Gold Stocks Headed for Boom or Bust?

Commodities / Gold & Silver Mar 14, 2008 - 01:59 PM GMTBy: Alex_Wallenwein

Depending on whether you prefer to see the glass as half full or half empty, the technical picture for gold stocks is either great – or horrible, at this point.

Depending on whether you prefer to see the glass as half full or half empty, the technical picture for gold stocks is either great – or horrible, at this point.

Bad news first: - Three Megaphones

The HUI continues to trace out one successive megaphone pattern after another. There is the big one that was begun in November-December last year.

Yet, despite presenting such an anemic picture, there is light at the end of the tunnel. Blinding light, one might say.

The fact that the successive megaphone patterns are all following along the upper border of the configuration speaks well for the stocks' future prospects. At least, there are no exacerbating wild swings that take the HUI all the way from the top to the bottom of the original “big” megaphone starting in November.

A Rising ChannelTaking away the lines drawn above and starting with a clean slate, two other and equally compelling technical patterns can be demonstrated. One of them is a rising up trend channel if one ignores the short dip below its lower trend line in mid-December.

The other is a powerfully rising triangle or pennant formation:

The Rising Pennant

That breakout, however, will not necessarily come from gold's passing of the psychologically important $1000 barrier. That, alone, is not enough.

Naturally, as long as gold and silver keep on rising, the stocks are very unlikely to suffer significant falls. However, if gold does take its by now near-traditional mid-year plunge in 2008, the downside potential of the stocks is absolutely humongous. That point alone screams for caution to the utmost for hopeful gold stock investors.

But then again, there may very well not be a midyear correction this year.

In times like these where the entire fabric of the US financial system is being torn apart by incurable distrust among banks when it comes to lending to each other (witness Bernie's latest “prime for slime” ploy of swapping pristine treasuries for subslime-infected mortgages), erratic, frantic and ill-conceived Fed policy moves are lighting gold's afterburners on its rise into the fiat-dollar price stratosphere.

The point is: It pays to wait.

If by the end of June no major correction in the gold price has occurred, the chances will be very good that it will not happen.

The crucial factor to watch out for is US treasury bond prices.

Chaos in the Bond MarketBond investors, as sophisticated as they are always said to be, are a very confused bunch right now. The level of their profound confusion can easily be gauged from the horrific, terminally disorganized picture of the30-year bond's price movements.

Poor bond investors. Sophisticated they may be, but their thinking is still stuck in the paper and computer blip world of breakable promises and government-decreed make-believe. Right now, they are disoriented and have no clue where to go. They will soon get one.

As I keep saying: The day the bond investors and the regular stock investors simultaneously abandon any last hope of future gains in their respective investment markets (other than shorts) will be the day the gold stocks will start enjoying a mania that puts all prior manias to shame.

In other words: Gold stocks will take off when everything else (besides precious metals) goes to hell.However, a mania it will certainly be, and it should be treated with the same caution as all manias. The coming gold stock mania can get so out of hand that even consistently rising gold prices will not soften the blow when it finally collapses.

Gold Not Mania-ProneGold itself, on the other hand, will keep on rising and rising in fiat terms. It may occasionally enjoy its own manias, but their breakdown will not affect the underlying bull market. They will merely mark occasional up ticks within its inexorable rise.

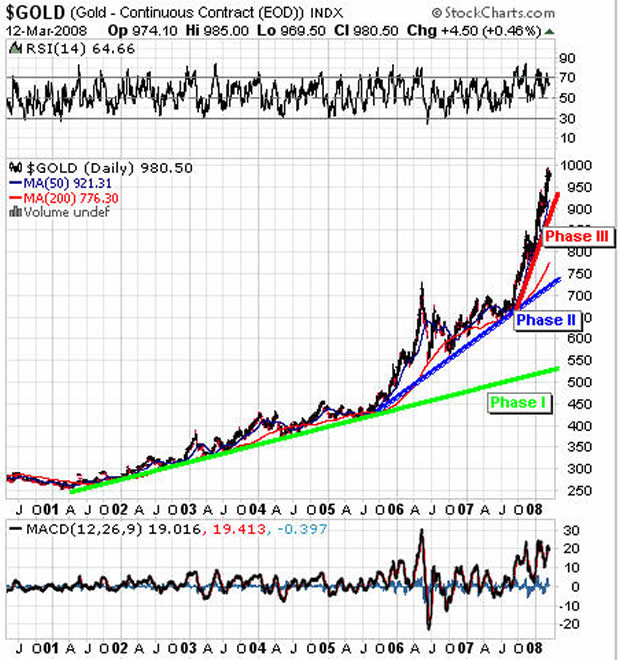

For example, gold could fall back to the $900-$950 range without violating its current Phase III bull run, or back to $750 without violating Phase II, and all the way back to $550 per ounce without breaking its Phase I uptrend going back to 2001.

While investing in gold stocks will, like all stock-investing, remain a matter of knowing when to buy and knowing when to sell, successful investing in physical gold will continue to be mostly a matter of knowing when NOT to sell for a very long time.

Monitor subscribers will know both.

Got gold?

Alex Wallenwein

Editor, Publisher

The EURO VS DOLLAR MONITOR

Copyright © 2008 Alex Wallenwein - All Rights Reserved

Alex holds a B.A. degree in Economics and a juris doctorate in Law. His forte is research. In late 1996, he began to research how money is used by some to exert political and economic control over others' lives. In the process, he discovered that gold (along with silver) is the common man's antidote to this effort. In writing and publishing the Euro vs Dollar Monitor, he explains the dynamics of this process and how individuals can harness the power of gold in their efforts to regain their political and financial autonomy.

Just like driving your car, investing only makes sense if you can see where you are going. The Euro vs Dollar Monitor is the golden windshield wiper that removes the media's greasy film of financial misinformation from your investment outlook. Don't drive your investment vehicle without it!

Alex Wallenwein Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.