Silver Market Buy Signal - Again!

Commodities / Gold and Silver 2013 Jul 03, 2013 - 03:40 PM GMTBy: DeviantInvestor

For the umpteenth time (actually the 3rd since June 2012), silver has given a buy signal according to my reading of the technical indicators.

For the umpteenth time (actually the 3rd since June 2012), silver has given a buy signal according to my reading of the technical indicators.

Problem: How valuable is technical analysis (moving averages, oscillators, over-sold conditions, etc.) when the silver and gold markets are dominated by computers (High Frequency Trading - HFT) and not human beings?

GATA had this to say: "Technical analysis of a manipulated market like gold has been tedious nonsense for years, but these days, with virtually infinite paper dropped on the gold futures market at illiquid times to drive the price down even as the physical market remains strong, technical analysis has become insulting.

The only analysis worth anything anymore is the identification of the source of all the paper.

The suspects are obvious -- Western central banks."

Gold and silver bottomed in June of 2012, dollar printing moved into high-gear, and the metals "should" have rallied from there. Instead, they did a brief rally and fell to extraordinary lows in April 2013 and even lower lows in June of 2013.

How Extraordinary?

Technical indicators are still somewhat valid (in my opinion) at indicating how much a market is over-bought or over-sold, even if those indicators are less useful (thanks to HFT) at indicating future moves and timing.

Silver RSI (Relative Strength Indicator - 14 period): On a weekly basis, it is the lowest in 40 years of data and nearly that low on a daily basis. This timing indicator suggests that silver is extremely over-sold on both a daily and weekly basis. Gold is similarly oversold.

Gold stocks % bullish Index ($DPGBM): This indicates the % of gold stocks above their 200 day moving average. It currently ranks at zero - gold stocks have been hammered. This indicates gold stocks are very low and hopefully ready to rally. Sentiment toward gold among independent financial advisors, as reported by The Hulbert Financial Digest, is at all-time lows. Prices usually rebound after such lows in sentiment.

COT Net long: The Commitment of Traders data provided by the CFTC indicates the long and short positions of the non-commercials and commercials. Yes, I know, the data is somewhat suspect, but it still has value. Take the net of non-commercial longs less shorts and the net of commercial longs less shorts. Then subtract the net commercial longs from the net non-commercial longs. This difference correlates quite well over a long period of time with the price of silver. When the net long difference (as described above) is low, silver is low and due to rally. As of Friday, June 28, 2013 that net long difference was the LOWEST since the beginning of my data in January 2001 and probably for several decades. This indicates that the large bullion banks (JPM, etc.) are in a position to profit from a rally in the silver (and gold) markets.

The weekly TDI - Trade Signal Line (a technical oscillator) for silver as of June 28, 2013 registered the lowest reading since my data began in 1974. On a daily basis, the April reading was the lowest since 1980, and the June low was only slightly higher. Silver is ready to rally.

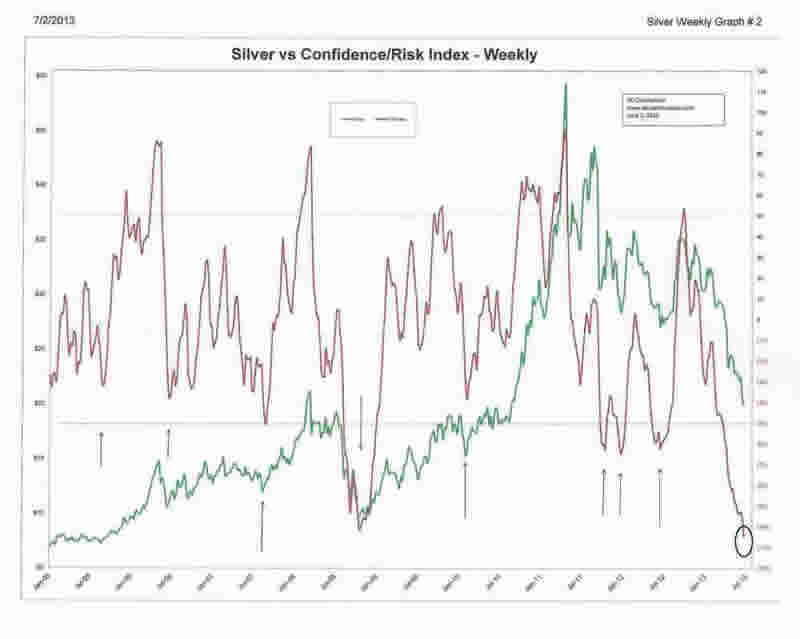

My risk/reward index is a weighted blend of COT data, moving averages, relative strength timing oscillators, and disparity between the current price and a long-term moving average. This weekly index has been quite accurate at indicating bottoms in the silver market. What it cannot do is indicate if a lower low is coming in another few months or if the current low is likely to indicate a multi-year bottom. This indicator is currently the most oversold since the beginning of my data in January 2001 and is even more oversold than at the bottom after the 2008 crash in the silver market. The indicator is currently suggesting a major rally is ahead for the silver market - perhaps a multi-year continuation of the bull market. Please examine the graph of silver prices and this risk/reward index.

There are many other technical indicators, oscillators, and sentiment measures that suggest a similar story. For all practical purposes, it appears that the large bullion banks and traders (the JPMs, etc.) are now net long in gold and probably net long in silver. The stage is set for a JPM managed rally to take advantage of their net long position, having dumped their shorts in the last two engineered declines in gold and silver.

However, it is possible that their agenda is to generate further support for the dollar and additional declines in gold and silver. With essentially unlimited financial backing, their ability to create and sell huge quantities of PAPER silver and gold and a "free pass" from the regulators, they are the elephants in the room, and they can overwhelm technical indicators, oversold conditions, and sentiment if they so choose. That would not be the case if we had an honest physical market where a company has to have physical product to sell it.

Conclusion

-

The stage is set for the large bullion banks to profit from a rally. Expect a rally.

-

The silver and gold markets are deeply oversold and sentiment in both markets is very low. Are silver and gold investors currently disgusted and disappointed or happy and excited? Right! Rallies occur when practically everyone is disappointed, disgusted, or frightened out of the market. It was the same with the S&P (March 2009, October 1987) and crude oil (December 2008) and gold (October 2008).

-

Now is a time to buy gold and silver, not sell them.

-

Listen to the national media and consider doing the opposite.

-

Silver and gold sentiment and indicators are at multi-year, multi-decade, or all-time lows. The indicators and sentiment suggest the high probability of a substantial rally ahead.

-

The cash markets are strong. Individuals and central banks are buying gold and silver in Russia, China, India, and other Asian countries. Individuals who see the big picture are also buying in Europe and the US.

Does a certificate of deposit paying 1%, gold, or silver look more safe and rewarding at this point in time?

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.