Zero Interest Rates - The Federal Reserve’s War on Seniors

Personal_Finance / Pensions & Retirement Oct 09, 2013 - 04:45 PM GMTBy: Jeff_Berwick

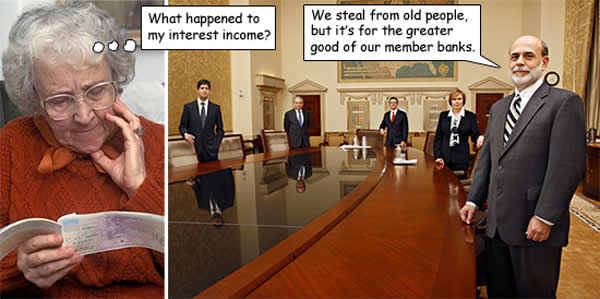

Antonius J. Patrick writes: The Federal Reserve’s “zero interest rate policy” (ZIRP) of the last half dozen years or so has been a financial act of war on the country’s seniors and, for that matter, on all savers. Under ZIRP, interest rates are artificially lowered through the Fed's monetary policy popularly known as, "QE," quantitative easing.

Antonius J. Patrick writes: The Federal Reserve’s “zero interest rate policy” (ZIRP) of the last half dozen years or so has been a financial act of war on the country’s seniors and, for that matter, on all savers. Under ZIRP, interest rates are artificially lowered through the Fed's monetary policy popularly known as, "QE," quantitative easing.

The primary reason for this is twofold: first, to allow the federal government to borrow money at next to nothing in order to maintain its current gargantuan level of spending; and, second, to prop up the nation’s insolvent banking system which can continue to engage in all sorts of reckless speculations.

ZIRP is extremely hard on seniors who, for the most part, can no longer rely on earnings through employment income, but have to live on their accumulated wealth. Instead of reaping the rewards for a lifetime of frugal behavior, seniors are being systematically fleeced by the Fed’s action.

ZIRP is actually “class warfare” not in the Marxist/socialist sense of “labor vs. capital,” but in its surreptitious redistribution of wealth from savers (retirees) to the government and politically well-connected financial elites. Moreover, the Fed's action is turning seniors into a dependent class who are no longer able to sustain a reasonable standard of living.

Not only are retirees and savers punished by ZIRP, but the policy is quite destructive to the entire economy since low interest rates discourage savings which are key to economic growth. Savings provide the means (capital) for production and without savings, lengthier and more complex production processes will not take place. The personal saving rate in the US has plummeted for years with the current level at about 4% of disposable income.

The amount of savings is also crucial for the level of employment and wage rates. Greater savings allows entrepreneurs to hire additional labor plus offer higher wage rates. Policies such as ZIRP have destroyed the savings pool not only in the U.S. but throughout the Western world which explains, in part, the persistent high levels of unemployment and stagnating wages. Organized labor should be at the forefront in opposing ZIRP.

ZIRP reduces seniors’ standard of living in another devastating sense. To keep interest rates below market levels, the Fed has to purchase larger and larger amounts of U.S. government bonds. Since the Fed has no assets of its own, it must create money to buy the debt (“monetizing the debt”). This, of course, is inflation, the nasty consequence of which is a rise in the price of consumer goods.

For seniors, not only are they receiving little reward for saving which diminishes their capacity to remain self sufficient, but the money they do have, because of the Fed's policy, is worth less and less. John Williams of Shadow Statistics has shown that consumer price inflation over the past year has ranged between five to ten percent far above the government’s estimates.

ZIRP and other such measures are the reason for the creation of a dependent society where reward for hard work and thrift is being systematically undermined for the benefit of a Leviathan state and the financially privileged. The policy has other societal repercussions as younger generations are coming to realize that since prudent behavior will not be rewarded, they will engage in more present-oriented lifestyles. Can there be any doubt that contemporary America's hedonistic society has resulted, in part, from the punishment of future-oriented behavior.

Less than the abolition of the Fed and a return to a commodity-based monetary order, the solution to the current financial plight of seniors and the economy in general is for the Fed to immediately suspend ZIRP, which would allow interest rates to rise to “normal levels.” Not only would retirees benefit, but the higher rates would induce greater savings which would eventually spur real and sustainable economic growth.

Unfortunately for seniors, until the Fed's interest rate policy is reversed, their retirement will be a lot less prosperous than anticipated, as the years of toil and sacrifice will have been for naught. As with so many aspects of the American Dream, the golden years are becoming a thing of the past.

[Editor's Note: For help in building a new dream even as the old one dies, click here.]

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.