Why Bernanke Can’t Stop Deflation

Economics / Deflation Apr 10, 2013 - 05:54 PM GMTBy: Clif_Droke

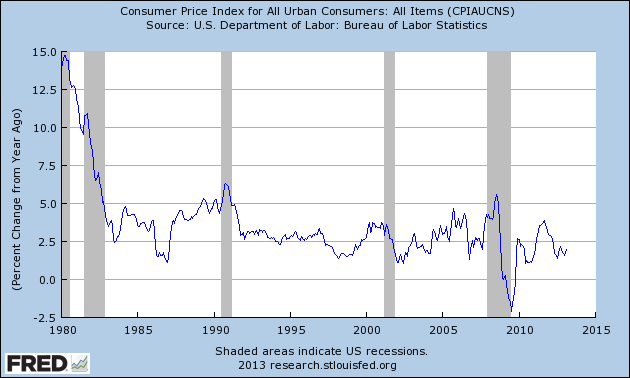

While there are many risks to the current ultra loose money policy, consumer price inflation isn't one of them. Inflation remains persistently low despite the best efforts of central banks to increase it.

While there are many risks to the current ultra loose money policy, consumer price inflation isn't one of them. Inflation remains persistently low despite the best efforts of central banks to increase it.

The Consumer Price Index (CPI) among the G7 economies was only 1.6%, year over year, during February. It was even lower at 1.4% excluding food and energy, according to economist Ed Yardeni. Meanwhile Producer Price Index (PPI) inflation rates are close to zero, Yardeni points out. In the euro zone, the CPI inflation rate is just 1.7%, and 1.4% excluding food and energy. Japan continues to experience deflation despite continuous efforts at reversing it through monetary easing.

"In the Brave New World (BNW)," writes Yardeni, "pumping more liquidity into financial markets won't stop consumer price deflation, but it will inflate asset prices, a.k.a. asset bubbles. Central bankers like Ben Bernanke at the Fed and Haruhiko Kuroda at the BOJ are still using models based on the 1930s. They are clueless about the BNW." Yardeni believes this is why central bankers are so committed to doing whatever it takes to avert deflation. They fail to realize that productivity-led deflation should be welcomed as the best way to boost the purchasing power of consumers, thereby increasing government tax revenues.

The Bank of Japan recently voted to flood its economy with freshly printed yen in an effort to reverse the country's 20-year deflationary trend. BOJ Governor Kuroda has previously said that he would do "whatever it takes" to drive growth in Japan. The central bank underscored its commitment to fighting deflation by announcing that it would also buy riskier assets such as ETFs and REITs. The move toward an even looser monetary policy by BOJ, while decreasing the value of the yen, is also expected to decrease the prices of its manufactured goods sold abroad. That would be a boon for U.S. consumers but Japan's move could also hurt U.S. exports.

Japan's latest move illustrates how deflation isn't actually stopped by central bank intervention - it's merely exported. Moreover, the CPI trend for G7 economies shows that try as they may, central bankers are simply unable to reverse the deflationary impact of the 120-year mega cycle which is in its final "hard down" phase through late 2014.

What does this have to do with gold, you may ask? Recall that gold typically benefits from both ends of the long-term cycle of inflation/deflation. It tends to outperform during extreme inflation (a' la the 1970s) and extreme deflation (viz. the last 10 years). The odds of a significant "financial event" between now and late 2014 when the 120-year Kress cycle bottoms is very high. Any reversal of the status quo due to increased deflationary pressure between now and then will almost certainly result in increased safe haven buying of gold. This is why it's possible - and even common - for both gold and the dollar to rise in unison during the final stage of long-wave deflation.

As the crisis in Cyprus recently reminded us, don't underestimate the long-term Kress cycle. Also, don't overestimate the ability of central bankers to inflate their way out of deflation.

Cycles

David Knox Barker has made some intriguing observations on the Fed's attempt at nullifying the long-wave deflationary cycle. He writes: "If cycles are science which are the expressions of the emotional contraries of crowd psychology in global financial markets, the central bank efforts to eliminate them from the global economy will fail. Intervention and QE may make the downswing of the cycles less severe, but it will not eliminate them."

"There is no free lunch, Barker continues," the bad debts removed from the private sector and now placed on the backs of the private sector will curtail growth in future cycle advances."

Barker also points out that the response of the international bankers regarding Cyprus's recent crisis has caused investors to re-evaluate the concept - and fairness - of central bank intervention. "Billions in deposits [were] vaporized with one stroke of the pen in a central bank and government deal," writes Barker. "What fundamentally occurred is that massive financial institutions were insolvent, and the bad debts that were propping them up were not acquired by a central bank. They were written off, along with the uninsured deposits."

He went on to point out that this represents the first time that the 2008 financial crisis that the innocent tax payers are left holding the bag; instead the penalty is being absorbed by shareholders, viz. bondholders and large depositors. "Cyprus is the template for future banking insolvency resolution," says Barker. "That was just the opening act."

This brings to mind one of the most accurate economic prophecies I've ever read. Many years ago I discovered the wonderful book, A World in Debt, by Freeman Tilden. Although it was written in 1936 during the Great Depression, it's as alive and meaningful now as it was back then. Prediction after prediction that Tilden made has since been fulfilled in the years since he wrote the book.

Citing the experience of the Roman Empire in attempting to outlaw usury, Tilden comes to the conclusion that "if a man could have the longevity of Methuselah, it would pay him to be never out of debt, for he could count on a political upheaval which would relieve him of his burden every so many years." In other words, debt is always forgiven or written off whenever worse comes to worse. The great financial systems of the world are debt-based and the game of debt must always be allowed to continue. It's therefore not surprising that, in Barker's words, "Billions in deposits [were] vaporized with one stroke of the pen in a central bank and government deal."

In the final analysis, as Tilden concluded, debt will likely never be prohibited and there will always be 'credit crises' followed by debt cancellations in which the creditor class is mulcted. As Tilden would say, "And so it goes."

Interview

I was recently interviewed with Rob Graham of SmartStox Radio. You can listen to it at the following link: www.smartstox.com/analysts/clif_droke

We talked about the outlook for equities, gold, the Fed and the U.S. economy. Special thanks to Mr. Graham for the interview.

Momentum Strategies Report

Check out our first quarter 2013 performance at the following link: http://cdroke.blogspot.com/...

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.