Cyprus Crisis Means Do Not Buy Gold Stocks

Commodities / Gold and Silver 2013 Mar 27, 2013 - 09:38 AM GMTBy: Bob_Kirtley

Crisis in Cyprus has lead investors and speculators re-considering how they allocate their portfolios. Despite Cyprus only representing a minute 0.2% of Eurozone GDP, the possibility that fear of a meltdown may spread across the markets does mean that one should consider the possible downside risk. If the market believes that other Eurozone nations could go the same route as Cyprus, then it is likely that we would see a selloff in the market.

Crisis in Cyprus has lead investors and speculators re-considering how they allocate their portfolios. Despite Cyprus only representing a minute 0.2% of Eurozone GDP, the possibility that fear of a meltdown may spread across the markets does mean that one should consider the possible downside risk. If the market believes that other Eurozone nations could go the same route as Cyprus, then it is likely that we would see a selloff in the market.

To minimize the downside risk of this current market situation there are a variety of trades that one can make; however, buying gold stocks should not be included.

The argument for buying gold stocks as protection against the downside risk is along the lines of this, “Cyprus will have a contagion effect and send Eurozone back into crisis, thus increasing the demand for safe haven assets such as gold. This would push gold prices higher, and therefore gold mining companies will make greater profits in the future. Higher profits mean that the stock price of these companies should rise”.

We do not believe that the Eurozone will follow Cyprus into crisis, given that the S&P closed on highs of 1556.89 on Friday and the market appears to be shrugging off problems in Europe. However, for the sake of argument let us therefore assume it does.

In such a situation, the first thought of an investor is not “I must own gold mining companies, they are the best place for my money now that the Eurozone is in crisis”. In fact, this is likely not in the top 100 thoughts of an investor in that kind of situation. If a Eurozone crisis does follow Cyprus and there is a Eurozone break up, then it will be risk off 2008 style and every stock holding will be dumped.

A Eurozone breakup may push gold prices higher, as some investors go to the yellow metal as a safe haven asset. However, if one wished to make money during such an event, they would do well to remember that gold prices fell during the global financial crisis, and therefore could do the same through a Eurozone breakup.

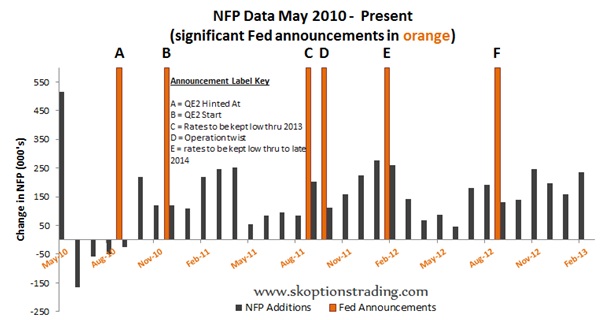

Europe falling apart in 2011 coincided with gold soaring to all time highs of over $1900, and because of this there is a school of thought that states gold will rise if Europe falls apart now. However, the key driver behind the 2011 rally was increased money printing from the Fed. The graphs below show the 2011 rally came following a collapse in US employment data, and the consequent Federal action. Therefore if the Fed prints money in response to a Eurozone meltdown, then it is possible that gold will rally; however, a lack of money printing in response will likely result in gold prices falling.

If there were a Eurozone meltdown it is possible that the Fed could respond, but with some kind of action that would not involve quantitative easing, such as Operation Twist in the past. Operation Twist had a relatively no positive effect on the gold price during its span, and therefore any similar operations would be unlikely to shift gold in either direction. This means that considerable monetary easing would be required by the Fed as a response to a Eurozone meltdown to trigger a rally in gold prices.

This entire scenario is based on a great many if’s, and given the current market situation we see its unfolding to be very unlikely. Gold stayed stagnant through the latest news surrounding Cyprus. Equities have not been sold off; in fact they are staying at all time highs with the S&P closing at over 1550! What we can glean from this is that the market believes any activity in Europe will not have a major effect on the markets.

Those who are currently recommending buying gold stocks due to the Cyprus situation are the same ones who were recommending buying last month when gold was at the same level, and at the beginning of the year when gold was higher, and a year ago when gold was higher.

We have no time for the “permabulls” who do not change their view on the market. Markets change and one’s outlook must be prepared to change as well. The graph below shows how gold has broken down in recent times and how it has failed to make a higher high since August 2011. This is a good example of markets changing, and we have therefore changed our stance to match, generating profits for our subscribers this year as opposed to those buying gold stocks who are losing money.

Gold has not rallied since the Fed announced rates were to be kept low until late 2014, and gold stocks have consistently underperformed for 7 years; without a major collapse in US employment data we see this as unlikely to change. Of the strategies that can be used to take advantage of the current market situation and the crisis in Cyprus, buying gold stocks is not one of them.

To find out what we are doing to maintain our 2013 winning streak and what strategies we are using to make money right now, then all you have to do is become an SK Options Trading subscriber. In just the five trades closed this year our portfolio is up 17.27%. We currently have an annualized return of 63.72%, and on average a trade returns 30.83% in 52.38 days. Our model portfolio is up a grand total of 489.13%, and of the 118 trades closed 86.44% of have been winners.

You can join the winning team today for just $499 per 6 months, or $799 for 12 months. Simply click subscribe on either of the buttons below, purchase a subscription, and you will be on the SK Options Trading subscriber list.

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.