Gold And Silver Increased Odds For Rally - The Clock Is Ticking

Commodities / Gold and Silver 2013 Mar 10, 2013 - 03:19 PM GMTBy: Michael_Noonan

Based on the tape, [in chart form], precious metals appear postured for a rally. To what degree is unknown, but current developing market activity favors one. Silver continues to outperform gold, and we start there.

Based on the tape, [in chart form], precious metals appear postured for a rally. To what degree is unknown, but current developing market activity favors one. Silver continues to outperform gold, and we start there.

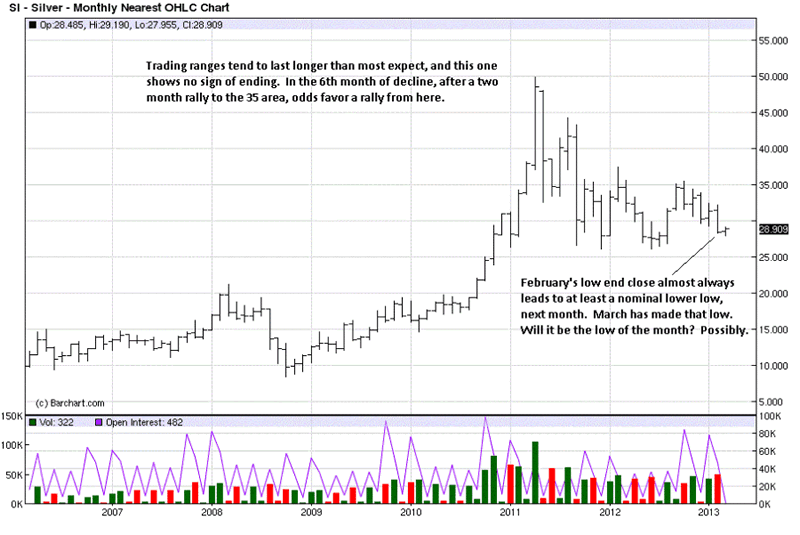

Based on February's low-end close, one would expect at least a nominal lower low for March. That event has occurred, and already one-third through for the month, there has been no other downside effort. Just that showing alone gave rise for expectations of a better performance this month.

Price still remains entrenched in a sideways trading range [TR], and they tend to last a lot longer than most expect, this one being no exception.

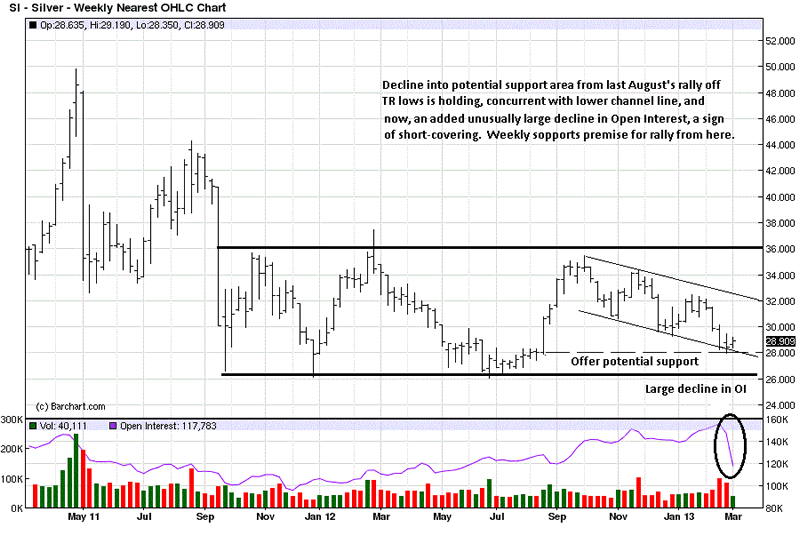

We often draw attention to the last August breakout as being significantant, and the strong likelihood for its breakout to be important support. That has not disappointed. Now, in addition to the lower channel line also checking the price decline, we note an important drop in Open Interest over the past few weeks.

Time will tell, but this may be another, if not the most important low within the TR.

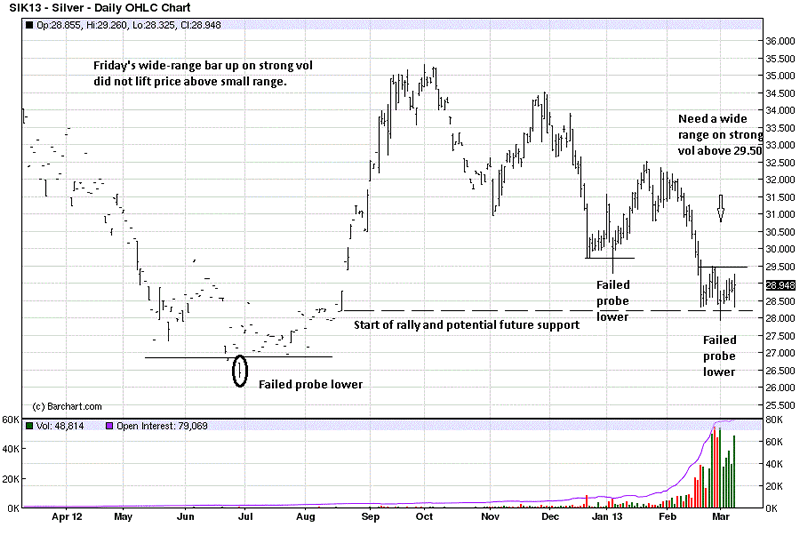

Failed probes lower can be interesting, but they are much less reliable in a down trend. It depends upon where they occur. The one from last August was at important support. Early January was another, and the current failed probe is a part of another pattern that suggests a high reliability for a rally from current levels.

The silver stars appear to be lining up.

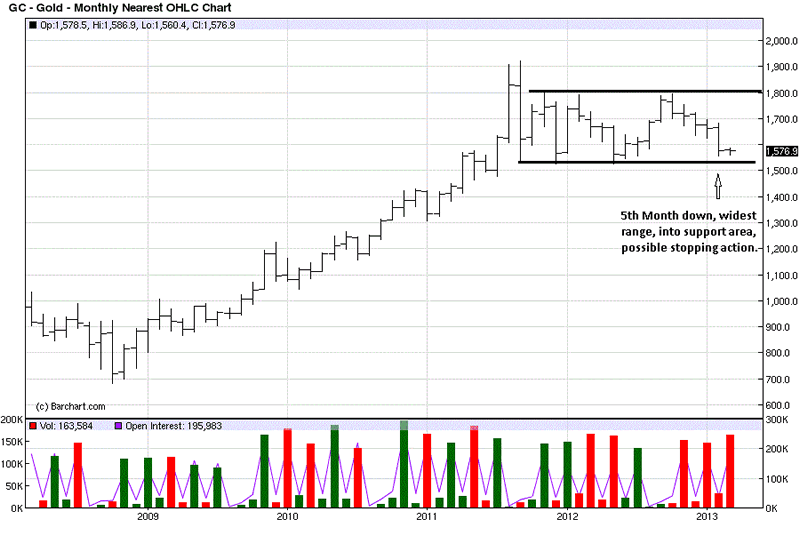

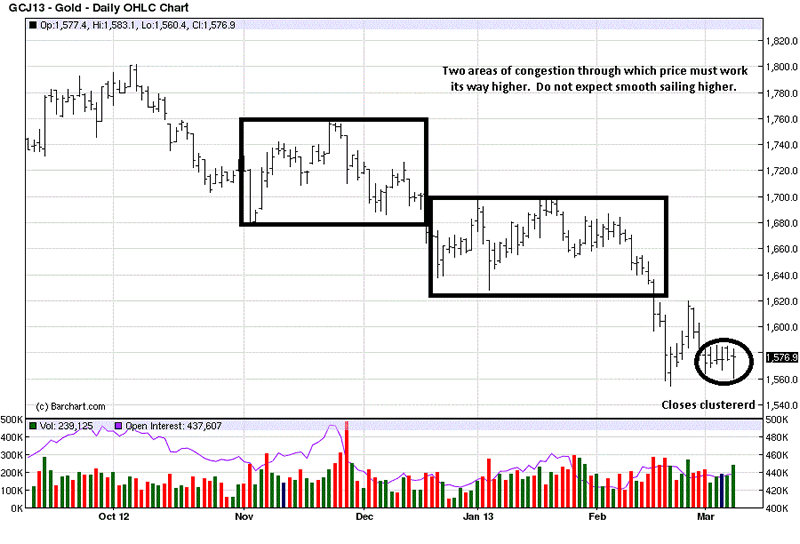

Where silver's monthly close was low-end, gold's was slightly off the low. What became a distinguishing potential turnaround for gold was the fact that February was the widest of the past 5 month decline. You tend to see the widest bars at the beginning, but when at the end, they can be a sort of selling climax and a form of downside stopping action.

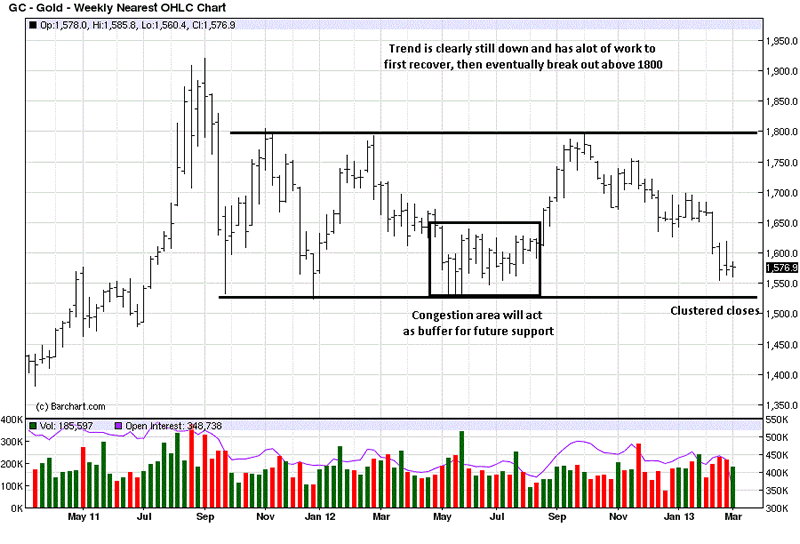

We see the clearer activity from the silver charts giving greater support for how to view the gold charts. Without silver, gold's interpretations would be much more subjective. Instead of a more obvious starting point for a rally from last August, gold had a congestion area that was likely to act as support in the future.

The last three weeks have overlapping bars, a form of balance between buyers and sellers at an area where sellers have been in control for the past six months, and perhaps now losing it. The clustering of closes echoes the same thing, a possible turning point.

Where the present suggests a rally, and the future has not yet happened, the past reminds us that there is considerable work to overcome selling efforts, and future rallies appear to have their work cut out for them. One needs to be select in buying futures.

As we have steadfastly maintained every week for so many months past, buying physical gold and silver are the best steps one can take for preservation of buying power and for wealth accumulation. The stock market may be at all-time highs, but as Goldcore points out, the Dow rally since 2007 is just 50% of gold's appreciation for that same period. The reasons for buying physical PMs is vastly different in purpose and in risk when compared to buying futures.

There are records being set for buying Silver Eagles, and for gold eagles, they are equally encouraging. Still, the numbers of people who own and hold physical gold and silver are still relatively small. Those who know are buying and know why. Those who have yet to buy have no reason to wait even one day longer. The government noose is tightening, and sooner, rather than later, it may be close to impossible to buy physical gold and silver without directly reporting purchases to the central planners whose plan will be nothing short of confiscating the last remaining "vote" of freedom.

If you want to know the future, be very aware of the past. There is one, and one reason only why Socialist Franklin Delano Roosevelt issued an Executive Order to have those poor saps who listened turn in their gold. The New World Order has been taking over this country since the 1860s, one piece at a time. The "outlawing" of gold was their effort to get people to give-up their only means of wealth. When one has wealth, one does not need the government, and central planners know this. It is unacceptable to not be in total control of the people. When you give up your wealth, you give away your independence.

As an aside, Executive Orders only apply to federal employees and "persons." You should know that by statute, a "person" is a corporation, a creature of the state and owing total compliance to the state. If one chose to believe that he/she were such a "person," [a word of art purposefully used to deceive], and "felt" obligated to turn in his/her gold, well the government was not going to tell them otherwise, for that was its purpose, back then. With today's Rule Of Law being ignored by all forms of corporate federal government, it is also much easier to keep the people dumbed down, and afraid.

The turning in of gold then is now the effort of the NWO to get people to "register" their guns. It is easy to control a people with no form of wealth. It is not so easy to control even a poor population that remains so heavily armed. This is exactly what Hitler did in Germany. If you want to see your future, look to the mistakes made in the past, and learn from them.

If you do not physically own and hold gold and silver, and your ownership is in some form of paper promise, you may never own it. If you do not know what a "stacker" is, it is time to become one, with diligent haste. The clock is ticking.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.