Proof U.S. Housing Market Recovery is for Real and Just Beginning

Housing-Market / US Housing Mar 27, 2013 - 05:06 PM GMTBy: Money_Morning

Ben Gersten writes: The housing market has rebounded in a big way, with home prices increasing the most since the housing bubble burst in 2006.

Ben Gersten writes: The housing market has rebounded in a big way, with home prices increasing the most since the housing bubble burst in 2006.

Prices aren't the only indicator pointed toward recovery.

Housing barometers including sales, permits and housing starts have surged well beyond their recession troughs and back into healthy territory - and bullish analysts say there's plenty more room for growth after years of decreased activity.

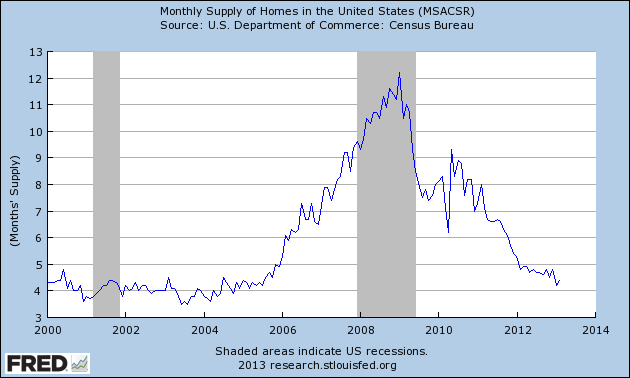

The housing market activity has been driven by pent-up demand, improved consumer confidence, low interest rates and still affordable prices. And the industry's comeback comes at a time when supply is tight. The inventory of homes available is at near-historic lows, and foreclosures have declined.

Looking ahead to the rest of 2013, JPMorgan Chase & Co. (NYSE: JPM) has doubled its forecast for U.S. housing price gains in 2013 to 7% and expects a more than 14% increase through 2015.

And Bank of America Corp. (NYSE: BAC) - in a recent report titled "Someone Say House Party?" - said home values will climb 8% this year, up from its previous estimate of 4.7%.

Well-known industry analyst Ivy Zelman, CEO of Zelman & Associates, shares the bullish outlook.

"I think we're in nirvana for housing," Zelman, who correctly called both the housing market's peak in 2005 and the bottom in 2012, told CNBC. "I'm probably the most bullish I've ever been fundamentally, and I'm dating myself - been around for over 20 years, so I've seen a lot of ups and downs."

These five charts provide more evidence the housing industry is on its way back.

The U.S. Housing Recovery in 5 Charts

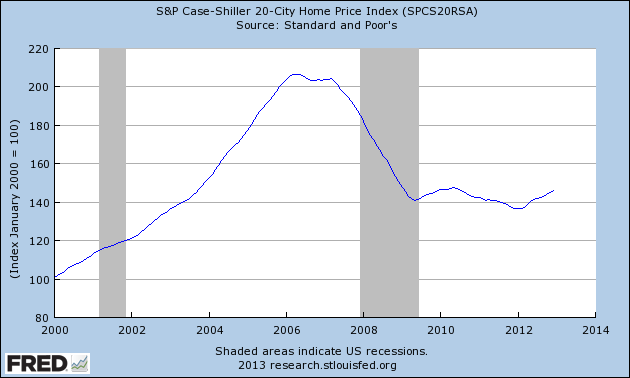

1. Prices of existing homes in 20 major U.S. markets rose 8.1% in January, the biggest year-over-year increase in nearly seven years, the S&P Case-Shiller Index showed Monday. But while prices hit a two-year high, they're still down 28.4% from peak prices in 2006.

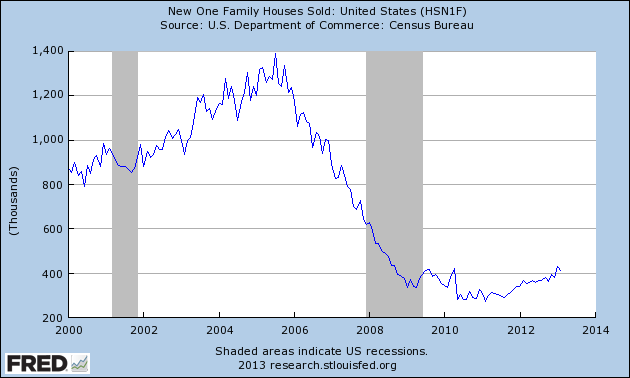

2. New home sales started the year off strongly with a 13.1% jump in January from the previous month, bringing new sales to 431,000 units, the highest level since September 2008, but still down more than 70% from the 2005 high.

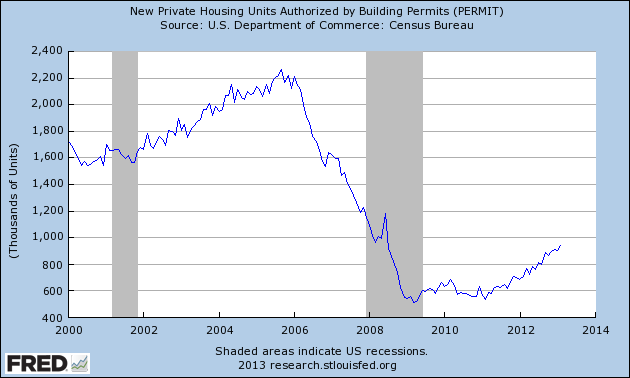

3. In February, the number of building permits - a forerunner of housing activity - increased 3.7% to 939,000 units, the most since June 2008, but that's still down nearly 60% from the 2005 high.

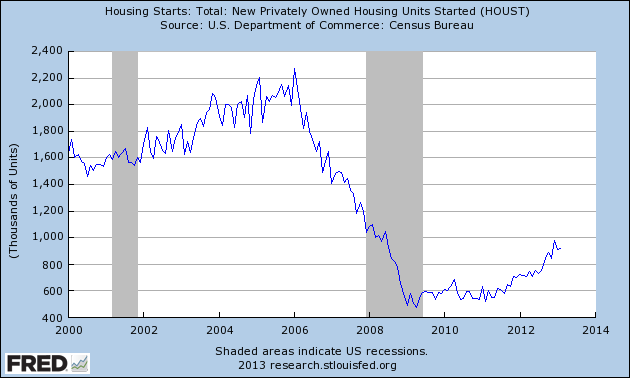

4. Housing starts for February came in at 917,000 units, a 27.7% year-over-year increase, and the second-fastest pace since June 2008, trailing only December's 982,000 units. Still, starts are also down almost 60% from their 2006 peak.

5. February's level of 1.94 million existing homes available for sale is down 19.2% from a year ago. That equals about 4.7 months' supply of homes, below the six months' supply economists consider a healthy balance of supply and demand, which should continue to drive up prices.

Source :http://moneymorning.com/2013/03/26/these-5-charts-prove-the-housing-recovery-is-for-real-and-just-beginning/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.