Junior Gold Mining Stocks Have Bottomed

Commodities / Gold and Silver Stocks 2014 Jan 16, 2014 - 07:22 PM GMTBy: Jordan_Roy_Byrne

There is no need to beat around the bush. Junior mining stocks have bottomed. The bear market is over. Sure we could be wrong. We’ve been wrong before and will be again. However, the evidence is too compelling and is growing by the day.

There is no need to beat around the bush. Junior mining stocks have bottomed. The bear market is over. Sure we could be wrong. We’ve been wrong before and will be again. However, the evidence is too compelling and is growing by the day.

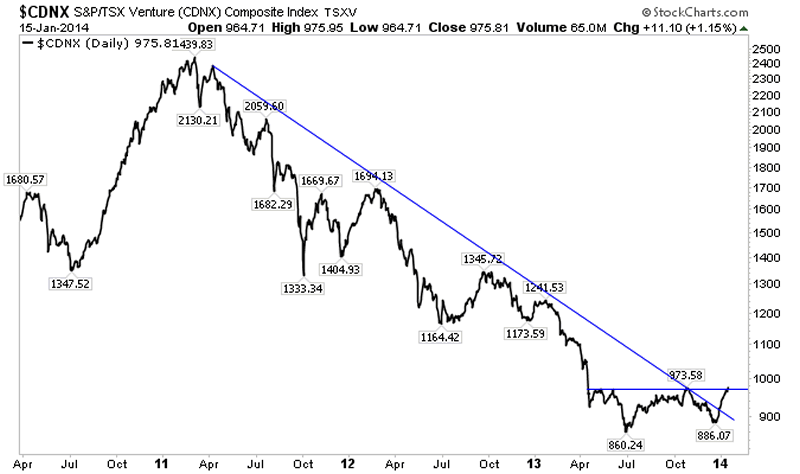

The TSX Venture (CDNX) is the market for juniors in Canada. The market consists of exploration companies focused on precious metals and other minerals, energy companies and some technology companies. It’s not a perfect indicator for the junior mining industry but it’s good enough for the experts. On Thursday the CDNX closed at a nine month high. No, that is not a misprint. The junior market reached a nine month high. It bottomed in late June, made a higher low in December and has surged 10% since.

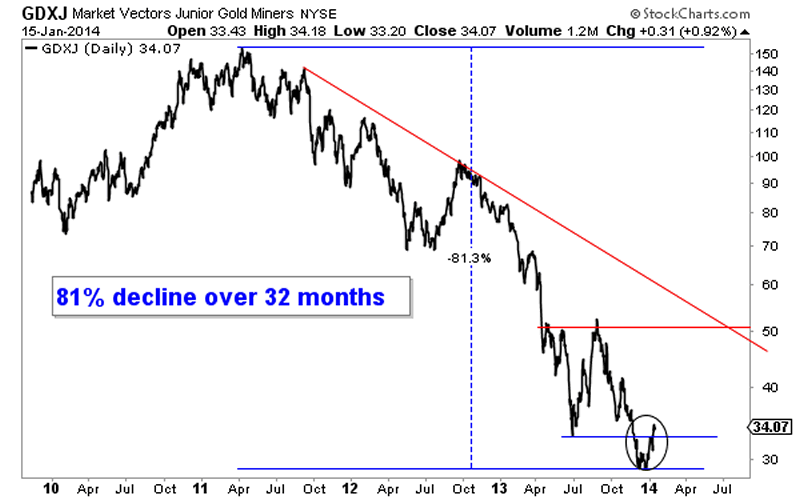

For an American, GDXJ is the proxy for junior gold stocks or junior miners. I like to think of GDXJ as the “senior” or established juniors. The CDNX consists of many stocks trading under $1 and a $100M market cap while GDXJ is mostly comprised of companies in the $100M to $500M market cap range.

GDXJ declined 81% from its April 2011 peak to its December 2013 bottom. As we noted several weeks ago, GDXJ tried to penetrate its December low three times and failed. The market has since rallied back above the previous (June) low. Given the severity of the bear in terms of price and time, extreme negative sentiment and recent bullish price action I believe it is highly likely that the bottom is in.

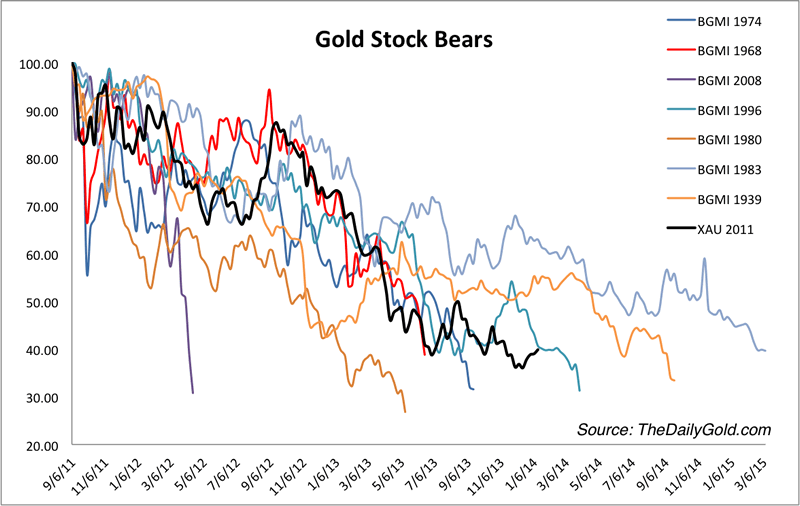

Our frame of reference for the bear, the gold stock bear analogs chart continues to suggest that the bear market in senior gold stocks is all but over.

The juniors (both CDNX and GDXJ) peaked in April or five months before the senior gold producers. Hence, it makes sense that the juniors would bottom first. The assertion from the analogs chart (that the seniors may have bottomed or are very close) gives us further confidence that the juniors have bottomed.

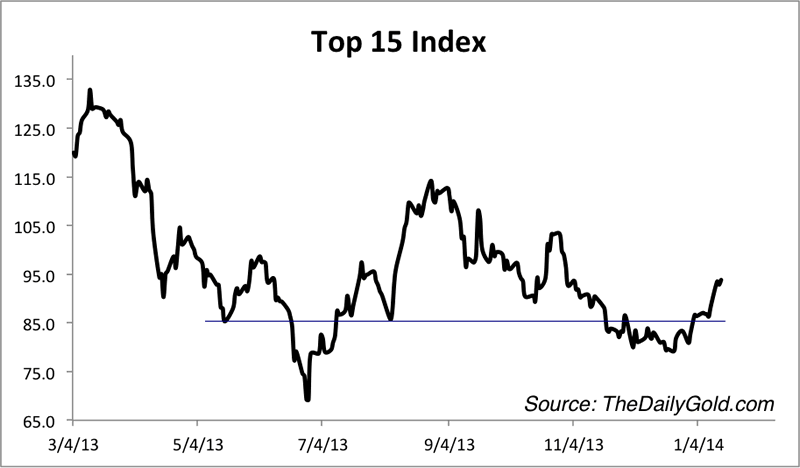

Most of the stocks that we follow bottomed in June. The following chart, which was sent to premium subscribers is an equal weighted index of 15 of our favorite gold and silver stocks. The index bottomed in late June 2013 and made a strong higher low in December. It would have to decline 26% to test the June low.

Extreme bearish sentiment, compelling valuations and an extreme oversold condition can create a compelling contrarian opportunity. However, that opportunity can remain far fetched without some positive price action. We now have the positive price action that allows us to call a bottom in the mining stocks and strongly so in the junior gold stocks. The CDNX looks to have made a real double bottom and closed at a nine month high. GDXJ reversed course after failing to continue a breakdown when the time was ripe. Moreover, as evidenced by our top 15 index, the stronger and higher quality companies are showing leadership. The risk has shifted from getting caught in a final plunge to missing out on the rebound.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.