The Truth About the U.S. Jobs Report and the Economy

Stock-Markets / Stock Markets 2014 Jun 07, 2014 - 01:07 PM GMTBy: Sy_Harding

Let’s see now.

Let’s see now.

Last week, the Commerce Department unexpectedly revised first quarter GDP growth down to negative, -1.0%. The Fed reported its National Business Activity Index, a weighted average of 85 economic indicators the Fed believes are important, fell from +.34 in March to -.32 in April. The Conference Board’s Consumer Confidence report showed that those who plan to buy a home in the next six months declined to 4.9%, its lowest level in 21 months, and those who plan to buy major appliances fell to its lowest level since 2011.

This week, first quarter productivity was revised down sharply to 3.2%, its lowest level in six years, and the U.S. trade deficit for March was revised up sharply, from the originally reported $40.4 billion to $44.2 billion. The trade deficit for April unexpectedly surged still higher, to $47.2 billion (versus the consensus forecast for a sharp decline to $41 billion). Additionally, construction spending was up only 0.2% in April, missing the consensus forecast of 0.8%.

The reports have economists expecting 1st quarter GDP will be revised down even further into negative territory, and already rethinking their forecasts for the 2nd quarter.

Yet Friday’s jobs report of 217,000 new jobs in May is being headlined as providing evidence that the economy is recovering from the winter slowdown.

Huh? There were 222,000 jobs created in February, 203,000 in March, and 282,000 in April. They certainly were not signs of the economy recovering from the winter slowdown. Indeed as those jobs were being created, the economy worsened.

Why then would a decline from 282,000 new jobs in April to 217,000 in May be a sign of recovery, especially when so many disappointing reports and downgrades are saying otherwise?

The truth is that the Federal Reserve has a real concern about the jobs picture, and the worry is not in the overall employment numbers.

The problem is the employment picture in construction. The housing industry is a major driving force of the economy, and a leading indicator for the economy. The lack of progress in that industry is therefore an understandable concern.

The St Louis Fed conducts studies of how different sectors of the economy normally contribute to recoveries from recession. In an article reporting on the current situation (www.stlouisfed.org), Fed research officer Carlos Garriga states that, “One notorious case of malfunctioning is in the construction sector, which currently has a very different pattern of recovery compared to other sectors, and compared to its impact in previous recoveries.”

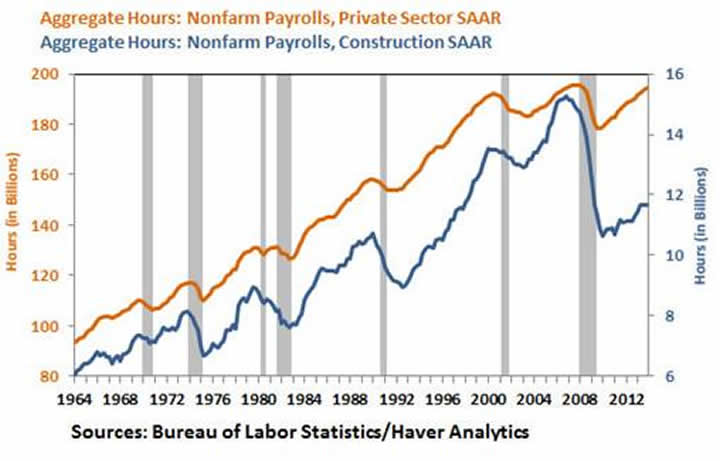

One of the methods the Fed uses is to track the progress of employment hours in various sectors compared to previous recoveries.

The current comparison of the recovery in construction jobs to the overall recovery of private sector jobs is not an encouraging picture. (The vertical gray lines are recessions).

Notice how as previous recessions approached, construction jobs usually led the way down, and then plunged more severely than overall jobs. In the recoveries from those recessions, construction payrolls led overall jobs recovery, and accelerated faster than overall jobs.

That confirms the frequent observations that the housing industry tends to lead the economy in both directions.

It also confirms how seriously construction and the housing industry are lagging behind in the current recovery, even though overall employment has returned to pre-recession levels.

Garriga notes that, “The plunge in the housing market and impact of a malfunctioning constructions sector, which is largely interconnected with other sectors, has important implications for aggregate economic activity. This is because the production of residential and non-residential real estate requires not only physical goods, but also financial intermediation and services.”

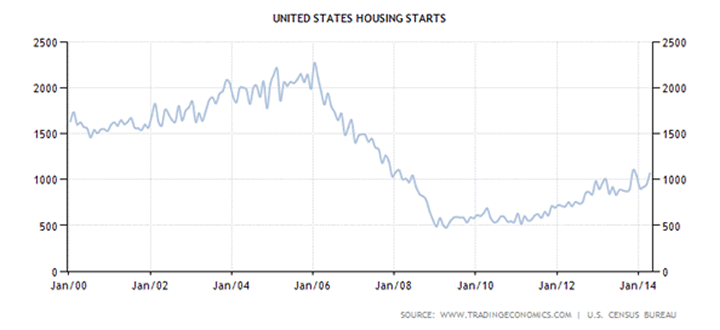

Other studies similarly show how revival in the housing industry is still missing in this recovery. Although occasional headlines of a rise in housing sales or starts create temporary excitement, the fact is that new housing starts are still 50% below the activity in the 2001 recession, 14 years ago, let alone during the improving economy of 2002 -2006.

But not so fast.

Let’s look at the quality of the jobs the economic recovery is now depending on. Once again in May, the growth was mostly in low-paying restaurant, leisure, healthcare, and temp jobs. Once again, employment in good-paying sectors, construction, manufacturing, and government, lagged behind. Still no improvement in construction jobs is a particular concern.

Which brings me to another set of statistics the Fed tracks and is worried about, the percentage of the population that has jobs, the so-called ‘participation rate’, which includes such factors as population growth, and the number of people who have dropped out of the labor force. It’s an important measurement of the percentage of the population that has buying power from jobs to participate in the consumer spending that accounts for 70% of the economy.

The participation rate was unchanged at 62.8% in May, a 36-year low.

This the St Louis Fed’s chart of the percentage of the population that has jobs.

Wall Street and the media love the jobs report. The Fed will no doubt say publicly that it likes the report. Therefore, the initial reaction of investors to the report is positive. However, to remain so they have to ignore both the real employment picture, and the additional troubling economic reports and downgrades of the last two weeks.

I remind you of the historical pattern surrounding the monthly jobs report. It almost always creates a one to three day triple-digit move by the Dow in one direction or the other. The other side of the pattern is that it is almost always reversed over subsequent days, as the market goes back to whatever was its focus prior to the report.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.