U.S. Housing Market Once in a Century Opportunity

Housing-Market / US Housing Jun 24, 2013 - 05:15 PM GMTBy: DailyWealth

Steve Sjuggerud writes: The numbers just came out... and they're excellent...

Steve Sjuggerud writes: The numbers just came out... and they're excellent...

The median existing home price is up 15.4% year over year... to $208,000. But even at these higher prices, homes are going fast...

The latest numbers show that houses are only on the market for 41 days before they sell, versus 72 days a year ago. (These numbers are nationwide medians.)

The demand for homes is back, but we don't have enough supply yet. This means higher prices are ahead.

So even though house prices are up, I don't think you've missed it yet... The opportunity is still great... Hundreds-of-percent profits are possible, as I'll show you.

I don't think I'll ever see an opportunity this good in U.S. housing again... Not in my lifetime. We're coming off record-low mortgage rates and the largest fall in home prices in my lifetime.

I don't think we will see these two things happen at the same time and to the same degree ever again.

It's simple...

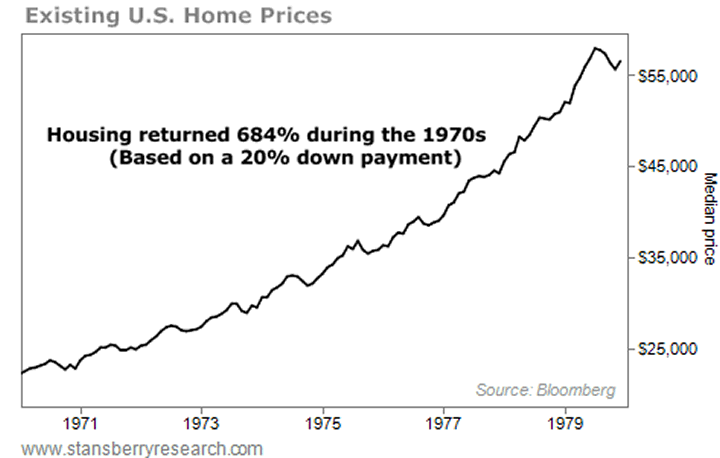

We've only seen an opportunity this good once in history... the 1970s. Back then, buying a home with a mortgage would have resulted in a 680% gain on your initial investment.

From 1970 to 1980, house prices went up from $22,000 to $56,500.

If you bought a house in 1970 with a 20% down payment ($4,400), a decade later you'd be sitting on a 684% return on your initial investment. (This return doesn't include property taxes or interest or anything. It's just comparing the initial equity in 1970 – the down payment – to the rise in value by 1980.) The table below shows the math:

1970s Housing Gains |

|

Starting price, January 1, 1970 |

$22,000 |

Ending price, December 31, 1979 |

$56,500 |

Down payment (starting capital) |

$4,400 |

Capital gain |

$34,500 |

Return on starting capital |

684% |

Here's the thing: Housing was affordable in the early 1970s. And house prices soared. Today – after the great bust, and with our ultra-low mortgage rates – housing is affordable again.

Triple-digit gains – even with a big down payment like in the example above – are certainly possible. I expect we'll see them.

Your upside potential is incredible, by the way... even if interest rates are going up... Interest rates in the 1970s shot up – from 7.5% to near 15%. House prices went straight up, too.

I've been urging you to buy real estate in recent years. I hope you've followed my advice... You should be up at this point already. The good news is, it ain't over yet.

If you haven't followed my advice, you still can. Don't miss out. Take advantage of it!

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.