Bubbleberg News Drivel Masquerading as Financial Reporting

Stock-Markets / Mainstream Media Apr 01, 2014 - 11:57 AM GMTBy: LewRockwell

David A. Stockman writes: One of the evils of massive over-financialization is that it enables Wall Street to scalp vast “rents” from the Main Street economy. These zero sum extractions not only bloat the paper wealth of the 1% but also fund a parasitic bubble finance infrastructure that would largely not exist in a world of free market finance and honest money.

David A. Stockman writes: One of the evils of massive over-financialization is that it enables Wall Street to scalp vast “rents” from the Main Street economy. These zero sum extractions not only bloat the paper wealth of the 1% but also fund a parasitic bubble finance infrastructure that would largely not exist in a world of free market finance and honest money.

The infrastructure of bubble finance can be likened to the illegal drug cartels. In that dystopic world, the immense revenue “surplus” from the 1000-fold elevation of drug prices owing to government enforced scarcity finances a giant but uneconomic apparatus of sourcing, transportation, wholesaling, distribution, corruption, coercion, murder and mayhem that would not even exist in a free market. The latter would only need LTL trucking lines and $900 vending machines.

In this context, the sprawling empire known as Bloomberg LP is the Juarez Cartel of bubble finance. Its lucrative 320,000 terminals and profit-rich $10 billion in revenue are not purely a testament to the extraordinary inventive genius of Michael Bloomberg The Younger. In fact, Bloomberg’s 1981 invention owed a huge debt of gratitude to Richard Nixon and Milton Friedman. It was they who destroyed the Bretton Woods regime of anchored money and global financial discipline that made “Bloombergs” necessary.

Let me explain. Under the fixed exchange rate regime of Bretton Woods—ironically, designed mostly by J.M. Keynes himself with help from Comrade Harry Dexter White—there was no $4 trillion daily currency futures and options market; no interest rate swap monster with $500 trillion outstanding and counting; no gamblers den called the SPX futures pit and all its variants, imitators, derivatives and mutations; no ETF casino for the plodders or multi-trillion market in “bespoke” (OTC) derivatives for the fast money insiders. Indeed, prior to Friedman’s victory for floating central bank money at Camp David in August 1971 there were not even any cash settled equity options at all.

The world of fixed exchange rates between national monies ultimately anchored by the solemn obligation of the US government to redeem dollars for gold at $35 per ounce was happily Bloomberg-free for reasons that are obvious—albeit long forgotten. Importers and exporters did not need currency hedges because the exchange rates never changed. Interest rate swaps did not exist because the Fed did not micro-manage the yield curve. Consequently, there were no central bank generated inefficiencies and anomalies for dealers to arbitrage. Stated differently, interest rate swaps are “sold” not bought, and no dealers were selling.

There were also natural two-way marketsin equities and bonds because the (peacetime) Fed did not peg money market rates or interpose puts, props and bailouts under the price of capital securities. This means that returns to carry trades and high-churn speculation were vastly lower than under the current regime of monetary central planning. Financial gamblers could not buy cheap S&P puts to hedge long positions in mo-mo trades, for example, meaning that free market profits from speculative trading (i.e. hedge funds) would have been meager. Indeed, the profit from “trading the dips” is a gift of the Fed because the underlying chart pattern—mild periodic undulations rising from the lower left to the upper right–is an artifice of central bank bubble finance.

And, in fact, so are all the other distincitive features of the modern equity gambling halls—index baskets, cash-settled options, ETFs, OTCs, HFTs. None of these arose from the free market; they were enabled by central bank promotion of one-way markets—that is, the Greenspan/Bernanke/Yellen “put”. The latter, in turn, is a product of the hoary doctrine called “wealth effects” which would have been laughed out of court by officials like William McChesney Martin who operated in the old world of sound money.

In short, Wall Street’s triumphalist doctrine—claiming that massive financialization of the economy is a product of market innovation and technological advance—is dead wrong. We need “bloombergs” not owing to the good fortuneof high speed computers and Blythe Master’s knack for financial engineering; we are stuck with them owing to the bad fortunethat Nixon and then the rest of the world adopted Milton Friedman’s flawed recipe for monetary central planning.

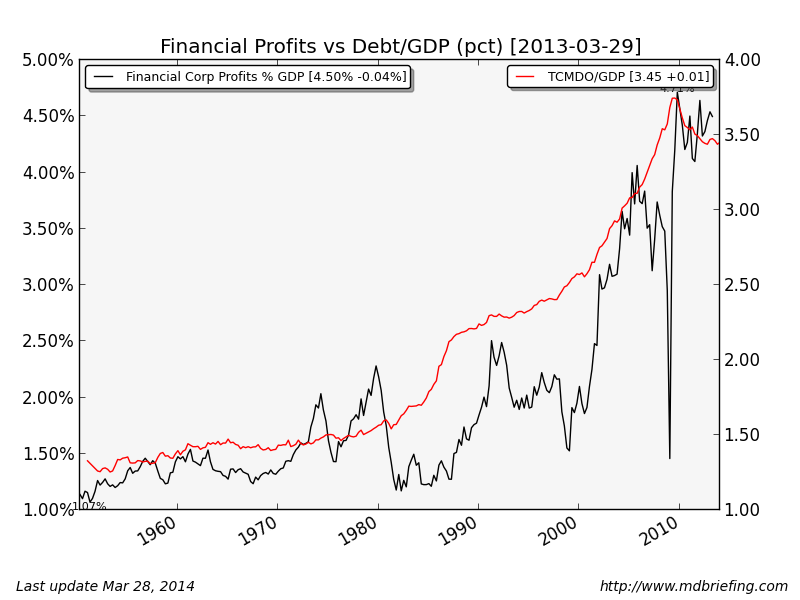

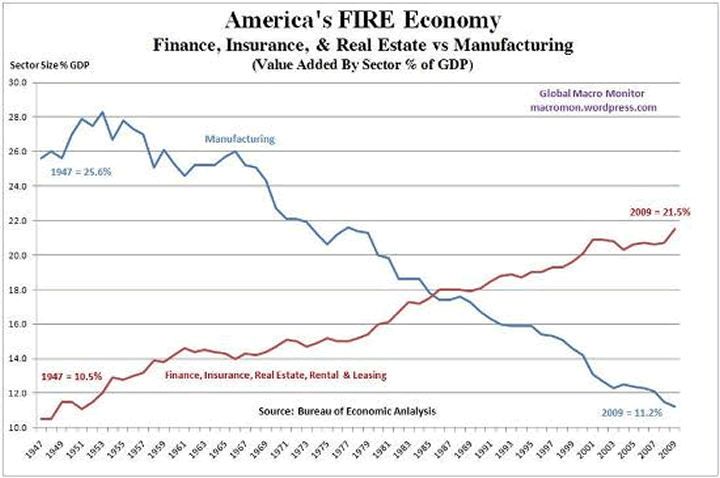

Needless to say, the parabolic rise in financial sector profits from about 1.25% of GDP prior to Camp David to 4.25% of GDP today—call it a round $500 billion per year—is only the tip of the ice-berg. What lies beneath, according to the Commerce Department numbers crunchers, is “value-added” of some $3.75 trillion in the FIRE sector (finance, insurance and real estate), which generates the aforementioned accounting profits and consists primarily of compensation.

Here the uplift is even more dramatic. The FIRE sector’s 800 basis point gain from 14% of GDP in 1970 to 22% at present rounds to about $1.4 trillion. That’s the bloat from financialization—which is to say, the infrastructure of bubble finance. Embedded in that bloat is everything from the running cost of fund-of-funds and family offices (i.e. private chefs, ”investor” conferences at tony resorts etc.) to the vast network of bankers, brokers, appraisers, title insurers, settlement lawyers and escrow agents that tend the home mortgage churning machine.

In the latter case, the untoward impact of financialization on the world of George Bailey’s Savings and Loan can not be gainsaid. Back then, people took out mortgages and paid them off a bit at a time over 30 years owing to the fact that there was no basis for today’s serial “mortgage refi”. On the free market, mortgages would either carry floating rates or have embedded call protection on fixed rates.

Moreover, the basis for today’s serial refi would not exist. Interest rates would have no directional trend in an environment where they represent the market clearing price, balancing the supply of savings and the demand for loanable funds.

By contrast, the artificial downward-sloping trend in mortgage rates in recent decades has been an intentional outcome of the Fed’s interest rate rigging policies designed to goose housing prices and spur homebuilding. During the 55 months that elapsed between Lehman’s failure and April 2013, for instance, the Freddie Mac reference rate for 30-year mortgages dropped almost linearly from 6.5% to 3.3%.

As it happened, this massive inducement to home-borrowing did not generate much lift in the home-building sector because the stock of residential homes is massively over-built from the first housing bubble. But it did generate a substantial “refi” wave owing to the sheer math of mortgage finance. Indeed, the Bernanke-Yellen regime has made no bones about its alleged success in driving down the 10-year treasury benchmark rate and thereby reflating the housing market.

In truth, the monetary politburo induced nothing more than another round of mortgage churnamong a small sub-set of existing homeowners. There are approximately 115 million households in the US—40 million of which are renters and 25 million own their homes free and clear. Yet even among the 50 million households with mortgages, upwards of 25 million are still under-water or do not have enough positive equity to cover transactions costs and meet today’s more stringent loan-to-value requirements.

So at the end of the day, the refi churn machine has arbitrarily conferred debt service relief on a randomly selected sub-set of perhaps 10-20% of households—many of which have engaged in serial refi for several decades now. This serves no evident principle of public policy based on need or merit. But that doesn’t matter to the monetary central planners. Their only goal is to stimulate GDP as measured by the government stat mills—even if what they are measuring is more bloat from financialization.

In fact, that’s about all the Fed’s housing stimulus is now generating. For nearly 40 years, household mortgage borrowing did stimulate measured GDP. During that span the ratio of debt/wage and salary income was ratched-up by periodic Fed reflations from a pre-1970 level of about 80 percent to a peak of 210% by 2007.

But now that ”peak” debt has been reached and the household leverage ratio has fallen back slightly to about 180%, what the Fed’s ministrations produce is only a tepid amount of GDP from financialization; that is, we get a dollop of GDP from the pointless churning of home mortgages—a financial engineering process that does not create new wealth, but simply siphons existing wealth into activity among loan brokers, appraisers and real estate attorneys that the BEA is pleased to call GDP.

.

Indeed, the elephant in the room lurking behind the rising FIRE line in the graph above is the nation’s current $59 trillion in credit market debt. At 3.5 turns of GDP it represents a vast aberration of bubble finance, and compares to a healthy ratio of 1.5 turns that prevailed for more than a century before 1971.

These two extra turns of combined household, business, finance and government debt are not simply statistical curiosities. It represents $30 trillion of incremental debt that not only weighs heavily on the stagnating incomes of borrowers, but also represents a vast inventory of loans, bonds, hypothecations, re-hypothecations, derivatives and securitizations. It goes without saying that this immense inventory must be constantly tended, serviced, repackaged, extended, pretended and re-sliced and re-diced. Juggling the debt and chasing the “assets” which it funds and hypothecates is what financialization does.

As is well-known, the “Bloombergs” at the center of the bubble finance casino are so immensely profitable that they generate the equivalent of a drug lord’s surplus— which, in turn, funds the extensive apparatus of financial information and news production that comprise the Bloomberg empire. But at the end of the day, Bloomberg News LP is only a vertically integrated representation of the entire infrastructure of bubble finance. Reuters, the Financial Times, CNBC, Dow-Jones/News Corp and Inside Mortgage Finance are all part of the food-chain by which the bloated financial sector maintains and services itself.

It is not surprising, therefore, that the scribes and pundits employed by the bubble infrastructure cannot see beyond it; that CNBC can find an endless supply of fund managers who are buying the dips and following the Fed’s promise to keep interest rates lower longer and stock prices rising higher forever; that a corrupt financial market in which all interest rates are pegged and rigged by the Fed is taken for granted as the natural order of economics; that government borrowing to stimulate and support the economy is viewed as essential regardless of its baleful future consequences; that arbitrary central banking targets like 2% inflation as an instrument of optimum GDP growth or the bogeyman of “deflation” are embraced uncritically as axiomatic; or that economic absurdities such as zero money market interest rates for seven years running are rarely even noted.

In short, the vast infrastructure of bubble finance bends, shapes and curates the daily narrative so thoroughly that the denizens on the stage set do not even notice its vast artificiality. Its just one day at a time, and one more fix by the monetary and fiscal authorities to keep the bubble inflating, or at least stable.

In that context comes the monetary insanity of Abenomics and the economic freak-show of Japan Inc. After 20 years of relentless borrowing and money printing, it teeters on the edge of an economic abyss, shackled with massive public debt, a shrinking/aging population, a rapidly depleting savings pool, comically low interest rates on its public debt and a truly horrid fiscal posture—namely, it will need to borrow 50% of every dime its spends in the year ahead, even with the long-overdue rise of consumption taxes beginning in April.

Into that miasma comes a Bloomberg scribe, Matthew Klein, offering to essay on the upcoming baby-step toward fiscal sanity in Japan. The headline says it all:

Japan Is Taxing Itself Into Trouble

And then there follows more of the mindless narrative:

On April 1, Japan’s national sales tax will rise to 8 percent from 5 percent. Unless wages rise by an equal amount, the effect will be a drop in consumer spending…. Even if this isn’t enough to push the economy into recession, raising the sales tax is a bad move that will undermine Prime Minister Shinzo Abe’s agenda for the world’s third-largest economy….If anything, the government should be cutting taxes now

Young Matthew also notes that the Japanese people have not been astute enough to recognize what Wall Street and London gunslingers intuitively understood. That is, with the BOJ expanding its balance sheet at three times the rate relative to GDP of the Fed’s mad money printing, stock prices would soar and wealth effects would be had by all:

For instance, Japanese have been large net sellers of Japanese stocks ever since the big rally that began in the fall of 2012. Foreign investors have more faith in Abenomics than the people with the most at stake.

Then there is the news that victory over ”deflation” is in sight. Never mind that there has never been any sustained consumer price deflation in Japan, and that the current index of about 99.0 stands almost at the very spot it occupied 21 years ago in March 1993—with only tiny undulations during the intervening years:

A more encouraging bit of news is the rise in consumer prices, excluding food and energy. This measure of inflation has accelerated to 0.7 percent annually — its fastest pace since 1998, although still slower than the official target of 2 percent…..

On the drivel meanders. Nowhere is it noted that Japan’s scheduled consumption tax rise is a bitter, chronically deferred, end-of-the line fiscal necessity; that sustained 2% inflation would destroy its monstrous $10 trillion government bond market; and that Abenomics has already manifestly failed.

By trashing the Yen, Abenomics has imported massive commodity inflation onto an island that has no hydrocarbons, industrial raw materials or even operational nuke plants. Consequently, real wages are falling at an even faster rates than before and the massive debt burdens created by decades of bubble finance push the world’s largest retirement community toward its final demise.

This bit of tommyrot was published under Bloomberg Views—perhaps suggesting that it represents opinion, not hard news. But that’s just the trouble. The vast infrastructure of bubble finance generates an overpowering consensus of opinion that is utterly blind to the very bubble in which it resides.

Former Congressman David A. Stockman was Reagan's OMB director, which he wrote about in his best-selling book, The Triumph of Politics. His latest book is The Great Deformation: The Corruption of Capitalism in America. He's the editor and publisher of the new David Stockman's Contra Corner. He was an original partner in the Blackstone Group, and reads LRC the first thing every morning.

David A. Stockman

© 2014 Copyright David A. Stockman- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.