Illusion of Euro-zone Stability as France Sinks Further Into the Economic Gutter

Economics / France Feb 22, 2013 - 11:48 AM GMTBy: Mike_Shedlock

While laughing at the amusing exchange of letters between the CEO of Titan and Arnaud Montebourg, Minister of Industrial Renewal of France, I awaited the latest PMI report on France, expecting findings to be horrific.

While laughing at the amusing exchange of letters between the CEO of Titan and Arnaud Montebourg, Minister of Industrial Renewal of France, I awaited the latest PMI report on France, expecting findings to be horrific.

The PMI reports are out today, and inquiring minds will note the Markit Flash France PMI shows the decline in French private sector output accelerates further to reach near four-year record.

Key points:

- Flash France Composite Output Index drops to 42.3 (42.7 in January), 47-month low

- Flash France Services Activity Index falls to 42.7 (43.6 in January), 48-month low

- Flash France Manufacturing PMI climbs to 43.6 (42.9 in January), 2-month high

- Flash France Manufacturing Output Index rises to 41.2 (40.8 in January), 2-month high

Latest Flash PMI data indicated that the downturn in French private sector output deepened in February. January’s Markit Flash France Composite Output Index , based on around 85% of normal monthly survey replies, slipped from 42.7 in January to 42.3, its lowest reading since March 2009.

The steeper fall in overall output was driven by an accelerated decline in the service sector where activity contracted at the fastest pace in four years. Manufacturers signalled a slightly slower decrease in production compared with one month previously, albeit still sharper than signalled in the service sector.

New business placed with private sector companies in France fell again in February, extending the current sequence of contraction to one year. The rate of decline quickened slightly since January and was only marginally slower than December’s 45-month record.

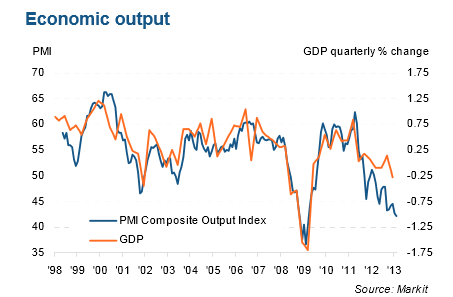

Service providers indicated that new business fell at the sharpest rate for just under four years. Survey respondent s commented that difficult business conditions and intensifying competitive pressures had conspired to depress inflows of new work. France Economic Output

Expect GDP to follow the PMI far more than economists expect.

Eurozone Aggregate PMI

The Markit Flash Eurozone PMI shows steepening downturn in February.

Key Points:

The Markit Eurozone PMI® Composite Output Index fell to 47.3 in February from 48.6 in January, according to the flash estimate. The decline signals a steepening of the economic downturn, contrasting with the easing trend seen in the previous three months. Business activity has now declined throughout the past year-and-a-half, with the exception of a marginal increase in January last year.

- Flash Eurozone PMI Composite Output Index at 47.3 (48.6 in January). Two-month low.

- Flash Eurozone Services PMI Activity Index at 47.3 (48.6 in January). Three-month low.

- Flash Eurozone Manufacturing PMI at 47.8 (47.9 in January). Two-month low.

- Flash Eurozone Manufacturing PMI Output Index at 47.5 (48.7 in January). Two-month low.

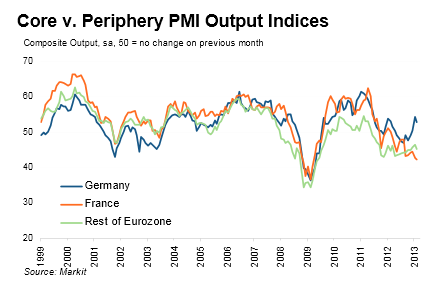

Output rose for the third month running in Germany, albeit at a slower rate, contrasting with accelerating, steep rates of decline in both France and across the rest of the Eurozone on average. French businesses were particularly weak, reporting the largest monthly drop in output since March 2009. Outside of France and Germany, the rate of decline was the fastest for three months, though it was weaker than the downturn seen in France.

New orders fell for the nineteenth month running, with the rate of decline gathering pace having eased to the weakest for 11 months in January. However, the overall rate of loss in February remained less steep than that seen throughout much of 2012.

Chris Williamson, Chief Economist at Markit said: "A steepening rate of decline in February is a disappointment, and suggests that the eurozone is on course to contract for a fourth consecutive quarter in the first three months of the year. Digging into the data shows increasing schisms within the eurozone. National divergences between France and Germany have widened so far this year to the worst seen since the survey began in 1998. Germany is on course to grow in the first quarter, recovering from the 0.6% GDP fall seen in the fourth quarter, possibly expanding by as much as 0.4%. In contrast, France’s downturn is likely to deepen, bringing the euro area’s second-largest member more in line with the periphery than with the now solitary-looking German ‘core’.”

"Core" of Europe vs. Periphery

Recall that the "core" of Europe was once Germany, France, and Italy. Italy went down the tubes long ago and the "core" became Germany and France. The "core" is now Germany.

Rotten to the Core

Last month the eurozone composite PMI rose from 47.2 to 48.6.

Chris Williamson, Chief Economist at Markit offered this interpretation: "The

eurozone is showing clear signs of healing, with the downturn easing

sharply in January and the region moving closer to stabilisation in the

first quarter."

I offered a completely different interpretation on February 7 in Illusions of Stabilization.

No Signs of Healing

I disagree with Williamson. Those divergences show the eurozone is getting sicker, not healing.

If there was any healing, and certainly if there was any rebalancing,

manufacturing and export growth would be picking up in Spain, in Italy,

and in France at the expense of Germany.Illusion of Eurozone Stabilization

There is no real stabilization and there is no healing. Rather, the

policies of Hollande are so disastrous that some output has shifted to

Germany and elsewhere, (coupled perhaps with some inventory

replenishment and a temporary stimulus-fueled increase in demand in

Asia).

Even that cannot last. How can it?

US growth has stalled (at best) and 2% payroll tax cuts will tip the US into recession (assuming it's not there already).

With employment sinking in France, Italy, and Spain, precisely who will buy German exports?

Properly rebalancing will require a shift in production from Germany to

the rest of Europe as well as a shift towards more consumption in

Germany from the rest of Europe. That cannot and will not happen with

the destructive polices of Hollande, and the lack of reforms in Spain

and Italy.

Something has to give. And it's something very few people see coming.

Germany Will Pay a Steep Price

One way or another Germany will pay a huge price.

These are the only two eurozone recovery options

- Germany gives (not lends) more bailout money to the rest of Europe

- The eurozone breaks up

There are no other options, and no other choices. Meanwhile, imbalances grow and German taxpayers keep funneling tax dollars to the Southern states to keep them afloat.

How long German citizens are willing to put up with this sorry state of affairs remains to be seen.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.