Stock Markets Headed Lower into June-Sell in May and Go Away

Stock-Markets / Global Stock Markets Apr 30, 2008 - 06:01 AM GMTBy: Donald_W_Dony

The old stock trader's saying of “sell in May and walk away” appears to be unfolding right on schedule this year. And with the expected major low coming in June, for the next 2 months, investors may wish to sit on the sidelines to watch the show and keep their investing on hold. If the last three major lows (March 2007, August 2007 and January 2008) were any example, the trough in June could be quite interesting. No one can say that this market is boring.

The old stock trader's saying of “sell in May and walk away” appears to be unfolding right on schedule this year. And with the expected major low coming in June, for the next 2 months, investors may wish to sit on the sidelines to watch the show and keep their investing on hold. If the last three major lows (March 2007, August 2007 and January 2008) were any example, the trough in June could be quite interesting. No one can say that this market is boring.

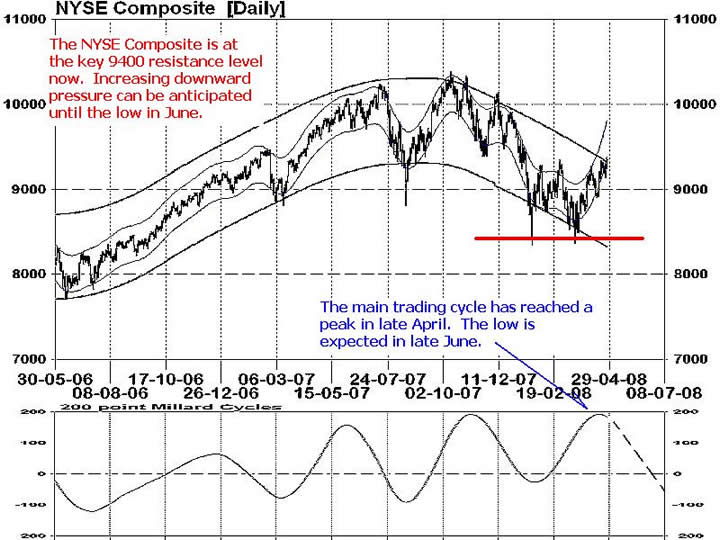

Since 2007, North American equity markets have been moving to a dominant 5-month trading cycle. With recent significant lows in August 2007 and January 2008, the next anticipated trough in late June for U.S. markets (Chart 1) could hold some interesting consequences depending on how this low plays out. Let me explain.

Should the cycle low in late June break down below the 8,330 support line set in January for the NYSE Composite, and then this drop would signal that the bear market is gaining strength and lower numbers can be expected over the summer.

However, if the anticipated low in June holds at the 8330 level, then there is a slightly brighter picture developing for the equity markets. As technical models points to mild upward pressure beginning in July, the New York Stock Exchange Composite would likely find a bear reprieve over the summer until the gravitational pull begins again for the next major low in September.

The outcome of the late June trough will be greatly dictated by what happens in this month. If selling pressure builds in earnest, you can bet that the key 8330 will be broken. The opposite also applies. So, May is the guiding month. Watch it closely.

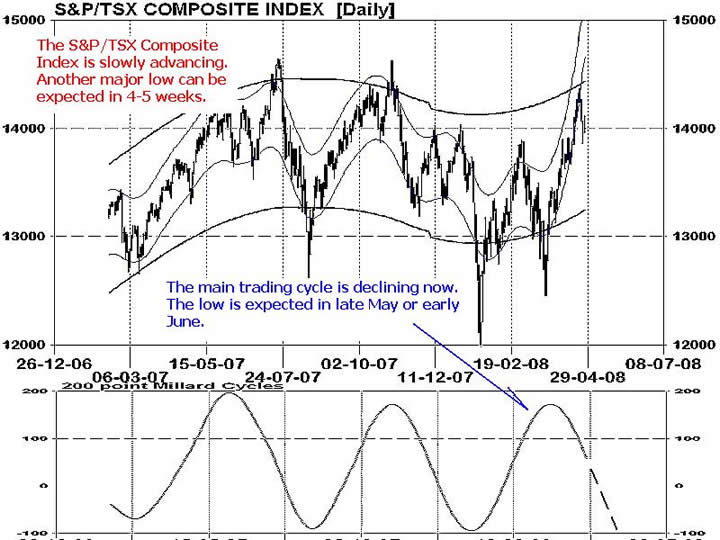

With so much negative talk about the U.S. economy pulling down Canada alone with it, why is this market advancing so high? It certainly is not because of the normal market leaders (financials and industrials) pushing up. Their performance lately has been anything but stellar. The reason for the rally is very finite. Commodities and particularly energy has allowed the S&P/TSX Composite (Chart 2) to move above the quagmire that has gripped most equity markets around the world. In fact, outside of Brazil and Mexico (both commodity-based markets) Canada's TSX is a bit of a poster child of performance.

But this de-linking of performance from the much larger U.S. markets (and for that matter, most global indexes) is very fragile. Because the lift that the S&P/TSX Composite is receiving is coming from such a narrow group of companies, this recent rise is more like a one legged jump. Any weakness in commodities could topple this energy heavy composite down faster than a tripped acrobat.

For those individuals who want to invest in the Canadian market, they will need to use a rife and certainly not a shotgun to be successful now. The strength is in materials, natural resources and that's it.

During this anticipated major cycle low coming in June, I expect the S&P/TSX Composite to pullback to the 13,400-13,650 zone. There is good solid support at this area. Technical models suggest that July appears to be a time to stabilize.

This article is part of the May newsletter. Additional research can be found on commodities, the economy and global equities in the up coming May newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.