|

The Market Oracle |

|

By: Raul_I_Meijer

Throughout history and throughout the world, there have been classes of untouchables. Best known perhaps (other than Elliott Ness and Wall Street bankers) are the caste that goes by the name in South Asia, a.k.a. the Dalits, but there are/were also for instance the Cagots in France, the Burakumin in Japan, and the Roma and Jewish populations in medieval Europe though the Middle East. In the US, one could include the black and native populations. Wikipedia has this definition:

Throughout history and throughout the world, there have been classes of untouchables. Best known perhaps (other than Elliott Ness and Wall Street bankers) are the caste that goes by the name in South Asia, a.k.a. the Dalits, but there are/were also for instance the Cagots in France, the Burakumin in Japan, and the Roma and Jewish populations in medieval Europe though the Middle East. In the US, one could include the black and native populations. Wikipedia has this definition:

Untouchability is the social-religious practice of ostracizing a minority group by segregating them from the mainstream by social custom or legal mandate. The excluded group could be one that did not accept the norms of the excluding group and historically included foreigners, house workers, nomadic tribes, law-breakers and criminals and those suffering from a contagious disease. This exclusion was a method of punishing law-breakers and also protected traditional societies against contagion from strangers and the infected.

The origin of the phenomenon may have started simply as a way to exclude criminals and diseased people from a community, but obviously that's not where it led.

Untouchability typically means none to limited access to public resources, schools, churches, temples, and having to live outside of established communities and villages. Often - but not always - there was a connection with certain occupations, especially those seen as impure, such as handling the dead (this could include executioners), and dealing with human and animal waste. In parts of Europe, dealing with money was seen as impure, from a religious point of view, which drove a lot of Jews into the field, since they were banned form most other occupations.

I could write a lot more on the interesting though often cruel and barbaric history of untouchability in a wide definition of the word, but I want to focus on what started to make me think of it, modern unemployment numbers in the western world. That is to say, we are now on the verge of casting a huge group of people, essentially our own neighbors, outside of our communities. They are no longer allowed to participate in what makes our societies tick.

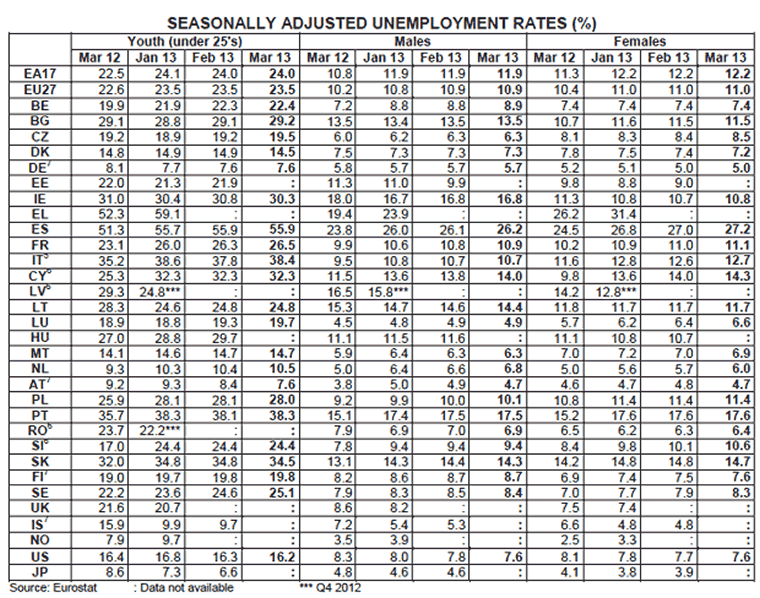

This is true for people of all ages (see: Companies won't even look at resumes of the long-term unemployed), but it's an absolute "disaster that got tired of waiting to happen" among young people. Eurostat published this graph last week:

Youth unemployment in Greece (EL) is at about 60%, in Spain (ES) at 55.9%. Then Portugal and Italy at 38.3% and 38.4%, Ireland at 30.3%. Add a bunch of eastern European nations and you have the obvious suspects. Among the others, though, some truly stand out. How about Finland at 19.8%? That's an AAA country, EU core. Same story, only worse, for France: 26.5%. Sweden (SE), supposedly doing so well without the euro: 25.1%. Belgium at 22.3%, the UK 20.7%. They make the US look sort of OK at 16.2%, or at least they serve to somewhat hide how ugly that number really is. In comparison, the EU "hard core" gets no higher than Holland at 10.5%.

Of course there are people who will argue that some of the youth included are in school, not looking for jobs. But given such notions as A) governments' propensities to present rose-colored numbers and B) the numbers of kids enrolled in schools only to not be counted as jobless, I would be wary of overemphasizing the argument.

The numbers, let's focus on Europe for now, are certain to only get worse. How do we know? Easy as pie. It's a matter of political principle. All those unemployed young people are nobody's priority but their own. They simply don't have the political might yet to swing policy decisions in their favor. That is still with the generations of their parents and grandparents, who will vote against anyone trying to cut their wages and benefits. Who will even demand, and receive, government help in dealing with the losses on the homes they bought at irresponsibly elevated prices; they'll claim the government should have warned them.

Losses on homes is one thing the young need not worry about: purchasing a house is way out of reach for them, and for most will remain so for the rest of their lives. The lack of - conventional - political might threatens to doom the young to a life of subservient survival. What might they have will have to come from unconventional methods to change matters. For now, the situation is locked, even as it's sinking fast. What happened in Portugal over the past month is a "great" example of how Europe deals with its issues.

You may remember that in early April, Portugal's highest court declared a set of austerity measures included in the government’s 2013 budget illegal, saying they couldn't single out public workers for salary and benefits cuts. Then, before you could think: democracy works!, the EU/ECB/IMF troika paid an an "unscheduled" visit to Lisbon. The result? Portugal fires another 30,000 public workers. That's right, if you can't cut their benefits, you just fire them.

Of course this is merely the latest in a long line of troika induced measures. 50,000 public sector jobs were already lost in the past two years , and 205,000 jobs disappeared overall in 2012 alone, and 500,000 since 2008.

What do these numbers mean? Here's a helpful little exercise: The US is 30 times the size of Portugal. So to put them in an American perspective, it's like 900,000 public workers are fired in one fell swoop, after 1,5 million lost their jobs in the two years prior, in an economy that lost 6.15 million jobs overall in just the last year(!), and 15 million since 2008.

Not that the troika is done just yet:

Still, an I.M.F. report issued in January concluded that "Portugal’s education system remained overstaffed and relatively inefficient by international standards." It suggested "making the education system more flexible and limiting the state’s role as a supplier of education services" by eliminating 50,000 to 60,000 jobs. 15,000 public school teachers lost their jobs in the past two years.

That's right, their words, not mine: making the education system more flexible [..] by eliminating 50,000 to 60,000 jobs. Again, that would compare to firing between 1.5 and 1.8 million American teachers.

Can Portugal afford to lose all these teachers? Maybe not: about 63% of Portugal’s adult population has not completed high school. Plus, recently graduated teachers can forget about ever getting a job. And so 60,000 young and educated Portuguese emigrate every year. I don't know about you, but to me it's starting to feel like a scorched earth policy.

The European Commission, meanwhile, not only has no answer to these problems, it doesn't even have any intention of doing anything about them. Quite the opposite. The EC wants to continue with the "reforms" it has forced upon PIGSIC countries (can I buy a K?), and we all know what that means: jobs must be cut. Which in turn means that unemployment will rise. Even if they don't say it in so many words. In order to create jobs, you need to cut them first.

[Olli Rehn, the EU's economic and monetary affairs commissioner], had no good news for Europe's growing ranks of unemployed and admitted that "mitigating" against unemployment was all that could be done under the present austerity policy that rules out public-led investment to boost jobs.

He also warned that growth across the EU would return too slowly to reduce unemployment in the short term as European economies remain dependent on exports to offset the impact of the recession and lack of investment caused by the financial and sovereign debt crisis.

"We are living through a very difficult process of adjustment and it is having an unfortunate toll on employment," he said.

"We need consistent consolidation of public finances and structural reforms to boost growth. We need to reform labour market policy to fight youth unemployment. We have to use all possible ways and means to turn the trend in the European economy and mitigate effects of current protracted recession."

"High unemployment points to the need for continuing the course in structural reforms," said Marco Buti, head of the commission’s economics department. "The reduction in fiscal deficits is making headway in a differentiated way."

That last bit is just meaningless weirdspeak, if you ask me. "The reduction in fiscal deficits is making headway in a differentiated way." Maybe he simply means to say that the people may be screwed, but the banks are fine.

What I do understand is that his words again come down to: "High unemployment points to the need for job cuts". And that remains a strange point of view, especially when seen from the eyes of the unemployed.

So is there any good news? Perhaps that depends on your point of view as well. For instance, I read this in the Telegraph:

"Austerity is finished. This is a decisive turn in the history of the EU project since the euro," [French finance minister Pierre Moscovici] told French TV. "We're seeing the end of austerity dogma. It's a victory of the French point of view."

First of all, that "victory" looks about as Pyrrhic as can be. Several EU nations get more time to cut their deficit to the mandated 3% maximum, but that's just because they're even more broke broker brokest than anyone was ready to admit last time around. And the EU did another round of adjusting predictions downward, a move that's devoid of any meaning if you repeat it every single time. There was also another round of "but next year we'll see the return of growth", but really, who listens anymore? As for the "French point of view", the people hate President Hollande so much after less than a year in office they long back for the good old days of Sarkozy. France is so screwed, but no-one has the guts to say it out loud.

Oh, right, and the EU was proven wrong in Italy. That must have hurt, even if they didn't say so. The return to power of Silvio Berlusconi caused yields on Italian 10 year bonds to plummet. Ergo: they should have left the midget mummy in place, so the markets spoke.

On the whole though, there is just one conclusion left for southern Europe, and I apologize in advance for repeating myself. Countries like Greece and Portugal and Italy need to get out of the Eurozone as quickly as they can. They badly need to regain of their own monetary policy. They must be able to devalue their currencies vis a vis Germany and Holland and the US. Moreover, if they don't leave, they will be swept up (and under) in the wave of bad data that will come out of the EU core. That will start a much bigger squeeze of the periphery than the one we've seen so far. It'll be like being trapped underneath a badly wounded behemoth, not something you should volunteer for.

The Eurozone (and probably the EU as a whole and as a mechanism) has nothing left to offer its poorer members but a world of pain. But it's up to the people themselves to make sure they get out in time. And all the countries still have europhiles in power. Italy got close, but it's already back to the days of old with the same old president and a new PM from the same old school. And if leaving half your children with the prospects of being condemned into meaningless lives, of being ostracized as modern day untouchables, is not enough to wake you up and say No Mas, you really need to wonder what is.

Brussels is not going to create jobs for Europe's young people, they're instead going to cut more jobs, they say so themselves. What they intend to do is squeeze the politically relevant - older - part of the population, but only so far. They don't want them to revolt. That leaves only the young to be squeezed more. Brussels incessantly produces positive looking economic growth numbers, and then incessantly adjusts them downward. They do this because it puts people to sleep. It works. People actually believe that things will get better, that their economies will start growing again and it'll all be fine.

People who are in power will do almost anything to hold on to it. That includes politicians, bankers, corporate executives. We can all identify those groups, and we love to rage against them. But political power in our societies is also defined by age. In that the young have very little of it, and the older have a death grip. That can work, and has worked, as long as - economical - trend lines are positive. It no longer does, however, when these lines break.

Then you don't have one society anymore, but several, starting with older haves and younger have nots. And of course everyone's parents have more than they do, but until now there was the prospect of going out and getting as much as or more than, one's parents have (a better life for my children). That prospect is now gone. But people are slow to realize and accept that. They'd rather believe otherwise, and there are scores of politicians and media willing to keep that faith alive. After all, their own livelihoods depend on it.

Unfortunately for our children, our believing it just about literally means we throw them away with the bathwater. And that can of course only spell trouble down the road. Unless we create all those millions of jobs for them. But we're not even trying: our politicians are busy only keeping us from blowing our gaskets over budget cuts and tax raises; they don't care about out children, because they're not the ones voting them in power. This is not a road to nowhere, it's a road to surefire mayhem. There will inevitable come a point where the younger generation we now leave out to dry gains the voting power and asks: What have you done for me lately? And then, what will be the answer?

But the reality is that in Europe too, "Companies won't even look at resumes of the long-term unemployed". And there are millions of long-term unemployed. Who will never have a real job. Which means that you will arrive at a point where this is no longer a problem solvable within current paradigms. So maybe we need to change those.

Our definition of work has slowly slid from doing something that is useful to yourself, your family and the society you live in, to doing something, a job, that will allow you to buy as big a car and home as possible, and consume as many products as you can whether you need them or not, in order to keep the economy growing. This change in definition has gone largely unnoticed until now, but in light of the levels of - youth - unemployment we see in ever more places, maybe we should take another look at what it means.

Maybe countries like Italy and Greece and Portugal would do better at this point in time to get out of the rat race posing as a force for the good that is the EU. Maybe they have to get back to basics, to making sure they can independently feed themselves, build shelter, and get clean water to everyone.

Maybe competing with Germany and Holland for a scarce musical chair is not the way to go; looking at those unemployment numbers, one might easily come to entertain that idea. And feeding and clothing oneself is not exactly a bad thing to begin with. Our ancestors did, that's why we're here. Maybe it's the best chance they have to engage their young people: in (re)building their societies. And even if things in the global economy do improve somewhere down the line, what exactly would they risk losing?

Better be quick though: the EU has one of its numerous edicts coming out soon that bans people who grow their own food in their gardens, in small plots and allotments, from using their own seeds. They must instead by law buy their seeds from vendors "ordained" by Brussels (yeah, there's Monsanto again...).

Any one of these countries can tell Brussels to go take a hike, and they'll pay back the debt over 50 years in a currency of their own choosing. But they're not doing it. Not so far. Coincidentally, in the graph above, if you look at Iceland, you'll notice they're doing about the best of the lot, with fast falling jobless numbers. Iceland didn't have to leave a monetary union, granted, but still.

They can either cling to our faith in a recovery that's been promised for years while everything has only gotten progressively worse, or they can do something about it. And that will soon be true for all of us. We're just still living in a theater of illusion grace to the fact that we have collectively decided to keep our debts hidden under the carpet, which today no longer works in southern Europe, and tomorrow will grind Germany, Japan and the US to a halt.

If we go there in blind faith, the future - however brutal it may be - still belongs to the young, and guess who will become the untouchables?

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.