U.S. Stock Market Uptrend May be Ending

Stock-Markets / Stock Markets 2013 Mar 03, 2013 - 10:52 AM GMTBy: Tony_Caldaro

Another volatile week, as volatility has picked up since the SPX closed at 1531 a week ago tuesday. Since that close the SPX traded to 1497 last thursday, 1526 on monday, 1485 on tuesday, 1525 on thursday, and 1501 on friday. Two percent swings in a matter of days, when during most of February we were barely seeing 1.5% swings in a week. For the week the SPX/DOW were +0.40%, and the NDX/NAZ were +0.35%. Asian markets were +0.9%, European markets were -0.4%, and the DJ World index was flat. On the economic front positive reports outnumbered negative reports 12 to 5. On the uptick: Case-Shiller, FHFA housing index, new/pending home sales, consumer confidence/sentiment, Q4 GDP, Chicago PMI, personal spending, PCE prices, ISM manufacturing and weekly jobless claims improved. On the downtick: durable goods orders, personal income, construction spending, new home prices and the WLEI. New week we get reports on ISM services, the FED’s Beige book, and monthly Payrolls. Best to your week.

Another volatile week, as volatility has picked up since the SPX closed at 1531 a week ago tuesday. Since that close the SPX traded to 1497 last thursday, 1526 on monday, 1485 on tuesday, 1525 on thursday, and 1501 on friday. Two percent swings in a matter of days, when during most of February we were barely seeing 1.5% swings in a week. For the week the SPX/DOW were +0.40%, and the NDX/NAZ were +0.35%. Asian markets were +0.9%, European markets were -0.4%, and the DJ World index was flat. On the economic front positive reports outnumbered negative reports 12 to 5. On the uptick: Case-Shiller, FHFA housing index, new/pending home sales, consumer confidence/sentiment, Q4 GDP, Chicago PMI, personal spending, PCE prices, ISM manufacturing and weekly jobless claims improved. On the downtick: durable goods orders, personal income, construction spending, new home prices and the WLEI. New week we get reports on ISM services, the FED’s Beige book, and monthly Payrolls. Best to your week.

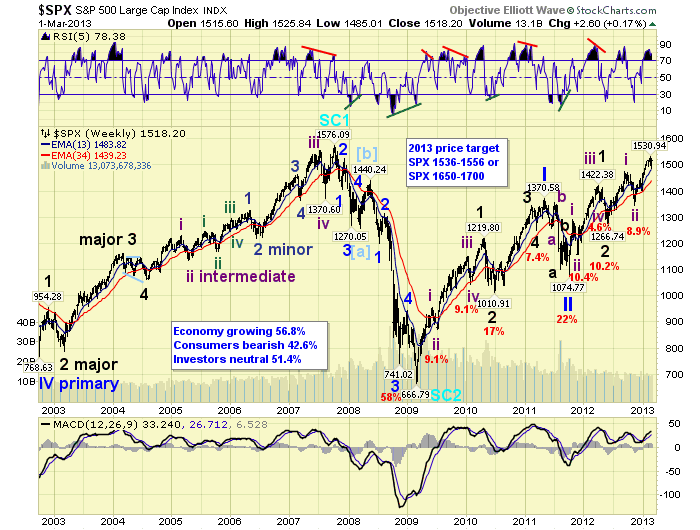

LONG TERM: bull market

This week the bellwether DOW came within 50 points of the all time high at 14,198. Considering this bull market started in March 2009 at DOW 6,470 it has been quite a rise in four years. Will this market duplicate its previous Cycle wave [1] bull market, 1932-1937, and stretch out to five years in 2014? This is certainly possible as there are several more uptrends to unfold. For now, we will just take it one uptrend/downtrend at a time and observe what develops.

The weekly chart continues to track this bull market as it unfolds. Cycle wave bull markets unfold in five Primary waves. Primary waves I and II completed in 2011, and Primary III has been underway since then. Primary wave I divided into five Major waves with a subdividing Major wave 1. Primary III is dividing into five Major waves, but both Major waves 1 and 3 are subdividing. Major waves 1 and 2 completed in 2012, and Major wave 3 has been underway since then.

Major wave 3 is currently in Intermediate wave iii, having completed Intermediate wave i and ii in late 2012. When this uptrend concludes we should get an Int. iv correction, and then an Int. v uptrend to complete Major 3. This is to be followed by a Major wave 4 correction, and then a Major 5 uptrend to complete Primary III. Then after a Primary IV correction, an uptrending Primary V should complete the bull market. So we still have three more downtrends and uptrends before this bull market concludes.

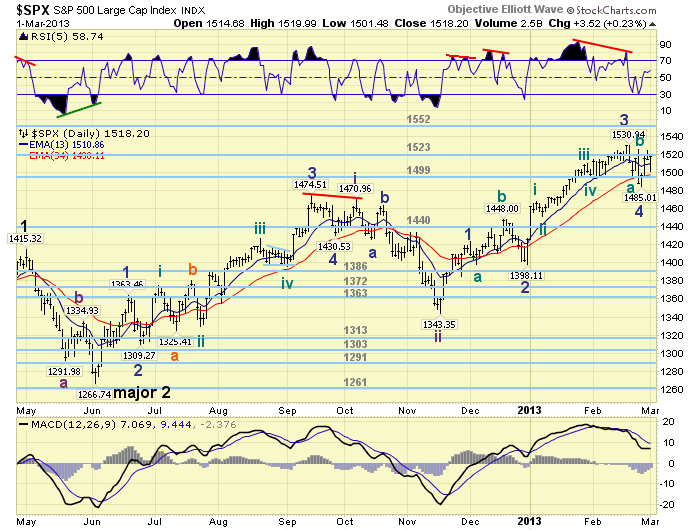

MEDIUM TERM: uptrend but weakening

This uptrend, Intermediate wave iii, has been dividing into basically five Minor waves: Minor 1 SPX 1424, Minor 2 SPX 1398, Minor 3 SPX 1531, Minor 4 SPX 1485 and Minor 5 SPX 1525 thus far. The DOW, btw, has already exceeded its Minor 3 high by about 100 points. When this uptrend began in November, we projected a rise into February reaching the OEW 1552 pivot. Now that we are into March, the market has slightly underperformed out expectations by only reaching the OEW 1523 pivot. In fact, we now have some concerns that the SPX may not even reach the 1552 pivot during this uptrend. We will try to explain.

Typically, towards the end of an uptrend the technicals supporting the rise start to fragment. We first started to notice the beginnings of this about three weeks ago, when the SPX first ended the week at 1518. Then six of the twenty foreign indices we track were in confirmed downtrends. Since then, week by week, the number has grown to 7, then 8 and now 11. It becomes exceedingly difficult for the US market to rise when many/most of the foreign markets are declining. Since that 08FEB close at SPX 1518, the market has closed at 1520, 1516, and 1518 again in the following weeks.

Now with 55% of foreign markets in confirmed downtrends more technical negatives are beginning to appear closer to home. The Commodity index GTX is in a downtrend, along with all five of its sectors. The US Bond market is now uptrending and yields are beginning to decline. The USD is uptrending, and most of the foreign currencies we track are in confirmed downtrends. On the positive side eight of the nine SPX sectors remain in uptrends and market breadth remains good. Can the US market ignore all these negatives and continue higher? It’s possible, but it does not appear probable at this time. Either a trading range, best case, or a correction, worse case, is quite probable.

SHORT TERM

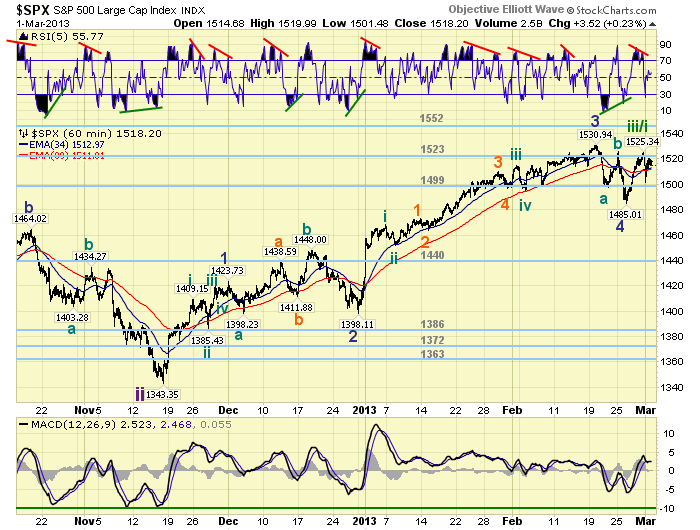

Short term support is at the 1499 pivot and SPX 1471/75, with resistance at the 1523 and 1552 pivots. Short term momentum hit oversold on friday then ended the week at neutral. The short term OEW charts ended the week positive with the reversal level at SPX 1512.

This market has had a fairly good uptrend from SPX 1343 to 1531 recently. This Intermediate wave iii (188 points) is about equal to Intermediate wave i (208 points). We can count five Minor waves up, with the fifth wave slightly below the high of the third: 1525 vs 1531. Thus far, this is a fifth wave failure. The SPX has recently displayed fifth wave failures before. While the DOW has not, and does not display one now. Intermediate wave i, the preceding uptrend, ended on a fifth wave failure. Intermediate wave v of Major wave 1, the uptrend before that, was also a fifth wave failure. So if this uptrend ends with a fifth wave failure it will be the third one in a row for the SPX.

Currently we have two green labels posted at SPX 1525. The green iii suggests the uptrend ended at that high with a fifth wave failure. The green i suggests SPX 1525 was Minute wave i of Minor wave 5 and friday’s low at SPX 1501 was Minute wave ii. Minute wave iii should be underway now if this is correct. We noted during the week that SPX 1500 was an important level for the uptrend. A drop to that level or below suggests the uptrend has ended. Holding that level, which it did friday, suggests the uptrend is still underway. We maintain this view.

In summary, with the negative technicals building it would appear this uptrend will continue to have a very difficult time making much more upside progress. The likely result, from any additional selling pressure, will be a downtrend. A correction from current levels would have to be small, around 3.5%, to avoid complications in the long term count. Keep in mind the DOW is the bellwether index and not the SPX. This could also create a volatile period, both up and down, lasting several weeks. Defensive measures appear warranted at this time. Best to your trading!

FOREIGN MARKETS

The Asian markets were mostly higher on the week for a net gain of 0.9%. Three of the eight indices are in confirmed downtrends and another is weakening.

The European markets were mixed for a net loss of 0.4%. Five of the eight indices are in confirmed downtrends and another is weakening.

The Commodity equity group were mixed on the week for a net loss of 0.6%. All three of the indices we track are in confirmed downtrends.

The DJ World index is still uptrending but ended the week flat.

COMMODITIES

Bonds are now in a confirmed uptrend, rates declining, and gained 0.8% on the week.

Crude is in a confirmed downtrend losing 2.4% on the week.

Gold remains in a downtrend and ended the week 0.2% lower.

The USD remains in an uptrend gaining 1.0% on the week. The downtrending EURUSD lost 1.3%, and the downtrending JPYUSD lost 0.3%.

NEXT WEEK

Friday night FED chairman Bernanke gave a speech at the San Francisco FED: http://www.federalreserve.gov/newsevents/speech/bernanke20130301a.htm. Tuesday kicks off the economic week with ISM services. Wednesday: ADP index, Factory orders, and the FED’s Beige book. Thursday: weekly Jobless claims, Trade deficit and Consumer credit. Friday: monthly Payrolls and Wholesale inventories. The FED has two speeches on monday. One at 8:00 with vice chair Yellen, and the other at 1:15 with FED governor Powell. Best to your week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2013 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.