U.S. Unemployment - They’re Lying To Us

Economics / Unemployment Jun 17, 2014 - 02:27 PM GMTBy: John_Rubino

One of the frustrating things about the monthly US jobs report is the way everyone focuses on the wrong number. The headline says “unemployment falls…” which sounds great, while the small print, which almost no one seems to read, explains that most of the improvement is due to people dropping out of the labor force. The number of new jobs created is frequently small or negative.

It’s understandable — though of course not admirable — that the government would try to spin its economic statistics to make itself look good. What is less understandable is why the media, whose job is supposedly to report the truth, are willing to take the lie at face value.

So it’s worth noting when someone breaks from the pack and actually analyzes the data, as the New York Times did today:

Measuring Recovery? Count the Employed, Not the Unemployed

South Carolina’s unemployment rate dropped to 5.3 percent in April, lower than in December 2007, when it stood at 5.5 percent on the eve of the Great Recession.The share of South Carolina adults with jobs, however, has barely rebounded.

The same contrast is visible in most states. Unemployment rates, the most familiar and famous of labor market indicators, are nearing pre-recession lows. But the shares of adults with jobs — or employment rates — look much less healthy.

The reason is that the numbers are not quite two sides of a coin. The employment rate counts everyone with a job, while the unemployment rate counts only people actively seeking work. It excludes most people who are unemployed.

After most recessions, the numbers have moved in sync as the share of the population neither working nor looking has remained fairly constant. But after this recession, the middle ground has ballooned as fewer people try to find jobs.

As a result, the employment rate has become the more accurate indicator of the nation’s sluggish and perhaps permanently incomplete economic recovery.

It shows that the economy is improving. Employment rates have climbed above the post-recession nadir in every state, although the improvements are often quite small. In Mississippi, the employment rate is just 0.1 percent above its recent low.

It also shows that the recovery has a long way to go. Employment rates have rebounded in some states with strong growth, like Utah, Nebraska and Montana. But only three states — Maine, Texas and Utah — have retraced more than half their losses.

The slow progress hints at a bleak reality. Most economists do not expect employment rates to rebound completely. A growing share of adults is too old to work, because baby boomers are aging into retirement while fewer immigrants are arriving to take their places in the work force. The share of workers claiming disability benefits, or retiring early, also increased sharply in recent years.

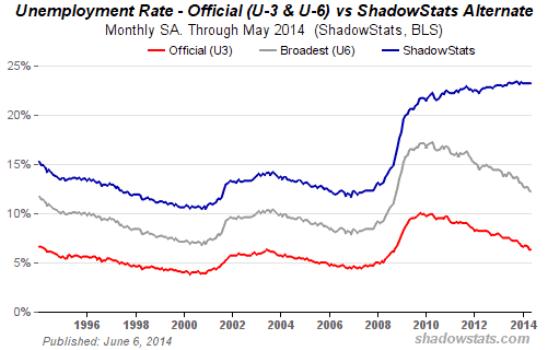

Here’s a chart from John Williams at ShadowStats showing how unemployment would look if the government counted the people dropping out of the workforce as unemployed. The blue line includes all drop-outs, and is not only at Depression-era levels but is still rising.

In an honest world, this “bleak reality,” as the New York Times puts it, would be the story. And though the Times omits the obvious discussion of why the government is focusing on the wrong number, the paper still deserves recognition for lifting the curtain a bit.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.