Manipulation in the Gold Market and a Related Opportunity

Commodities / Gold and Silver 2014 Aug 06, 2014 - 07:29 PM GMTBy: Submissions

Paul de Sousa writes:

Paul de Sousa writes:

Overview

- Barclays’ $44-million fine is the most recent evidence that gold prices have been manipulated for eighty years

- The manipulation serves to inspire confidence in the US dollar

- Gold should be owned as part of a diversified portfolio, and we have been presented with a wonderful opportunity to purchase it below its free market price

The manipulation of gold is self-evident

Arthur Schopenhauer said that “All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.” Well, it is now self-evident that the gold market is manipulated. On May 23, 2014, Barclays was fined $44 million for failures in internal controls that allowed a trader to manipulate the setting of gold prices. It’s egregious that this occurred just one day after the bank was fined for rigging LIBOR interest rates in 2012. To those with a passing interest in gold, the Barclays fine may have raised some eyebrows. For many in the gold community, however, the manipulation has been evident for years; this was simply the most recent example. According to Jim Rickards, author of Currency Wars and The Death of Money, “The manipulation of the gold market is not something that’s really debatable any longer. If I were running the manipulation, I would actually be embarrassed at this point because it's so blatant.” http://www.sprottmoney.com/news/ask-the-expert-james-rickards-march-2014

If I were running the manipulation I would be embarrassed as well because, with the exception of 2013, gold has been a top-performing asset for the past fourteen years. Can you imagine what the price would be without the manipulation? Nick Barisheff, president and CEO of Bullion Management Group and author of $10,000 Gold, says that “the future price of gold will shock the casual observer, and that $10,000 an ounce is not a pie in the sky number once gold is released to find its free market price”.

Eighty years of manipulating gold markets….stock, bond and currency markets as well

The manipulation of markets is not exclusive to gold. Stock, bond and currency markets are also manipulated, but there is one difference. Gold’s price is manipulated downward, while stock, bond and currency markets are typically manipulated upward. In February 2014, Bloomberg reported there were indications that gold has been manipulated for the past decade. “Large price moves during the afternoon call were also overwhelmingly in the same direction: down. On days when the authors identified large price moves during the fix, they were downwards at least two-thirds of the time in six different years between 2004 and 2013. In 2010, large moves during the fix were negative 92 percent of the time, the authors found.” http://www.bloomberg.com/news/2014-02-28/gold-fix-study-shows-signs-of-decade-of-bank-manipulation.html

Gold manipulation in the United States dates back to 1933, when President Franklin D. Roosevelt signed Executive Order 6102, forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States. This was the first time the United States was effectively bankrupt. The Order criminalized the possession of gold by any individual, partnership, association or corporation. All persons were required to deliver to the Federal Reserve, on or before May 1, 1933, their gold coins, bullion and certificates in exchange for $20.67 per ounce. Violation of the order was punishable by a fine of up to $10,000, a prison sentence of up to ten years, or both. US dollars could no longer be exchanged for gold.

On January 30, 1934, the United States Gold Reserve Act revalued the price of gold from $20.67 per ounce to $35, for a profit of $2.8 billion and a 42 percent devaluation of the dollar. In 1934 the US government set up the Exchange Stabilization Fund (ESF) at the Treasury Department for the specific purpose of trading in gold and foreign exchange markets. It was not subject to legislative oversight, and it was financed by $2 billion of the $2.8 billion paper profit the government realized from revaluing the price of gold.

In July 1944, the Bretton Woods agreement made the US dollar the world's reserve currency, and stipulated that all member nations' reserves had to consist of either physical gold or currency convertible into gold.

On November 1, 1961, an agreement known as the London Gold Pool was reached. The central banks of Germany, England, France, Italy, Switzerland, Belgium, the Netherlands and the United States agreed to cooperate in achieving an explicit purpose: keeping the price of gold suppressed, under control, and pegged at $35 per ounce through interventions in the London gold market. The eight central banks contributed gold to the “pot,” and when the gold price rose, they would sell enough of the pooled gold to put a ceiling on the price. When the gold price was weak, they would purchase gold to replace what they had previously sold.

The Gold Pool was terminated in 1968 as escalation in the Vietnam War sent US debt levels soaring, putting pressure on the dollar. Massive US balance of payment deficits led to surging demand for US gold. US gold holdings declined from 22,000 tonnes to 8,000 tonnes. On Sunday March 17, 1968, the London Gold Pool officially collapsed and the global gold markets were closed for several weeks.

The laws for the Exchange Stabilization Fund were modified in 1970, in that the Secretary of the Treasury, with the approval of the President, could use ESF assets to “deal in gold, foreign exchange, and other instruments of credit and securities.” Jennifer Huang (September 26, 2008). "What's the Exchange Stabilization Fund? A pile of cash that can be used for whatever"—Slate.

By 1971, more than 60 percent of US gold reserves had been delivered to European central banks in West Germany, Switzerland and France. The United States could not risk losing any more gold, and on August 15, 1971, America effectively declared bankruptcy for the second time when President Richard Nixon announced the “temporary” suspension of the dollar’s convertibility into gold. The closing of the gold window is known as the Nixon Shock, and it signified the end of the Bretton Woods system.

An important point overlooked by the media and others that continually denigrate gold is that if gold is a useless, risky, unimportant lump of metal, then why did Nixon choose to close the gold window and default on the Bretton Woods Agreement to prevent the depletion of America’s remaining gold, instead of permitting it to be sent to West Germany, Switzerland and France? Official US gold reserves are ostensibly 8,162 tonnes, but no one can corroborate that figure because there has not been an audit of the gold bars in Fort Knox since 1953.

After the Nixon Shock, gold was free of its $35 per ounce peg. Over the next nine years it rose substantially, ultimately reaching an intraday high of $850 an ounce in 1980, which led one-time Fed Chairman Paul Volcker to say “Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake."

On March 18, 1988, President Reagan signed Executive Order 12631, creating the Working Group on Financial Markets. The four members of this group are the Secretary of the Treasury and the chairs of the Federal Reserve Bank, the Securities and Exchange Commission, and the Commodity Futures Trading Commission. This group is also known as the Plunge Protection team, whose mandate is “enhancing the integrity, efficiency, orderliness, and competitiveness of our nation’s financial markets and maintaining investor confidence.” In other words, they prop up the stock, bond and currency markets to avoid major declines, while gold is manipulated downward.

The gold manipulation couldn’t have been more obvious than in July 1998, when Federal Reserve Chairman Alan Greenspan, speaking on the regulation of OTC derivatives, said, “Central banks stand ready to lease gold in increasing quantities should the price rise.” http://www.federalreserve.gov/boarddocs/testimony/1998/19980724.htm

In December 2013, Bloomberg reported that BaFin, the German equivalent of the SEC, had seized documents from Deutsche Bank, and concluded that manipulation in the gold market was “worse” than manipulation of LIBOR. http://www.bloomberg.com/news/2013-11-27/bafin-reviews-gold-silver-pricing-as-part-of-libor-review.html

Methods of gold manipulation

Former Assistant Secretary of the Treasury for Economic Policy Dr. Paul Craig Roberts, along with Dave Kranzler, outlined the methods of gold manipulation. One popular method involves the Fed dumping a large quantity of futures contracts into the market via naked short sales. “The Fed differs from the way in which a bona fide trader looking to sell a big position would operate. A bona fide trader would try to work off his position carefully over an extended period of time with the goal of trying to disguise his selling and to disturb the price as little as possible in order to maximize profits or minimize losses. In contrast, the Fed‘s sales telegraph the intent to drive the price lower with no regard for preserving profits or fear or incurring losses, because the goal is to inflict as much damage as possible on the price and intimidate potential buyers.” http://www.paulcraigroberts.org/2014/01/17/hows-whys-gold-price-manipulation/

Gold markets are further manipulated by central banks leasing their gold. In Frank Veneroso’s 1998 Gold Book Annual, he concluded that central bank gold leasing had artificially suppressed the full extent of gold demand to the tune of approximately 1,600 tonnes per year, when annual supply was 4,000 tonnes. Central banks were officially on record as owning 35,000 tonnes, and it is estimated that they had just 22,000 tonnes of physical gold. Several years later, Veneroso revised his estimate to 16,000 tonnes, or roughly half the central bank gold.

In addition to central banks selling their gold, they allegedly sell or lease gold that doesn’t belong to them and is held in their custody. The circumstances certainly don’t look good. In October 2012, Germany’s Bundesbank requested an audit of 300 tonnes of its 1,500 tonnes of gold held at the Federal Reserve Bank of New York. The Fed not only refused, but would not even allow Bundesbank officials to view their gold. In January 2013, the Bundesbank requested the delivery of their gold. The Fed agreed to a phased delivery over seven years. Why does it take seven years to complete the transfer? The popular explanation is that the Fed has already re-hypothecated all of its gold holdings as well as the gold holdings of other countries, such as Germany. A year later, just five tonnes have been delivered, all of which were not the original bars deposited.

Another method of manipulating the gold price down is to funnel investment demand for physical gold into investment vehicles that do not hold physical gold. Examples are ETFs, certificates and unallocated gold accounts. Pooled accounts may hold physical gold, but title does not belong to the investor, and there are several claims on the same bar of gold.

Why is gold manipulated?

When the world’s reserve currency—the US dollar—is at risk of losing its hegemony, it’s virtually assured that governments will intervene in various markets to protect it. Gold is the anti-dollar, because gold threatens the dollar’s hegemony and reserve currency status. The dollar is in the twilight of a 43-year pure fiat money experiment and, judging by the 85 percent loss of purchasing power, against gold it’s a failure when compared to the preservation of purchasing power under a gold standard. A rising gold price is the proverbial canary in a coal mine, signalling trouble for the dollar.

Last week, Russia and China announced a $400 billion, 30-year oil and gas deal with each other, using their respective currencies, and bypassing the dollar. It is obvious that countries are intensifying the phasing out of their reliance on the greenback. China has already signed twenty-five trade agreements that circumvent the dollar and settle trade imbalances with the participants’ own currencies. This will continue to place downward pressure on demand for dollars. If the dollar loses its reserve currency status, America’s ability to print unlimited amounts of dollars without consequences will be over. Trillions of dollars’ worth of greenbacks and Treasury Debt would be sold, and the dollar would fall significantly in value.

To further the illusion that the dollar is strong, important statistics such as unemployment, CPI and GDP are manipulated. Jim Sinclair refers to this as “MOPE: Management of perception economics.” Unemployment in the United States is actually 23 percent, CPI is 5.5 percent, and there has been negative GDP growth for several years. Time does not permit further discussion of this topic, and I recommend reviewing the research of John Williams at www.shadowstats.com. Dr. Williams offers one of the most valuable services to the financial industry by analyzing the changes in methodology that are used to calculate important government economic statistics, and calculates “actual” statistics rather than “tortured” statistics designed to obscure the financial realities of GDP, unemployment, money supply and inflation. As Mark Twain said, “Numbers are like people, torture them enough and they will tell you anything you want them to.” I can’t stress enough the importance of having accurate financial data with which to make financial decisions.

When and how does the manipulation end?

The manipulation will end when the physical shortage gets low enough that someone fails to deliver, which will result in a buying panic and gold moving sharply higher. China’s insatiable appetite for physical gold, along with India’s certain resumption of gold buying under the more gold-friendly Modi government, will accelerate this event.

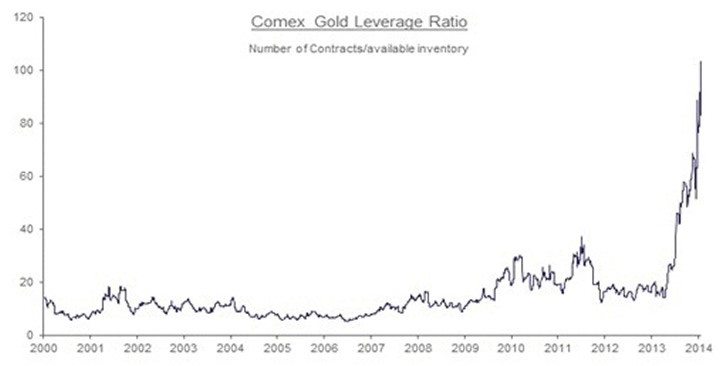

This chart illustrates the amount of paper gold versus the Registered Gold available for delivery:

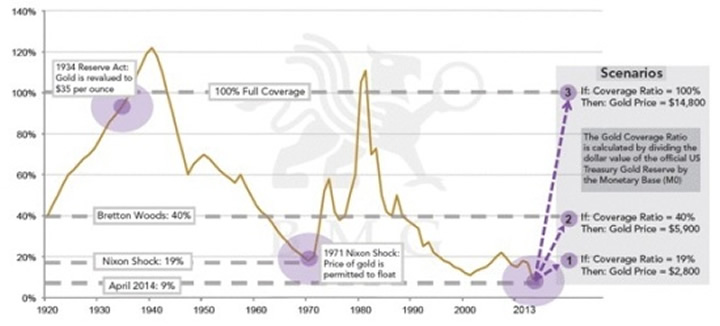

Since gold came under attack in April 2013, the COMEX paper-to-gold ratio has moved from less than twenty to over one hundred ounces of paper gold representing each single ounce of physical gold. To put this in context, less than 1 percent of futures contracts need to demand delivery of gold to create a default on the COMEX. Gold is like insurance in many regards; you have to own it before you need it. In an interview with Greg Hunter of USA Watchdog, Jim Rickards says: “Right now, we are on the precipice. When you are on the precipice, it doesn’t mean you fall off immediately, but you are going to fall off because you can see the forces in play… That’s what the system is right now; we are just waiting for a catalyst. People ask me all the time, what could it be? Technically, my answer is it doesn’t matter because it will be something. It could be a failure to deliver physical gold. It could be an MF Global financial failure. It could be a natural disaster. It could be a lot of things. The thing investors need to understand is the catalyst doesn’t matter. It’s coming because the instability is already there…” “It is the thing you won’t see coming that will take the system down. Things happen much more quickly than what investors expect.” “What will happen in gold is that it will chug along and then all of a sudden—boom. It will be up $100 an ounce, and then the next day it will be up another $200 an ounce. Then everyone will be on TV saying it’s a bubble—boom. It’s up $300 an ounce, and before you know it, it will be up $1,000 per ounce.” http://usawatchdog.com/catastrophic-outcomes-may-come-faster-than-expected-james-rickards/ We are in uncharted waters, and it is difficult to imagine how the manipulation ends. Jim Rickards and David Morgan superbly simulate how a currency crisis unfolds. https://www.youtube.com/watch?v=kdPkaCTdxBU and https://www.youtube.com/watch?v=NN97tmw6qvY The related opportunityIf you had the opportunity to go back to 2001 and purchase gold at $260 an ounce, would you? Valuing gold in terms of the gold coverage ratio [see chart] suggests that gold has never been as undervalued as it is now, including during 2001.

|

The gold coverage ratio measures the amount of US Treasury gold reserves against the Monetary Base (M0). Because of quantitative easing, the coverage ratio is currently at an all-time low of 9 percent, suggesting that gold is severely undervalued. The historical average for the gold coverage ratio is roughly 40 percent, meaning that the current price of gold would have to more than quadruple to reach the average. The gold coverage ratio rose above 100 percent twice during 20th century, most recently at gold’s 1980 peak. Were this to happen today, the value of gold would approach $15,000, assuming no further quantitative easing is employed. Gold is undervalued, oversold, and today represents a historically low buying opportunity for an asset that every investor should own. For investors who have not already built the foundation of their investment portfolio with gold, the manipulation has provided an opportunity to do so at extremely favourable prices. Investors who have already laid their gold foundation can rest assured that the manipulation cannot last forever, and the greater and the longer the manipulation, the greater the eventual price will be. It is easy to purchase assets when they are moving up. The best time to purchase is at the time of maximum pessimism. Click to download full articleBy Paul de Sousa © 2014 Copyright Paul de Sousa - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.