US Dollar As Money, Myths, Lies, Deceptions and Millstones

Currencies / Fiat Currency Sep 05, 2013 - 07:15 PM GMTBy: Jim_Willie_CB

Many are the myths held so firm by the public. Many are the lies told so boldly by the leaders. Many are the millstones around the neck of the system that is fast losing its momentum. Many are the frauds committed routinely in full view. The entire US system is unraveling, myths exposed, lies contradicted, while the millstones weigh down the financial and economic system. The absent Gold Standard, the invalidity of money, the insolvency of banks, the toxic nature of sovereign debt, the illegitimate money, the intrusive debilitating central bank franchise system, these are grand millstones around the neck of the Western system. The current monetary policy is killing capital, a fact not observed by 5% of working economists, the harlots working closely to policy making. The nation is hurtling quickly toward systemic failure in every conceivable frame of light. A quick review should be revealing of myths, lies, deceptions, and millstones.

Many are the myths held so firm by the public. Many are the lies told so boldly by the leaders. Many are the millstones around the neck of the system that is fast losing its momentum. Many are the frauds committed routinely in full view. The entire US system is unraveling, myths exposed, lies contradicted, while the millstones weigh down the financial and economic system. The absent Gold Standard, the invalidity of money, the insolvency of banks, the toxic nature of sovereign debt, the illegitimate money, the intrusive debilitating central bank franchise system, these are grand millstones around the neck of the Western system. The current monetary policy is killing capital, a fact not observed by 5% of working economists, the harlots working closely to policy making. The nation is hurtling quickly toward systemic failure in every conceivable frame of light. A quick review should be revealing of myths, lies, deceptions, and millstones.

USDOLLAR AS MONEY

The greatest myth of all is that the USDollar is money. No way, not a shred of truth! The reality is that Gold & Silver are money. The USDollar is declared to be legal tender, when it is actually debt denominated coupons brought down to low parcels for spending purposes. Being debt, the monetary system based upon the USDollar will next deliver powerful blows to the US population. Their savings and investments are based in the USDollar. Therefore the debt writedown will foist a huge wealth writedown upon the hapless masses. Their wealth was never wealth at all. It was more debt markers, gathered in much like Al Capone would hold.

LIFE SAVINGS

The myth is that the people's life savings are always protected and safe. The reality is that 401k, IRA, and Keough savings plans are a grand trap. They entice the participants with tax deferral which is hardly tax avoidance. People's savings are then stuck in the system, never to come out. The reality is that funds are subjected to the whiplashes of the ever-present asset bubbles. Next on the reality tap is the forced conversion to special USTreasury Bonds, where they will earn no interest yield and be vulnerable to USGovt debt default writedowns. The ongoing risk is also for Bail-in confiscation taxes, but that seems more like a fail-safe insurance threat in protection of accounting fraud and bank criminality.

BAIL-IN PROTECTION

The myth is that the Bail-in plans would recapitalize the big banks. The myth is that conversions would build back the urgently needed bank capital base. The reality is that the big banks are far too insolvent to remotely be in a position for such restoration. As the Western nations one by one installed the Bail-in plans, the light bulb went on in the Jackass skull. The Bail-in plans are an insurance policy against the big banks ever being forced to capitalize to proper levels. The Bail-in plans are an insurance policy against the big banks ever being prosecuted for grand fraud and grand larceny and grand counterfeit. Attack the big banks, and the people will lose a large portion of their life savings. Therefore, the big banks will be left alone to go about their business, whatever that is, to be sure mostly criminal.

SOLUTIONS AND SACRED TOO BIG TO FAIL BANKS

The myth is that the United States leaders are working avidly on a solution to end the stubborn financial crisis. The myth is that feeding the banking sector gobs of welfare cash will bring about a recovery. The reality is that the political and banking leadership of the nation has absolutely no interest in seeking a solution or implementing it. They are fully dedicated to preserving power, at any cost, even lost wealth of the nation, even wrecked economic system, even destroyed financial structure. The first step to any viable workable solution with potential to solve anything is the liquidation of the big banks. They suffer from incurable cancer in the form of the grotesque disease of insolvency, which plagues the nation. Such a step will never be taken, crystal clear from the last five years since Lehman was killed for exploited purpose, since Fannie Mae was hidden under the USGovt wing to conceal its multi-$trillion fraud. The powers in place will remain in place. Therefore, the US will remain on the path to suffer a systemic failure.

ZERO INTEREST RATE POLICY AS STIMULUS

The myth is that the ZIRP in place is stimulus to the USEconomy. The reality is far in the opposite direction. The only benefit from the 0% rate is that the big banks can fund their toxic bond redemptions with free money. They can fund their Interest Rate Swap derivatives with free money, in order to keep the USTreasury Bond complex from toppling over. The basic economic science dictates that when debt supply remains over $1 trillion annually, but with a vanishing breed of creditors willing to finance the debt, the prevailing rate should rise and rise and rise, kind of like in Greece, Portugal, and elsewhere. The reality is that the 0% cost of money has distorted all pricing of assets. The entire capital system has been turned upside down, unclear as to where value or profit lies. The reality is that the 0% rate is a gigantic wet blanket on the USEconomy, offering pitiful low yields to savers. The reality is that the 0% rate is slowly killing the entire pension fund system, and the insurance sector. The reality is that more savings are to earn interest than consumer loans are to pay out interest. Therefore the Zero Bound is a massive smothering device on the USEconomy. No stimulus here.

BOND MONETIZATION AS STIMULUS

The myth is that the QE programs are stimulus to the US financial system. The reality is far in the opposite direction. The reality is that the USFed is gradually becoming the only buyer of USGovt debt, the only buyer of converted maturing USGovt debt. The Weimar machine is the last resort window to purchase USGovt debt, and to prevent the rate on borrowing costs from rising to 10%. The reality is that the USDept Treasury is fast converting mountains of fraud-ridden USAgency Mortgage Bonds whose volume lies in the $trillions, so that the housing market might be freed up to recover. The reality is that the entire world reacts to the hyper monetary inflation that is the bond purchase initiatives, by hedging against it. The investment community and business sector hedge by buying hard assets. The rising commodity prices, energy prices, material prices, and resulting service prices, all result in a rising cost structure. The reality is that the QE bond purchases force rising costs and shrinking profits, which bring about a colossal capital destruction from business segment shutdown and retired equipment, later liquidated equipment. Outside Antal Fekete, hardly an analyst has noticed. The economists are fast asleep on this extraordinary destructive factor. They are paid to be asleep. No stimulus here.

USFED STIMULUS UNTIL RECOVERY

The myth is that the Bernanke Fed is committed to stimulus until a recovery occurs. They speak about a dual mandate of low price inflation and full employment, with the third priority of preserving financial stability. The reality is that the current monetary policy assures further capital destruction, further business shutdown, and further job cuts. The promised continuation is a death sentence, truth told. ZIRP is the smothering device. QE is the capital destruction tool. The fixed monetary policy relying upon both ZIRP & QE will continue until the US systemic failure and climax of USGovt debt default. One might be reminded of the old pirate saying, "The beatings will continue until morale improves!" The USFed monetary policy is killing the nation, rather than anything remotely resembling a solution, and surely not stimulus.

INSTITUTIONS AS BRAIN TRUST FOUNDATION

The myth is that the bank sector, the economic counsel, the news networks, even the charities, will offer intellectual and foundational support as the system works toward its restoration. The reality is that the bank sector is motivated only by preservation of power and protection of the money printing machinery. The reality is that the economists are obvious props for the big money center banks and investment banks. They have morphed over the years into a veritable harlot community with no motive to inculcate or disseminate truth. They have stepped into the roles of Wall Street marketing agents and the roles of apologist for failed government economic policy. They have been forced into the role of concealing what the big banks have created since the 1990 decade, a vaporous false foundation upon which the entire banking system rests, namely the derivatives. The news networks cannot speak the truth, or else the population would exit banks, exit investment securities written on paper, and invest heavily in Gold & Silver, even take wealth in droves outside the country. The charities are best exemplified by United Way, which devotes 5% of donations toward actual projects, with a ripe 95% devoted to executive compensation, their perks, and overhead. A nation's institutions are its pillars for building wealth. Not much evidence here.

HOUSING IN RECOVERY

The myth is that the US housing market is in recovery, prices having bottomed, on the rise again. To be sure, the mortgage rates even at 4.5% on 30-year loans are still quite low. The reality is that most cities and states have seen no appreciable rise in home prices. The reality is that big banks have been hiding their bloated home inventory, seized by virtue of home foreclosures. The reality is that off-market sales by banks of REO homes are not counted in the official statistics. The reality is that private equity firms funded by Wall Street are scooping up large tranches of bank-owned properties with the hope of converting them into massive cash flow machines. They are the primary factor in any semblance of fortified demand, the supply from continued foreclosures ongoing. The nasty ugly facade to the housing market is the cost that the private equity firms will be smacked with for renovation, vandalism, and rugged tenants who refuse to vacate. Two subscribers provided direct experience from South Florida and NorthEast Ohio on the upcoming sinkhole the carpetbaggers from Wall Street will see. No recovery remotely visible.

STOCK BULL AGAINST ECONOMIC DEPRESSION

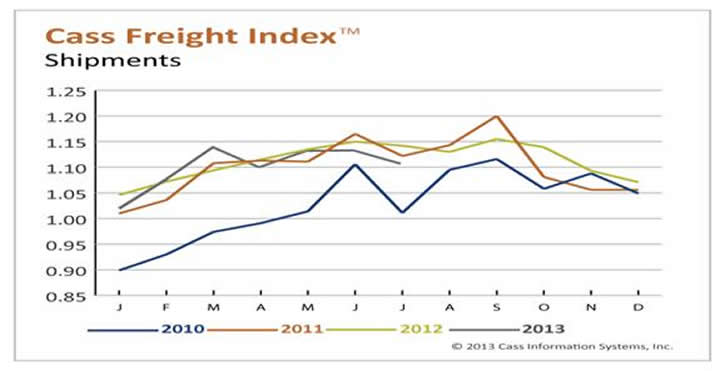

The myth is a bull market in stocks has been underway for two years. It is bull, but more like bull droppings. The myth is that stocks have value. Perhaps when placed within the Fed Valuation Model and 0% rates, the stocks can benefit from an endless rise in share prices, the model broken by the outlier zilch rate. The reality is that accounting standards have become a mockery, with debt value adjustments and raids on loss reserves. The reality is that the USEconomy is mired in a powerful recession. A quick look at the Cass Freight Index and the Electrical Power Usage Index, and the conclusion is easy on a flat-line comatose economy. No recovery visible, same story as in 2008 through 2012. Thanks to Cass, Barrons, and GATA for a glimpse of truth, which is the enemy of the fascist state.

LOW-COST SOLUTION IN CHINA

The myth was that the USEconomy would benefit greatly from the low-cost manufacturing done in China after the year 2000. The foreign direct investment from US and Western corporations was staggering in the following years, well over $25 billion toward creation of a vast industrial sector. The myth was that the entire movement would power corporate profits and bring a new decade of prosperity. It would have to follow the Stolen Decade of Prosperity from the Clinton-Rubin era. The reality is that the United States forfeited and dispatched the core of its industry to China, and along with it the core of its legitimate income. The nation was forced to rely heavily upon the housing & mortgage bubbles for income and disposable funds. The nation was locked into a death grip of rising debt and falling income. The ugliest secret associated with granting China the Most Favored Nation status was the deal cut by Wall Street banks to lease Mao Era gold. It was not returned to China under contract, causing enormous resentment and tremendous anger, in addition to ample motive to render the USDollar to the dustbin. The MFN grant permitted the continuation of the gold lease game and gold price suppression. However, the reality is that China has been transformed into a formidable enemy, which alongside Russia, have accumulated over 30,000 tons of gold together. They expect to be ready for the next Gold Standard, launched through trade and not banks. The United States will be outside looking in, the great gold thieves and conmen.

COMMUNIST NATIONS CANNOT LEAD

The myth is that both Russia and China have no concept of leadership, no concept of capitalism, and are fraught with corruption, if not broken systems. The reality is that the United States is caught in the mire of profound insolvency, a lopsided economy lacking industry, a government incapable of managing its spending, and a lethal devotion to war. The United States has created some powerful enemies over the last couple decades. The Russians & Chinese are dedicated to establish a new fair monetary system, and a new fair trade settlement system. The United States will be outside looking in, no longer able to control the system.

POLITICAL SKULLDUGGERY

The nonsense is endless and truly moronic, the stuff of mental midgets to consume and lap up. The myth is the story of rampant deflation as promoted regularly. At the same time, the USGovt was spinning off annual deficits over $1 trillion. At the same time, the USFed was engaged in multi-$trillion monetary expansion. That can be called hyper monetary inflation with the clear Weimar nameplate on the printing press, devoted for near exclusive bank and government privilege. The Deflation Knuckleheads have been silent for over two years by the QE to Infinity programs. Good thing, since they were as tiresome as they were imbecilic. The news network propaganda has been pumping out the story of a USEconomic recovery and a War on Terrorism. The recovery is non-existent, the memories still fresh of the Green Shoots nonsense spread by financial press networks in 2009. The war is to cover the domestic eradication of civil liberties, while on foreign lands to cover the narcotics monopoly in Afghan soil. It remains a highly profitable business, set with vertical integration and enjoying full USGovt agency protection. The profits range from $800 billion to $1.2 trillion per year, the costs mostly covered by sleepy dopey dullard taxpayers. The nation building in Iraq and Afghanistan will be judged by history to be rather empty. The drone strikes on civilian centers and helicopter gunship target practice on civilians will be remembered well. When discussion of chemical weapons takes place, let the white phosphorus that rained on Fallujah Iraq in 2003 be remembered.

The myth is that the US is still a beacon of freedom. It is unclear how large the moron population is that clings to such klaptrapp hokum in beliefs. The USGovt tore up its Constitution, ripped its Bill of Rights, installed numerous fascist executive orders to kill citizens, to seize property of citizens, to jail citizens, to silence citizens. The British overlords have seen fit to create the most monitored society in the world. The oft-heard cry that they hate us for our freedom brought laughter to the Jackass for years, uttered by the president with the sub-90 IQ who served as a pompom-toting cheerleader at Yale University, where secret societies were a regular haunt. The reality is that the United States, Great Britain, and a small ally nation on the SouthEast corner of the Mediterranean are the Axis of Fascism. They are hell-bent on destroying the beacon of freedom and the cradle of democracy and the foundation of free enterprise capitalism. The narco barons have taken control. The big US banks are so deeply dependent upon narco money, that they would collapse in three months without it. The Jackass had the privilege of meeting Aaron Russo in January 2005 in Los Angeles, the producer of "From Freedom to Fascism" before his death a couple years later. The primary success of the Axis of Fascism is in banishing freedom, crushing democracy, and extinguishing capitalism. However, the vengeance will be with the rise and return of the Gold Standard.

The irony of removing the United States from its privileged perch in command of the USDollar as reserve currency will have a nasty foul consequence on the other side. The United States has for two generations provided adequate useful police protection and sentry duty across the world. When the USMilitary withdraws, perhaps to repeat the Nazi German route of embarking on a private enterprise (see the Odessa Group), the world will become a more dangerous place. The various hot spots across the world, like at entry points to sea passageways, will be inhabited by more pirates inflicting their violence. The world will have to rely upon Russia and China for more global protection and sentry. It is unclear they can meet the task. They will have a first priority very soon to protect the Persian Gulf. A transition is in progress. The victim will be the Petro-Dollar, the defacto trade standard that keeps the USDollar afloat and keeps the USTreasury Bonds firmly in place within the banking reserve systems. That will all change, and cause a grand shock.

IRONY OF NEW ASSET-BACKED MONETARY SYSTEM

A significant Jackass theme stated since 2009 and 2010 has been that a new legitimate monetary system is coming, but it must arrive with a critical mass. The concept has been articulated and explained in numerous Hat Trick Letters over the past three years or more. Here is the main point. A new asset-backed currency can arrive, but it is at risk of killing its own economy quickly from its own sudden success unless certain conditions are met. If only one or two nations use the new currency, then they will see the currency rise quickly, too quickly, which would result in a massive loss of export industry. No foreign trade partner could afford its output. Although the imports would be made absurdly cheap, the domestic economy could not support the system. The ultimate requirement of a new asset-backed currency is for the new instrument to be used by a large critical mass of the global economy. The Eurasian Trade Zone combined with the BRICS nations, along with other wise nations wishing not to be excluded, could actually form the requisite critical mass.

For five years since Lehman Brothers failed, the world has been seeking to exit the USDollar. The challenge has been in setting up financial frameworks, creating trade platforms, and wiring them to banks and commodity markets. They are on the verge, with G-20 Meetings scheduled to forge out the necessary tools and platforms. The nations not participating in the combined platforms established by the BRICS nations, the Eurasian Trade Zone players, and the G-20 members, run the extreme risk of being left out in the cold. They will fall into the Third World. Many are the rumored stories of a group of Gold-backed new currencies to arrive soon, like with the Chinese Yuan, like with the new USTreasury Dollar, like with the new Nordic Euro. My gut tells me that United States will be the last to participate, and the first to fall into the Third World. The next chapter will be all about Gold-backed currency and a return to the Gold Standard. Any analyst, any counselor, any economic planner with integrity knows that the Gold Standard is the missing solution since 2008 when the global financial crisis struck. The hammer will come through the Gold Trade Standard, and not from banks or the FOREX currency market. The rest of the world cannot seek a solution when the Wall Street bankers and the London bankers are in the room. Watch the Moscow G-20 Meeting, where the quasi ostracized Anglo delegates will be watching from the corner, not participating, reporting home on progress.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"I commend the Jackass for being the most accurate of all newsletter writers. Others called for the big move in Gold right away, but you understand that the enormous fraud in the system needs to play out before free market forces can begin to assert themselves. You seem to have the best sources and insights into the soap opera that is our global financial system. Most importantly, you have advised readers to be patient, stay safe, and avoid mining shares like the plague. Calling the top in the USTreasury Bond (10-yr yield at 1.4% yield) stands out as a recent fine accomplishment. The Jackass understands the markets, understands the fraud, and also has the sources to keep him the most up-to-date on the big geopolitical and financial events and scandals. Few or no other writers have all three of these resources."

(Austin in California)

"After first reading the Hat Trick letter a few years ago, I was amazed at Jim Willie's prophetic calls concerning the economic forgery and corruption worldwide. His knowledge, coupled with his worldwide contacts and gutsy fortitude to call out and expose the evil criminal bankers, and to expose the lying US government, forced me to become a subscriber. I have no plans to cancel. Willie's work creates an anticipated excitement for new reports issued in the middle of the month."

(JeffH in Virginia)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.