natural Gas Unseasonal Price Rise. Why is it Rising?

Commodities / Natural Gas Mar 05, 2008 - 12:59 AM GMTBy: Donald_W_Dony

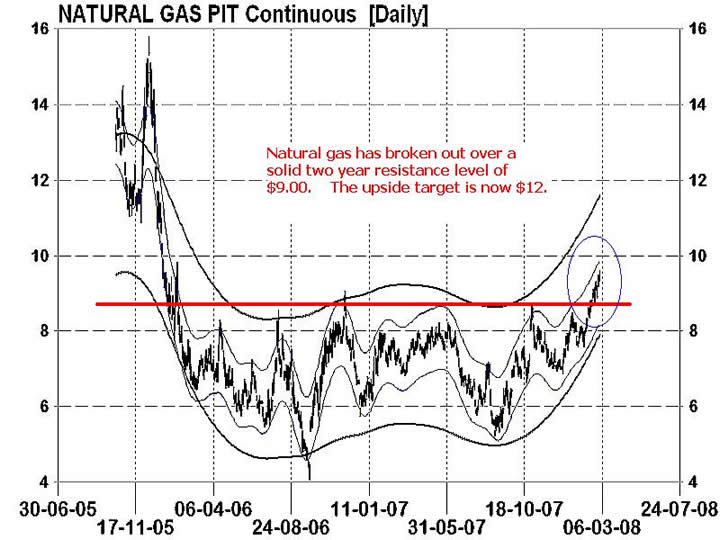

Something is happening to natural gas that should occur at this time of the year; it is rising. This commodity normally starts to strengthen early in the 4th quarter or, to a lesser degree, advance during the summer months. But rallying in between these higher demand periods is certainly unique, and more importantly, breaking through the solid price resistance level of $9.00 is very unexpected. So, what is driving this natural source higher?

Something is happening to natural gas that should occur at this time of the year; it is rising. This commodity normally starts to strengthen early in the 4th quarter or, to a lesser degree, advance during the summer months. But rallying in between these higher demand periods is certainly unique, and more importantly, breaking through the solid price resistance level of $9.00 is very unexpected. So, what is driving this natural source higher?

There are a couple elements colliding together that is pushing natural gas higher than it normally should at this time of the year.

The weather, of course, is a key factor. Throughout most of the eastern portion of North America, winter has held that part of the country in a long icing grip. Snow storms continue to batter much of the central and east of Canada and the

U.S. as spring approaches.

Storage levels are another issue. They are getting a lower than the market would like. Withdrawals from natural gas in storage have been a lot larger than the expectations over the last several weeks.

The other key driver is imports. Almost 18% of natural gas that goes to the U.S. is met through gas imports. Some of this comes from Canada and the rest is from liquid natural gas (LNG). Recent data indicates that many new LNG projects have been delayed and that LNG imports are on the decline. Canada, which provides a good deal of the U.S. gas imports, has slashed rig rates due to the low natural gas prices in Alberta, while Canadian demand is rising. Mexican natural gas demand is also growing very strongly, while Mexican supply growth has slowed steadily. Overall, net supply is decreasing at a fast rate then expected.

However, one of the biggest problems for the gas industry has been the low prices. After soaring to a December 2005 high of over $15 US per mcf, prices fell below $5.00 US in the summer of 2006 and below $6.00 US in the summer of 2007.

The good news is that U.S. natural gas storage levels have fallen below 2007 year levels. Canadian natural gas production in January has also fallen considerably. Plus, with the gas industry's recent cuts in capital expenditures due to low prices, drilling activity has had a major downturn. This also impacts the new supply.

Technical models are indicating a positive turn for natural gas, especially now that the commodity has crossed the $9.00 resistance zone. Models are suggesting that $9.00 will now be the support line on any price pullbacks and a target of $12 can be anticipated for 2008.

Bottom line: Natural gas is advancing into a price range that the commodity has not seen since mid-2005. With weaker supply and steady building demand, gas prices can be expected to remain strong moving into the summer. Also, with the hurricane season only several months away, any disruption in the already soft supply , can send natural gas easily above $12.

Investment approach: Many natural gas stocks have already moved to 52 week highs but are expected to continue climbing in 2008. The strongest period for gas prices still remains in the 4th quarter. There are also new natural gas ETFs that track the commodity.

More research is in the March issue of the Technical Speculator.

Your comments are alway welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.