Gold Futures Raid Leads To ‘Extraordinary’ Demand For Bullion Globally

Commodities / Gold and Silver 2013 Apr 19, 2013 - 10:54 AM GMTBy: GoldCore

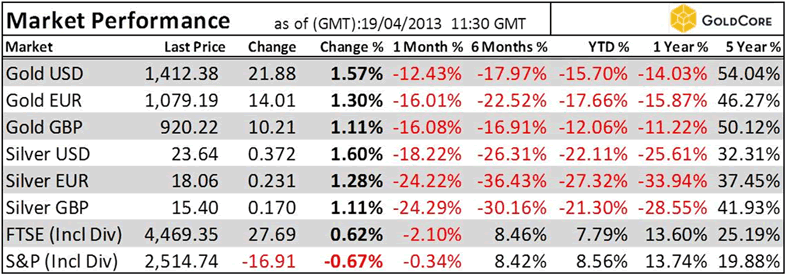

Today’s AM fix was USD 1,414.00, EUR 1,080.46 and GBP 920.63 per ounce.

Today’s AM fix was USD 1,414.00, EUR 1,080.46 and GBP 920.63 per ounce.

Yesterday’s AM fix was USD 1,397.00, EUR 1,070.17 and GBP 917.09 per ounce.

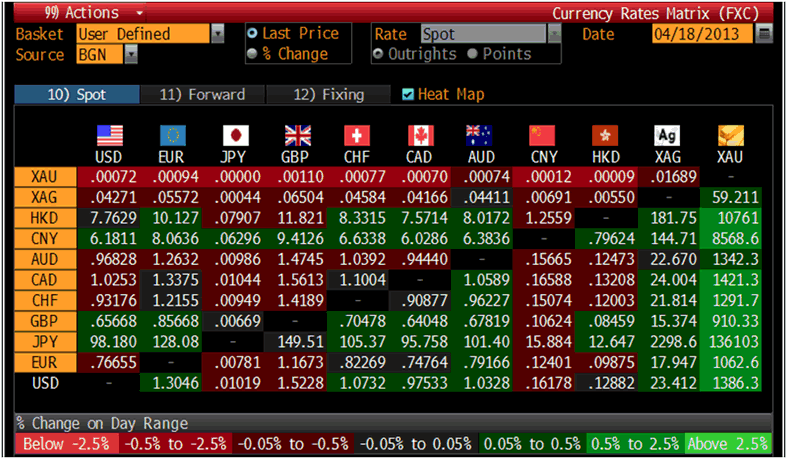

Cross Currency Table – (Bloomberg)

Gold rose $14.80 or 1.08% yesterday to $1,388.00/oz and silver ended with a loss of 0.26%.

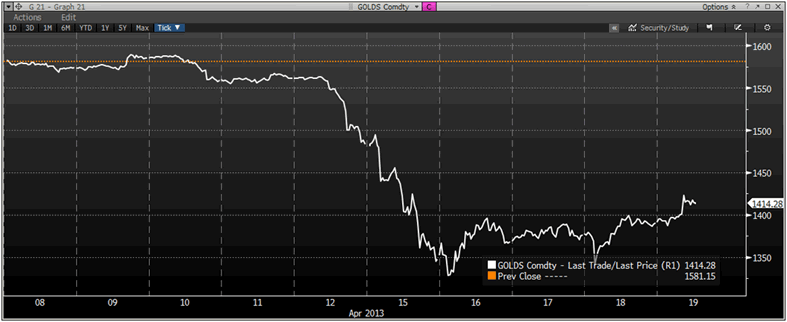

Gold in USD, by Tick, – (Bloomberg)

Gold extended gains above $1,400 an ounce on signs that jewelers, investors and store of value buyers of gold are taking advantage of the biggest slump in prices in three decades.

Global demand for physical is very clearly seen in rising premiums being seen internationally. The drop in prices ignited a spate of buying in gold coins and bars, sending premiums for gold bars to multi-month highs throughout Asia. Demand intensifed overnight as prices rose over $1,400/oz.

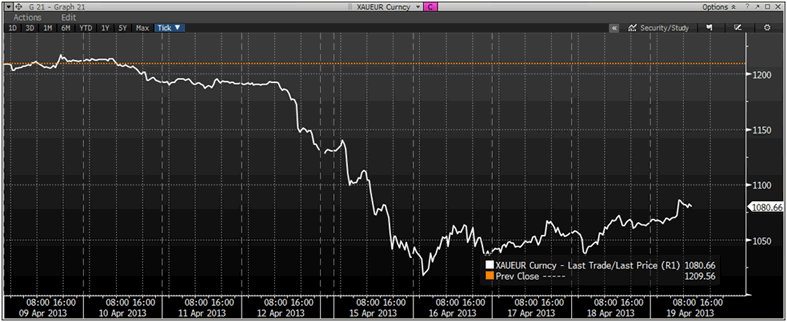

XAU/EUR Currency, by Tick, 2 Weeks – (Bloomberg)

Indian gold premiums, always a good indicator of demand for physical have jumped due to tight supplies. Premiums charged by banks for gold has increased from around $1.20 to between $3 to $5 per ounce.

The premium for metal on the Shanghai Gold Exchange is up to as much as $10, in Turkey it’s almost $20 and in Asia it’s about $5. Premiums for gold bars in Hong Kong were at $1.90 to $2.00 an ounce to spot, their highest level since early last year. Premiums in Singapore and Tokyo were also at multi-month highs.

Government mints, bullion refineries and dealers around the world report a dramatic increase in demand for coins and bars.

Bullion refiner, MKS said that “physical demand is extraordinary.”

Digital gold provider, Bullion Vault, said that Monday and Tuesday were their “strongest 48 hour period for new customers this year.” Bullion Vault said that they saw record volumes of digital gold and silver transactions on Monday “beating the previous peak of September 2011.”

There has been a marked increase in demand since the price plunge. We saw a huge amount of panic selling Monday but Tuesday saw as many buyers as sellers. Since Wednesday, we have experienced more buying than selling and most of the selling was of small orders, less than fifty ounces, while there were lumpier buy orders from high net worth clients.

Ironically, the gold futures price plunge has resulted in one of our best weeks in terms of sales so far in 2013. In some ways, the price shake out was needed by the market as buyers are no longer on strike and are seeing value at these levels.

Demand for gold is also coming from contrarian investors who are concerned that stock markets are at multiyear and all time record highs and looking toppy at these levels and there are also concerns about deposits in Europe.

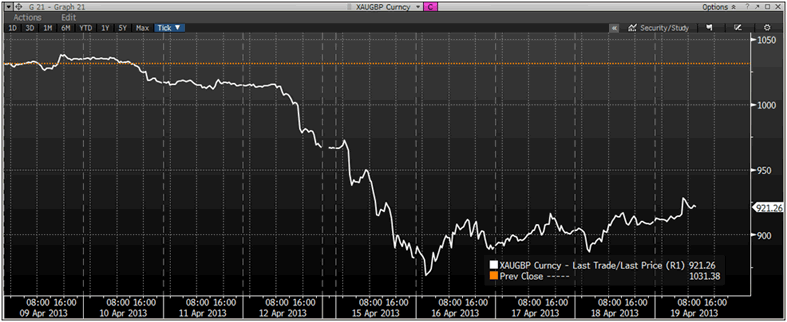

XAU/GBP, by Tick – (Bloomberg)

In terms of transactions, gold buyers outnumbered sellers by a ratio of nearly five to one yesterday. In terms of volume, gold buyers outnumbered sellers by a ratio of nearly nine to one yesterday. Meaning that there were more buyers than sellers and buyers were placing larger orders than those selling and this trend has continued today.

U.S. gold coins sales have been at record levels this week. Lower prices and the tragic events in Boston may have contributed to increased buying due to concerns about the risk of terrorist attacks.

Premiums are rising in Europe and the U.S. and there are delays of a few weeks on some smaller coins and bars showing the growing tightness in the market.

“We are hearing of huge jumps in premiums for all gold products at the street level, so there is a sense that the downdraft for gold futures has overrun the rear physical metal market in a big way,” said Gene Arensberg, editor of the Got Gold Report.

“High premiums mean supply is drying up and it is just a question of time before that shows up in the paper gold markets,” he said.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.