QE and the Stock Market - The "Taper" Is Here... This Is What You Need to Know

Stock-Markets / Stock Markets 2013 Dec 19, 2013 - 03:17 PM GMTBy: DailyWealth

Porter Stansberry writes: We knew it would happen eventually... so now what?

Porter Stansberry writes: We knew it would happen eventually... so now what?

Yesterday, I explained how the Federal Reserve's quantitative-easing programs have transferred enormous wealth into the hands of the very rich.

Today, I'm going to show you what's going to happen now that the Fed is beginning to rein in these quantitative-easing bond-buying policies. This is what people refer to as "tapering."

In short, not one single sector of the stock market is completely safe... But there is a "window" of opportunity.

Let me explain...

Since the housing market collapse, the Fed has instituted three separate rounds of quantitative easing... QE1, QE2, and QE3.

The Fed also tried something called "Operation Twist," which attempted to replicate the effects of quantitative easing without printing more money.

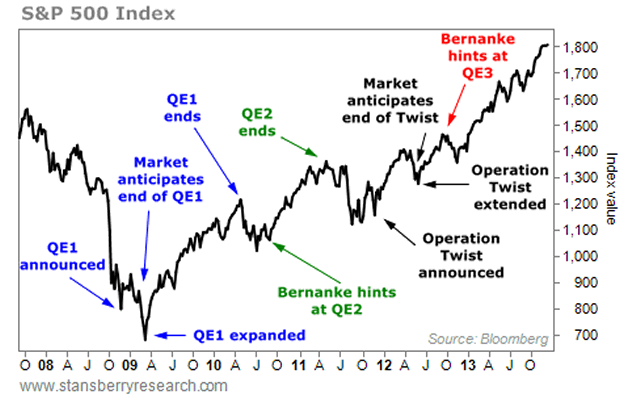

A lot of the extra QE dollars found their way into the equity markets and have driven up stock prices. The chart below shows how the market reacted to the Fed opening and closing of the money spigot...

With trillions of extra dollars sloshing around the economy, some are bound to be dumped into equities and drive up prices. Notice that every peak and valley for the past five years corresponds with a Fed QE action.

You may think that any policy that helps your investment account can't be all bad. But asset surges predicated by dollar printing never work out well.

It's impossible to know when this Fed-induced market exuberance will end. But we know it will.

Even the Fed knows quantitative easing is not sustainable. That's why the Fed has already tried three times before to stop the charade.

And yesterday, the Fed announced that it will be reducing – or "tapering" – QE3 by $5 billion per month. Notice, in the table below, that every time the Fed stops quantitative easing, the equity markets have pulled back.

Specifically, take a look at the periods below marked with gray highlights. The market has dropped throughout each of these "tapered" periods.

The market has obviously been indiscriminately selling whenever the Fed hints at tapering its quantitative easing.

The "tapered" periods in the table above (the rows highlighted in gray) lasted an average of 84 days. And the market lost an average of 16% over those periods.

We examined more than 2,000 large U.S. stocks and 39 industry segments to see if we could spot trends that would improve our performance (or limit the damage) as tapering begins. The results of our analysis can be found in the table below...

Clearly, in times of uncertainty, investors hang onto companies that sell the stuff people really need: utilities, food, and medicine. And they buy the things people can't stop using, like sodas and nicotine. On the other hand, construction-related industries and companies with a lot of interest-rate exposure struggled during the taper periods.

What surprised us was that certain industries had a lot of companies whose stock actually advanced during these periods. You can see this in the column labeled "Percent Winners."

For example, if two out of the 20 companies in a given segment actually had stock-price gains during the taper periods, you'll see 10% (2/20) reflected in the "Percent Winners" column.

Looking at both metrics, our analysis exposed a cluster of industries that all sell mass consumer goods with inelastic demand: big tobacco, beverages, pharmaceuticals, and the stores that sell them. The one thing they have in common is that they can all be growth industries, even in the face of stock-market retrenchment.

Think about the products those companies sell. Marlboros, Cokes, Twinkies, Tylenol... These are not products people stop buying when interest rates rise. And you can buy them at any store on any corner in any town.

That's why, after taking in all the data, we think one of the best ways to play this is to dig into the retailers that sell these goods. Buying the right retailer is like buying a basket of all the products that people need most.

You'll notice the companies in the "Food and Drug Retailers" and "General Retailers" segments lost on average 8%-13% over the Fed's taper periods. That's not too bad compared with the overall market. But when we dug deeper, we noted that 14 companies in these segments enjoyed stock-market gains over the taper periods... and some of the gains were big.

If recent history is any indication, big gains may be hard to come by in the coming months.

But we believe we found the best place to look for opportunity, both during quantitative easing and now that we've reached the "taper."

Regards,

Porter Stansberry

Editor's note: If you'd like more insight and actionable advice from Porter Stansberry, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on how to prosper despite the Fed's inflationary policies. This report will show you how to protect your hard-earned money from what Porter has dubbed the "End of America." Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

peterpalms

21 Dec 13, 23:15 |

Tapering

Tapering is just a synonym for "stealing less" from taxpayers |