Vulgar Competition and Italian Gold

Commodities / Gold and Silver 2013 Oct 19, 2013 - 11:39 AM GMTBy: Adrian_Ash

Alessandra Pilloni writes: Vulgar competition needs to come to Italy's delicate jewelry business...

Alessandra Pilloni writes: Vulgar competition needs to come to Italy's delicate jewelry business...

"Italy accused of protectionism!" is hardly news.

Wanting free competition in the airline market, IAG - the group formed from the UK's privatized British Airways and Spain's privatized Iberia in 2012 - has urged the European Commission to investigate and block the possible rescue of Italy's bankrupt Alitalia by the state-owned Italian Post Office. This tells a story all too familiar in Italy - the lack of a reality check, or any market discipline, for companies who are struggling to remain competitive in today's global economy.

Competitiveness? It's unknown, a taboo word in Italy, as the Wall Street Journal notes. Prime minister Enrico Letta, meeting the country's "political and business elites" on the shores of Lake Como after defeating Silvio Berlusconi at the start of this month, shocked nobody by not daring to utter the forbidden word once.

Competitiveness? How vulgar!

The crisis in Italy's gold industry is emblematic in this regard. After peaking in the late 1990s, the jewelry industry entered a deep crisis. This crisis may have bottomed out during 2012, but this year's slight improvement still needs to be borne out by the data.

Yes, the gold jewelry sector is Italy's sixth largest provider of positive trade flows. As much as 70% of its output is destined for international markets, according to data from gold industry federation, Confindustria Federorafi. So it remains a crucial area.

But the gold sector in Italy has shrunk dramatically over the last 15 years, as a report presented earlier this month in Rome at the 14th Conference of the London Bullion Market Association showed. Produced by MetalsFocus and Metallis Consulting, two independent consulting agencies based in London, the report highlights how Italy's annual gold manufacturing declined 80% by weight between 1998 and 2012.

How could an industry so integral to Italy's self-image get beaten up so badly?

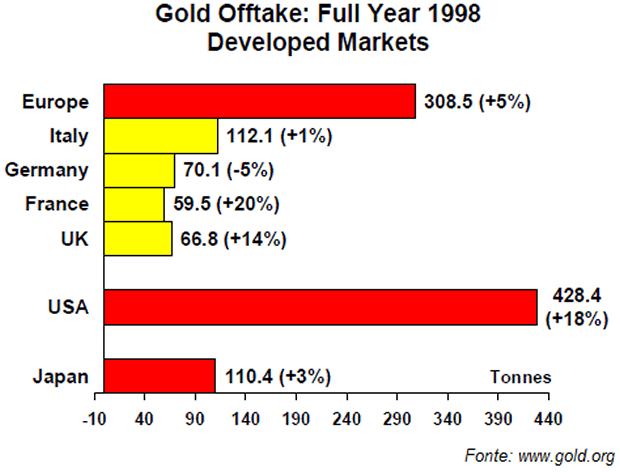

At the end of the 1990s, Italy was among the largest manufacturers of gold jewelry in the world, and the largest in Europe. Meeting 10% of global demand, Italy's goldsmiths worked metal weighing more than 500 tonnes per year.

The year 1998 marked the peak for finished gold exports from Italy. Production reached 540 tonnes, of which 420 were for export, mainly to Europe and North America. That same year, domestic demand reached above 112 tonnes, a level considered to be stable after the peak achieved in 1992.

In 2012, in contrast, a mere 62 tonnes were produced for export according to MetalsFocus and Metallis, less than 15% of the volumes reported 15 years before. At home, Italy's domestic market for gold jewelry is estimated to have shrunk by three quarters.

Now, it must be said that this decline in Italy's own jewelry demand is consistent with other Western countries, meaning the rest of Europe and the United States. These two areas were also the favored destinations for exports of gold products from Italy. In combination they constituted two-thirds of Italy's total gold exports. And as the MetalsFocus/Metallis report explains, the decline in demand was caused by several structural changes in the market, including the rising gold price (up six-fold in Dollar, Sterling and Euro terms), competition from other consumer goods (especially hi-tech gadgets), and of course the economic crisis starting in 2007.

The global financial crisis has caused a bifurcation in gold jewelry demand worldwide. At one end consumption has become concentrated amongst the luxury-loving uber-rich on the highest quality items (and hence the highest mark-ups for workmanship). At the other, lower-income consumers now favor lower-cost items, with strong substitution of steel, leather and ceramics for gold and other precious metals.

In total, as a result, annual gold jewelry demand in Western countries was 600 tonnes lower in 2012 than in 1998. So Italy's once-booming gold sector already faced problems. But so did everyone else. And faced with this major decline in Western demand, Italy proved itself uniquely inadequate in terms of competitiveness, losing much of its share in those declining markets.

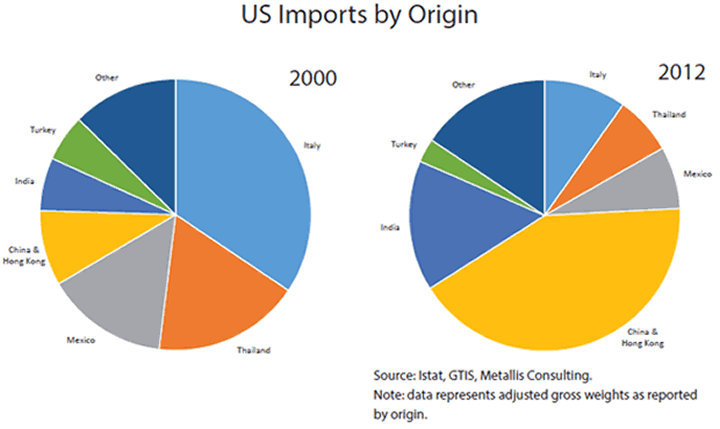

In 2000 Italy met 40% of Western gold jewelry consumption. By 2012 it met only 10%. As shown in the graph below, Italian gold imports constituted a third of the US market at the turn of the century. That share has shrunk by more than 60%, replaced mostly by products from China, Hong Kong and India.

One mitigating factor: Italy was penalized in trade with the United States by import duties of 6% on gold jewelry. That handicap does not exist for its key competitors. This September, Stefano De Pascale, director of Federorafi, said at the Vicenza Fair that he's calling for a bilateral agreement with the US. "If the trade barriers were removed, our exports would immediately jump 20 percent," he said to Reuters.

So the export industry is starting to fight back. But is it too late? Staying competitive over the last 15 years would now mean gold sector exports of 100-120 tonnes per year, the new report estimates. That would equal nearly 200% against the 62 tonnes exported in 2012, according to BullionVault calculations.

What's more, the causes of Italy's declining gold sector may not entirely be in its hands. Note that the beginning of the end came with the turn of the new millennium, which also marked the change of currency from the Lira to the Euro. Deprived of the systematic help given by a weak currency, Italy's gold exports aren't alone in plunging as the single currency union took hold. Competitive devaluation was a classic economic strategy for Italian governments. It has been closed since 2000.

Let me be clear - it is not my intention to talk down the gold sector in Italy, which has done and continues to do much for the Italian economy. But the fact that this sector of excellence has not been able to keep pace with the evolution of the global market it once led proves how much work there is to do in reviving the Italian economy.

The global market is a tough place. But remaining blind to its challenges will not provide a solution. Shackled by the Euro, Italy's export sectors needed to adapt more quickly, embracing the healthy climate of competitiveness which the single market imposed. Once again however, Italy seems genetically incapable of responding as shown by the Alitalia affair.

Alessandra Pilloni

European Operations Executive

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich, Switzerland for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Adrian Ash Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.