Is Our Financial System Out Of Control?

Stock-Markets / Financial Markets Apr 05, 2008 - 07:24 PM GMT

The financial crisis that started in 2007 had its genesis in the deregulation of the financial markets. This began in the mid-90s when Travelers Insurance Company bought Citibank, forming Citigroup, thumbing its nose at the Glass-Steagall Act , which separated Commercial banks from owning other financial institutions. This led to its repeal by the Gramm-Leach-Bliley Act that implied that Citigroup would not be held accountable for flaunting the law.

The financial crisis that started in 2007 had its genesis in the deregulation of the financial markets. This began in the mid-90s when Travelers Insurance Company bought Citibank, forming Citigroup, thumbing its nose at the Glass-Steagall Act , which separated Commercial banks from owning other financial institutions. This led to its repeal by the Gramm-Leach-Bliley Act that implied that Citigroup would not be held accountable for flaunting the law.

Since then, the lines have blurred between insurance, commercial banking and investment firms. In addition, deregulation has been the byword of all our regulatory agencies. That, coupled with the loss of an arms-length relationship between lenders and borrowers has led to leverage going out of control . This is why the commercial banking division of Citigroup can lend 95-97% of the assets of a hedge fund also owned by Citigroup. This massive leverage gave Citigroup huge profits when the markets were rising, but are causing huge headaches when asset values are falling. This is also why a company such as Bear Stearns might appear healthy one day and bankrupt the next. Under the radar are several companies that had near-death experiences, such as Lehman Brothers, which tumbled to $20.25 on March 17 th , then rallied to nearly $50.00 a week later, just in time for it to sell $3 billion shares of preferred stock to the public on March 31 st .

All of this is being done quietly with the help of the President's Working Group on the Markets. Most of the work it does is behind the scenes in order to keep investor confidence. The run on Lehman Brothers was due to rumors that it, too, was running out of money and would suffer the same fate as Bear Stearns . Like a row of dominoes, the Fed considers the large brokerage firms and commercial banks “ too interlinked to fail .”

Employers cut the most jobs since 2003.

Employers in the U.S. cut the most workers in five years last month, signaling that the economic contraction is deepening and raising the potential that the Federal Reserve will continue to lower interest rates. Payrolls shrank by 80,000 , more than forecast and the third monthly decline, the Labor Department said today in Washington . The jobless rate rose to 5.1 percent, the highest level since September 2005, from 4.8 percent. The alarming part of this report is the CES Birth/Death model used to statistically smooth the unemployment numbers, added 142,000 jobs to the report. Could it be that we really had 222,000 people added to the unemployed list?

Is the bottom in?

A week ago, investor and advisor sentiment numbers are all suggesting that the Bulls and the Bears are evenly split. That was before the April Fool's rally on Tuesday. That was certain to give bullish sentiment a boost. But are they correct?

Next week will usher in the first quarter earnings reports. The consensus is that, due to banking losses, first quarter earnings will be about 10% less than the fourth quarter 2007. Could the surprise be that losses might be even greater than anticipated? The technical view is that the markets could fail here, suggesting that earnings reports could be worse than anticipated.

Anticipation of recession doesn't help Treasury Bonds this time.

The employment numbers may have helped shorter-term notes and bills, but the long bond is suffering the doldrums from a waning interest by investors in making a longer commitment to lower yields.

The employment numbers may have helped shorter-term notes and bills, but the long bond is suffering the doldrums from a waning interest by investors in making a longer commitment to lower yields.

The May fed funds contract jumped to 98.11 after the pre-market report, signaling traders expect a 44% chance of a half-point reduction, which would bring short-term interest rates to 1.75% from 2.25% currently. At Thursday's close of futures trading, odds of a half-point cut were 20%. Traders are fully pricing in the chance of a quarter-point cut.

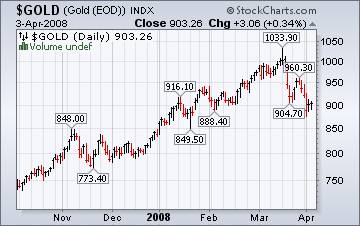

Cashing in on the high price of gold.

Gold futures closed today with a modest gain, but ended the week down $23.00 under last week's close. Traders are being torn between rallying on the back of a weaker dollar but holding back on a weaker economy knocking down new demand for gold.

Gold futures closed today with a modest gain, but ended the week down $23.00 under last week's close. Traders are being torn between rallying on the back of a weaker dollar but holding back on a weaker economy knocking down new demand for gold.

" How this tussle eventually plays out remains to be seen, but we have been arguing for some time that the demand component will eventually prevail and exert downward pressure on metals," said Meir, an analyst for MF Global, in a research note.

Nikkei stocks fell, led by concern about auto slowdown.

Japan's Nikkei index fell last night on concern purchases of cars and parts will dwindle as the U.S. economy slows. Goldman reduced its rating on Japan 's auto industry to “cautious” from “neutral,” saying a stronger yen, higher steel prices and falling U.S. sales will cause combined profit at 11 companies to drop 29 percent this year. Goldman's cut followed downgrades by Morgan Stanley and Nomura Holdings Inc. this week.

Shanghai…picture of a stock market bubble that burst.

Few experts say the stock plunge is a major threat to growth in the real economy here. But there are worries that a prolonged downturn could reverberate through China 's financial markets — especially since a large number of corporations had aggressively shifted money, sometimes secretly, to play the market.

The market mayhem began after concerns grew late last year about inflation at home and an American financial crisis. Now, even though China 's economy is growing at its fastest pace in over a decade, stock prices have fallen back to earth, crushing small investors on the way down.

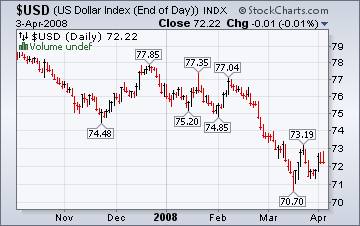

Dollar falls, commodities rise on Employment concerns.

April 4 ( Bloomberg ) -- The dollar fell against the euro and dropped the most versus the yen in a week as a government report showed the U.S. lost jobs for a third straight month in March, increasing concern the economy is falling into a recession.

April 4 ( Bloomberg ) -- The dollar fell against the euro and dropped the most versus the yen in a week as a government report showed the U.S. lost jobs for a third straight month in March, increasing concern the economy is falling into a recession.

By most standards, the dollar still looks very weak. However, the declining liquidity at banks worldwide may put a premium on the dollar, since most other asset values could collapse in a credit squeeze.

Housing continues to decline…is that news?

U.S. mortgage foreclosures rose to an all-time high at the end of 2007, the Mortgage Bankers Association said in a March 6 report. New foreclosures jumped to 0.83 percent of all home loans in the fourth quarter from 0.54 percent a year earlier. Late payments rose to a 23-year high, according to the Washington-based trade group's report. “Like homebuilders who feel pressure to get rid of inventory quickly, many banks and lenders experience the same pressure when dealing with homes from foreclosure,” and decide to sell at below-market prices, the Radar Logic report said.

U.S. mortgage foreclosures rose to an all-time high at the end of 2007, the Mortgage Bankers Association said in a March 6 report. New foreclosures jumped to 0.83 percent of all home loans in the fourth quarter from 0.54 percent a year earlier. Late payments rose to a 23-year high, according to the Washington-based trade group's report. “Like homebuilders who feel pressure to get rid of inventory quickly, many banks and lenders experience the same pressure when dealing with homes from foreclosure,” and decide to sell at below-market prices, the Radar Logic report said.

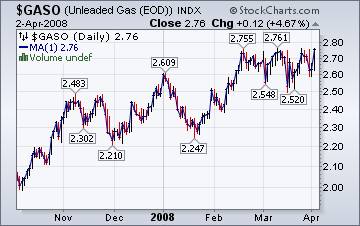

The price of gasoline spikes to record high.

The Energy Information Administration's This Week In Petroleum tells us that, “Reversing the drop of last week, the U.S. average retail price for regular gasoline rose by 3.1 cents to reach a new all-time high of 329.0 cents per gallon, surpassing the previous high set two weeks earlier. Prices on a regional basis increased throughout the country.” Drive much?

The Energy Information Administration's This Week In Petroleum tells us that, “Reversing the drop of last week, the U.S. average retail price for regular gasoline rose by 3.1 cents to reach a new all-time high of 329.0 cents per gallon, surpassing the previous high set two weeks earlier. Prices on a regional basis increased throughout the country.” Drive much?

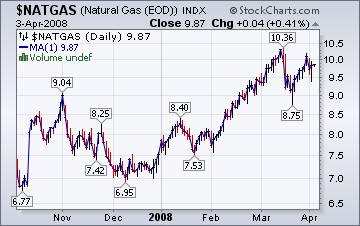

Cold weather alone wouldn't cause this spike.

The Natural Gas Weekly Update reports, “Natural gas spot prices increased in all trading regions in the Lower 48 States this report week (Wednesday–Wednesday, March 26–April 2). During the report week, the Henry Hub spot price increased $0.34 per million Btu (MMBtu) to $9.59. Frigid temperatures continued for a portion of the week in the Northeast and for most of the week in the West, likely boosting space-heating demand.”

The Natural Gas Weekly Update reports, “Natural gas spot prices increased in all trading regions in the Lower 48 States this report week (Wednesday–Wednesday, March 26–April 2). During the report week, the Henry Hub spot price increased $0.34 per million Btu (MMBtu) to $9.59. Frigid temperatures continued for a portion of the week in the Northeast and for most of the week in the West, likely boosting space-heating demand.”

April Fool's Day Rally.

Michael Nystrom thinks that it is just like Wall Street to play a joke on the investment public, just the day after the UK's Independent proclaimed on its front page, "USA 2008: The Great Depression?"

“ In truth, the market wasn't joking around at all. The Dow's 391 point rise was a deadly serious message: Financial markets don't care about newspaper articles. Nor do they care about the high prices you're paying for food, gas, rent, tuition, debt service, clothes or anything else that you can no longer afford. Financial markets have their own internal rules and logic, and right now they simply cannot be bothered with average Americans' struggles to make ends meet. At present, they are concerned mainly with the money free-for-all going on over at the Federal Reserve. ”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program starting in March.

I am now a regular guest on www.yorba.tv every Thursday at 4:00 pm EDT . The first two show is archived. Look for Archives, March 6 and 13, segments 1 & 2.

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.