U.S. Dollar, Gold and Stocks Most Important Market Analysis Update Ever!

Stock-Markets / Financial Markets 2014 Jul 01, 2014 - 02:50 PM GMTBy: David_Petch

A few notes first off...the US Dollar Index has broken below 80.0, but for this to mean anything, the US Dollar must close below 79.40 on a weekly basis. The critical levels of upper support and resistance are so tight right now, that the volatility we have seen has caused many players to go long when its wrong and go short when they should abort. The trend finally does "appear" as if the 79.40 level will break, but nothing is better than waiting for confirmation than speculation.

A few notes first off...the US Dollar Index has broken below 80.0, but for this to mean anything, the US Dollar must close below 79.40 on a weekly basis. The critical levels of upper support and resistance are so tight right now, that the volatility we have seen has caused many players to go long when its wrong and go short when they should abort. The trend finally does "appear" as if the 79.40 level will break, but nothing is better than waiting for confirmation than speculation.

If the US Dollar Index does go lower, then this would allow US exports to become cheaper and further enhance the stock market. The note below is very important, so please consider this: a decline in the US Dollar Index from 80.0 to 73.0 represents a loss of 8.75%. If the S&P were to retain its S&P/US Dollar Index valuation, then it would have to rise from 1960 to 2148. So even though the S&P could rise to this level, which remains our longer-term target into August 2015 next year (Please Google Contacting Fibonacci Spiral (CFS) and CFS chiral inversion with my name to get an understanding of this longer-term stock market cycle and its implications for how things unfold into 2020), it merely becomes an extension based upon a declining currency. If the US economy strengthens, then this number could become even higher.

The outcome for such an event if it does unfold as expected (things have been going as expected, just a few bumps in the road have happened) will result in many other regions of the globe experiencing sharp reductions in global GDP and rising energy prices (since oil is primarily priced in US Dollars). Rising energy costs are instrumental in throwing the global economy into a deflationary spiral, coupled to demographics so a sharp spike in energy prices to $150-160/barrel (our target for next year) is seen as the catalyst. Based upon the chiral inversion that the CFS had last year, it is expected the market tops out next year, followed by a series of lower lows in 2016, 2018, 2019 and 2020 (3,2,1,1 to complete the Fibonacci spiral). This would be expected for the broad stock market indices of the US and not necessarily expected for commodities or their related stocks, particularly gold and silver.

A shift into gold and silver as a store of value will happen en masse once people see that governments will do whatever they can to try to steal the wealth of citizens. This will raise their sought value, alongside stocks that mine gold and silver.

The very last few charts of this update provides an update of the Elliott Wave count for the S&P 500 Index. I did not understand how this count was possible because I really doubted it. So far, it seems to be holding out and does have some interesting twists over the next 10-13 months if things continue to unfold in somewhat of an expected fashion, then the period of time between 2015 and 2020 will not be nice.

If we do get a 5 year period of cycling deflation/inflation, with the overall trend being deflationary, then keeping money in cash equivalent funds will be of utmost importance for preserving wealth. For those who can time things right, buying near the coming bottoms and selling near their short-term tops stand to generate significant returns. For those that have pension funds or RRSP's LIRA's etc. that are are defined contribution plans (i.e. YOUR money, not money thrown into corporate or unionized pots that are invested for everyone (think pyramid scheme)) the above may work well. In the end, those with defined contribution plans for their own pensions may see government take them over and put them into a pot...this is out of everyone's control, but one can only do the best to preserve what they have.

Continue to pay down debt and minimally invest money into RRSP's or LIRA's as this could be taken over by government. Keep money in on hand investments and of course, continue to accumulate gold and silver bullion. This piece should keep everyone afloat with knowledge for what to expect over the coming 12-14 months out.

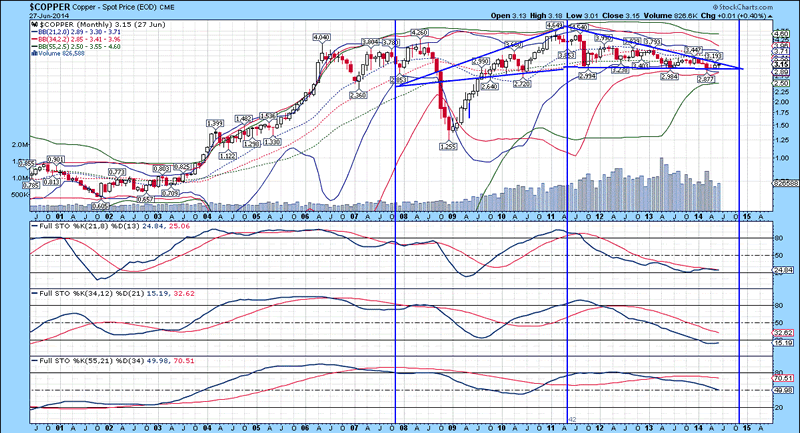

Copper Chart

I thought I would include the monthly chart of copper, because today it broke out of this very long diametric triangle structure, that has a measured move up to $4.80/pound if this analysis is correct. Bollinger bands are not providing any indication of trend, but a pop above the upper trend line (which is what has happened today) should provide further bullishness in this metal. Nickel and other base metals are rising, so copper is one of the most critical to confirm this trend. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in all three instances. Extrapolation of the %K trend in stochastic 1 has yet to rise above the %D, but follow through over the next few months in copper prices would be enough to indicate a change in trend. The latter half of the diametric triangle pattern (not a diametric Elliott Wave triangle) has seen an evermore narrowing of the trading range in price. Given the way everything is expected to occur over the coming year (higher inflation due to a declining US Dollar, which further fans the global economy due to more potential for the US to export goods at cheaper prices), it stands to reason that copper prices head higher. We have one copper stock (producer/explorer) that we follow that trades well below $1/share but has significant opportunity for rising in price, pending it is not bought out beforehand.

Gold Ratios

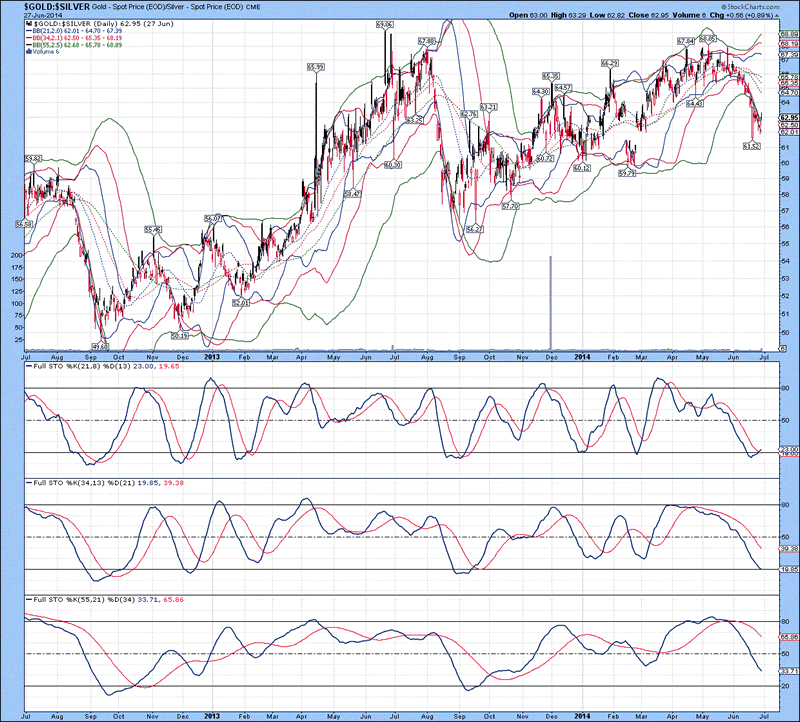

The daily chart of the gold/silver ratio is shown below, with several price excursions beyond lower Bollinger bands over the past week strongly suggests an oversold condition has been generated, which should see gold outperform silver over the course of the next few weeks. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K above the %D in 1 and beneath the %D in 2 and 3. Although there could be a change in trend with respect to the ratio, weakness could remain in effect, with a longer-term trend being down (i.e. Silver would outperform gold under this scenario).

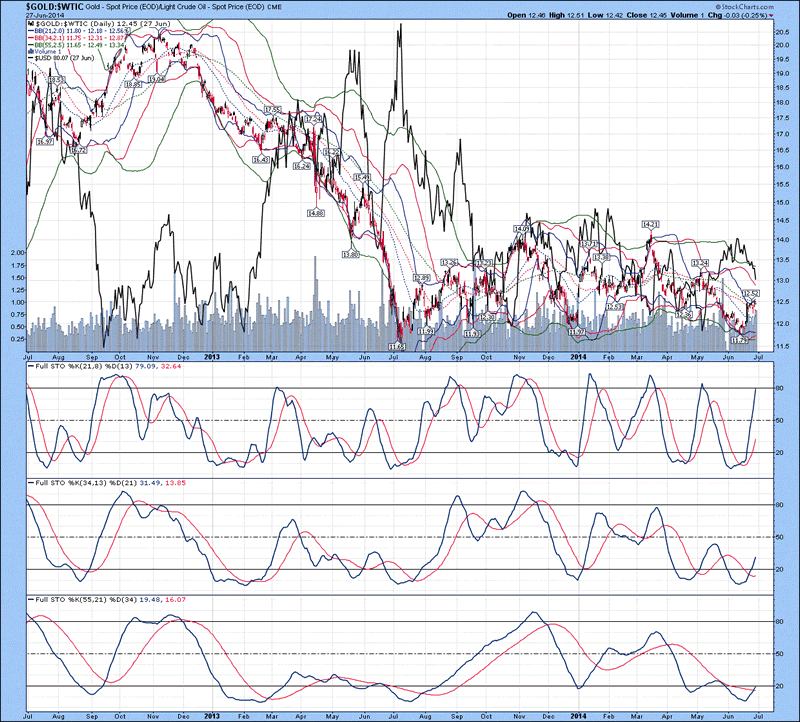

The daily chart of the gold/oil ratio index is shown below, with the US Dollar Index denoted in black. Bollinger bands are providing no indication of trend, while the %K in all three stochastics are above the %D, indicating gold is likely to continue outperforming oil over the next 5-7 weeks (based upon the depth of the %K in stochastic 3). The ratio is likely to only rise no higher than 14 over the short-term, which would represent 12% higher gold prices than current levels, assuming oil remains fixed around $105/barrel...that would work out to $1484/ounce, which is right in line with the expected high for gold over the course of the next 12-14 months. Since gold stocks generally outperform gold by a factor of 3, that would suggest the HUI tacks on around 36% above current levels, which works out to a move to 320. Things finally appear to be pointing towards higher commodity prices, but remember, THIS IS ONLY A TRADE UNTIL AROUND THIS TIME NEXT YEAR, because from late 2015 and into 2020, a severe global contraction will likely result in a bear market across many fronts. Precious metals are likely to rise in value as fewer people trust government and a rush into tangibles happens.

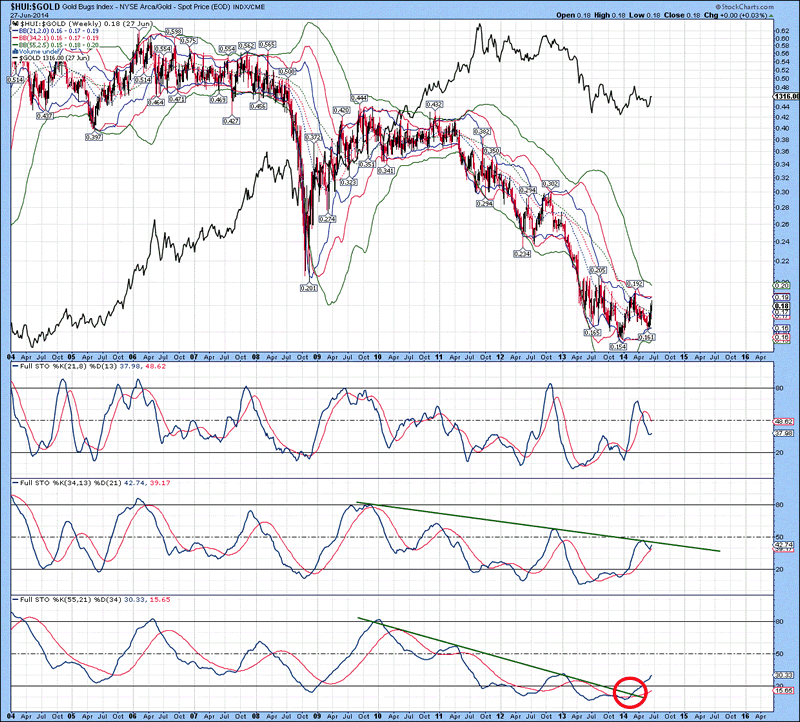

The weekly chart of the HUI/gold ratio is shown below, with gold denoted in black. This is probably the most important chart in the Universe for those who hold precious metal stocks, because it gives an indication of whether or not shares will outperform gold on a relative basis. Bollinger bands are extremely tight as a base has been built over the past 12 months. Based upon this, a move higher is very likely since lower lows did not happen. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in 1 and above the %D in 2 and 3. Down trend lines for the %K in stochastics 2 and 3 are included which illustrates the %K in stochastic 3 breaking above its downtrend line. Notice the %K in stochastic 2 was recently repelled by this downtrend line, yet has curled up and appears set to break higher. Whenever a downtrend line setup is broken first by a longer-term setting, one must wait for confirmation from the shorter term indicator (stochastic 2 in our case). Based upon this reversal, it appears that gold stocks are on track to outperform gold during the latter half of 2014 and the first half of 2015. Things could reverse, but everything is aligning to suggest this scenario does not happen until around August 2015 (Which also aligns with the CFS cycle I discovered having a chiral inversion last year).

Gold

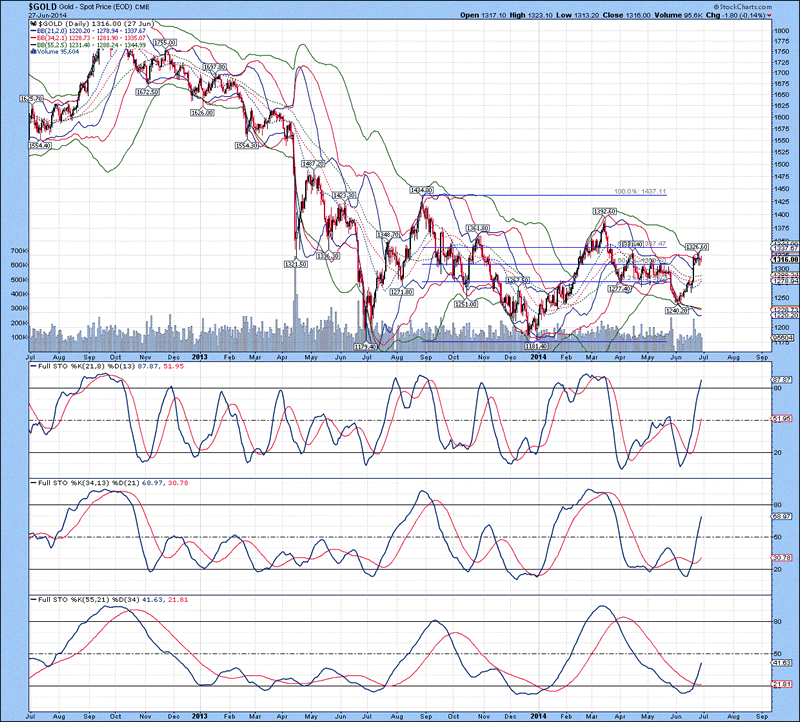

The daily chart of gold is shown below, with the upper 21 MA Bollinger band above the 34 MA Bollinger band, indicating a short-term overbought condition is developing. It is important to note that all three lower Bollinger bands are in close proximity to each other well beneath the current price, with all stochastics rising, indicates the uptrend in gold is only starting. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K above the %D in all three instances. Extrapolation of the %K trend in stochastics 2 and 3 suggest anywhere from 5-7 weeks of continued upside before any sort of a top is put in place. The expected top in gold is around $1500/ounce, which was last seen around May 2013 (yes, slightly shy of the target, but close enough). From a structural perspective, there is only one higher low put in place, with no higher high. We need to see a close above $1393 in order to have something qualify as a higher high, which in turn would provide cementing evidence that a turn in gold has happened.

The weekly chart of gold is shown below, with Bollinger bands not providing any indication of trend. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in 1 and above the %D in 2 and 3. Extrapolation of the %K trend in stochastics 2 and 3 suggest further sideways to upward price action over the course of the next 4-6 months, potentially longer, depending upon how long it takes the US Dollar Index to reach its target of 73.0, based upon the twin head and shoulders pattern that formed over the past few years.

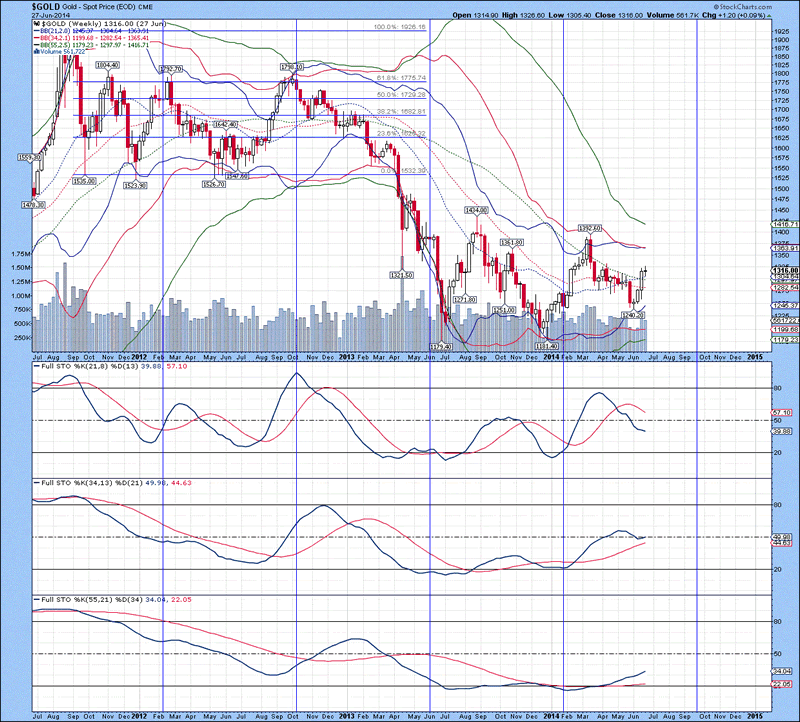

The monthly chart of the gold is shown below, with the lower 21 MA Bollinger band still beneath the lower 34 MA Bollinger band (which is now 10 months), indicates an extremely oversold condition has been generated. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in all three instances. Although the monthly chart provides no indication of a reversal in trend, the Bollinger band setup clearly is a bullish indication for a reversal...monthly charts are like a large ship like the Titanic trying to turn around, while a smaller vessel, like a sailboat (daily charts) can cut in and out quickly of the wind to change course. The trend in gold appears set to move higher and this hinges upon the fate of the US Dollar. For those waiting for a sign, when the US Dollar Index has a weekly close beneath 79.40, it should pave the way for a decline to 73.0.

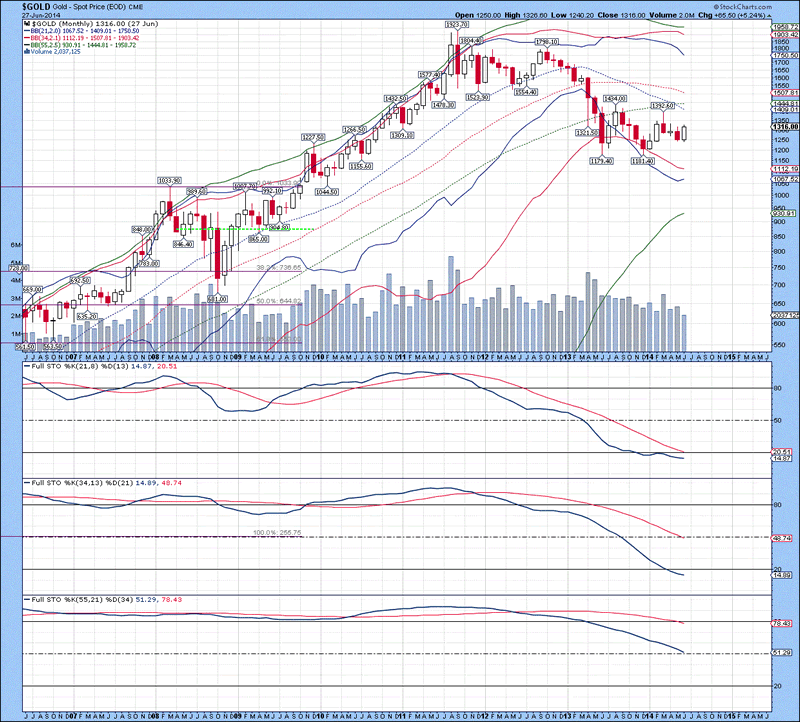

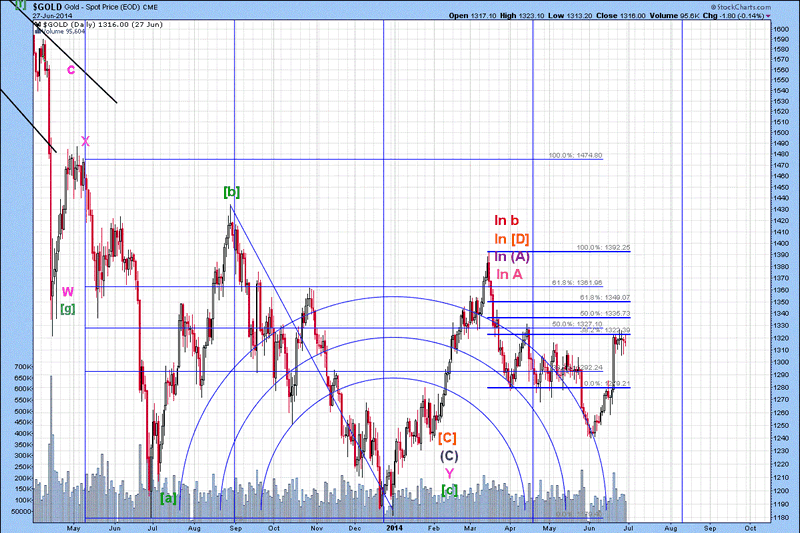

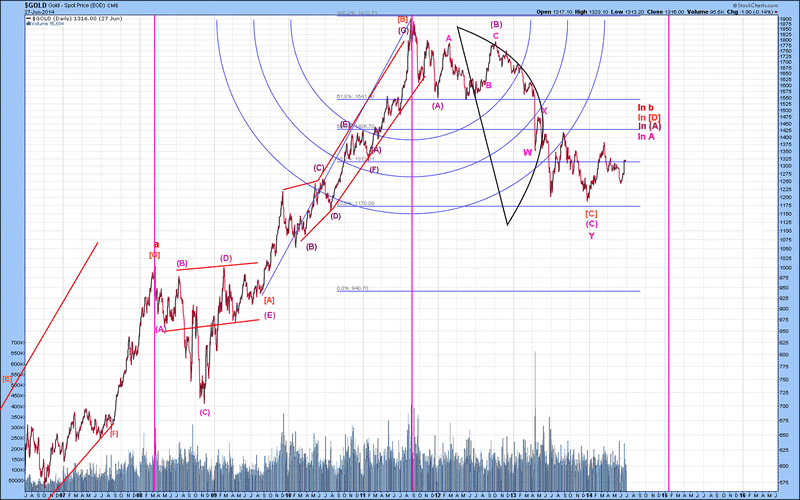

The short-term Elliott Wave count of gold is shown below, with wave [D].b thought to be forming. I am uncertain whether or not wave [C] is correctly positioned where it is (slightly lower than indicated towards the 2014 low) or if it just ended in June. I am going with the former thought, with the premise that wave [D] has been forming for the past 6 months...this may be wrong, but will merely be semantics come 12-14 months from now. The minimum upside price objective for wave [D] is $1500/ounce, based exclusively on the US Dollar Index declining to 73.0. Thrown in significantly higher oil prices and some geopolitical tension, then it could rise to $1600-1700/ounce.

The mid-term Elliott Wave count of gold is shown below, wave [D] thought to be forming at present. The entire move from 2008 until present is thought to be a part of the same corrective wave structure, with waves [D] and [E] required to complete it. Based upon the proposed count, wave [D] is likely to at least reach $1500/ounce within 12-14 months, with what seems to be a very less than likely level of confidence between $1600/ounce-1700/ounce. Upon completion of wave [D], wave [E] down should follow and last anywhere from 12-18 months before basing. After wave [E] completes, it will also complete higher Degree wave b, which sets the stage for wave c. As stated earlier, we just need one higher high to provide structural evidence for a reversal in trend. As things are starting to shape up, it appears that commodities as a whole are set for a sharp move higher over the coming 12-14 months.

S&P 500 Index

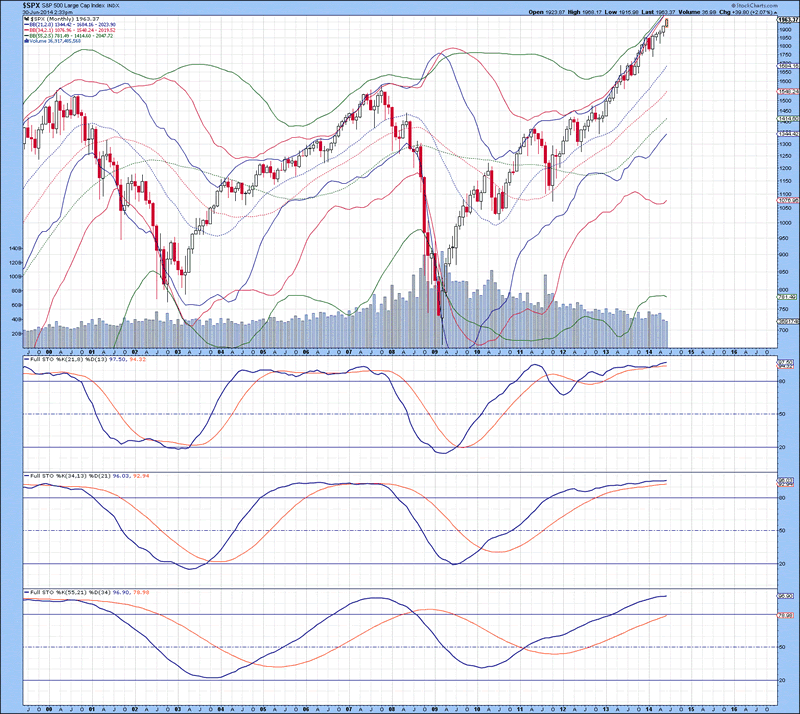

The monthly chart of the S&P 500 Index is shown below, with the upper 21 MA curled down. When the lower 55 MA Bollinger band curls down, it generally takes 10-14 months before it curls up to indicate a top. When the lower 55 MA Bollinger band does curl up, it could take anywhere from 2-4 months after before a top is put in place. Based upon this, I would not expect anything but sideways (10-15% drift up or down) to upward price action over the next 10-14 months...expect a corrective phase however between sometime in August at the latest and late January 2015. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K above the %D in all three instances. Given the huge uptrend in the S&P and for such a long time, the %K in stochastics 1 and 2 should fall beneath the %D before any sort of a top occurs. Collectively, it is fairly safe to assume the "big top" is not likely to be put in place until next year.

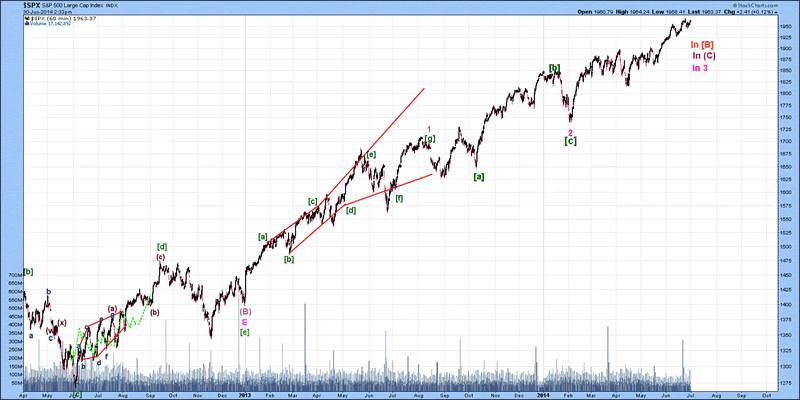

The mid-term Elliott Wave count of the S&P 500 Index is shown below, with wave 3.(C) thought to be developing at this point in time. The entire move is corrective in nature, so there should be overlap between waves 2 and 4. The maximum height of wave 2 is 1840, so at a minimum, wave 4 should decline to 1840, and maximally to 1630. A pullback in wave 4 to 1800-1840 is the most likely target for a low in wave 4 once wave 3 completes, so expect weakness between August and January 2015.

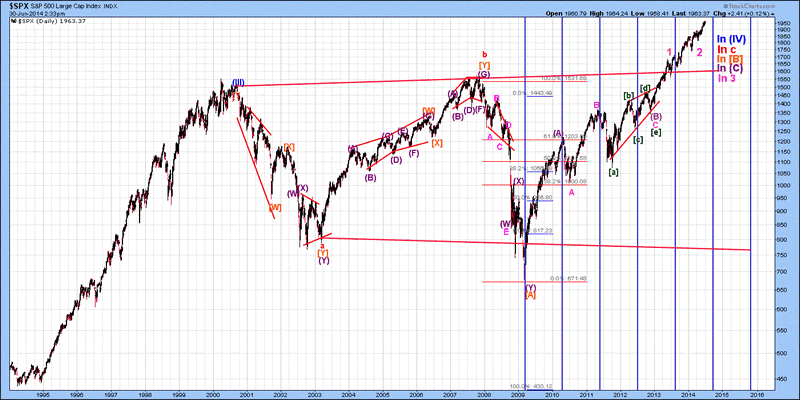

The long-term Elliott Wave count of the S&P 500 Index is shown below, with a bigger picture view of the pattern. Wave (C).[B] is thought to be forming, with an expected top due around August 2015. When this occurs, wave [C].c will either form an impulsive pattern to complete wave c as a flat (3-3-5), or merely be a corrective leg of a triangle not set to complete until around 2020. With the Contracting Fibonacci Spiral I discovered and the chiral inversion that it had last year, it implies a series of lower highs between the coming top and 2020, so after August 2015, there is an extremely sharp wave of deflation expected...it will likely be much worse than 2000 or 2008. Governments will be going after anyone that has any sort of money, so it will be important to try and hide it as well as possible.

We have been providing this service for over ten years now, and our subscribers have been able to stay ahead of the curve in trading the various markets we cover, with a focus on US equities and precious metals. Coverage includes cutting edge fundamental, technical, and sentiment-based studies that have proven pivotal for our subscribers throughout the years.

So, give us a try. One will not regret it if looking for insightful big picture thinking that keeps you on the right side of the trade.

By David Petch

http://www.treasurechests.info

I generally try to write at least one editorial per week, although typically not as long as this one. At www.treasurechests.info , once per week (with updates if required), I track the Amex Gold BUGS Index, AMEX Oil Index, US Dollar Index, 10 Year US Treasury Index and the S&P 500 Index using various forms of technical analysis, including Elliott Wave. Captain Hook the site proprietor writes 2-3 articles per week on the “big picture” by tying in recent market action with numerous index ratios, money supply, COT positions etc. We also cover some 60 plus stocks in the precious metals, energy and base metals categories (with a focus on stocks around our provinces).

With the above being just one example of how we go about identifying value for investors, if this is the kind of analysis you are looking for we invite you to visit our site and discover more about how our service can further aid in achieving your financial goals. In this regard, whether it's top down macro-analysis designed to assist in opinion shaping and investment policy, or analysis on specific opportunities in the precious metals and energy sectors believed to possess exceptional value, like mindedly at Treasure Chests we in turn strive to provide the best value possible. So again, pay us a visit and discover why a small investment on your part could pay you handsome rewards in the not too distant future.

And of course if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these items.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2014 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

David Petch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.