Is the US Fed Inflating or Deflating?

Economics / US Economy Apr 06, 2008 - 03:09 PM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. This week, I stick my nose in where it ain't wanted. (again)We get down in the dirt about deflation and we look at some stocks and wonder why and I show you my long term indicators.

Welcome to the Weekly Report. This week, I stick my nose in where it ain't wanted. (again)We get down in the dirt about deflation and we look at some stocks and wonder why and I show you my long term indicators.

Now, I'm not one to boast, really I'm not. No one enjoys the likes of me stuffing “I told you so” remarks down reader's throats. There comes a time when it does become slightly unavoidable. Is it ego, a demand of recognition? Is it a desire to be kingpin, the ultra guru? Frankly my dear, I don't give a damn, as long as my readers get something that helps make life as an investor /trader easier then my attitude is “so what?”

What a week that was, Dow up, then down, up again…..stop! Hindsight - blah! This is the Collection Agency, we pride ourselves on looking forward, not back. Where do I look, how far forward? The Occasional Letter looks 6-18 months ahead, soon it'll be looking for some buy opportunities. The Weekly Report is more short-termism, with the aim of looking for opportunities in the next few weeks.

Speaking of readers it is time for an update. Now most of you know I'm a blogger, no fund to sell, no angle to push, I really don't care what you buy and sell. I'm not bothered. I'm googlable but I don't really exist beyond those that read me at some rather classy sites. Yes that was me being a creep.

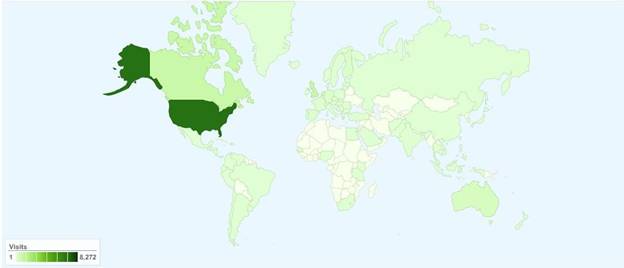

Here is my world coverage over the past 2 months, remember, I'm an unknown, a blogger:

If it's green, someone visited. I know, I'm amazed too, my grammar is awful! Around 16000 people have read my stuff in the past 2 months. Some may scoff at such figures, I don't. I would like to thank you all, I had no idea my “stuff” was that readable. As much as I can be, I feel slightly humbled.

“Enough” I here you cry and being one not to spit in the face of a crowd, lets get on with it.

There has been a war of words between Gary North and Steve Saville about whether the Fed is inflating or deflating. I have absolutely no connection with either writer and have no interest in badmouthing either of them. I am sure both have a loyal following and I do know both make interesting points.

Here is my roadmap, unchanged these past 5+ years:

"A recap of the scenario:

bubble, easy money, inflation in fiat money supply, inflation in commodities and hard assets, inflation, fear of inflation, rising rates, YC inverting, flattening, rising and inverting again, tightening, withdrawal of liquidity, corrections, crashes, talk of stagflation, FEAR, withdrawal of speculative funds, further corrections and crashes, demand collapse.......Deflation."

If you read that 5 years ago, you would have pegged me as a survivalist or a gold-bug. Now you can pick your appropriate position. How did I know such tremors were coming? Simple, I studied the very same things Ben Bernanke studied, he became a bald academic, I became a bald blogger. I am better looking though.

Back to the GN/SS spat. I looked on, an interested observer in all matters inflationary and deflationary and decided to strip the argument back to its core. From what I could see this was a difference between M1 and MZM as to which held the key to inflation/deflation signals. So I went to the Fed.

St Louis to be exact, mainly because I like Poole , his St L Fed site is excellent; I do hope his successor keeps the access to facts as open as Poole did. Its worth reading up on William Poole, he may well surprise you. I digress, again:

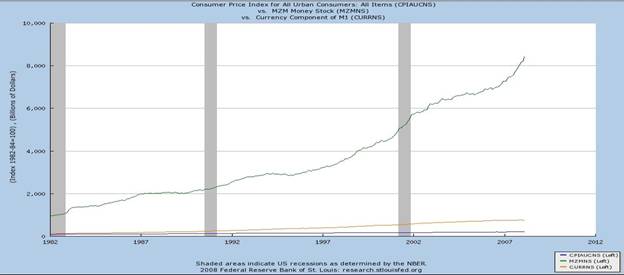

Charts:

This is a chart of MZM (green), M1(orange) and CPI(blue), using the base of 1982, as CPI was rebased in 1982/84 according to St L Fed statistics. Everything is based on the left side, pure figures. You know what's coming next:

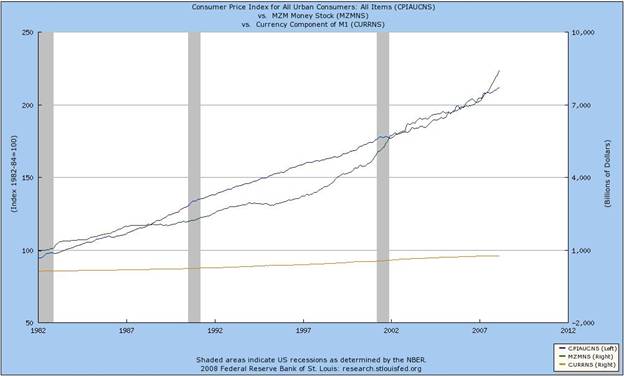

Same chart with CPI based on the left axis and M1 and MZM on the right axis with the same baseline of 1982. Astute readers can know see why I stick my nose into uninvited areas. Is any measure of “M” a worthwhile measure of inflation trends?

Inflation is not purely a monetary phenomenon. We all know if you over-print cash notes you encourage a debasement and a monetary inflation. What isn't so understood (except by some and believe it or not, the Fed) is that in a fiat monetary system, reliance on growth using leverage for the expansion of credit, is the true driver of inflation/deflation.

It's simple and easily understood if you think of greed. It is also why a fractional GOLD backed currency won't work.

I have $10, I lend it to my bank as a “savings” deposit. The Bank uses the deposit as an asset, lending on that asset by a factor of 10 (leverage). The bank lends out $100 backed by the original asset. The Hedge Fund borrows (credit) $100 from the Bank and utilising margin (further leverage), raises positions in markets notionally worth $1000.

The economy is booming, thanks to my $10. I am a capitalist hero. One day I decide to take my $10 out of the Bank to spend on a battery powered radio, to alleviate my boredom whist mowing the lawn.

Does the Bank have to unwind the leveraged lending based on my $10? No, it can count upon other deposits, savings, to replace the capital base.

This is all well and good during the good times. What happens when all my neighbours decide they would rather own assets than leave cash on deposit? We know already, thanks to the 3 day collapse of Bear Stearns. Banks fear above all else a run, where depositors decide they would rather have their cash in hand than in the Bank. You can see why they fear such a run, mass withdrawals would force the unwinding of leverage, a call on the loans made. That means the Hedge Funds would have to unwind their positions, to enable repayment to the banks. You get the picture. Another angle would be to look at productive workers, paid for their labour and depositing wages into the Bank. If the Banks had a shortfall of received wages the same problem would occur, Banks would no longer have the fractional base to enable their lending. Less workers, less deposits.

What we are witnessing is not a shortfall in the ability of innovative structures to enable credit. What we are seeing is the beginning of the destruction of the fractional base of Banks. I could go on, mentioning the shortfall in expected corporate profits over the next quarter or 2 as judged by the S&P500. My astute and clever readers have already jumped ahead to that conclusion.

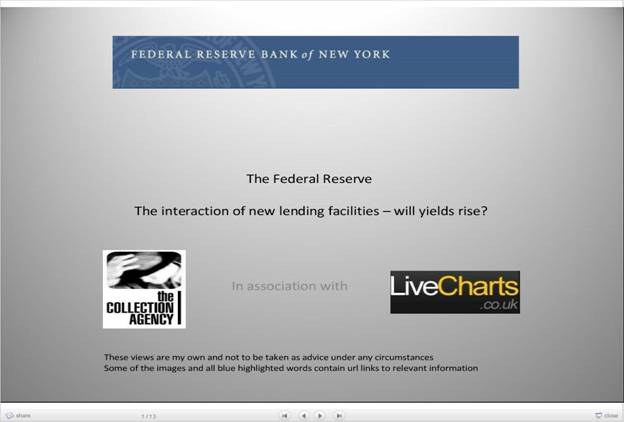

Back to the central question, is the Fed inflating or deflating? Amazingly, it is doing both, thanks to the newly introduced “Facilities”:

Above is something I rustled up earlier in the week. To my eye, the Fed is inflating the amount of Treasuries available to both Banks and Primary Dealers and debasing their worth by swapping them for cheaper assets. On the other hand the Fed has been extremely active with the Permanent Open Market Operations , selling treasuries and absorbing cash from the markets. The Fed is walking along a very loose tightrope, where each step is producing vibrations that affect all market participants.

It would seem the Fed is set on a course to provide solvency to Banks and Primary Dealers, by lending assets that can be used to raise/roll borrowing from Banks who are only willing to lend on AAA assets. This is far beyond the ability of MZM and M1 to measure. Such slow moving indicators are unable to capture the true intentions of the Fed as it provides the replacement for the Commercial Paper markets.

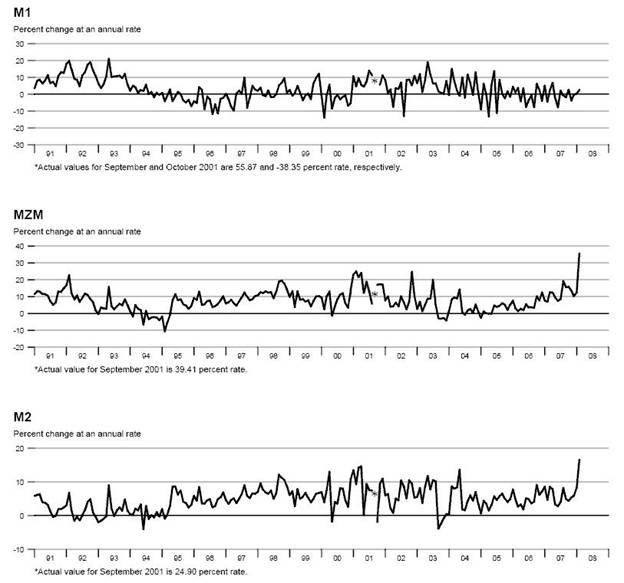

Let us gaze upon the graphs for M1, M2 and MZM:

Where M1 has remained in a tight range for the past 11 Quarters, the sudden acceleration in M2 and MZM points to a reflation BEYOND cash.

• M1 is defined as all coins and currency held by the public including travellers cheques, checking account balances, NOW accounts, ATS accounts and balances in credit unions.

• M2 is defined as all of M1 plus savings and small time deposits, overnight repos at commercial banks, and non-institutional money market accounts.

• MZM is defined as all of M2 minus time deposits but including money market funds.

Yes, we are back to the Fed and its Facilities again. M2 and MZM include overnight repos at commercial banks. Since the credit crisis burst open in the summer of '07, the Fed has made ample use of repos. Indeed when the crisis intensified in October '07 and again in January '08 the Fed enlarged the amounts and frequency of repo arrangements. It is quite clear that M2 and MZM are reflecting this. M1 does not include such actions as those carried out by the Fed. Repos can only be viewed as credit, newly created by the exchange of assets. Cash itself is not printed, there is no need. All that happens is a bank can swap assets to increase the notional amount it holds in its reserve and meet reserve requirements. Only if the repo was made permanent, with assets remaining at the Fed, could the Bank issue currency.

It is at this point I agree with

To read the rest of the Weekly Report, click here

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.